Last update: 19-02-2024

Top trading strategy Monero (XMR) Weekly – Live position:

- Long in progress

- Entry price : 146.1 $

- Pnl : -18.75 %

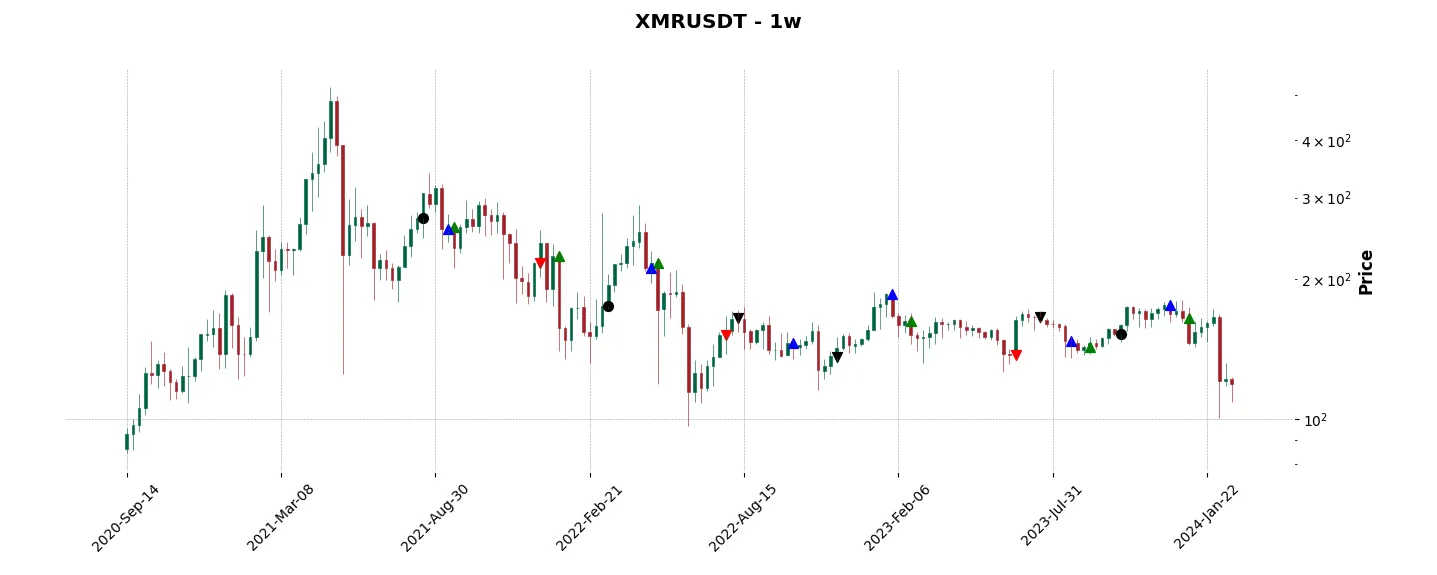

Trade history

Over 6 months

Complete

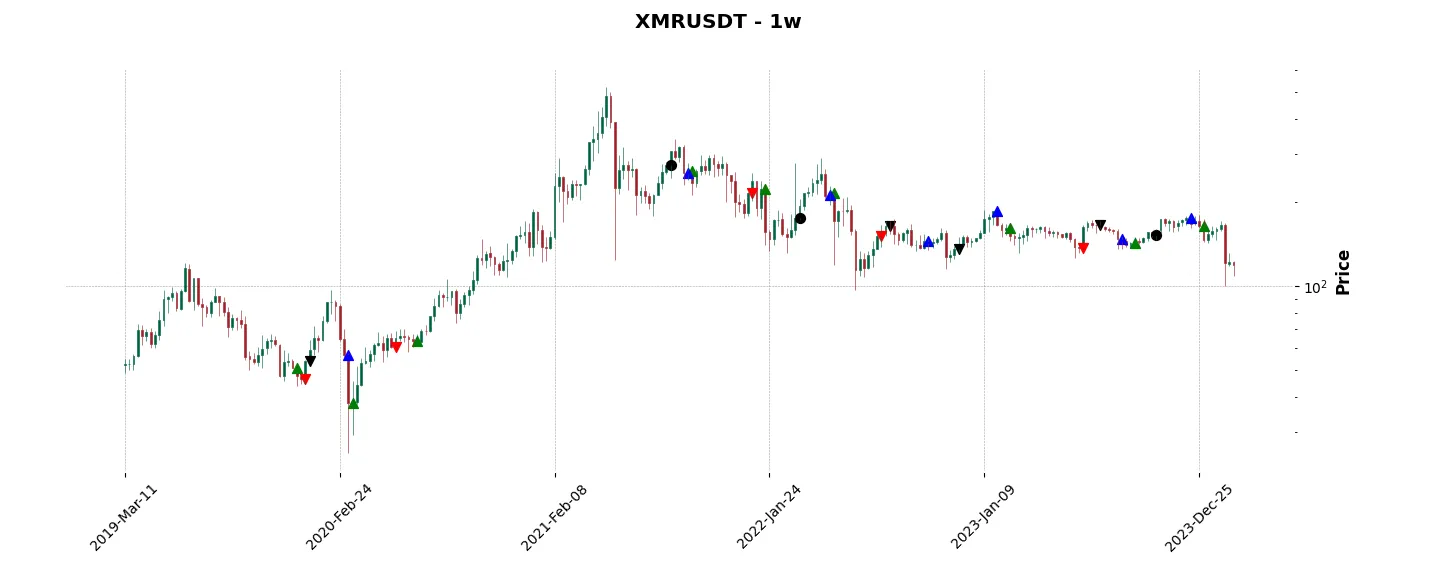

«Top trading strategy Monero (XMR) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy XMR Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

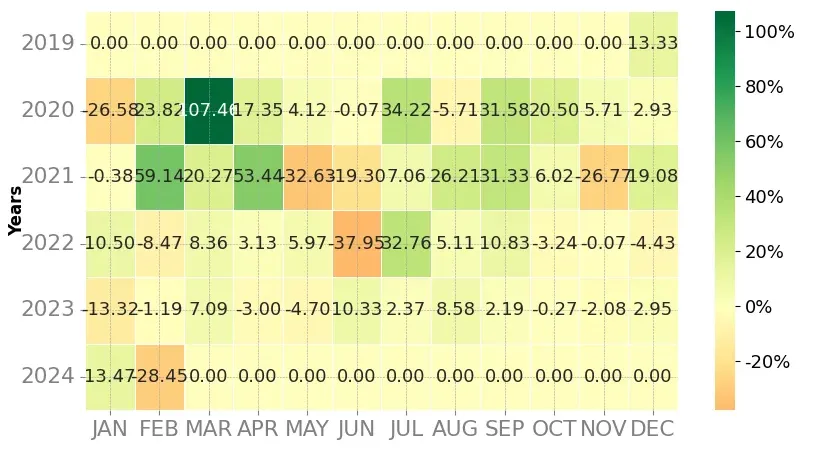

Heatmap of monthly returns

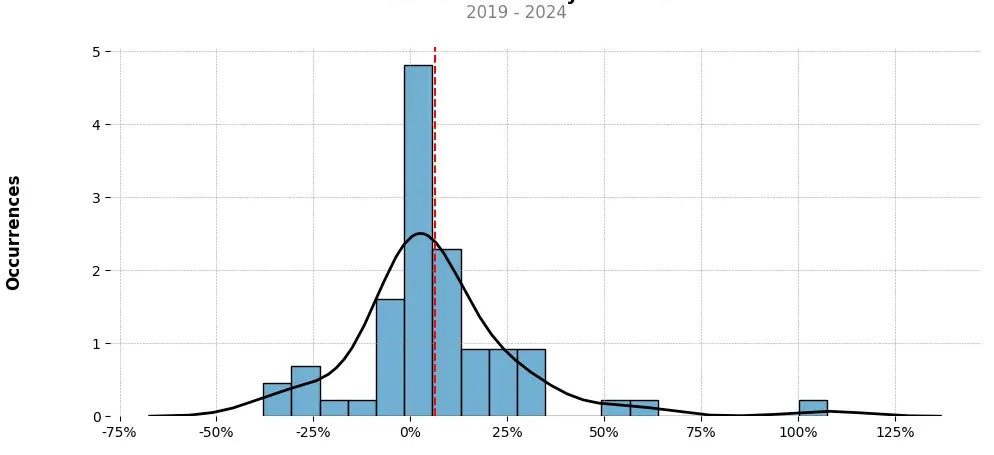

Distribution of the monthly returns of the top strategy

Presentation of XMR

Monero (XMR) is a privacy-focused cryptocurrency that was launched in April 2014. It distinguishes itself from other cryptocurrencies like Bitcoin by prioritizing user anonymity and transaction privacy.

The fundamental principle behind Monero is to provide a financial system where transactions are untraceable and unlinkable. To achieve this, Monero uses three main technologies: ring signatures, stealth addresses, and confidential transactions. Ring signatures allow for the mixing of multiple transaction inputs, making it difficult to determine the true sender. Stealth addresses ensure the receiver’s address is concealed by generating a unique one-time address for every transaction. Confidential transactions obfuscate the transaction amount by using cryptographic techniques while still allowing for network consensus.

One of the main advantages of Monero is its enhanced privacy features that appeal to individuals and businesses concerned about their financial transactions being exposed to the public. Without proper investigative resources, it becomes challenging to trace the origin and destination of funds, making Monero an attractive option for those seeking financial anonymity.

Furthermore, Monero’s emphasis on privacy aligns with the general societal shift towards valuing personal data protection. In an age where privacy breaches and data leaks frequently make headlines, individuals are increasingly seeking ways to retain control over their personal information. With the rise of blockchain technology and widespread adoption of cryptocurrencies, Monero offers an alternative where financial privacy is prioritized.

However, Monero’s focus on privacy has attracted negative attention from regulators and law enforcement agencies, who argue its anonymity features could be exploited for illicit activities such as money laundering or terrorist financing. As a result, some cryptocurrency exchanges and jurisdictions have implemented stricter regulations concerning Monero and similar privacy cryptocurrencies.

Despite regulatory challenges, Monero remains a prominent player in the cryptocurrency space and continues to evolve its privacy protocols. Its commitment to user privacy has garnered a loyal community of supporters who appreciate the core principles of the cryptocurrency, making it a significant player in the cryptocurrency market.

In conclusion, Monero is a cryptocurrency that prioritizes user privacy with advanced technologies such as ring signatures, stealth addresses, and confidential transactions. While facing regulatory challenges, its commitment to financial anonymity and data protection appeals to individuals and businesses seeking privacy in their financial transactions. With a robust community and continued development, Monero maintains its relevance in the cryptocurrency ecosystem.

Strategy details

«Top trading strategy XMR Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘mineable’, ‘pow’, ‘medium-of-exchange’, ‘privacy’, ‘ringct’, ‘boostvc-portfolio’, ‘electric-capital-portfolio’, ‘galaxy-digital-portfolio’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)