Last update: 20-12-2021

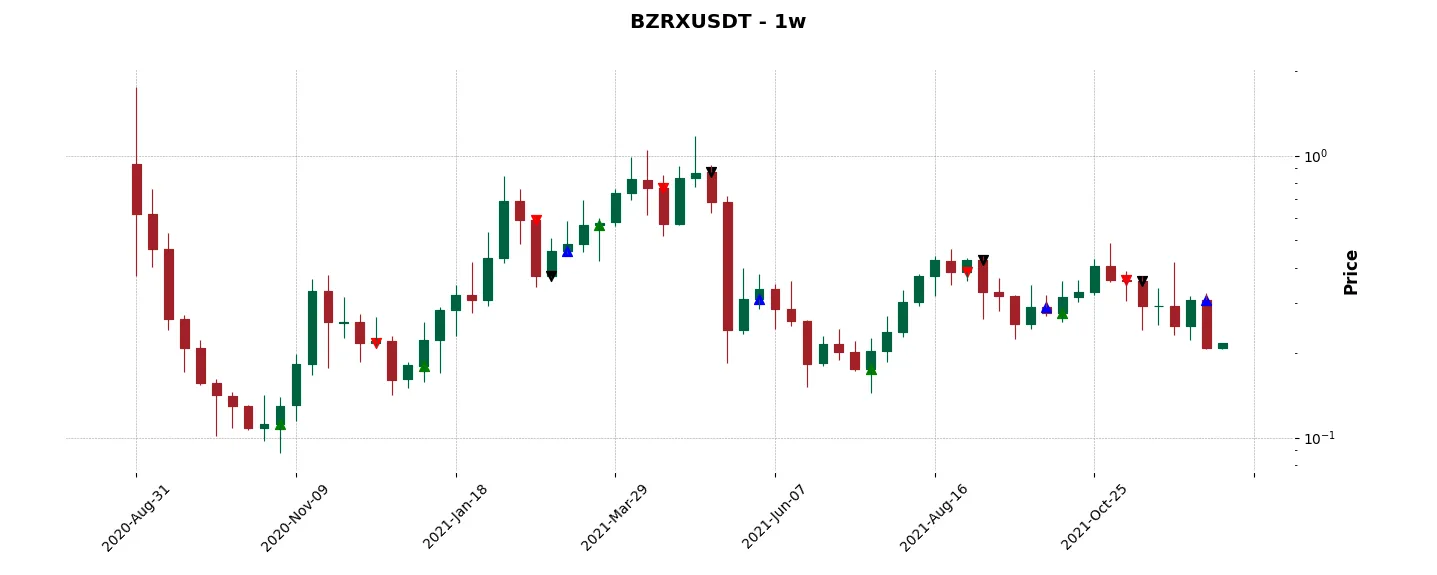

Top trading strategy bZx Protocol (BZRX) Weekly – Live position:

- Close short

- Entry price : 0.2924 $

- Pnl : 28.76 %

Trade history

Over 6 months

Complete

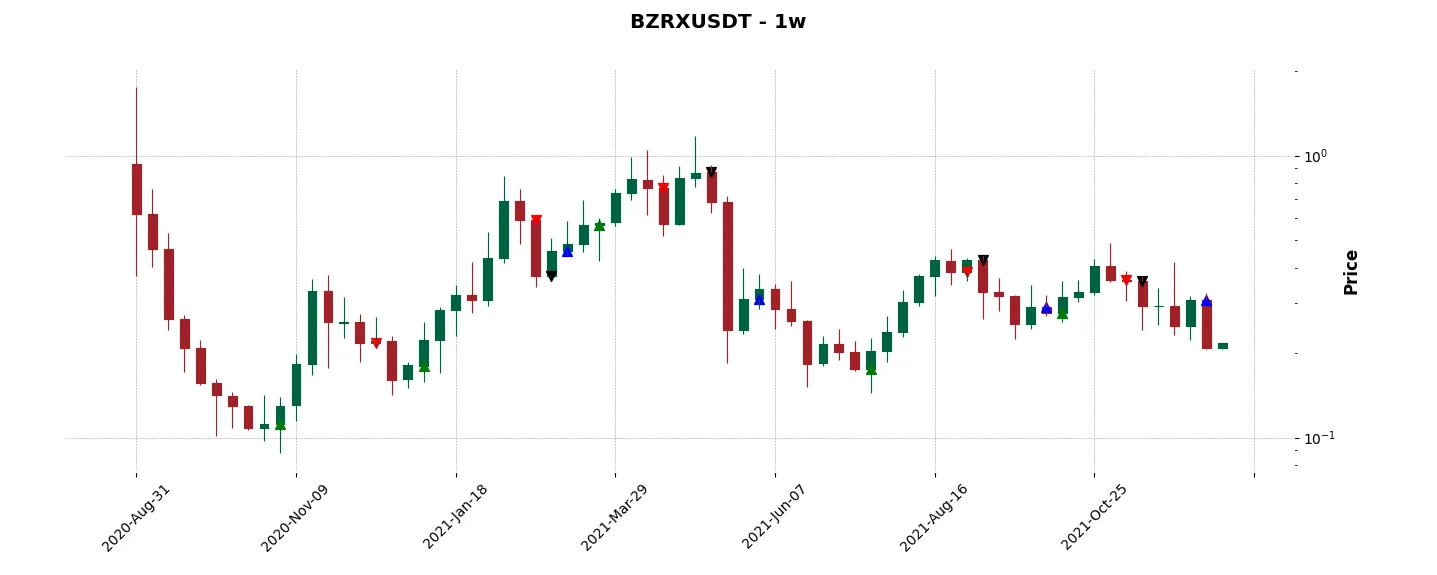

«Top trading strategy bZx Protocol (BZRX) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy BZRX Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

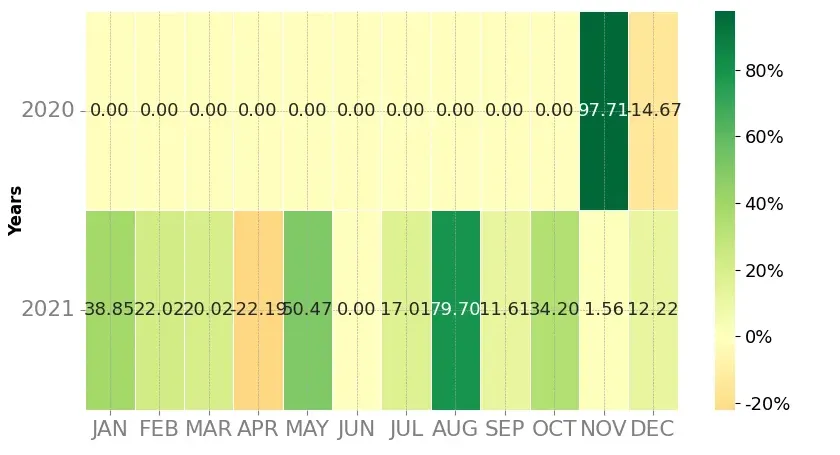

Heatmap of monthly returns

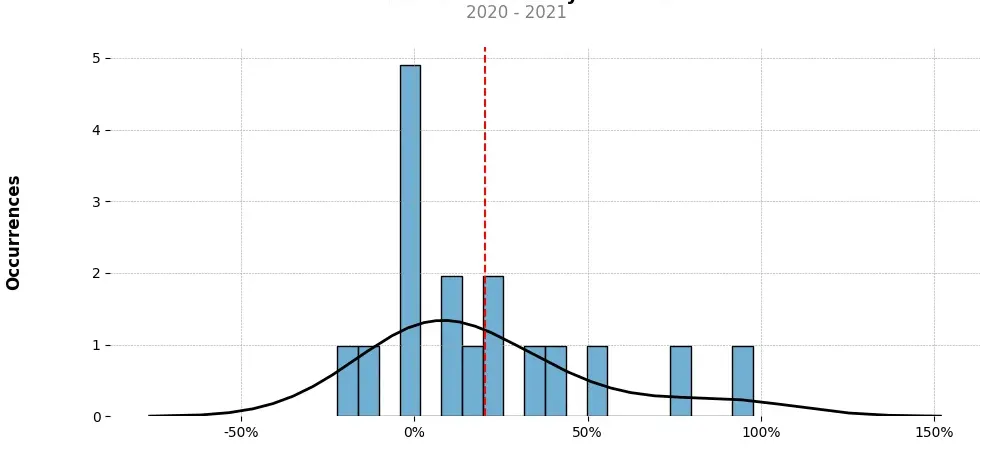

Distribution of the monthly returns of the top strategy

Presentation of BZRX

bZx Protocol (BZRX) is a decentralized finance (DeFi) protocol designed to enable lending, borrowing, and margin trading on the Ethereum blockchain. It operates as a non-custodial platform, which means that users have full control over their funds and transactions are conducted directly between participants without the need for intermediaries.

One of the core features of bZx Protocol is its lending and borrowing mechanism. Users can deposit their assets into lending pools and earn interest based on the demand for borrowing. On the other hand, borrowers can leverage their existing assets as collateral to borrow funds. This enables individuals to access liquidity without needing to sell their assets, allowing them to continue holding and potentially benefit from future price appreciation.

bZx Protocol also supports margin trading, which allows users to trade with borrowed funds, thus amplifying potential profits (or losses). Margin traders can utilize their existing assets as collateral to open leveraged positions, thereby increasing their exposure to the market. However, it is important to note that Margin trading carries higher risk levels, as losses can also be magnified, leading to potential liquidation events if collateral value drops below a certain threshold.

Another notable aspect of bZx Protocol is its integration with other decentralized exchanges (DEXs) such as Uniswap and Kyber Network. By partnering with these liquidity providers, bZx Protocol aims to ensure optimal asset availability and competitive interest rates for users. This integration also enhances the overall efficiency of the platform, as users can seamlessly swap their borrowed assets or repay loans directly within the protocol.

To ensure the security and integrity of the platform, bZx Protocol implements various risk management measures, including an insurance fund, stop-loss mechanisms, and flash loan protection. Moreover, the protocol utilizes smart contracts audited by reputable security firms, ensuring that user funds are safeguarded against potential vulnerabilities or exploits.

The native token of bZx Protocol, BZRX, plays a crucial role within the ecosystem. It serves as a governance token, allowing holders to participate in decision-making processes related to platform upgrades, fee structures, and other protocol parameters. Additionally, BZRX holders can stake their tokens to earn rewards and maintain an active role in the network’s governance activities.

In summary, bZx Protocol (BZRX) provides a decentralized lending, borrowing, and margin trading solution on the Ethereum blockchain. Through its non-custodial approach, integration with major DEXs, and risk management measures, bZx Protocol aims to offer users efficient access to liquidity, while prioritizing security and user control. With its governance token, BZRX, the protocol promotes community engagement and participation in shaping its future development.

Strategy details

«Top trading strategy BZRX Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘decentralized-exchange-dex-token’, ‘defi’, ‘smart-contracts’, ‘avalanche-ecosystem’, ‘lending-borowing’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)