Last update: 02-09-2024

Top trading strategy Ren (REN) Weekly – Live position:

- No position

Trade history

Over 6 months

Complete

«Top trading strategy Ren (REN) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy REN Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

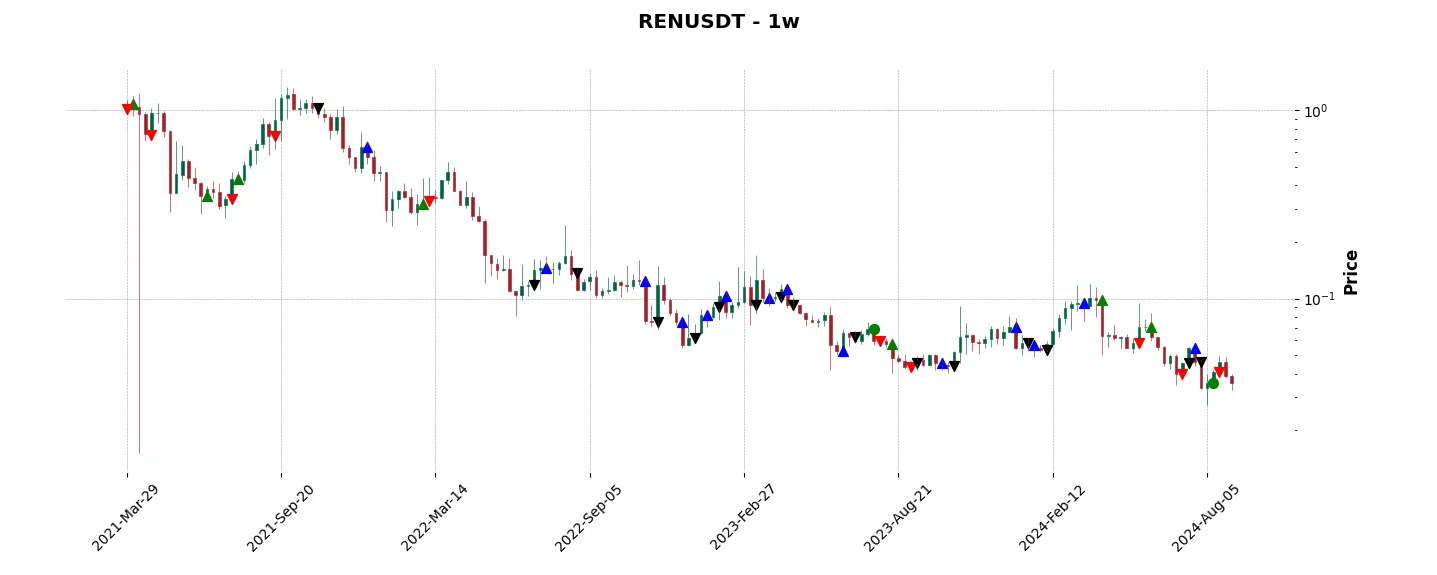

Historical comparison of cumulative returns with Buy & Hold

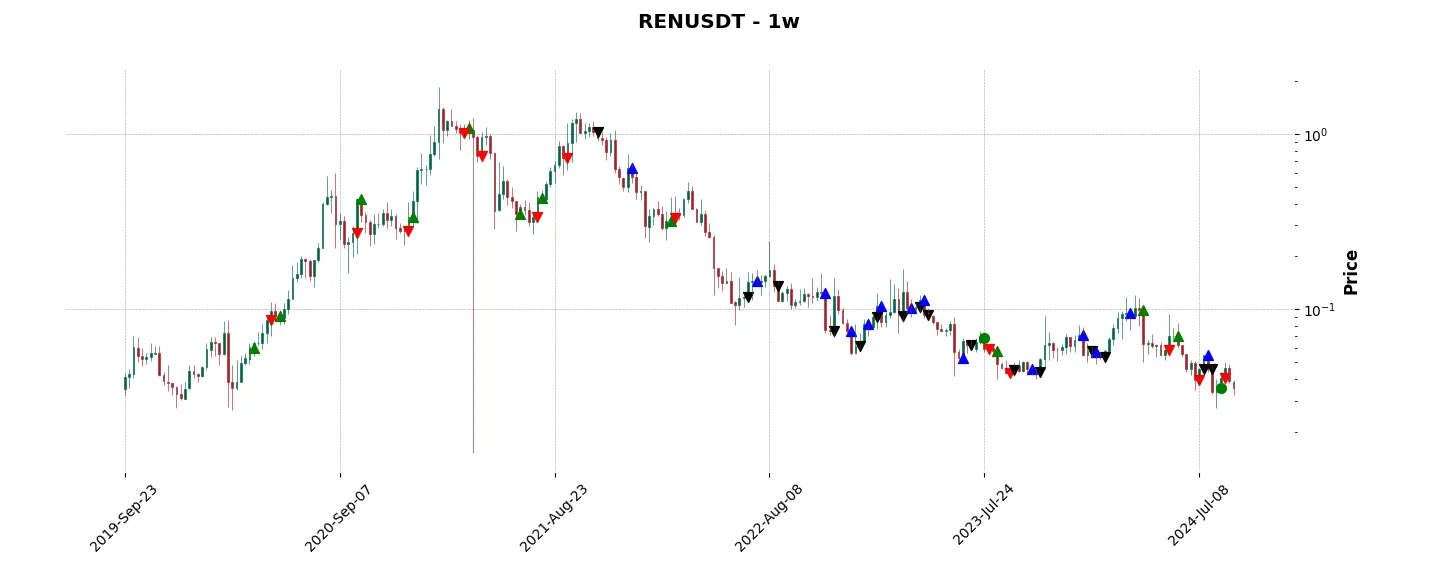

Annual comparison of cumulative returns with Buy & Holds

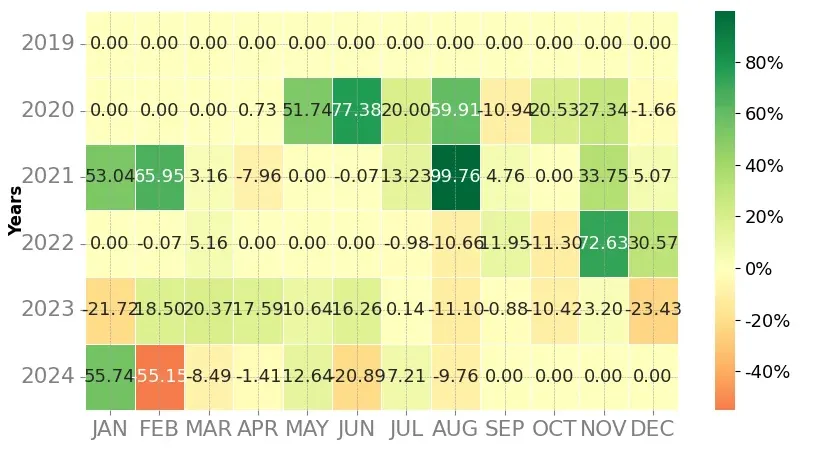

Heatmap of monthly returns

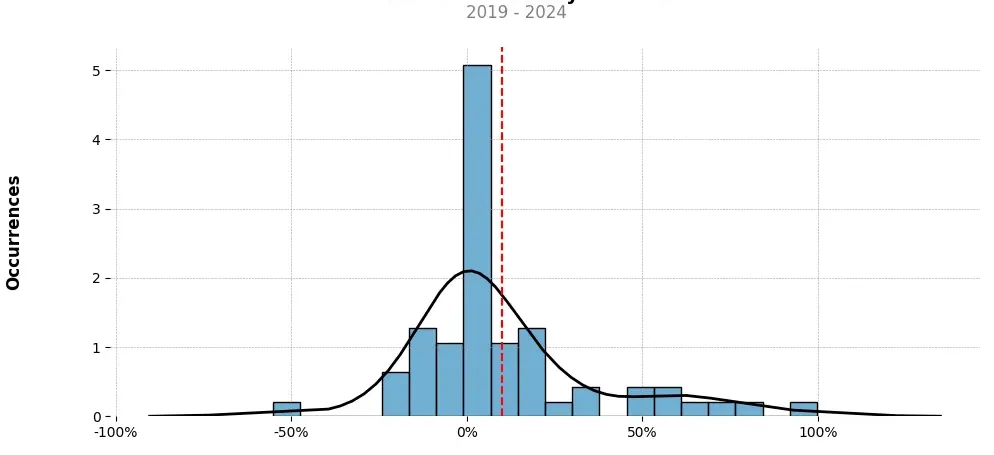

Distribution of the monthly returns of the top strategy

Presentation of REN

Ren (REN) is a decentralized blockchain protocol designed to facilitate interoperability and liquidity among different blockchains. It aims to create an interconnected network that allows users to move assets seamlessly between different networks, thus enabling cross-chain trading, lending, and decentralized finance (DeFi) applications.

With the rise of numerous blockchains, each with its own unique features and functionalities, interoperability has become a critical challenge. Ren seeks to solve this problem by acting as a bridge between different blockchain networks, enabling the transfer of assets from one chain to another. This interoperability opens up a range of possibilities, allowing users to perform transactions and utilize applications across multiple blockchains.

One of the key features of Ren is its ability to create wrapped representations of assets from different chains. These wrapped tokens, called RenBTC, RenZEC, RenBCH, etc., are designed to represent their respective cryptocurrencies on different blockchains. This allows users to access and utilize these assets on a different blockchain, expanding the utility and liquidity of those assets.

Ren also operates a decentralized network of nodes called Darknodes. These Darknodes play a crucial role in the functioning of the Ren protocol. They provide the computational power needed to facilitate cross-chain transactions, as well as network security and consensus. Darknode operators are incentivized through network fees and are required to stake a certain amount of REN tokens as collateral, which helps ensure the network’s security and integrity.

Ren’s interoperability and liquidity features make it particularly valuable within the DeFi ecosystem. It allows users to harness the potential of multiple blockchains, such as Ethereum, Bitcoin, and others, to create and utilize decentralized financial products and services. For example, Ren can enable the exchange of Bitcoin for Ethereum-based tokens directly within DeFi applications, eliminating the need for centralized exchanges and intermediaries.

Furthermore, Ren’s approach to interoperability provides enhanced privacy and security compared to traditional centralized exchanges. The decentralized nature of the protocol, combined with the usage of cryptographic techniques, ensures that users’ assets and transactions remain secure and private.

In conclusion, Ren (REN) is a blockchain protocol that tackles the challenge of interoperability by enabling seamless asset transfer and liquidity between various blockchain networks. Through its wrapped representations of assets and the operation of a decentralized network of Darknodes, Ren opens up new possibilities for cross-chain transactions, allowing users to access and utilize assets on multiple chains. This interoperability is particularly valuable within the DeFi ecosystem, as it enhances liquidity and introduces a higher level of privacy and security.

Strategy details

«Top trading strategy REN Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘marketplace’, ‘defi’, ‘polkadot-ecosystem’, ‘avalanche-ecosystem’, ‘solana-ecosystem’, ‘kenetic-capital-portfolio’, ‘huobi-capital-portfolio’, ‘alameda-research-portfolio’, ‘fantom-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)