Last update: 25-10-2024 12:00 UTC

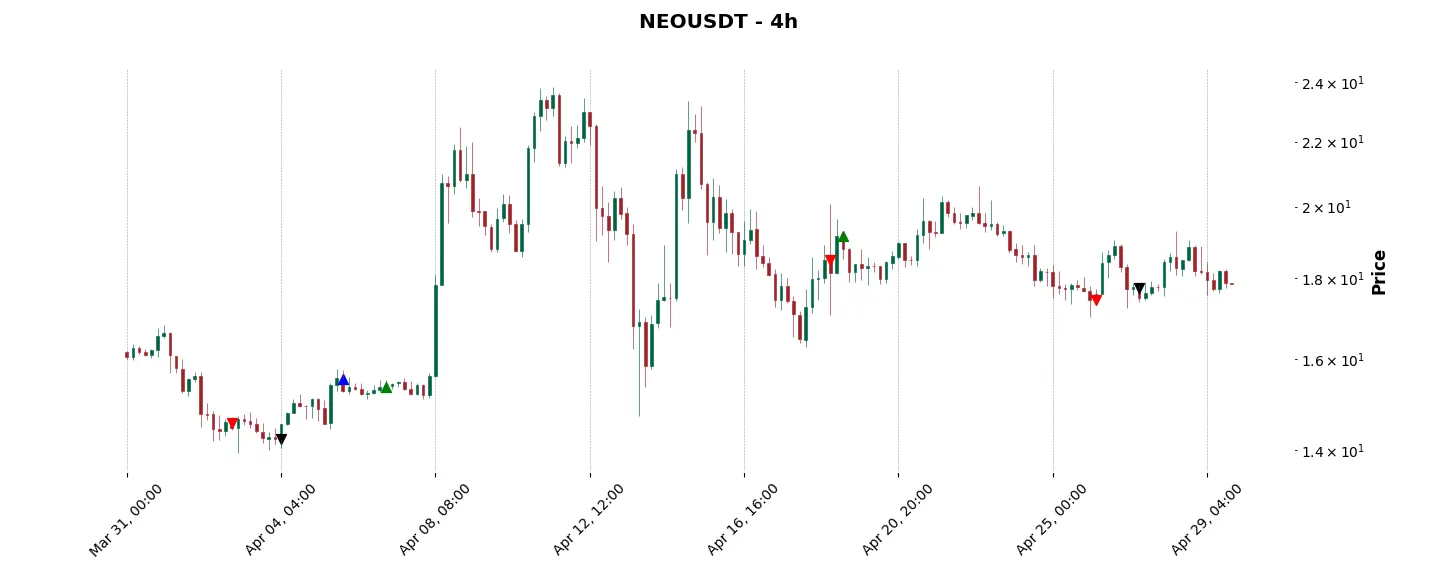

Top trading strategy Neo (NEO) 4H – Live position:

- Short in progress

- Entry price : 10.0 $

- Pnl : -1.0 %

Trade history

Over 6 months

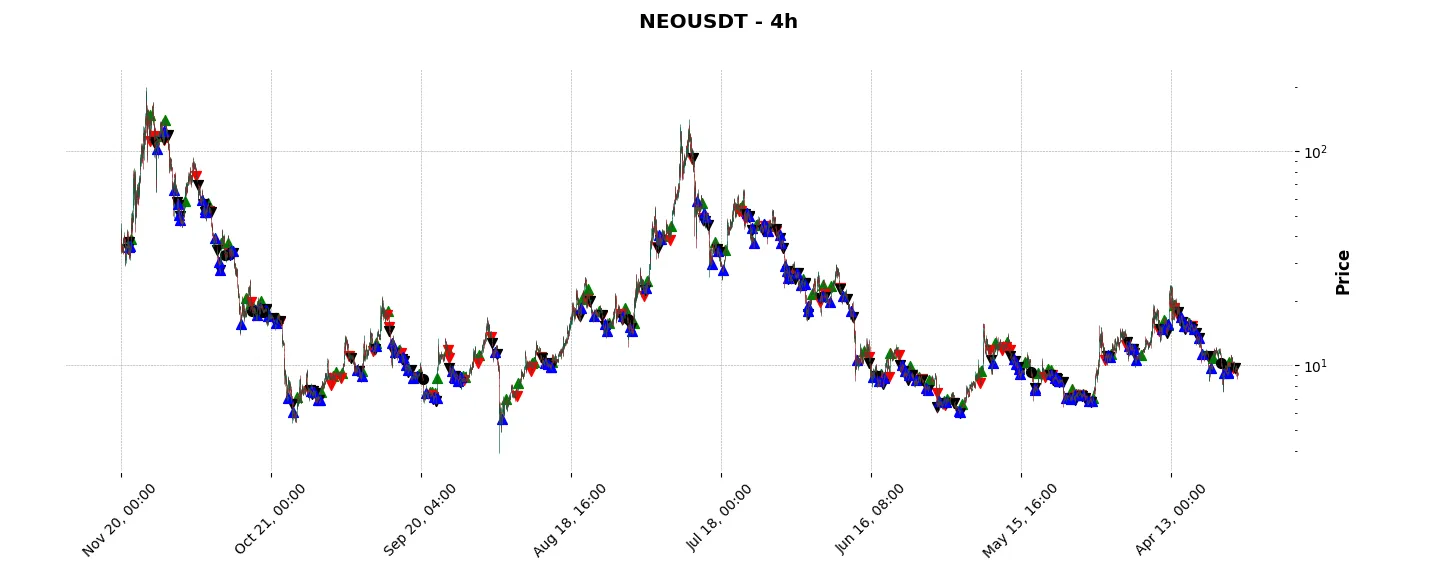

Complete

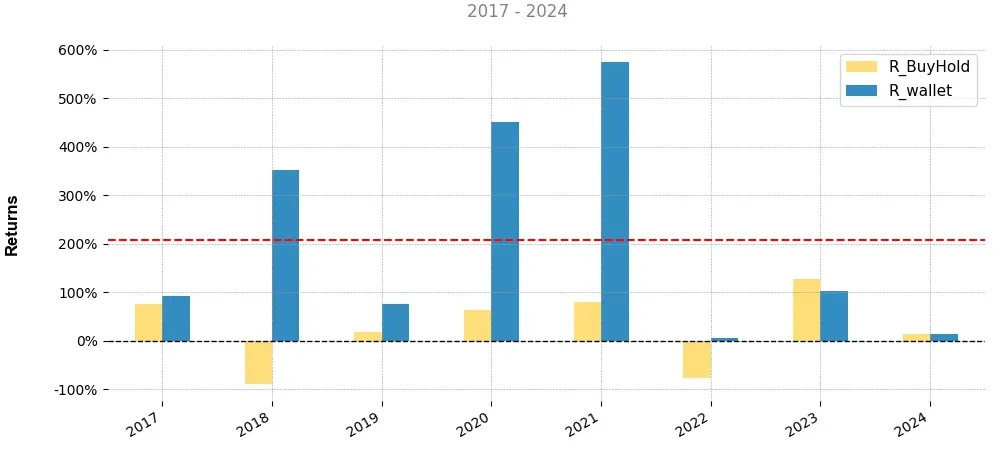

«Top trading strategy Neo (NEO) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy NEO 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

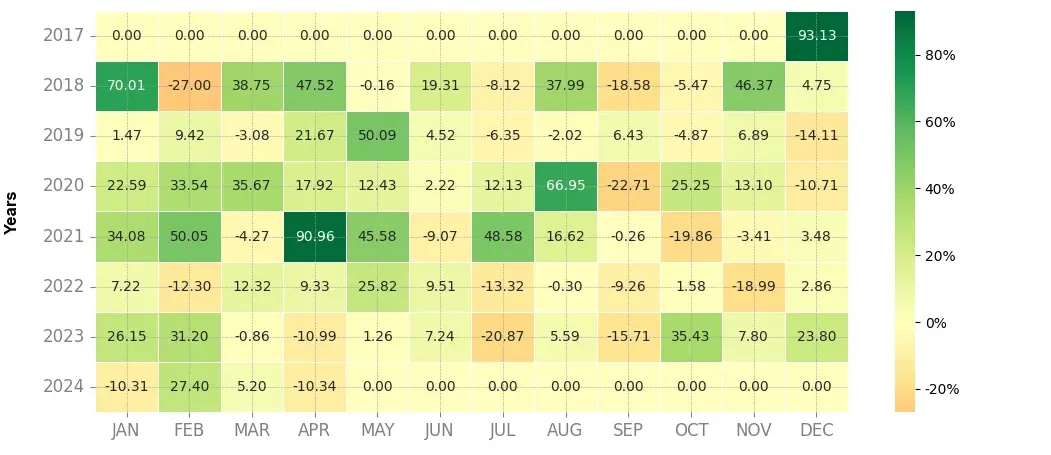

Heatmap of monthly returns

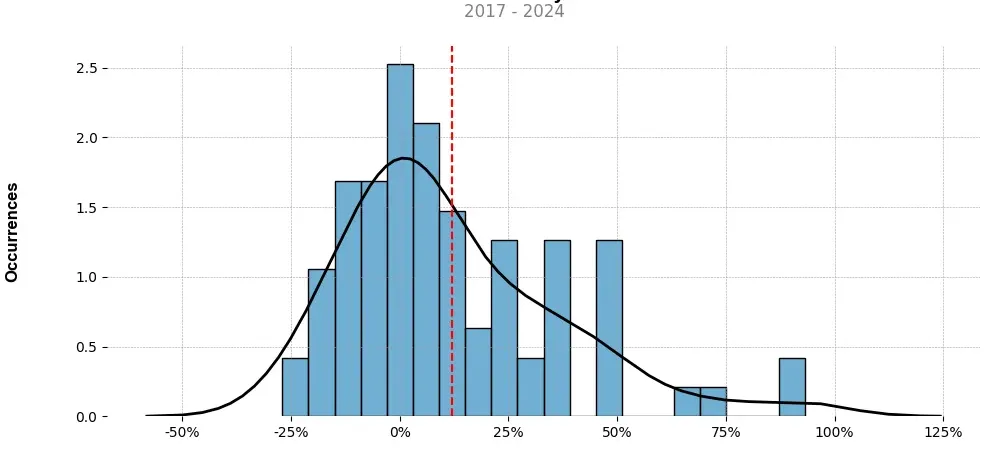

Distribution of the monthly returns of the top strategy

Presentation of NEO

Neo (NEO) is a well-known cryptocurrency that has gained significant popularity in the crypto market. It was created by Da Hongfei and Erik Zhang in 2014 and was previously known as Antshares. Neo is often referred to as “China’s Ethereum” due to its similarities with the Ethereum blockchain platform. This synthesis aims to provide an overview of Neo’s key features, benefits, and potential limitations.

One of Neo’s distinguishing features is its focus on digital assets and smart contracts. It allows developers to build decentralized applications (DApps) on its blockchain, making it a reliable platform for creating and managing digital assets. The use of smart contracts enables the execution of self-executing contracts with predefined conditions, eliminating the need for intermediaries and enhancing efficiency.

Neo also stands out for its commitment to regulatory compliance. Unlike some cryptocurrencies, Neo strictly adheres to regulations, which gives it an edge in terms of potential mainstream adoption. This approach also ensures transparency and trust, as Neo aims to establish a legally compliant smart economy.

Another important aspect of Neo is its consensus mechanism. While many cryptocurrencies use proof-of-work (PoW) or proof-of-stake (PoS), Neo employs a delegated Byzantine Fault Tolerance (dBFT) consensus algorithm. This algorithm accelerates transaction throughput and enhances network scalability, making Neo well-suited for enterprise applications.

Neo’s ecosystem comprises multiple components that work together to ensure its success. The first component is the Neo blockchain, which supports various programming languages, including C#, Python, and Java, making it accessible to a wide range of developers. Additionally, Neo provides a digital identity system, NeoID, which helps establish trust and prevents identity theft.

Furthermore, Neo has its own native token called Gas (GAS). Gas plays a vital role in the Neo ecosystem as it is used to pay for transaction fees and computational resources. Neo token holders are rewarded with Gas, incentivizing them to maintain and support the network.

Despite its many strengths, Neo does face some potential limitations. One notable concern is its centralization. While the ecosystem is overseen by the Neo Foundation, the community has raised concerns about the concentration of power. Striking a balance between centralization and decentralization will be crucial for ensuring Neo’s long-term success.

Another challenge Neo faces is competition from other blockchain platforms, particularly Ethereum. While Neo shares similarities with Ethereum, it will need to continue to innovate and offer unique features to stand out in a rapidly evolving market.

In conclusion, Neo is a prominent cryptocurrency that offers a unique set of features and benefits. With its focus on digital assets, regulatory compliance, and a scalable consensus mechanism, Neo has the potential to play a significant role in the emerging smart economy. However, it will need to navigate challenges related to centralization and competition to maintain its market position and continue to attract developers and users.

Strategy details

«Top trading strategy NEO 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘enterprise-solutions’, ‘smart-contracts’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)