Last update: 04-03-2025 00:00 UTC

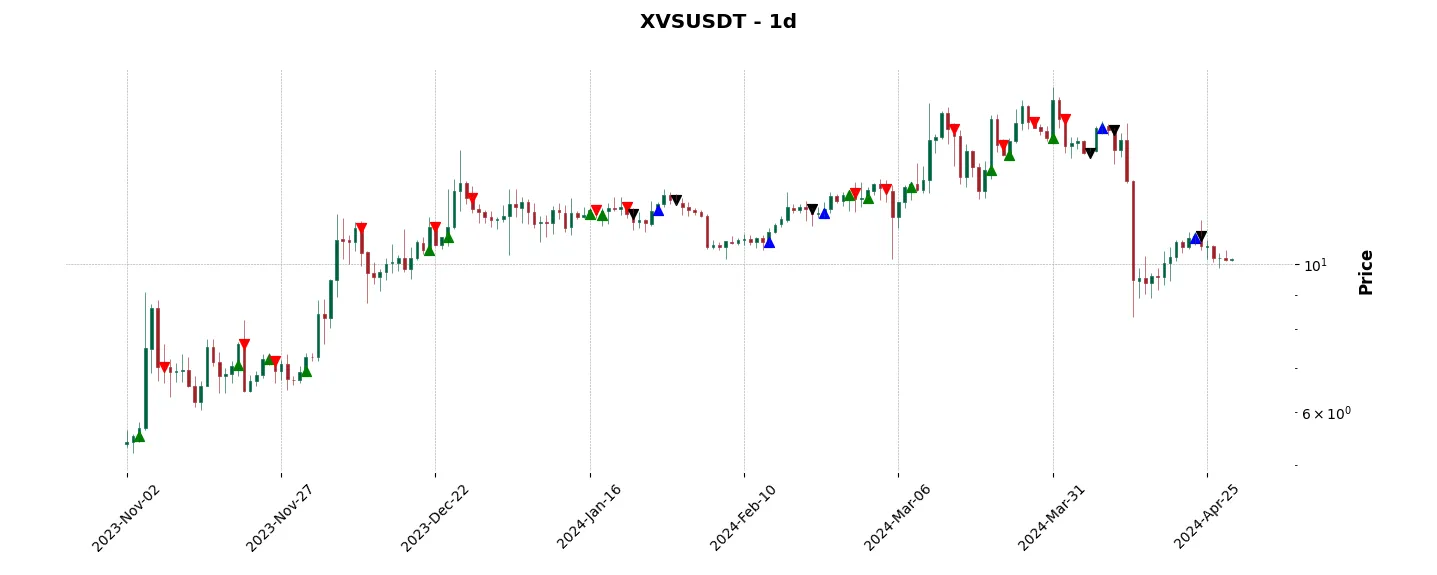

Top trading strategy Venus (XVS) daily – Live position:

- No position

Trade history

Over 6 months

Complete

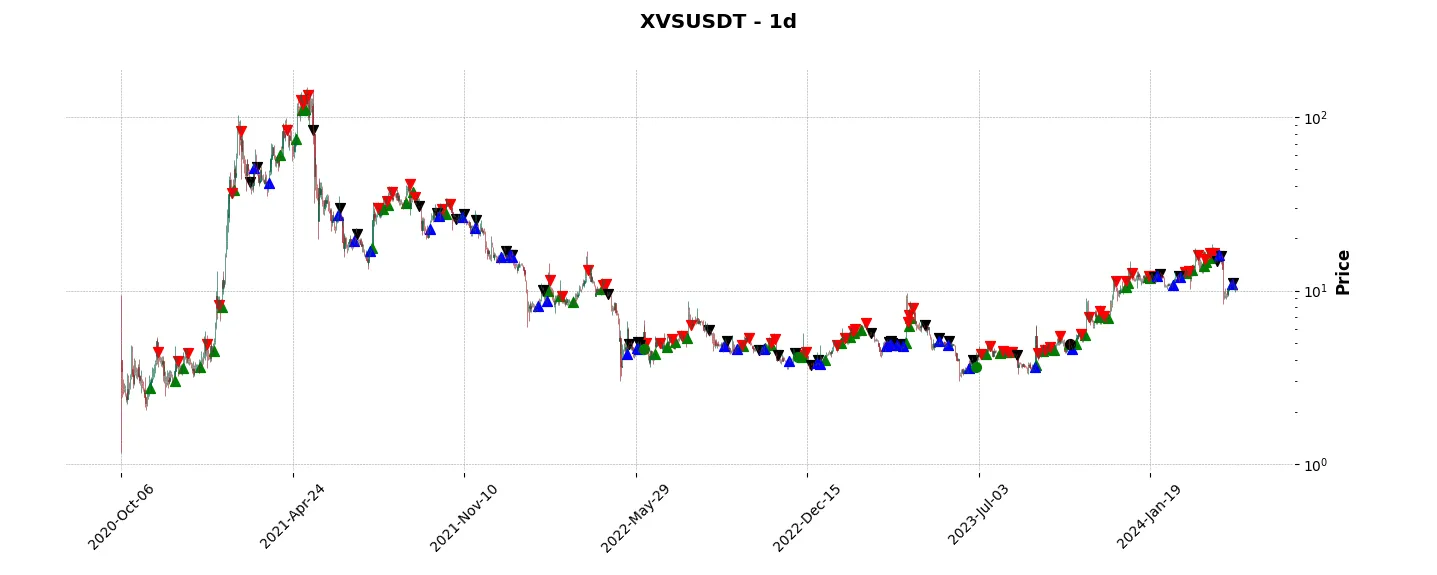

«Top trading strategy Venus (XVS) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy XVS daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

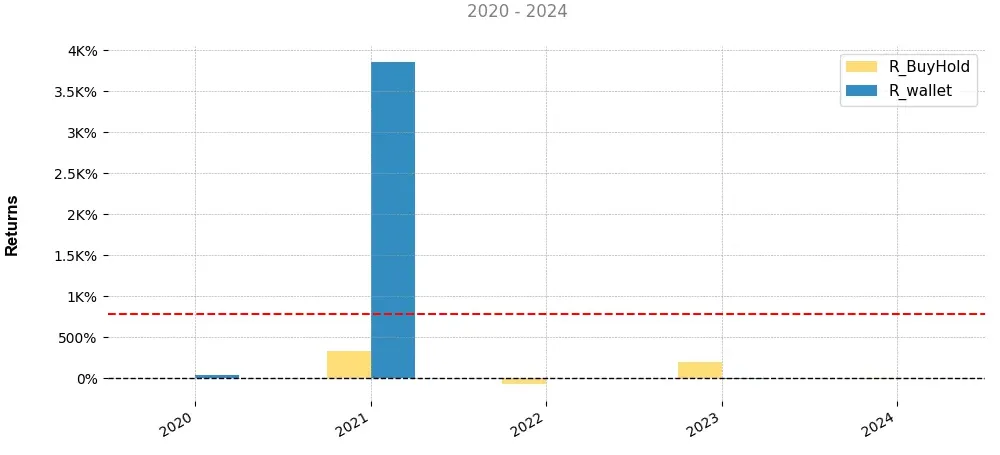

Annual comparison of cumulative returns with Buy & Holds

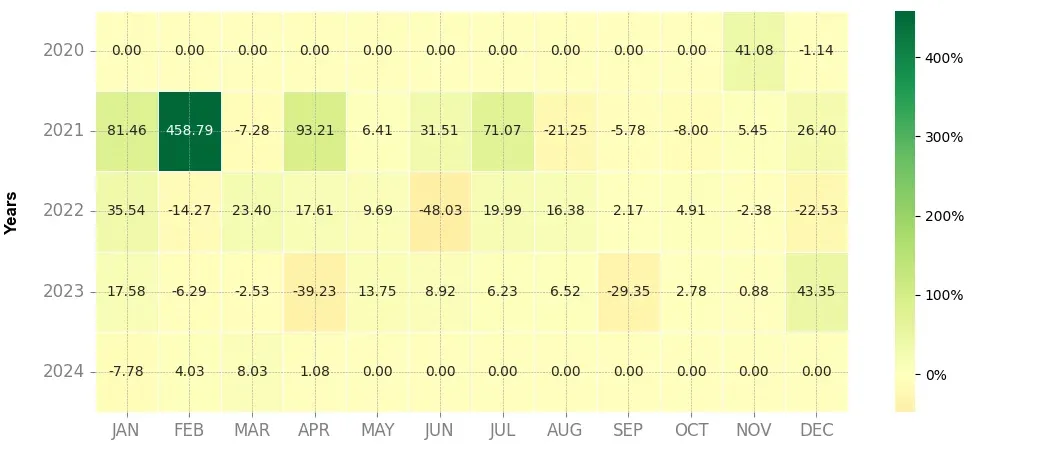

Heatmap of monthly returns

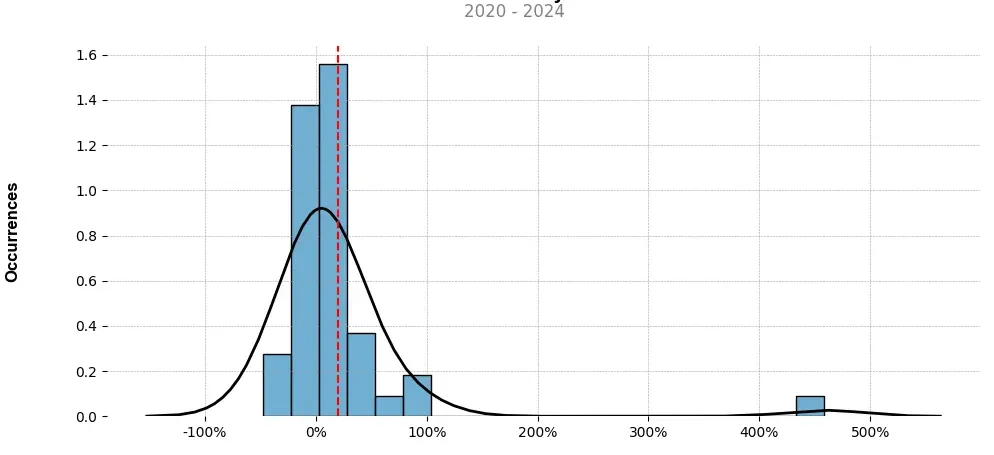

Distribution of the monthly returns of the top strategy

Presentation of XVS

Venus (XVS) cryptocurrency is a decentralized finance (DeFi) platform built on the Binance Smart Chain (BSC) that aims to provide users with lending, borrowing, and other financial services. Launched in October 2020, Venus has gained significant attention and popularity within the crypto community due to its unique features and potential for high returns.

One of the main features of Venus is its focus on money markets, allowing users to earn passive income by lending their idle assets or borrowing against their collateral. This decentralized lending protocol facilitates peer-to-peer transactions without the need for intermediaries, providing greater accessibility and efficiency in the financial services sector. By utilizing a liquidity pool mechanism, Venus ensures there is always sufficient liquidity for borrowers and lenders, increasing the overall stability and functionality of the platform.

Unlike traditional lending platforms, Venus operates on a collateralized model. Users can deposit their supported cryptocurrencies as collateral and borrow other digital assets against it. This creates a system that is both secure and transparent, as the value of the loan is always backed by collateral. Additionally, Venus utilizes algorithmic interest rates, which are determined by market supply and demand. This means users can earn variable interest rates based on the utilization rate of each asset, potentially enabling them to maximize their returns.

Furthermore, Venus supports various digital assets, allowing users to choose from a wide range of cryptocurrencies to lend, borrow, or use as collateral. This diverse portfolio enables users to hedge their risks and capitalize on different market opportunities. Venus also offers its native token, XVS, which serves as a governance token, giving holders the right to vote on platform improvements, protocol upgrades, and fee adjustments.

Additionally, Venus has integrated with multiple DeFi protocols and platforms, such as PancakeSwap and Binance Liquid Swap, to enhance interoperability and expand its user base. This integration allows users to access additional liquidity pools and trading options, further increasing the utility and functionality of Venus.

However, it is important to note that Venus operates within the volatile cryptocurrency market, and investing in XVS and utilizing the platform involves financial risks. As with any investment, users should conduct thorough research, assess their risk tolerance, and exercise caution.

In conclusion, Venus (XVS) crypto has emerged as a notable player in the DeFi space, providing users with lending, borrowing, and other financial services on the Binance Smart Chain. Its focus on money markets, collateralized lending, algorithmic interest rates, and wide range of supported assets have made it an attractive platform for users seeking passive income and additional DeFi opportunities. As the crypto market continues to evolve, Venus has positioned itself at the forefront of decentralized finance, offering innovative solutions to meet the growing demands of the crypto community.

Strategy details

«Top trading strategy XVS daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘defi’, ‘yield-farming’, ‘binance-launchpool’, ‘lending-borowing’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)