Last update: 04-03-2025 00:00 UTC

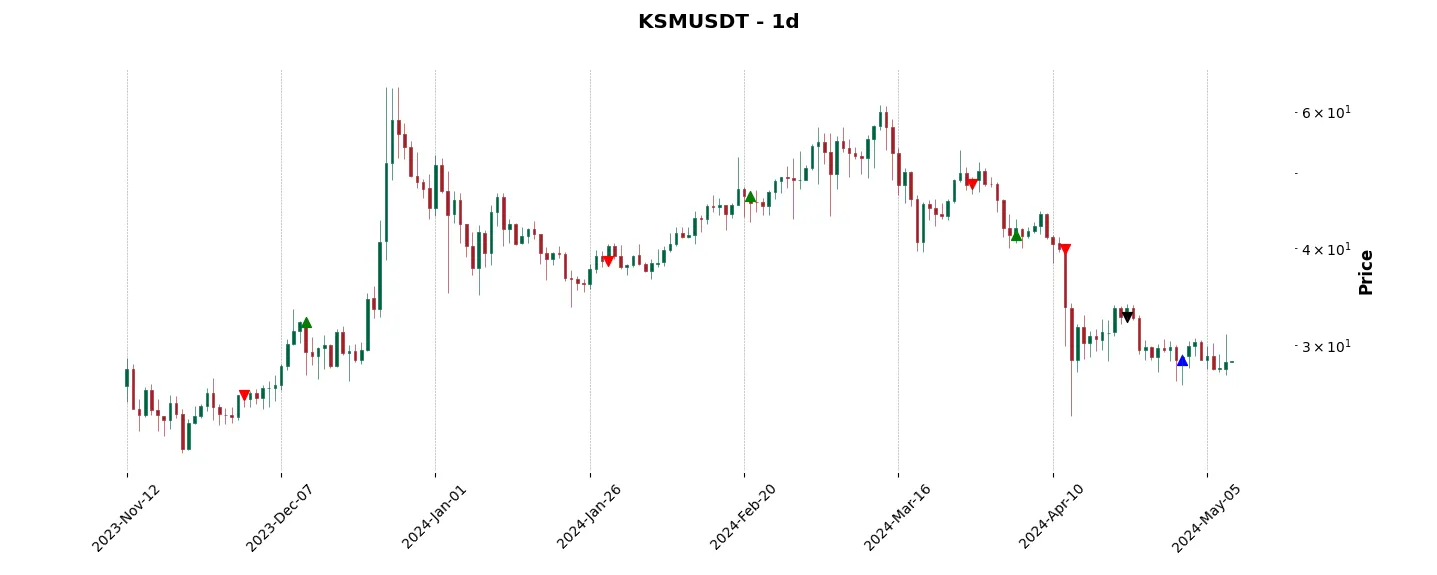

Top trading strategy Kusama (KSM) daily – Live position:

- No position

Trade history

Over 6 months

Complete

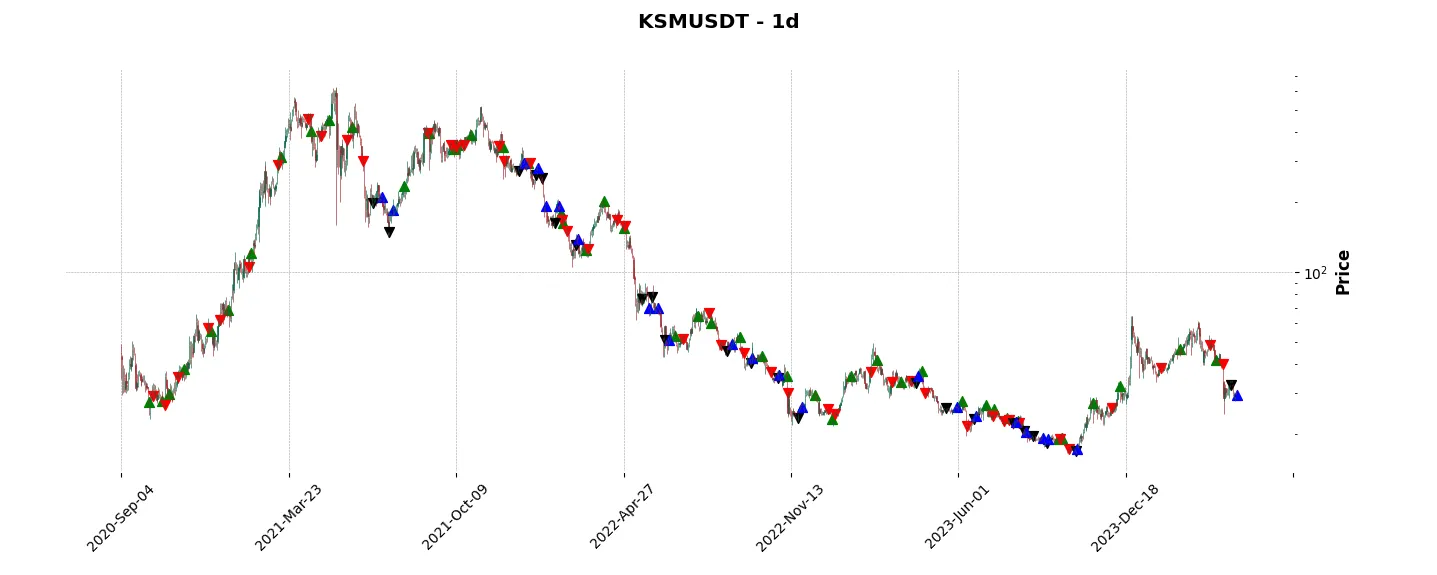

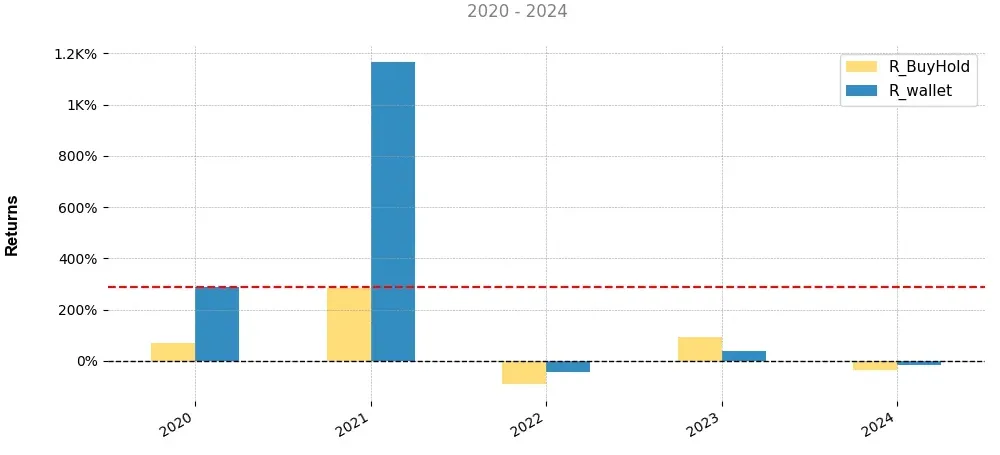

«Top trading strategy Kusama (KSM) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy KSM daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

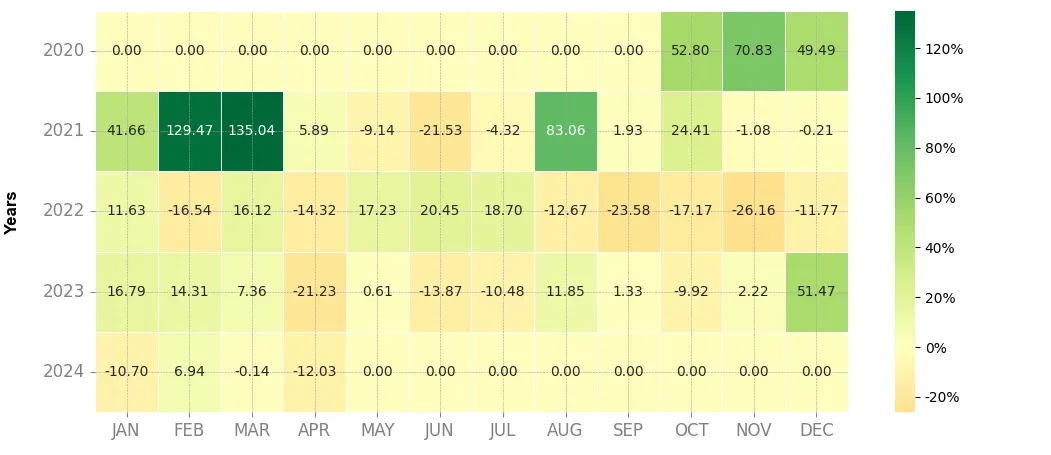

Heatmap of monthly returns

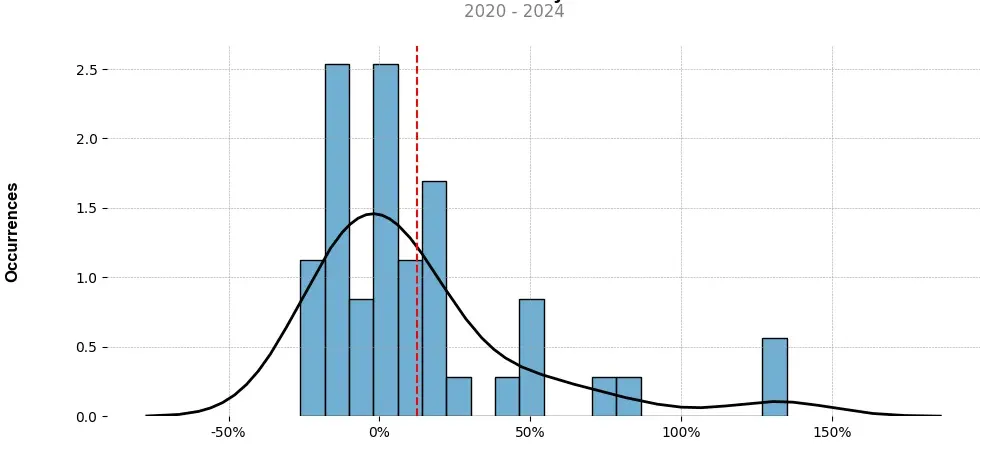

Distribution of the monthly returns of the top strategy

Presentation of KSM

Kusama (KSM) is a unique cryptocurrency that operates on its own decentralized network, serving as a testing ground for Polkadot, a larger multi-chain network. Founded by Gavin Wood, one of the co-founders of Ethereum, Kusama provides developers with a sandbox environment to experiment and test new blockchain technologies before they are deployed on the Polkadot network.

The main purpose of Kusama is to facilitate innovation and experimentation in the blockchain space. It allows developers to trial and validate their ideas, helping to weed out potential bugs and vulnerabilities before they are introduced on the more stable Polkadot ecosystem. This unique characteristic makes Kusama highly valuable for developers who can gain invaluable insights and feedback to improve their projects.

Kusama utilizes a Proof-of-Stake (PoS) consensus mechanism, where network participants known as validators are chosen based on the number of KSM tokens they hold. Validators are responsible for validating and verifying transactions on the network, maintaining its security and integrity. Alongside validators, Kusama also has a governance system that enables token holders to participate in decision-making processes, such as proposing and voting on network upgrades.

In terms of scalability and interoperability, Kusama takes advantage of the Polkadot technology. Polkadot’s vision is to create a network of parachains, specialized chains that can connect and communicate with each other, facilitating the seamless exchange of assets and data. Kusama acts as a canary network for Polkadot, enabling developers to test and refine new functionalities that will ultimately be integrated into the larger ecosystem.

As a cryptocurrency, KSM holds its own value and can be traded on various cryptocurrency exchanges. It is also used as a means of participating in the network’s governance process through staking. By staking KSM, users can earn rewards and actively contribute to the security and improvement of the Kusama network.

In conclusion, Kusama (KSM) crypto is a groundbreaking and innovative cryptocurrency that functions as a testing environment for Polkadot. It provides developers with the opportunity to experiment and refine their projects before they are deployed on the more stable Polkadot network. With its Proof-of-Stake consensus mechanism and governance system, Kusama promotes active participation and rewards for network participants. By leveraging the scalability and interoperability of Polkadot, Kusama offers a unique and valuable platform for blockchain innovation.

Strategy details

«Top trading strategy KSM daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘substrate’, ‘polkadot-ecosystem’, ‘cms-holdings-portfolio’, ‘kenetic-capital-portfolio’, ‘1confirmation-portfolio’, ‘vbc-ventures-portfolio’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)