Last update: 08-07-2024 00:00 UTC

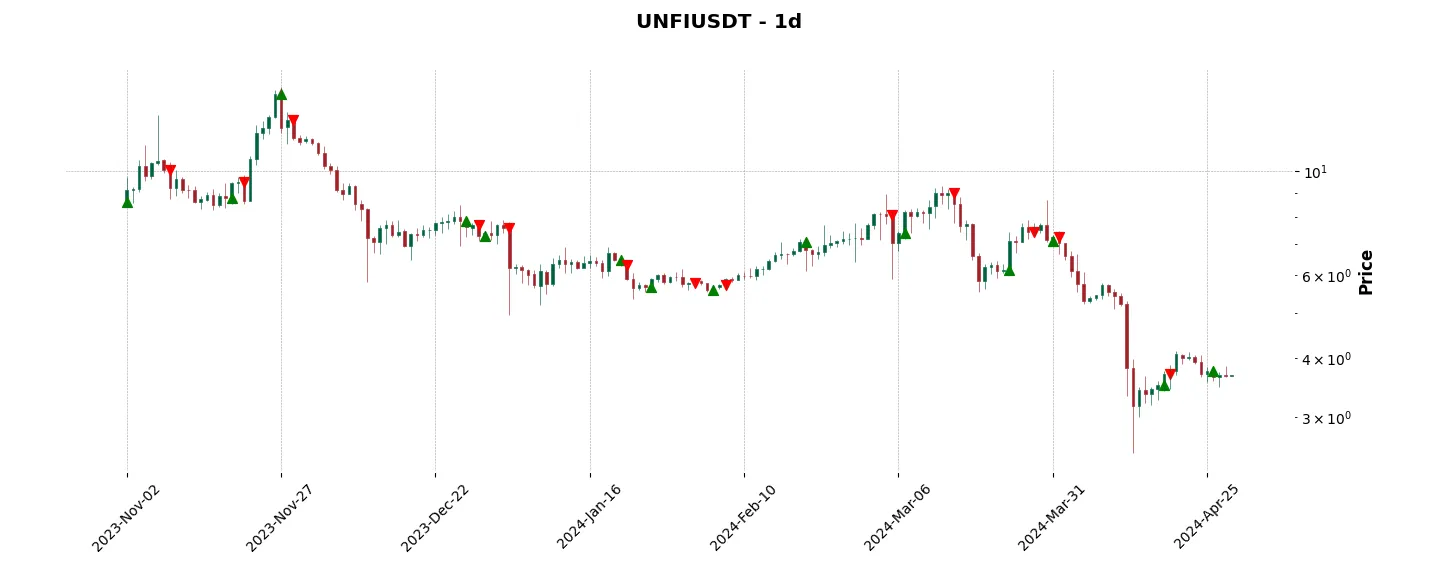

Top trading strategy Unifi Protocol DAO (UNFI) daily – Live position:

- Close long

- Entry price : 4.706 $

- Pnl : -12.32 %

Trade history

Over 6 months

Complete

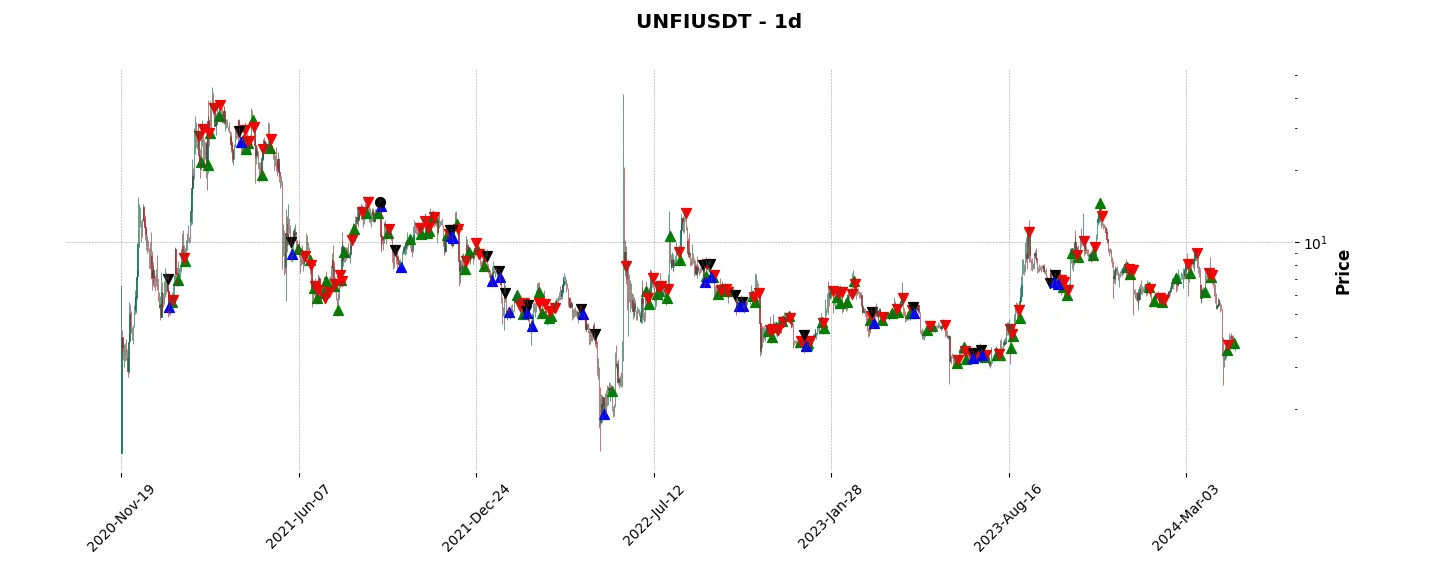

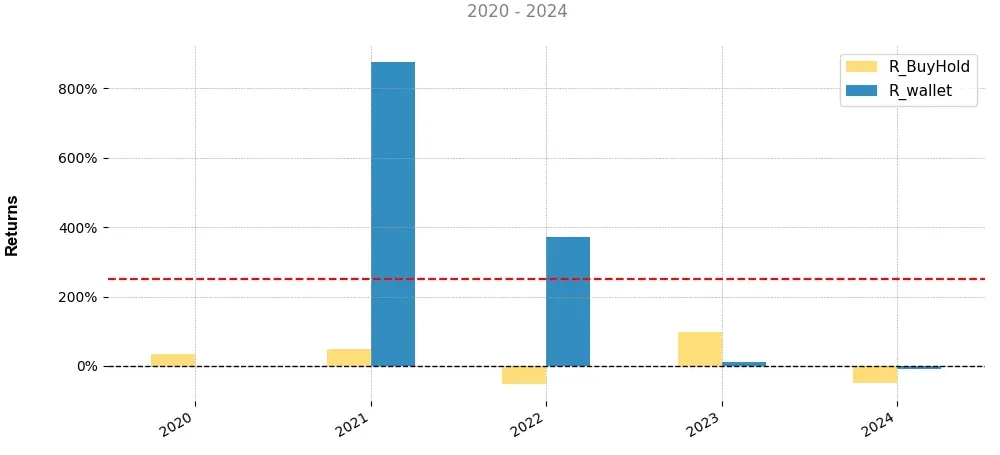

«Top trading strategy Unifi Protocol DAO (UNFI) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy UNFI daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

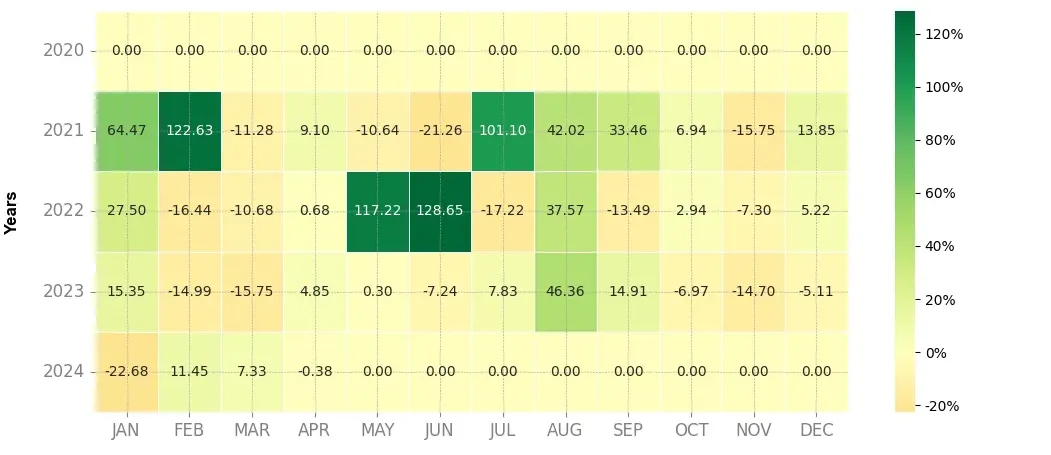

Heatmap of monthly returns

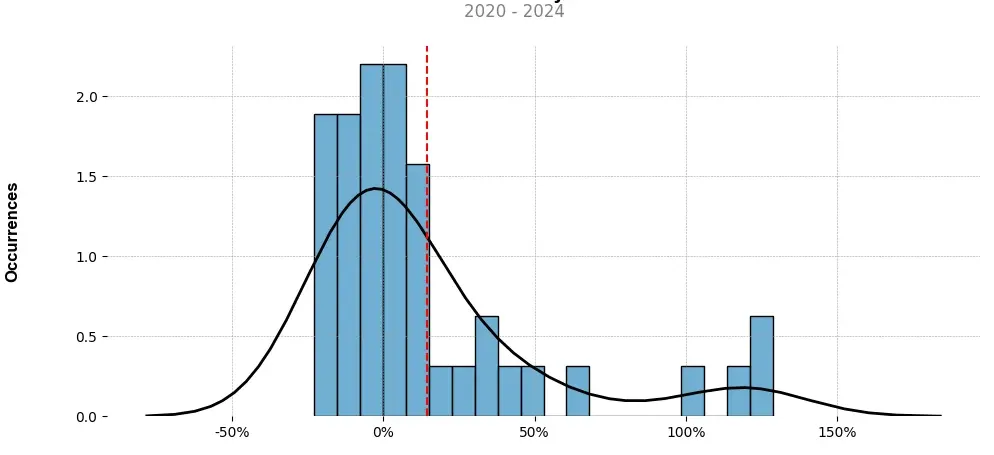

Distribution of the monthly returns of the top strategy

Presentation of UNFI

Unifi Protocol DAO (UNFI) is a decentralized finance (DeFi) project that aims to create a unified platform for the interoperability of various blockchain protocols. UNFI token serves as the native currency of the UNFI ecosystem and provides holders with governance rights and other benefits within the platform.

One of the key features of Unifi Protocol DAO is its focus on creating a truly decentralized and permissionless platform. The project aims to enable seamless collaboration and connectivity between different blockchain networks, allowing users to easily access and utilize various DeFi protocols and services.

Through its cross-chain functionality, Unifi Protocol DAO aims to bridge the gap between different decentralized platforms and enable the transfer of assets and data between them. This interoperability feature promotes efficiency and freedom of choice for users, as they can effectively leverage the benefits of multiple platforms without restrictions.

Furthermore, Unifi Protocol DAO aims to enhance the security of DeFi platforms by implementing advanced layers of protection. The project employs decentralized governance mechanisms, where UNFI token holders have the power to vote on proposals, upgrades, and other important decisions. This democratic approach ensures that the platform’s direction aligns with the interests and values of its community.

Another notable aspect of Unifi Protocol DAO is its commitment to supporting and incubating various DeFi projects. The platform offers a Launchpad feature, which serves as a fundraising avenue for new projects, providing them with access to capital and exposure in the DeFi space. This initiative not only encourages innovation but also strengthens the overall ecosystem by fostering collaboration and new development opportunities.

The UNFI token itself holds various utilities within the platform. In addition to governance rights, token holders can stake their UNFI to earn rewards and participate in liquidity mining programs. This incentivizes active participation and contributes to the overall stability and growth of the UNFI ecosystem.

In conclusion, Unifi Protocol DAO aims to revolutionize the DeFi landscape by creating a unified and interoperable platform. With a focus on decentralization, security, and inclusivity, UNFI strives to provide a seamless experience for users, while also supporting the growth and development of the broader DeFi community.

Strategy details

«Top trading strategy UNFI daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘defi’, ‘binance-launchpool’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)