Last update: 04-03-2025 00:00 UTC

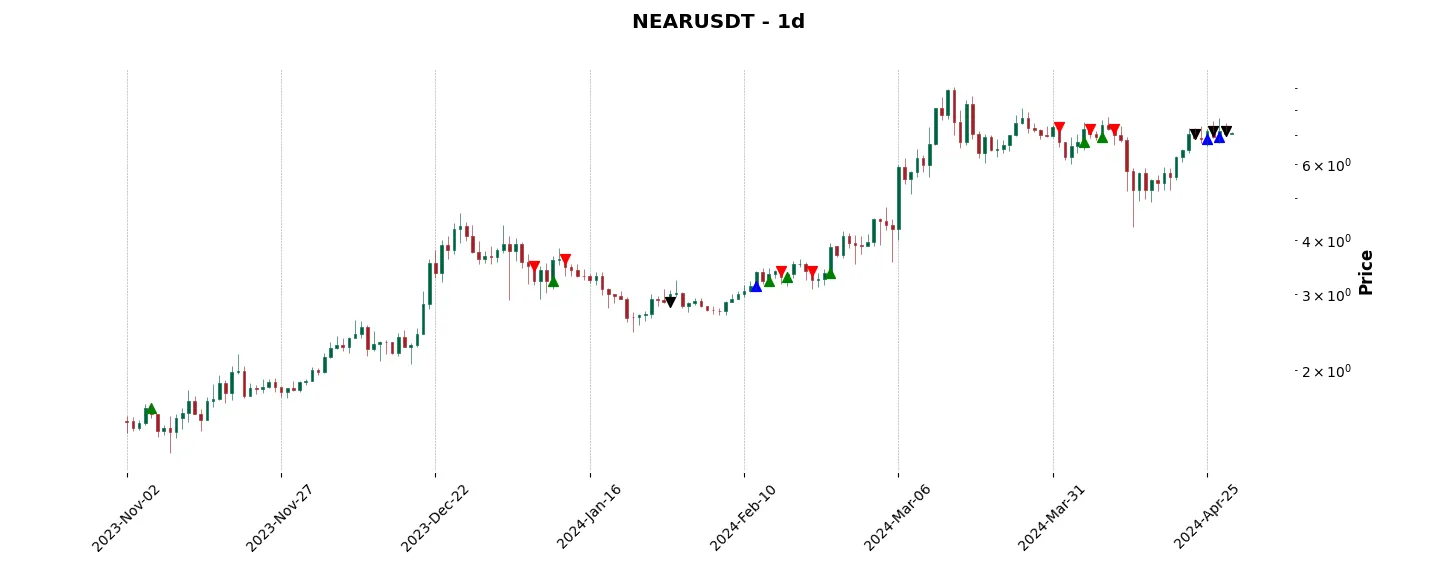

Top trading strategy NEAR Protocol (NEAR) daily – Live position:

- No position

Trade history

Over 6 months

Complete

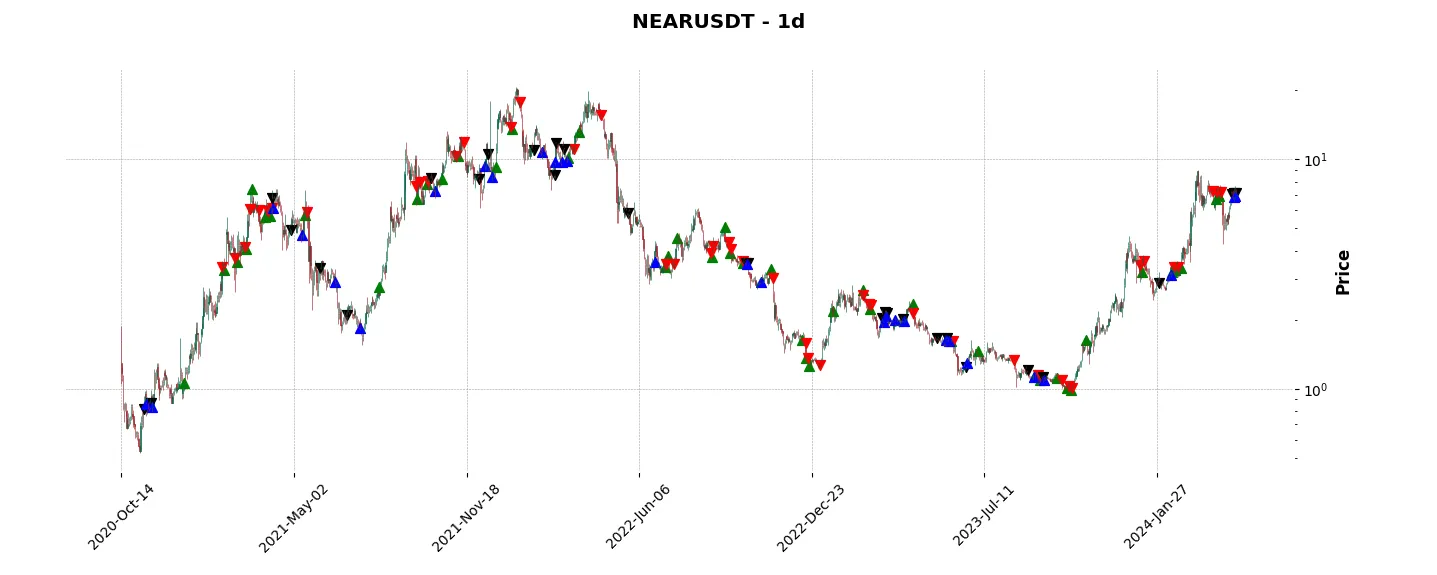

«Top trading strategy NEAR Protocol (NEAR) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy NEAR daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

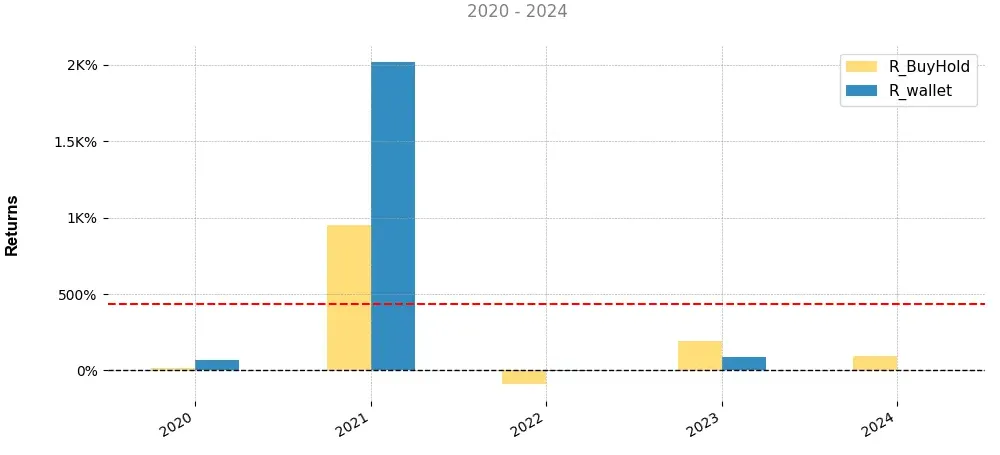

Annual comparison of cumulative returns with Buy & Holds

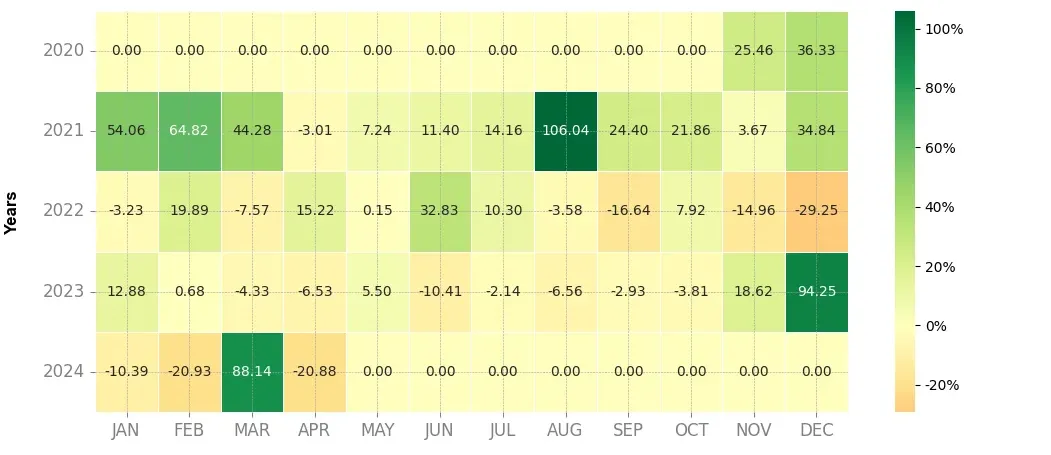

Heatmap of monthly returns

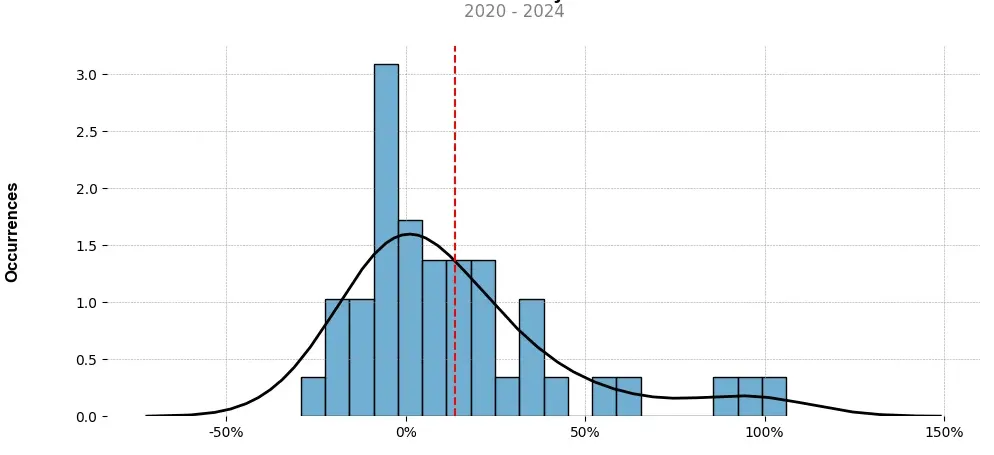

Distribution of the monthly returns of the top strategy

Presentation of NEAR

NEAR Protocol (NEAR) is a decentralized blockchain platform designed to enable the creation and management of decentralized applications (dApps) on a scalable infrastructure. Founded in 2018 by Alex Skidanov and Illia Polosukhin, NEAR seeks to address the limitations of existing blockchain platforms by combining the benefits of decentralization with the need for high throughput and low transaction costs.

One of the key features of NEAR Protocol is its scalability. Unlike many other blockchain networks that suffer from congestion and high fees during peak usage, NEAR utilizes a unique sharded design to increase network capacity. This approach allows the network to process a high number of transactions in parallel, thereby improving scalability and reducing transaction fees. The protocol also employs a proof-of-stake consensus mechanism, known as Nightshade, which helps ensure security while maintaining high throughput.

Another important aspect of NEAR Protocol is its developer-friendly ecosystem. NEAR offers a development environment known as NEAR SDK, which simplifies the process of building and deploying dApps on the platform. The SDK provides a comprehensive set of tools and APIs, making it easier for developers to write smart contracts, create user interfaces, and interact with the blockchain. Additionally, NEAR’s Rainbow Bridge technology allows developers to seamlessly port existing Ethereum-based dApps to the NEAR network, expanding the ecosystem and increasing interoperability between different blockchains.

NEAR Protocol also prioritizes user experience by providing a smooth onboarding process and intuitive user interfaces. The protocol offers a lightweight, web-based wallet known as NEAR Wallet, which allows users to store, send, and receive NEAR tokens and interact with dApps seamlessly. With its user-friendly interface and robust security measures, NEAR Wallet aims to make blockchain technology accessible to a wider audience.

Furthermore, NEAR Protocol is committed to fostering a strong and vibrant community. The protocol’s governance model enables token holders to participate in decision-making processes and contribute to the platform’s development. NEAR also supports various initiatives to engage developers, such as hackathons and grants programs, promoting innovation and growth within the ecosystem.

In summary, NEAR Protocol is an advanced blockchain platform that combines decentralization, scalability, and developer-friendliness to offer a comprehensive solution for building and deploying dApps. With its innovative sharding design, developer-friendly tools, and emphasis on user experience, NEAR Protocol seeks to overcome the limitations of existing blockchain platforms and drive the adoption of decentralized applications in a scalable and user-friendly manner.

Strategy details

«Top trading strategy NEAR daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘staking’, ‘coinbase-ventures-portfolio’, ‘three-arrows-capital-portfolio’, ‘arrington-xrp-capital-portfolio’, ‘coinfund-portfolio’, ‘electric-capital-portfolio’, ‘fabric-ventures-portfolio’, ‘kenetic-capital-portfolio’, ‘near-protocol-ecosystem’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)