Last update: 04-03-2025 00:00 UTC

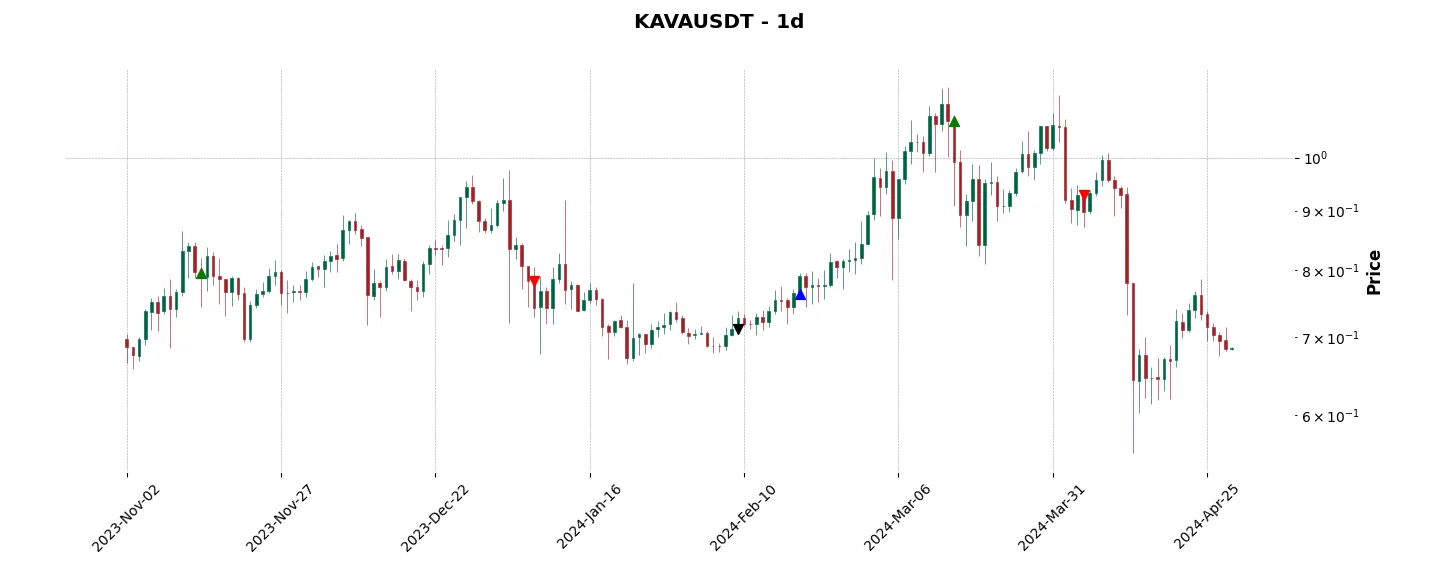

Top trading strategy Kava (KAVA) daily – Live position:

- Short in progress

- Entry price : 0.4553 $

- Pnl : 11.31 %

Trade history

Over 6 months

Complete

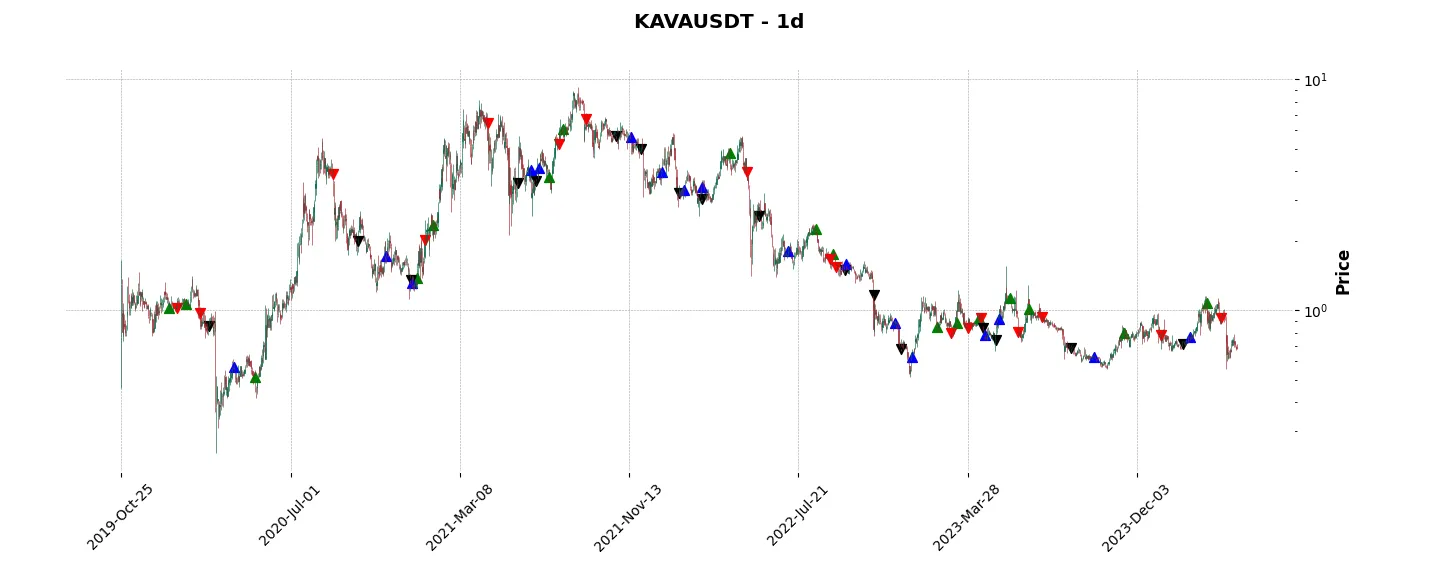

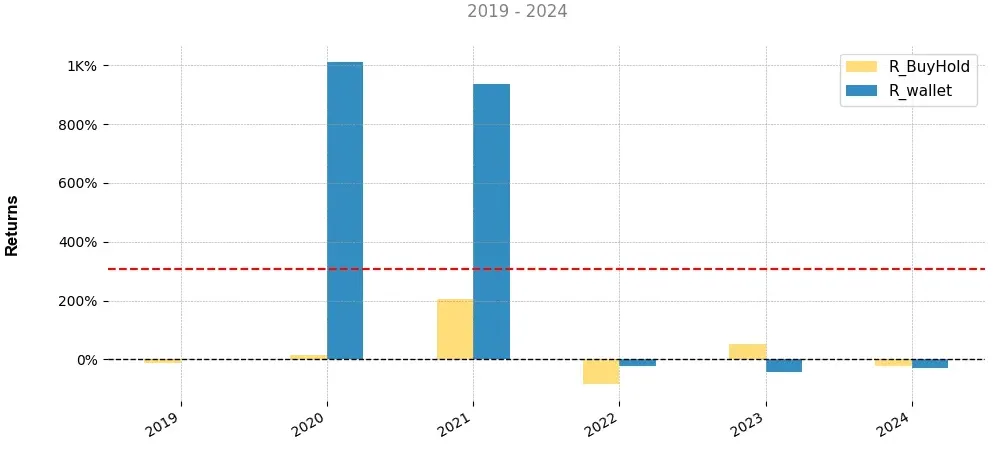

«Top trading strategy Kava (KAVA) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy KAVA daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

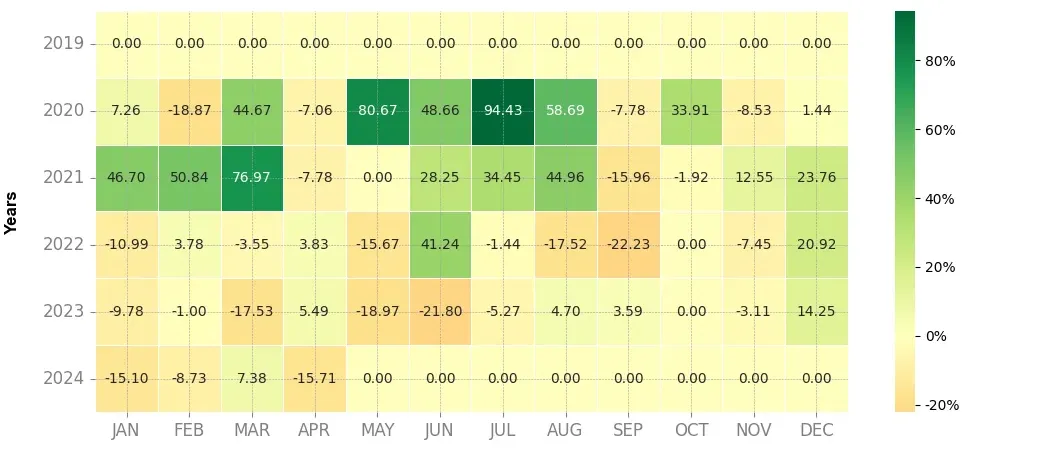

Heatmap of monthly returns

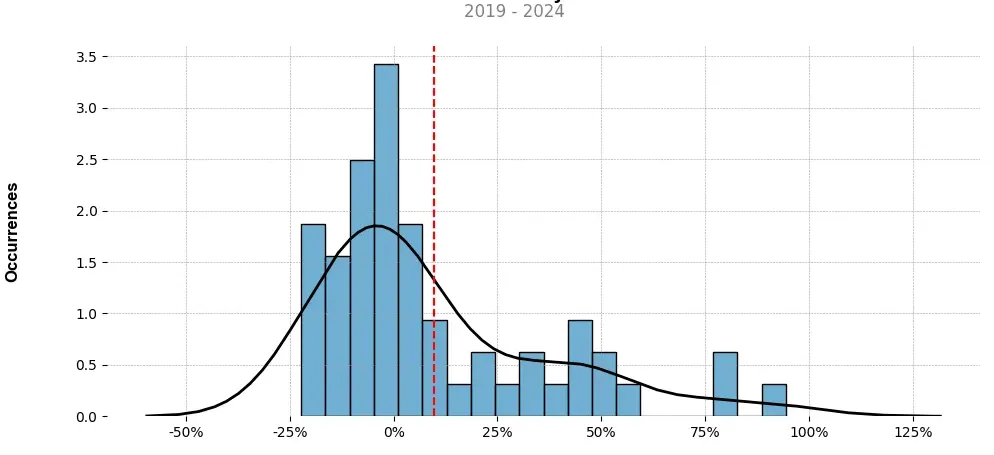

Distribution of the monthly returns of the top strategy

Presentation of KAVA

Kava (KAVA) is a cryptocurrency that aims to bridge the gap between decentralized finance (DeFi) and real-world assets. It aims to provide a platform that allows users to access various financial services, such as borrowing, lending, and trading, using collateralized digital assets.

One of the key features of Kava is its ability to enable cross-chain asset transfers. This means that users can collateralize their digital assets from different blockchain networks, such as Bitcoin or Ethereum, and access various financial services on the Kava platform. This interoperability enables users to leverage their existing digital assets to gain access to additional financial opportunities.

Kava utilizes a unique system called the Kava CDP (Collateralized Debt Position). Users can lock their digital assets as collateral and borrow stablecoins, such as USDX, which is pegged to the US dollar. This mechanism allows users to maintain ownership of their assets while still being able to access liquidity in the form of stablecoins.

Furthermore, Kava is designed to be a scalable and secure platform. It utilizes the Tendermint consensus algorithm, which enables fast transaction processing and ensures the security of the network. This approach also allows Kava to be integrated with other blockchain networks, benefiting from the security and decentralization provided by these networks.

Another important aspect of Kava is its governance model. Kava token holders have the ability to participate in the decision-making process for platform upgrades and proposals. This ensures that the community has a say in the development of the platform and helps maintain a decentralized governance structure.

The main use cases for Kava include borrowing and lending of digital assets, trading on decentralized exchanges, and accessing decentralized stablecoins. These use cases provide users with the ability to earn interest on their digital assets, hedge against volatility, and access liquidity in a decentralized and transparent manner.

Overall, Kava aims to provide a robust and accessible platform for decentralized finance. By enabling cross-chain asset transfers and incorporating a unique collateralized debt position system, Kava offers users the opportunity to leverage their digital assets in a secure and scalable manner. With its governance model and diverse use cases, Kava has the potential to contribute significantly to the growing ecosystem of decentralized finance.

Strategy details

«Top trading strategy KAVA daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘cosmos-ecosystem’, ‘defi’, ‘binance-launchpad’, ‘binance-labs-portfolio’, ‘lending-borowing’, ‘arrington-xrp-capital-portfolio’, ‘framework-ventures-portfolio’, ‘hashkey-capital-portfolio’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)