Last update: 15-10-2024 00:00 UTC

Top trading strategy Orion Protocol (ORN) daily – Live position:

- Open short

- Entry price : 1.031 $

- Pnl : %

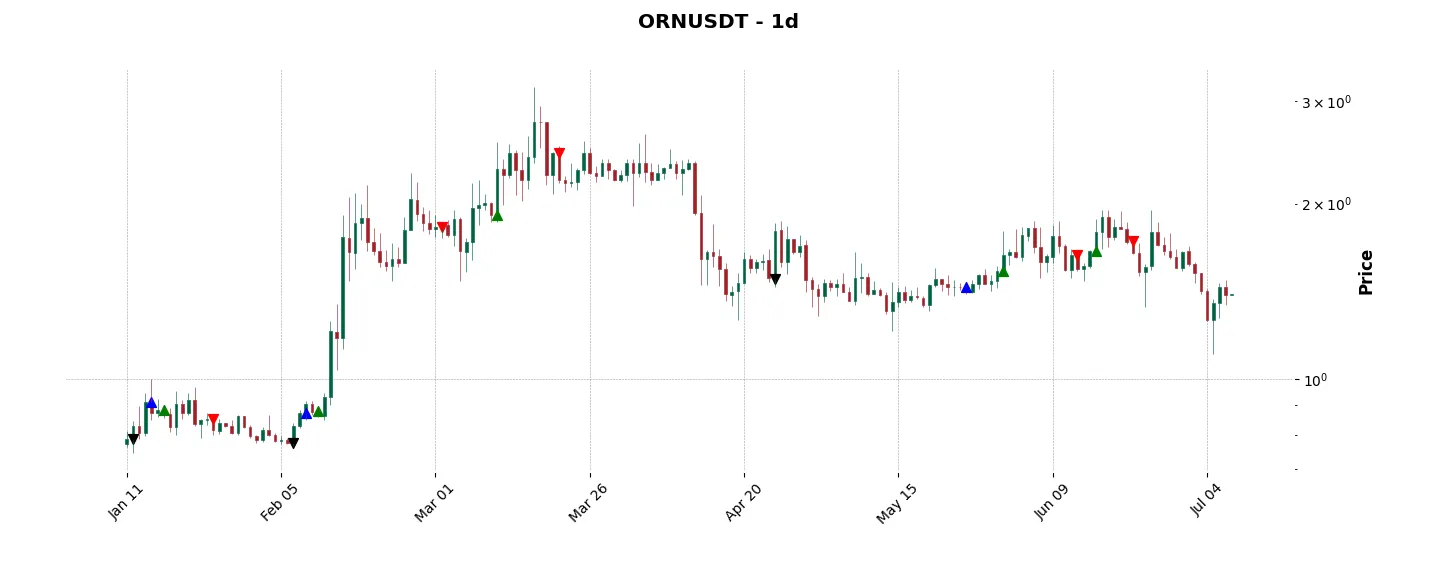

Trade history

Over 6 months

Complete

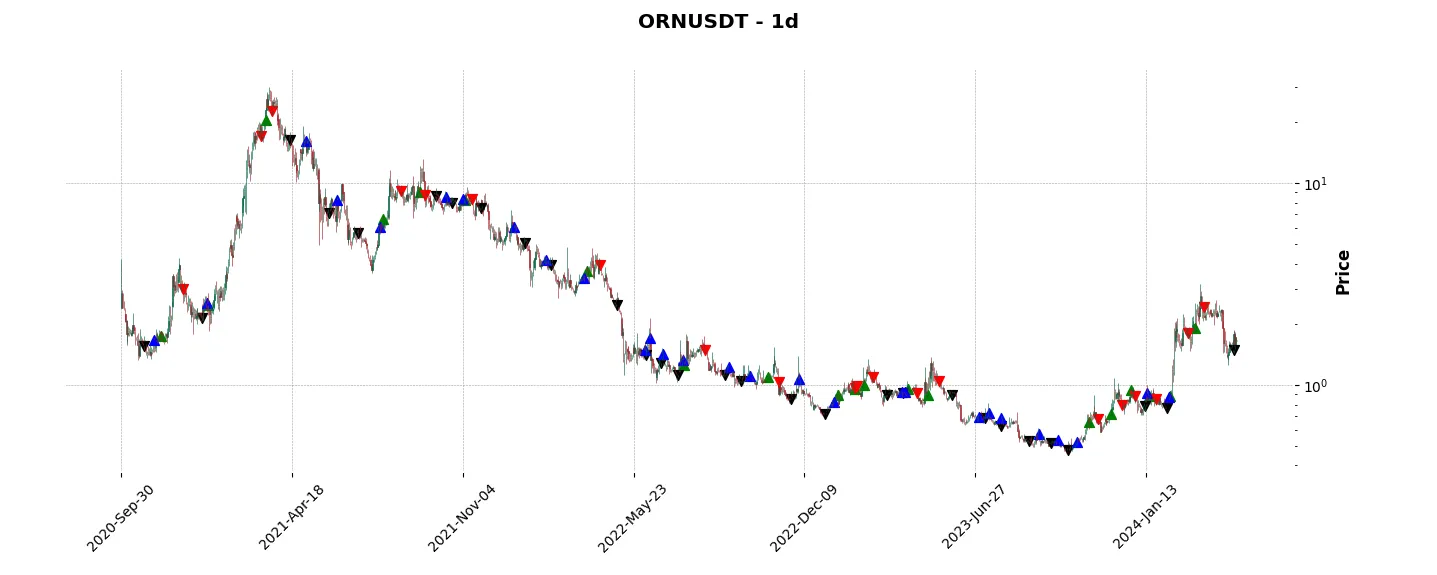

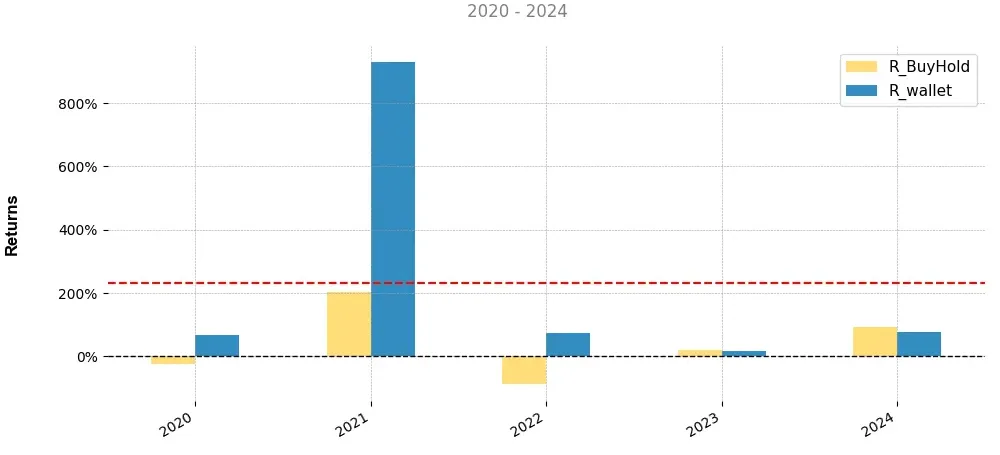

«Top trading strategy Orion Protocol (ORN) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy ORN daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

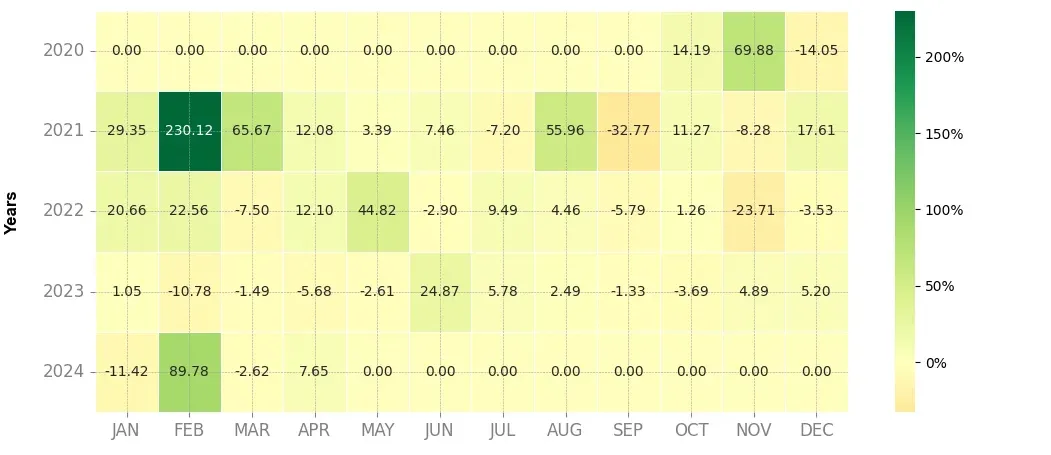

Heatmap of monthly returns

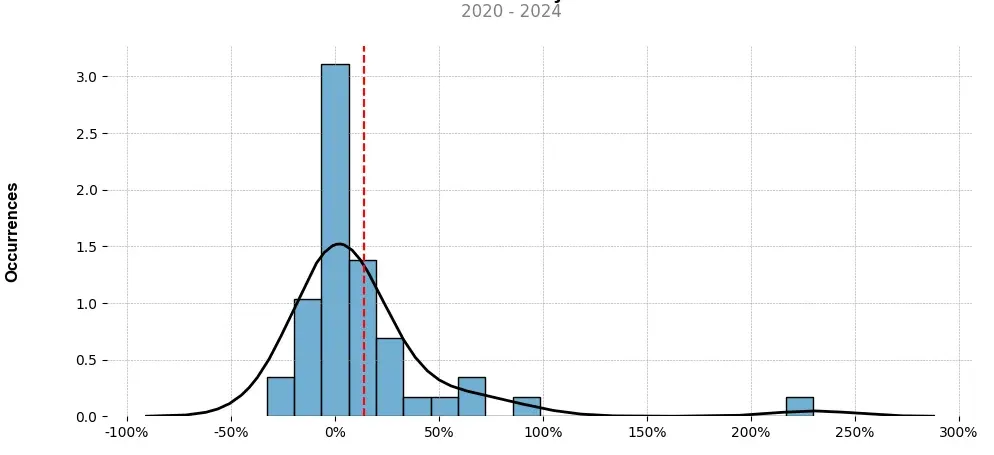

Distribution of the monthly returns of the top strategy

Presentation of ORN

Orion Protocol (ORN) is a blockchain-based cryptocurrency that offers a decentralized liquidity aggregator and a decentralized lending platform. It aims to solve the liquidity fragmentation problem in the crypto market by providing a universal gateway to all major exchanges, allowing users to access multiple trading platforms through a single interface.

One of the key features of Orion Protocol is its decentralized liquidity aggregator (DLA), which combines liquidity from various exchanges and sources into a single pool. This addresses the issue of fragmented liquidity in the crypto market, where traders often need to create accounts on multiple exchanges to access different trading pairs. With the DLA, traders can access a wide range of assets and trading pairs from multiple exchanges, providing them with better options for trading and maximizing their profit potential.

Furthermore, Orion Protocol also offers a decentralized lending platform, which allows users to lend and borrow cryptocurrencies securely and directly from other users. This peer-to-peer lending feature eliminates the need for intermediaries like banks or lending platforms, giving users full control over their funds while earning interest on their holdings. The platform utilizes smart contracts to facilitate transparent and automated lending processes, making it efficient and reliable for users.

Another noteworthy aspect of Orion Protocol is its emphasis on security and privacy. The platform does not require users to disclose their private keys or personal information, ensuring that their assets and identities are protected. In addition, the protocol integrates with secure wallets and decentralized applications (DApps) to enhance security and give users complete control over their digital assets.

The ORN token plays a crucial role within the Orion Protocol ecosystem. It serves as the utility token for various functions such as payment for transaction fees, providing access to advanced features and services, and as a governance token for community voting on platform upgrades and proposals. The token also has a deflationary mechanism, reducing its supply over time, which may potentially increase its value based on market demand.

Overall, Orion Protocol offers a comprehensive solution to the liquidity fragmentation problem in the crypto market while prioritizing security, privacy, and user control. By combining multiple exchange liquidity, providing a decentralized lending platform, and ensuring user anonymity, Orion Protocol aims to empower traders and investors with easier access to a diverse range of assets and services in a decentralized manner.

Strategy details

«Top trading strategy ORN daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘defi’, ‘dex’, ‘algorand-ecosystem’, ‘avalanche-ecosystem’, ‘dao-maker’, ‘exnetwork-capital-portfolio’, ‘fantom-ecosystem’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)