Last update: 04-03-2025 00:00 UTC

Top trading strategy Injective (INJ) daily – Live position:

- No position

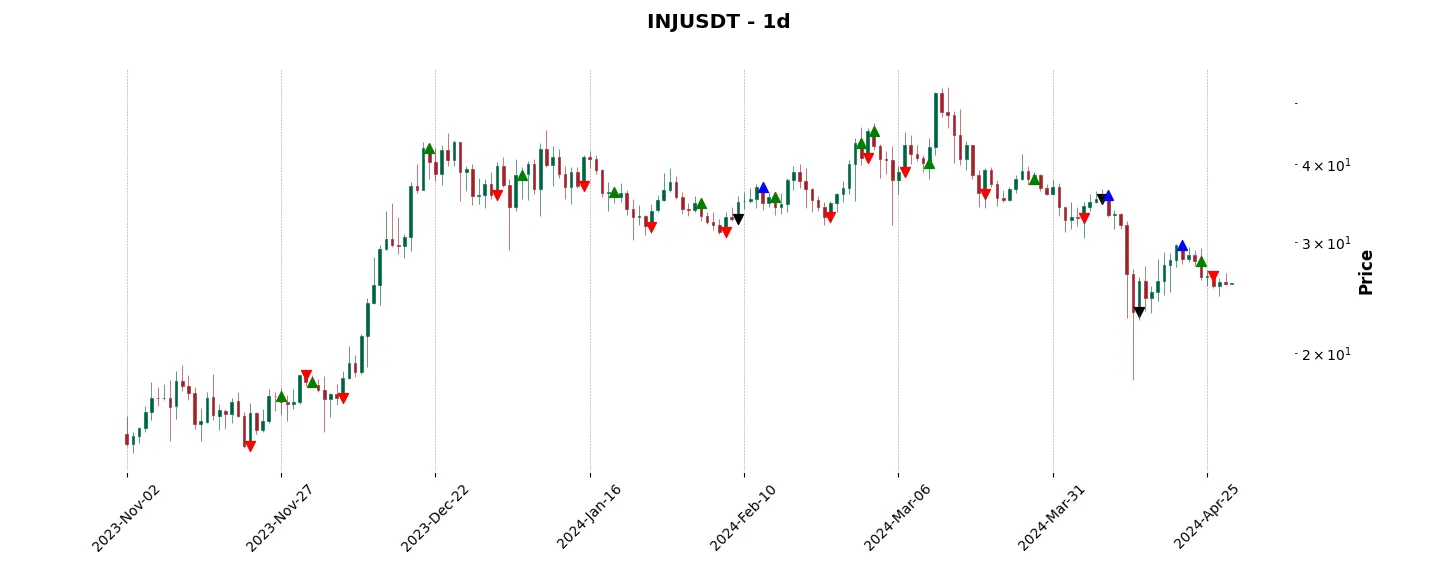

Trade history

Over 6 months

Complete

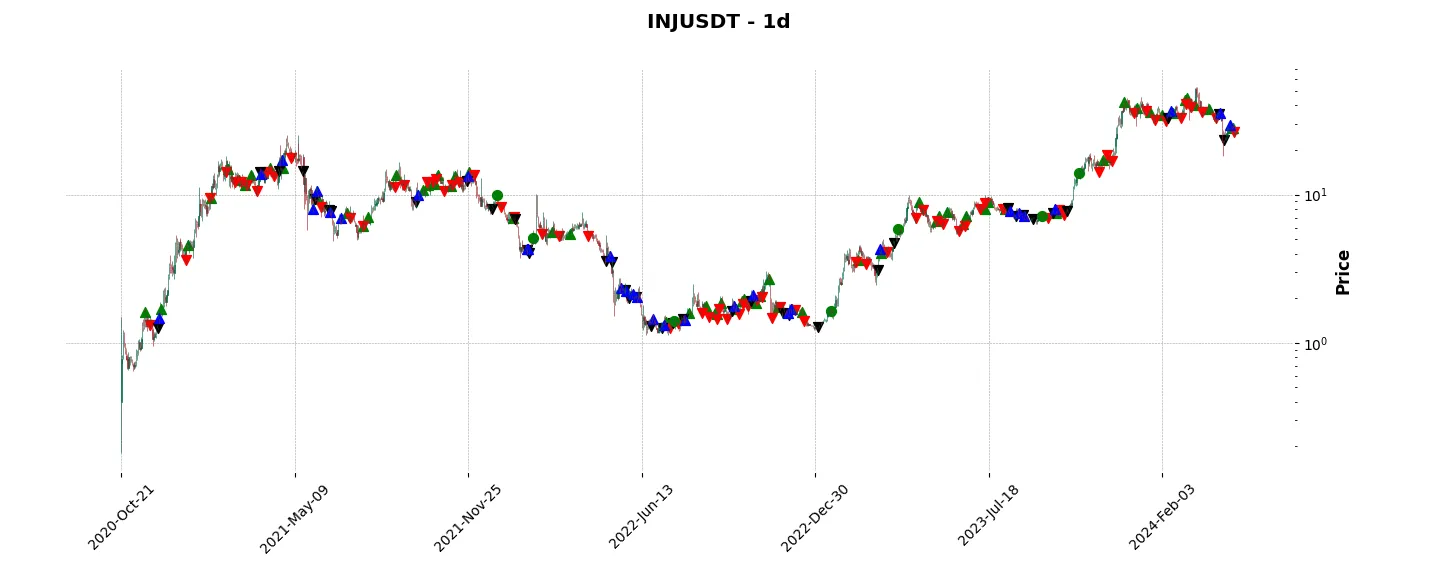

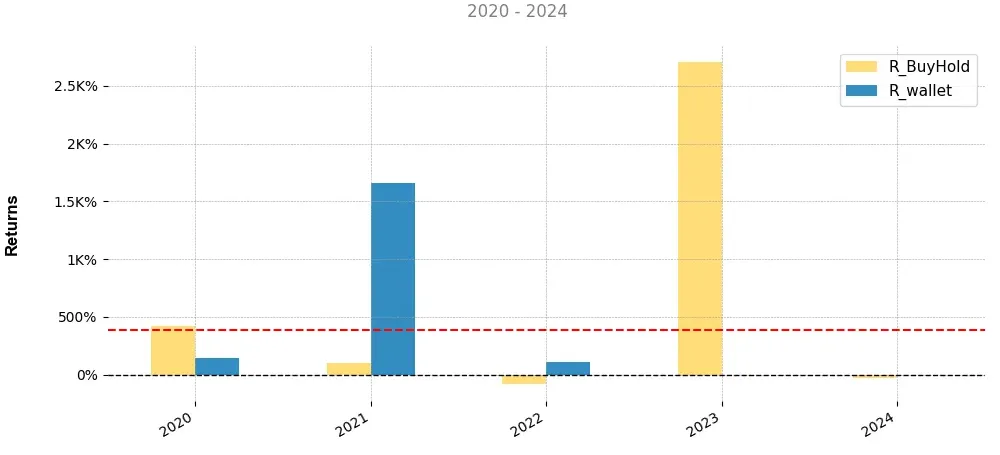

«Top trading strategy Injective (INJ) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy INJ daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

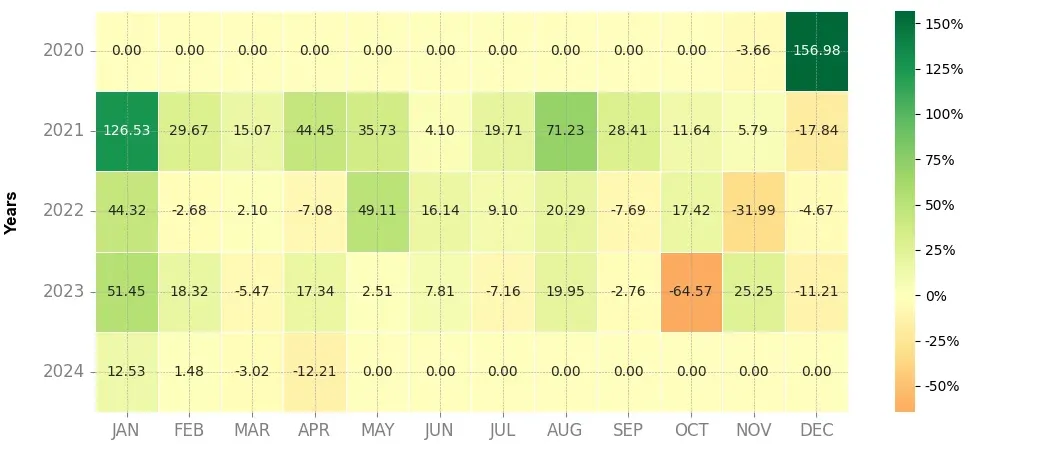

Heatmap of monthly returns

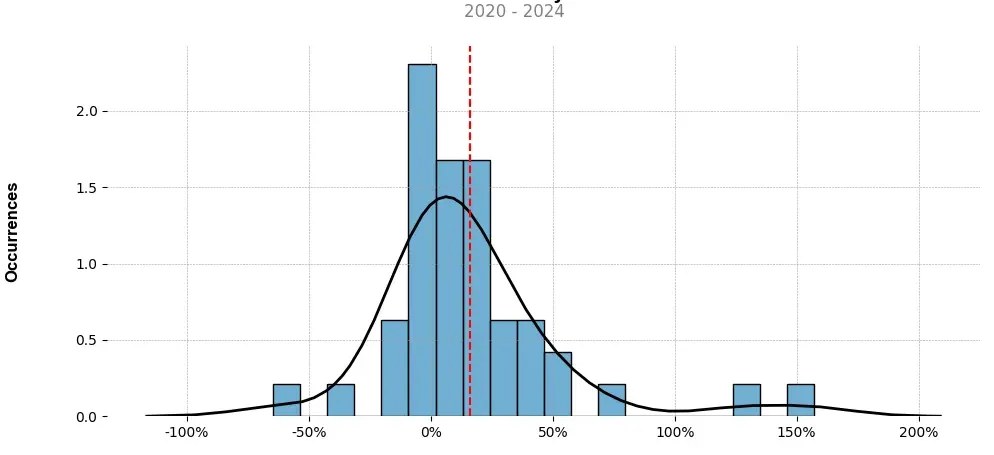

Distribution of the monthly returns of the top strategy

Presentation of INJ

Injective (INJ) crypto is a cryptocurrency that aims to revolutionize the decentralized finance (DeFi) space by offering a seamless trading experience on a truly decentralized platform. INJ is built on the Cosmos network, which utilizes a Tendermint consensus algorithm and inter-blockchain communication (IBC) technology, enabling cross-chain interoperability and scalability.

One of the key features of Injective is its focus on providing fully decentralized trading with minimal fees. By leveraging the advantages of blockchain technology, INJ eliminates the need for intermediaries such as centralized exchanges, reducing trading costs and increasing user autonomy. The platform allows users to trade a wide range of assets, including cryptocurrencies, derivatives, and real-world assets, all within a secure and transparent environment.

Injective further sets itself apart through its unique feature called “front-running resistance.” Front-running refers to the practice of prioritizing certain transactions to gain an unfair advantage over other traders. INJ combats this issue by implementing a mechanism called “order book sniping protection,” ensuring that all users have equal access to order execution.

Moreover, INJ offers a novel scaling solution known as “layer-2 derivatives protocol.” This protocol enables high-speed and low-latency trading, as well as the ability to handle large trading volumes. By leveraging layer-2 solutions, Injective enhances scalability without compromising on security or decentralization.

Another noteworthy aspect of Injective is its governance model. INJ holders have the power to vote on proposals and decisions related to platform upgrades, fee adjustments, and the addition of new features. This feature empowers the community and ensures that the platform evolves based on the consensus of its stakeholders.

Furthermore, Injective has formed strategic partnerships and collaborations with established DeFi protocols, including Chainlink and Elrond Network. These partnerships enhance interoperability and expand the capabilities of the Injective ecosystem.

Overall, Injective (INJ) crypto offers a promising solution to the challenges faced by traditional centralized exchanges. Its focus on decentralization, low fees, front-running resistance, and scalability, combined with its innovative governance model, position Injective as a significant player in the DeFi space.

Strategy details

«Top trading strategy INJ daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘pos’, ‘platform’, ‘cosmos-ecosystem’, ‘defi’, ‘derivatives’, ‘smart-contracts’, ‘staking’, ‘binance-launchpad’, ‘binance-labs-portfolio’, ‘cms-holdings-portfolio’, ‘pantera-capital-portfolio’, ‘injective-ecosystem’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)