Last update: 22-01-2024

Top trading strategy Horizen (ZEN) Weekly – Live position:

- Short in progress

- Entry price : 9.04 $

- Pnl : 18.58 %

Trade history

Over 6 months

Complete

«Top trading strategy Horizen (ZEN) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy ZEN Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

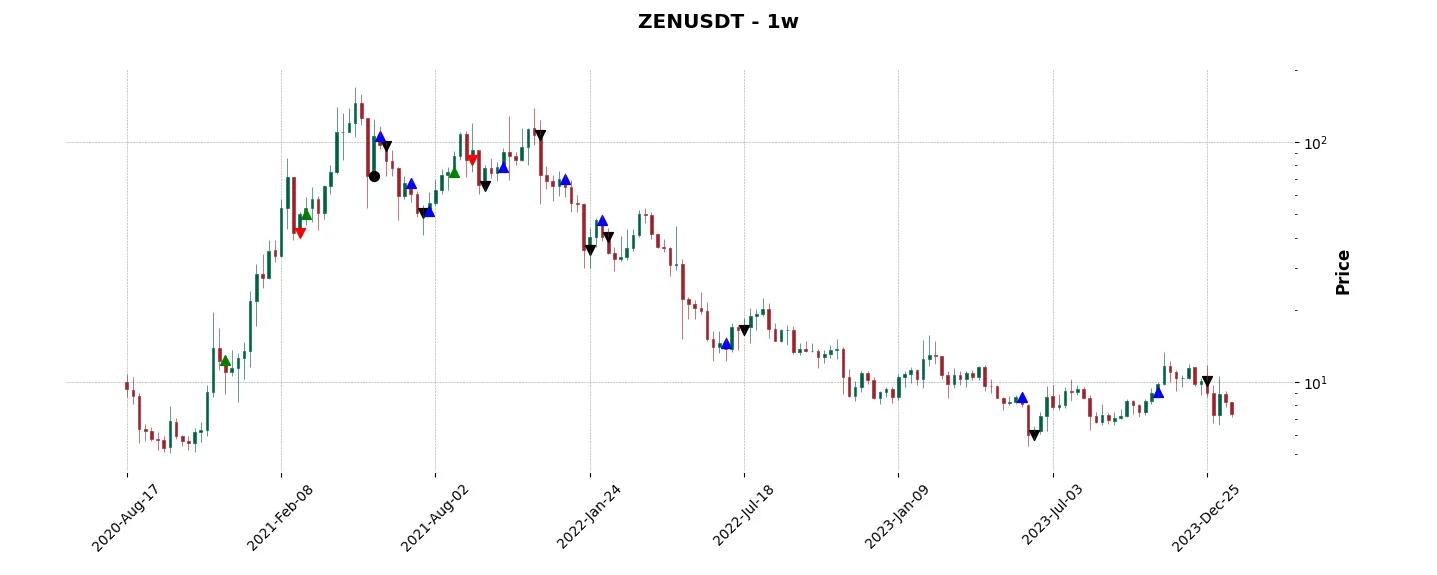

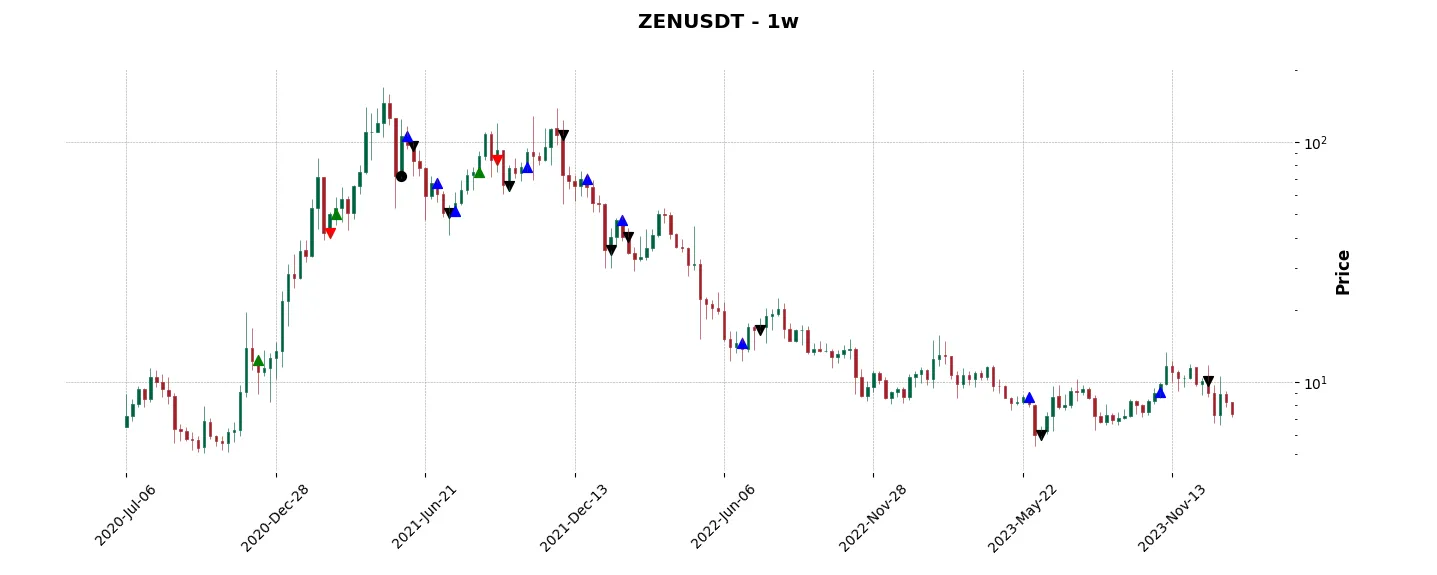

Historical comparison of cumulative returns with Buy & Hold

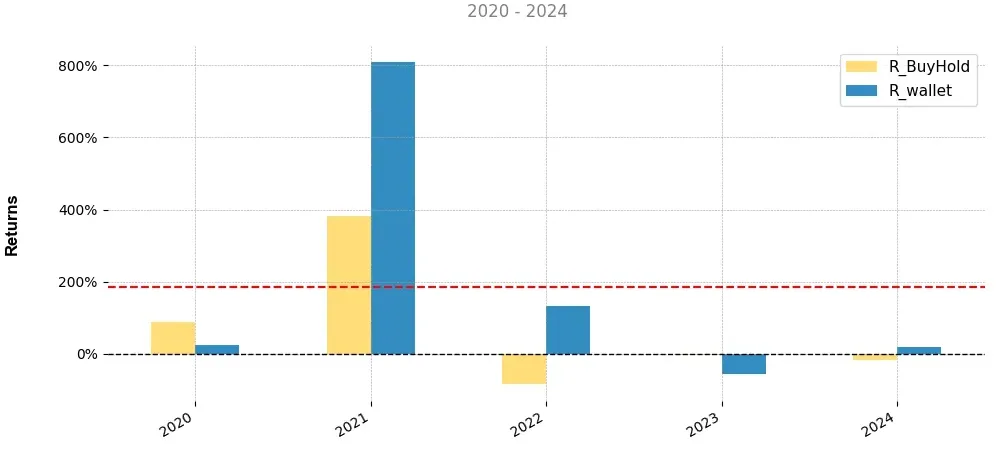

Annual comparison of cumulative returns with Buy & Holds

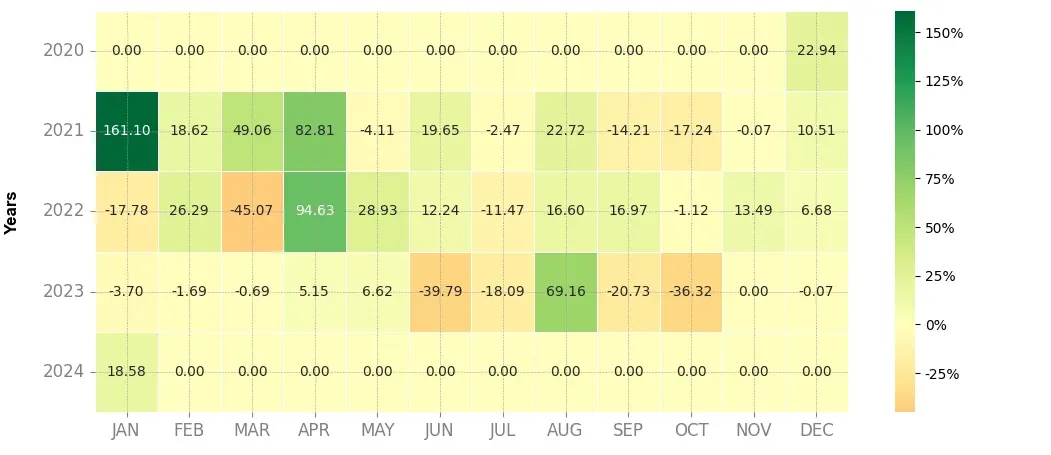

Heatmap of monthly returns

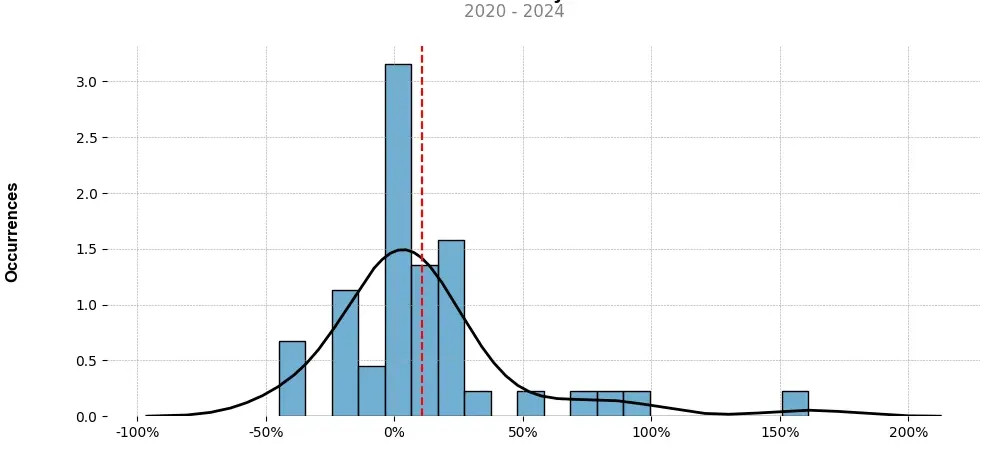

Distribution of the monthly returns of the top strategy

Presentation of ZEN

Horizen (ZEN) is a decentralized blockchain platform that aims to provide privacy and security in the digital world. It combines cutting-edge cryptography with a robust infrastructure to enable secure and anonymous transactions, messaging, and internet usage.

One of the key features of Horizen is its focus on privacy. It uses zk-SNARKs, a form of zero-knowledge proofs, to ensure that transaction details remain confidential and that user identity is protected. This allows individuals to have control over their personal information and financial transactions, eliminating the need for intermediaries or third parties.

In addition to privacy, Horizen also emphasizes security. It utilizes a secure node architecture, enabling participants to run full nodes, secure the network, and earn rewards in return. This distributed setup ensures that the network is not controlled by a single entity, reducing the risk of centralization and potential attacks. By incentivizing participation, Horizen aims to create a robust and secure ecosystem.

Horizen’s focus on privacy and security extends beyond just financial transactions. The platform also includes a messaging service called ZenChat, which allows users to communicate privately and securely. By encrypting messages end-to-end, ZenChat ensures that conversations are only accessible to the intended recipients, safeguarding sensitive information from prying eyes.

Moreover, Horizen aims to improve internet usage by enabling decentralized applications (dApps) development. Its flexible sidechain architecture allows developers to build their own dApps and utilize Horizen’s privacy and security features. By integrating these decentralized applications into the platform, Horizen seeks to empower individuals and businesses to leverage the benefits of blockchain technology without compromising on privacy and security.

To further enhance the platform’s capabilities, Horizen launched a treasury system called the ZenDAO. It allocates a portion of the block rewards to fund project development, community initiatives, and partnerships. This decentralized governance model ensures that the platform’s growth is community-driven and that important decisions are made collectively.

In conclusion, Horizen (ZEN) aims to provide privacy, security, and empowerment in the digital world. Through its focus on confidentiality, secure node architecture, messaging service, dApp development, and decentralized governance, it strives to create a platform where individuals can have control over their data and transactions. By combining cutting-edge technology with a community-driven approach, Horizen aspires to be a leading force in the privacy and security-focused cryptocurrency ecosystem.

Strategy details

«Top trading strategy ZEN Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘mineable’, ‘pow’, ‘medium-of-exchange’, ‘platform’, ‘enterprise-solutions’, ‘content-creation’, ‘privacy’, ‘zero-knowledge-proofs’, ‘masternodes’, ‘scaling’, ‘smart-contracts’, ‘staking’, ‘sidechain’, ‘dcg-portfolio’, ‘web3’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)