Last update: 02-09-2024

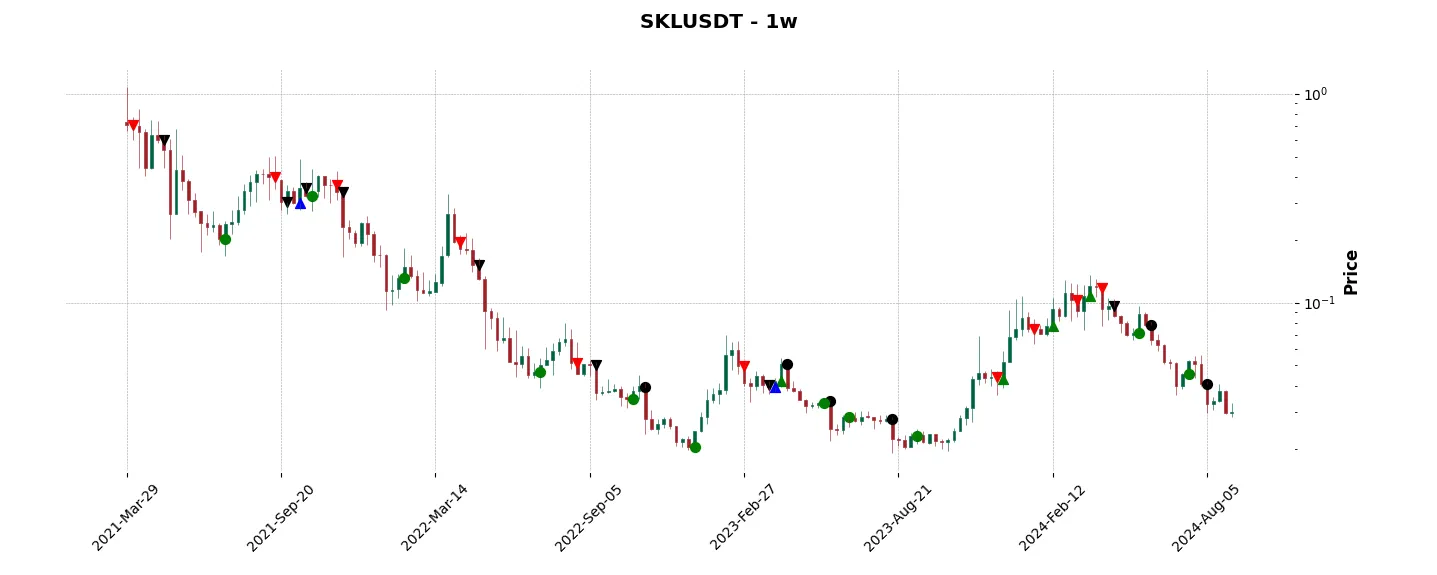

Top trading strategy SKALE (SKL) Weekly – Live position:

- Short in progress

- Entry price : 0.03276 $

- Pnl : 8.27 %

Trade history

Over 6 months

Complete

«Top trading strategy SKALE (SKL) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy SKL Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

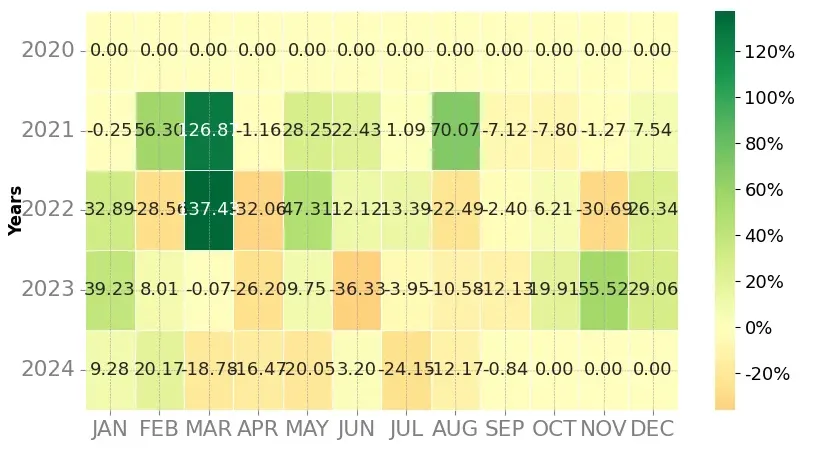

Heatmap of monthly returns

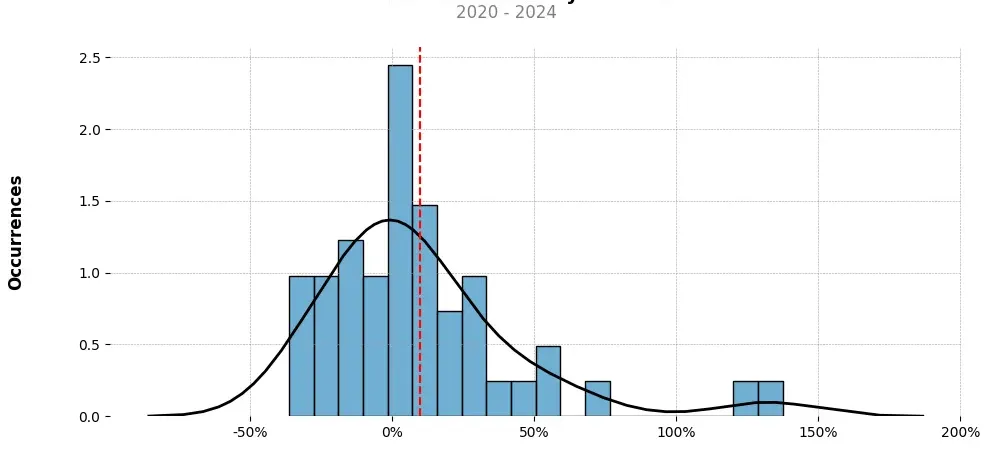

Distribution of the monthly returns of the top strategy

Presentation of SKL

SKALE (SKL) is a cryptocurrency that aims to address the scalability issues faced by many blockchain networks, especially Ethereum. It offers a decentralized, elastic blockchain network that enhances scalability without sacrificing security or decentralization. In this synthesis, we will explore the key features, use cases, advantages, and potential drawbacks of SKALE.

SKALE focuses on providing solutions to the scalability problem through the use of elastic sidechains. It employs a unique consensus mechanism called “Network of Networks” to enable independent sidechain operation while maintaining tight integration with the Ethereum network. This allows SKALE to add more sidechains as needed, effectively multiplying the capacity of the blockchain network.

One of the primary use cases for SKALE is in decentralized applications (DApps) that require high transaction throughput. With the ability to add more sidechains as demand increases, SKALE can handle a significantly higher number of transactions per second compared to traditional blockchain networks. This scalability feature opens up new possibilities for DApp developers to build complex applications without worrying about limitations imposed by network constraints.

Moreover, SKALE provides developers with a developer-friendly environment, offering tooling, APIs, and libraries to simplify the process of building and deploying DApps. This ease of use makes it attractive for developers looking to leverage blockchain technology without the complexities commonly associated with it.

Another notable advantage of SKALE is its focus on security. By integrating tightly with the Ethereum network, SKALE leverages Ethereum’s robust security infrastructure. This ensures that SKALE sidechains benefit from the same level of security as the Ethereum mainnet, minimizing the risk of attacks or vulnerabilities.

However, there are potential drawbacks to consider. Firstly, as SKALE is relatively new, it is essential to monitor its long-term performance and reliability. As with any emerging technology, there may be unforeseen challenges or vulnerabilities that could impact the network’s scalability and security.

Additionally, while SKALE aims to address scalability issues, it is important to note that it is not the only solution available. Other projects like Polkadot, Cosmos, and Matic Network also offer scalability solutions using different mechanisms. Therefore, it is crucial for potential users or developers to research and compare various options before deciding on the most suitable solution for their specific requirements.

In conclusion, SKALE (SKL) offers a promising solution to the scalability problem faced by blockchain networks, particularly Ethereum. Through its elastic sidechain architecture and integration with Ethereum, SKALE enhances scalability, security, and developer experience. While it presents exciting opportunities for DApp developers, it is crucial to closely follow its development and compare it with other scalability solutions to make informed decisions.

Strategy details

«Top trading strategy SKL Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘scaling’, ‘smart-contracts’, ‘staking’, ‘arrington-xrp-capital-portfolio’, ‘boostvc-portfolio’, ‘galaxy-digital-portfolio’, ‘hashkey-capital-portfolio’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)