Last update: 02-09-2024

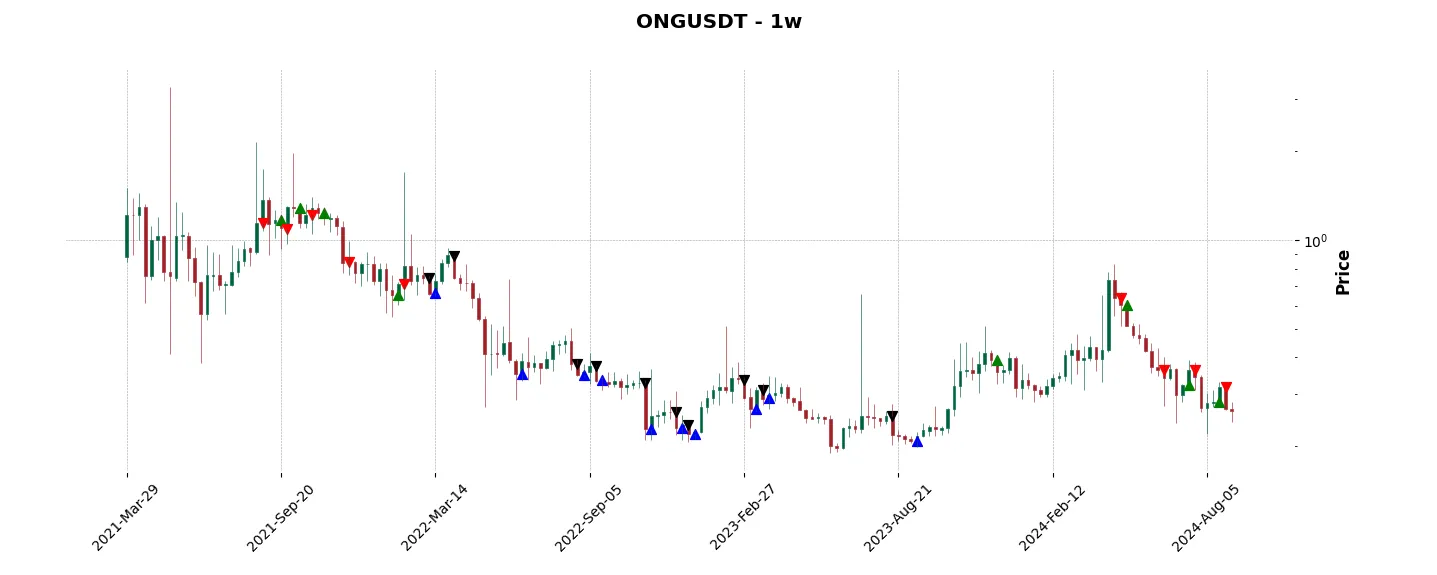

Top trading strategy Ontology Gas (ONG) Weekly – Live position:

- Close long

- Entry price : 0.3177 $

- Pnl : -15.77 %

Trade history

Over 6 months

Complete

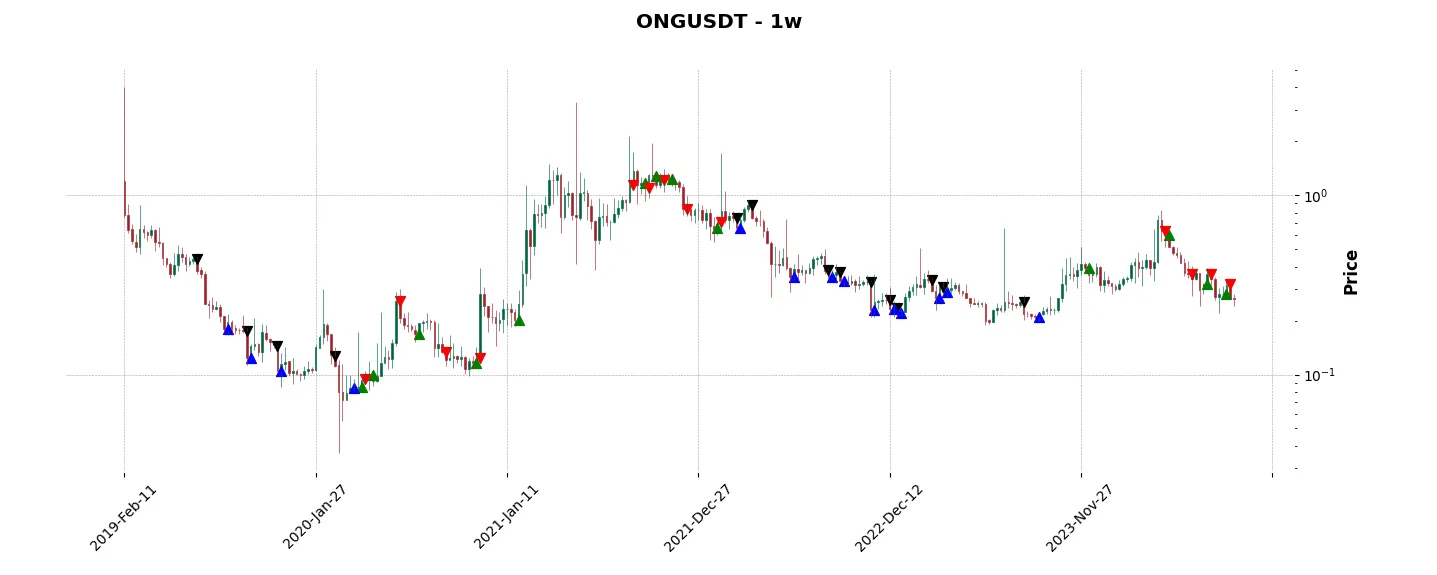

«Top trading strategy Ontology Gas (ONG) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy ONG Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

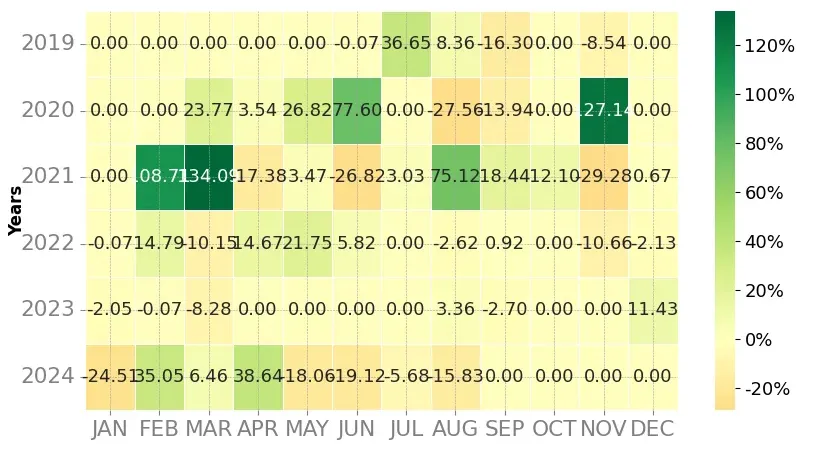

Heatmap of monthly returns

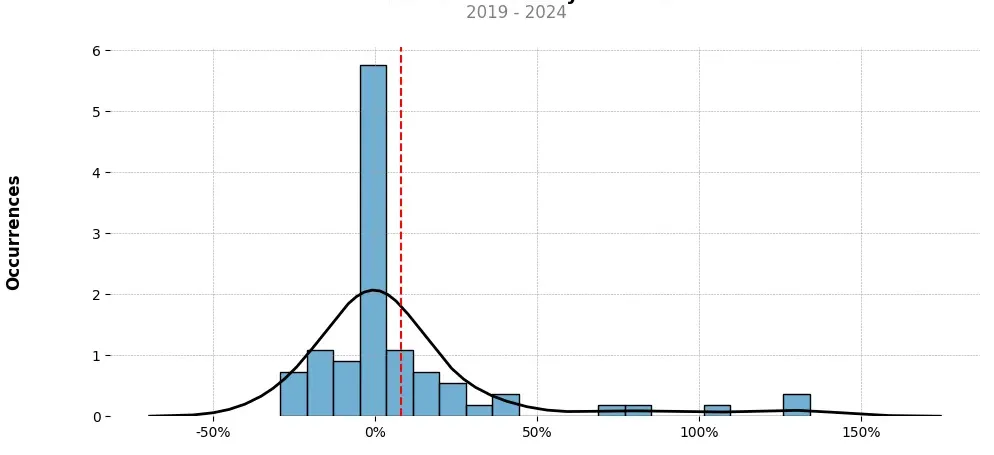

Distribution of the monthly returns of the top strategy

Presentation of ONG

Ontology Gas (ONG) is a cryptographic token that plays a significant role in the Ontology blockchain ecosystem. Ontology, a public blockchain network, aims to provide a comprehensive and decentralized platform for businesses and organizations to develop and manage their own blockchain solutions.

Synthesizing the key aspects of Ontology Gas (ONG) helps us understand its utility and significance within the Ontology network. Here are the prominent characteristics of ONG:

1. Gas Token: Similar to gas on other blockchain networks like Ethereum, ONG acts as a utility token on the Ontology platform. It serves as a medium to pay for computation and execution of smart contracts, as well as for deploying and interacting with decentralized applications (dApps) built on the Ontology blockchain.

2. Transaction Processing: ONG plays a pivotal role in processing transactions within the Ontology network. When users perform actions such as transferring assets, executing smart contracts, or interacting with dApps, ONG is consumed as fuel to power these operations. The amount of ONG required for a particular transaction is determined based on its computational complexity.

3. Governance and Staking: Ontology Gas also offers holders the ability to participate in the governance of the network. By staking their ONG, users can vote on important decisions such as protocol upgrades, consensus algorithm changes, or changes to network parameters. This provides users with a say in the evolution of the Ontology ecosystem.

4. Incentives: ONG holders are incentivized through a mechanism known as “ONG generation.” By holding the Ontology network’s primary utility token, ONT, users receive ONG as a bonus based on their ONT holdings. This incentivization system encourages users to acquire and hold ONT tokens, thereby actively participating in the Ontology network’s growth and stability.

5. Unique Token Distribution: Ontology Gas has a unique distribution model wherein it was initially distributed during the Ontology token sale in 2018. The total supply of ONG was allocated to ONT holders over an extended period. Since then, ONG can be obtained through various means, including participating in ecosystem activities and completing specific tasks within the Ontology platform.

In conclusion, Ontology Gas (ONG) serves as a vital cog within the Ontology network, acting as a utility token for transaction processing, enabling governance participation, and providing incentives through ONG generation. Its unique distribution model and integration within the Ontology ecosystem demonstrate its crucial role in facilitating a robust and decentralized blockchain platform for businesses and organizations.

Strategy details

«Top trading strategy ONG Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘ontology-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)