Last update: 02-09-2024

Top trading strategy Loopring (LRC) Weekly – Live position:

- No position

Trade history

Over 6 months

Complete

«Top trading strategy Loopring (LRC) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy LRC Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

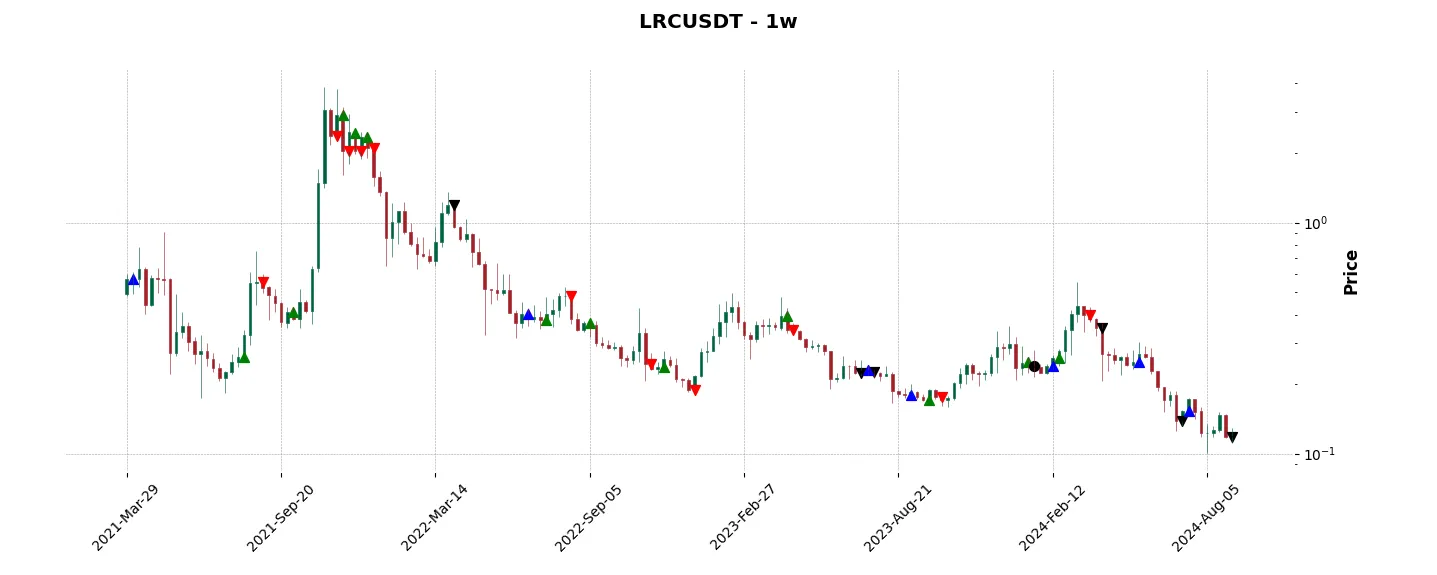

Historical comparison of cumulative returns with Buy & Hold

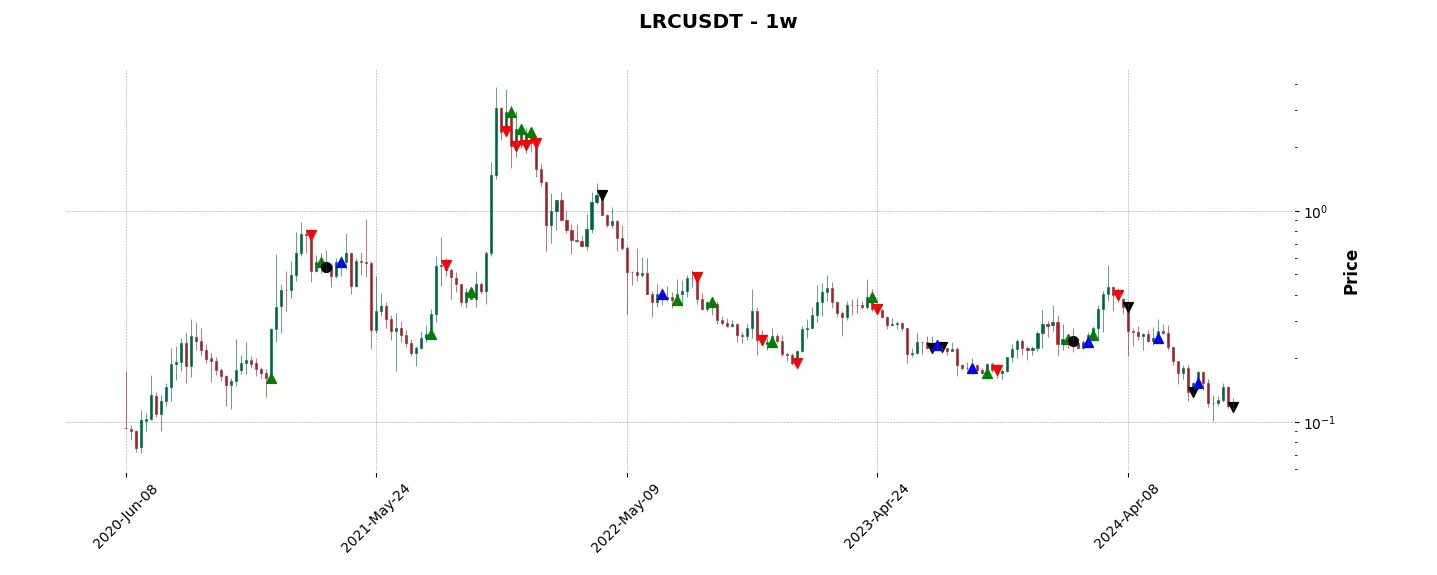

Annual comparison of cumulative returns with Buy & Holds

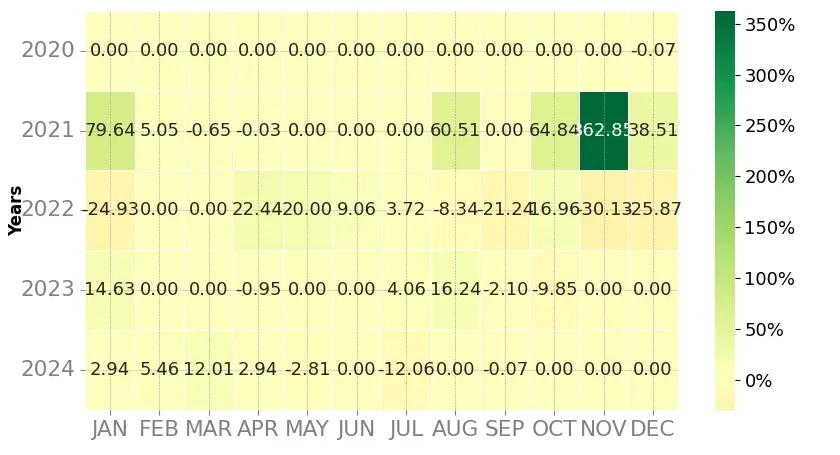

Heatmap of monthly returns

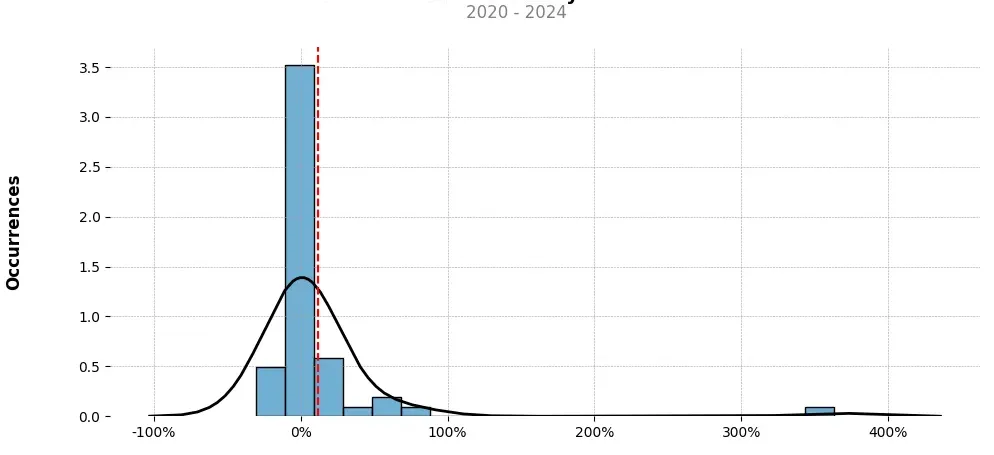

Distribution of the monthly returns of the top strategy

Presentation of LRC

Loopring (LRC) is a decentralized cryptocurrency exchange protocol that aims to revolutionize the way digital assets are traded on the blockchain. It combines the power of smart contracts with off-chain order book management, providing users with a secure, efficient, and transparent trading experience.

At its core, Loopring utilizes a unique Layer 2 scaling solution known as zkRollup. This technology allows for a significant increase in transaction throughput, enabling Loopring to process a large number of trades per second without congesting the underlying blockchain. By aggregating orders from multiple participants, Loopring achieves higher liquidity and better price execution for users.

One of the most compelling aspects of Loopring is its commitment to the principles of decentralization. Unlike centralized cryptocurrency exchanges that hold custody of users’ funds, Loopring adopts a non-custodial approach. Users retain complete control over their assets, eliminating the need to trust a third party with their funds. Furthermore, Loopring implements the concept of “ring trading,” where multiple trades are combined into a single transaction, ensuring that all participants receive the best possible exchange rate.

Loopring’s transparent order book allows users to monitor trades in real-time, ensuring that the protocol operates fairly and efficiently. Additionally, Loopring incorporates a unique fee structure that benefits both users and exchanges. Users can pay fees with Loopring’s native token, LRC, receiving discounts and additional benefits. Exchanges that integrate with Loopring can also enjoy reduced costs and increased liquidity, attracting more traders to their platforms.

Furthermore, Loopring actively encourages the development of the decentralized finance (DeFi) ecosystem by providing open-source software libraries and development tools. This enables developers to create their own decentralized exchanges or integrate Loopring’s protocol into existing platforms, fostering innovation and expanding the reach of decentralized trading.

In terms of security, Loopring employs various measures to protect users’ funds and data. With the power of zkRollup, Loopring ensures that all transactions are secure, private, and tamper-proof. Additionally, the protocol implements rigorous smart contract auditing and bug bounties to discover and fix potential vulnerabilities. By prioritizing security, Loopring aims to instill confidence and trust within the cryptocurrency community.

In conclusion, Loopring (LRC) is a decentralized cryptocurrency exchange protocol that leverages the power of smart contracts and zkRollup technology to provide users with a secure, efficient, and transparent trading experience. By adopting a non-custodial approach and utilizing innovative features like ring trading, Loopring ensures the best possible price execution and liquidity while maintaining user control over funds. With its commitment to decentralization, open-source development, and security, Loopring plays a vital role in the growth and development of the decentralized finance ecosystem.

Strategy details

«Top trading strategy LRC Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘marketplace’, ‘decentralized-exchange-dex-token’, ‘defi’, ‘zero-knowledge-proofs’, ‘scaling’, ‘smart-contracts’, ‘wallet’, ‘ethereum-ecosystem’, ‘amm’, ‘dex’, ‘layer-2’, ‘rollups’, ‘red-packets’, ‘web3’, ‘token’, ‘arbitrum-ecosytem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)