Last update: 02-09-2024

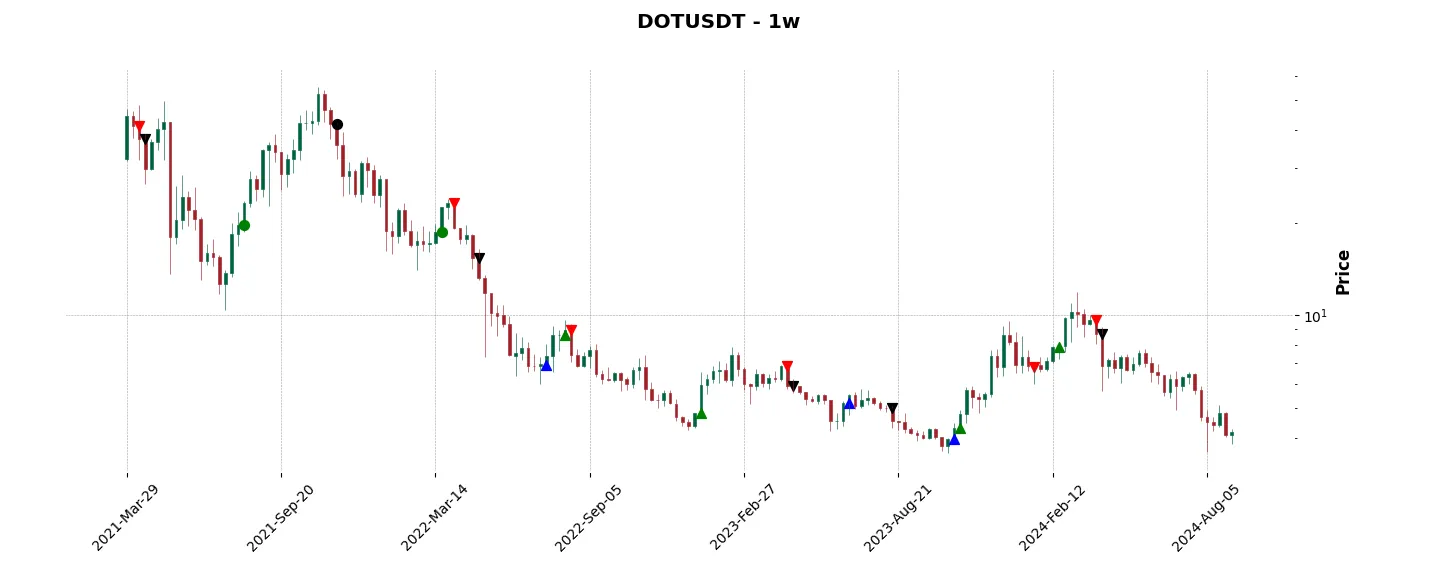

Top trading strategy Polkadot (DOT) Weekly – Live position:

- Short in progress

- Entry price : 6.855 $

- Pnl : 39.05 %

Trade history

Over 6 months

Complete

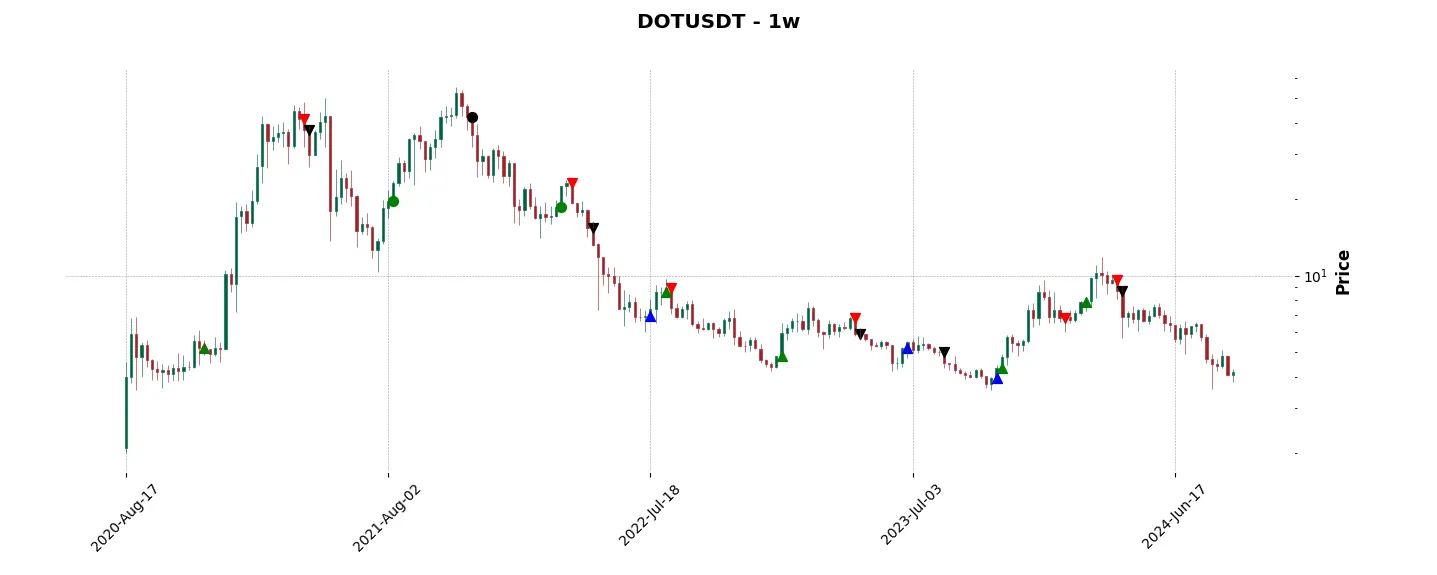

«Top trading strategy Polkadot (DOT) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy DOT Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

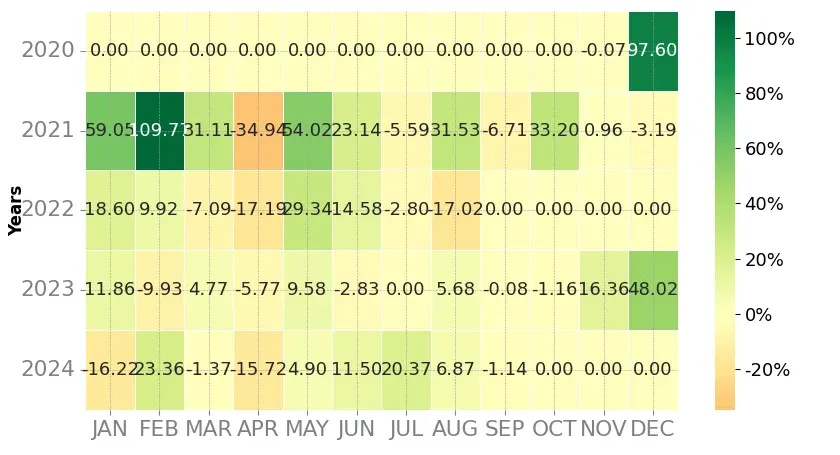

Heatmap of monthly returns

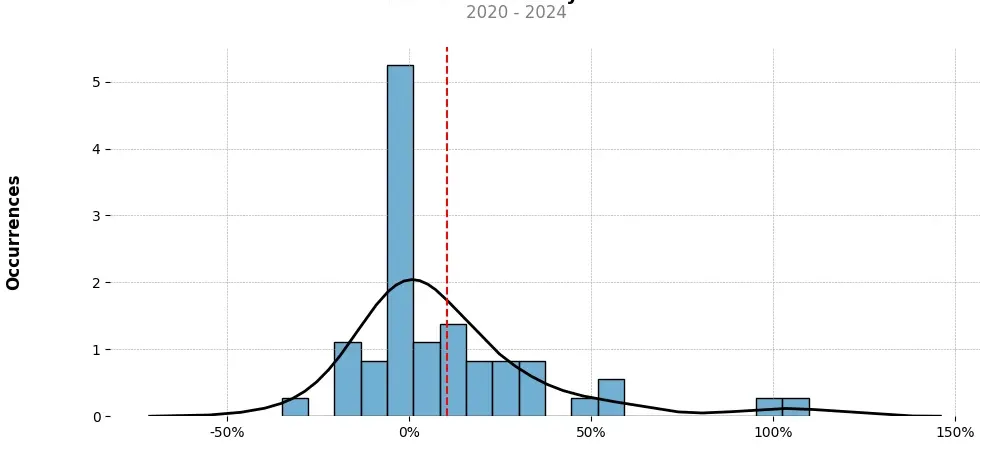

Distribution of the monthly returns of the top strategy

Presentation of DOT

Polkadot (DOT) is a blockchain-based platform that aims to solve the interoperability challenges faced by different blockchains. It was developed by Gavin Wood, co-founder of Ethereum, and launched in 2020. In this synthesis, we will discuss the key features, advantages, and potential applications of Polkadot.

One of the main features of Polkadot is its ability to connect different blockchains, creating a multi-chain ecosystem. This is achieved through its innovative architecture, called a “relay chain.” The relay chain acts as the heart of Polkadot, facilitating communication and data sharing between different blockchains. By enabling interoperability, Polkadot allows seamless transfer of assets and information across chains, enhancing scalability and efficiency.

Another notable feature of Polkadot is its focus on governance and scalability. The platform is designed to be highly adaptable, allowing stakeholders to upgrade and modify the network without requiring hard forks. Polkadot employs a customized governance system, where token holders can propose and vote on changes. This democratized governance model ensures that the platform remains flexible, secure, and responsive to the evolving needs of its users.

Polkadot’s architecture also enhances security. It utilizes a shared security model, where multiple parachains (parallel blockchains) can connect to the Polkadot network and benefit from its security mechanisms. This approach eliminates the need for each parachain to independently secure its network, reducing security vulnerabilities. Additionally, Polkadot employs a robust consensus mechanism called “proof of stake” (PoS), which not only alleviates energy consumption concerns but also makes the platform more decentralized and resistant to attacks.

The advantages offered by Polkadot have broad implications in various industries. By enabling interoperability, Polkadot can facilitate seamless integration between different smart contract platforms, enhancing collaboration and innovation. It can also support cross-chain decentralized applications (dApps), enabling greater functionality and utility for end-users. Additionally, Polkadot’s scalability and governance features make it an attractive solution for enterprises and organizations seeking to build and customize their own blockchain networks.

In conclusion, Polkadot (DOT) is a cutting-edge blockchain platform that addresses the challenges of interoperability, governance, and security. Its unique architecture, scalability, and focus on governance make it an appealing option for developers, enterprises, and organizations. With the potential to connect and enhance various blockchains, Polkadot plays a crucial role in advancing the adoption and evolution of the blockchain technology.

Strategy details

«Top trading strategy DOT Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘substrate’, ‘polkadot’, ‘binance-chain’, ‘polkadot-ecosystem’, ‘three-arrows-capital-portfolio’, ‘polychain-capital-portfolio’, ‘arrington-xrp-capital-portfolio’, ‘blockchain-capital-portfolio’, ‘boostvc-portfolio’, ‘cms-holdings-portfolio’, ‘coinfund-portfolio’, ‘fabric-ventures-portfolio’, ‘fenbushi-capital-portfolio’, ‘hashkey-capital-portfolio’, ‘kenetic-capital-portfolio’, ‘1confirmation-portfolio’, ‘placeholder-ventures-portfolio’, ‘pantera-capital-portfolio’, ‘exnetwork-capital-portfolio’, ‘web3’, ‘spartan-group’, ‘injective-ecosystem’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)