Last update: 02-09-2024

Top trading strategy Decred (DCR) Weekly – Live position:

- No position

Trade history

Over 6 months

Complete

«Top trading strategy Decred (DCR) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy DCR Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

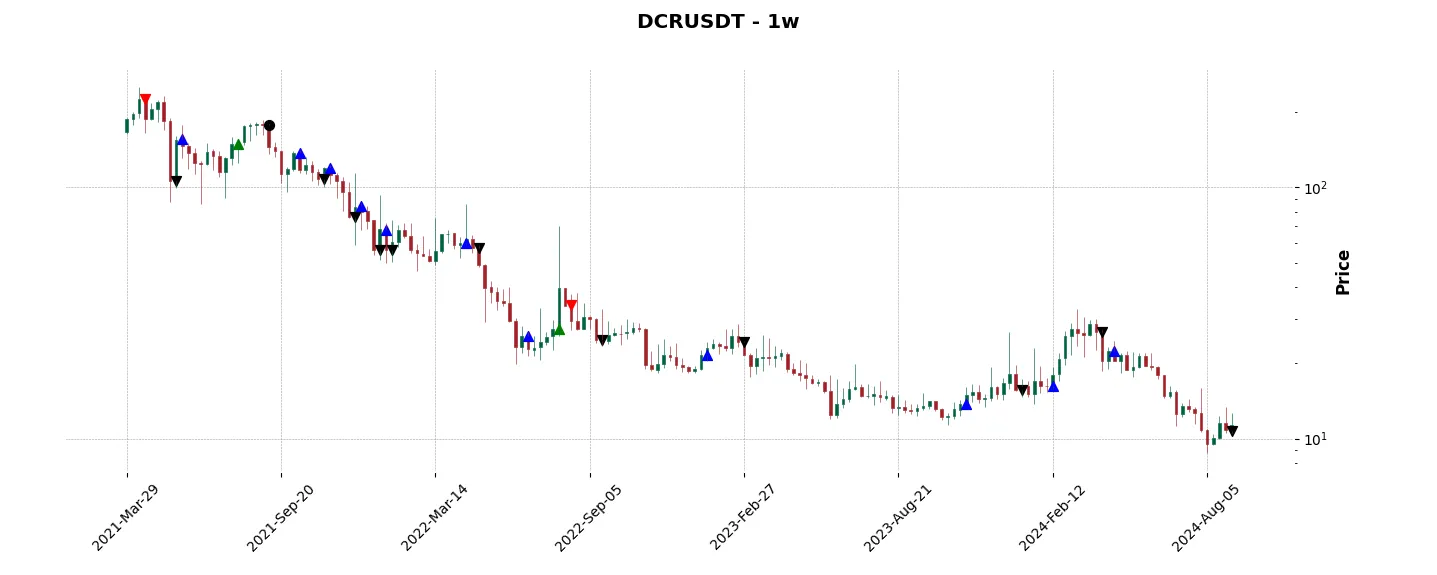

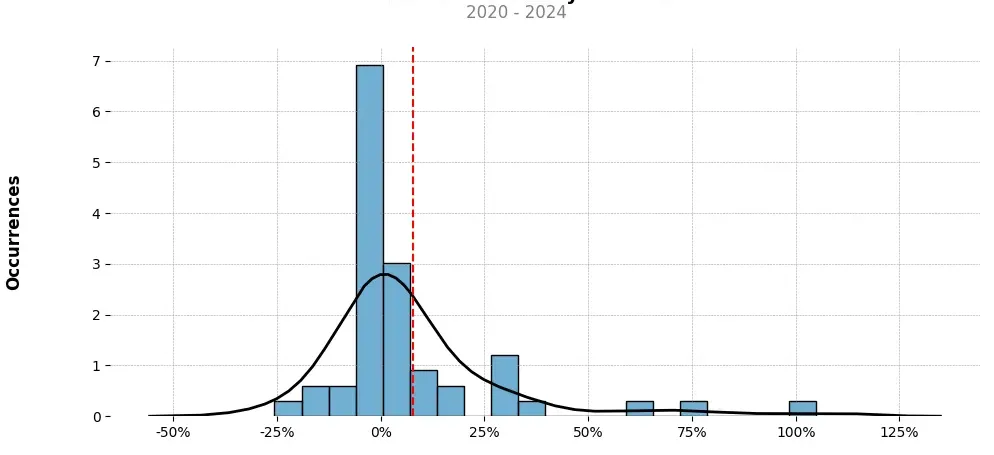

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

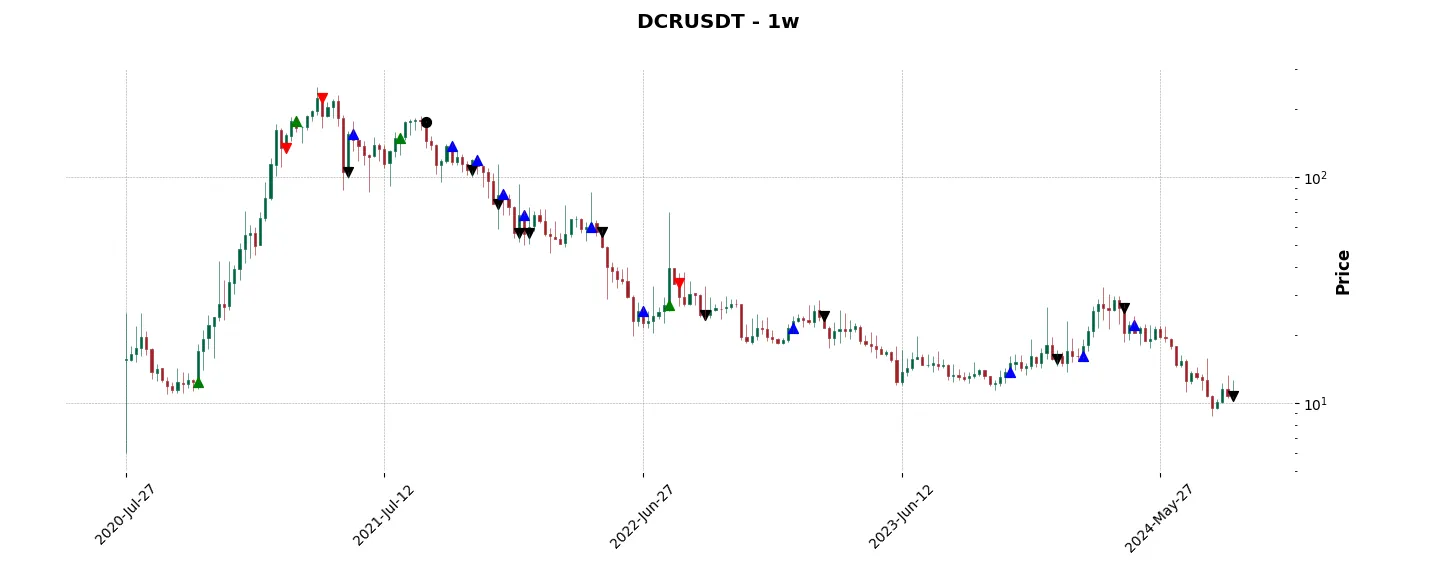

Heatmap of monthly returns

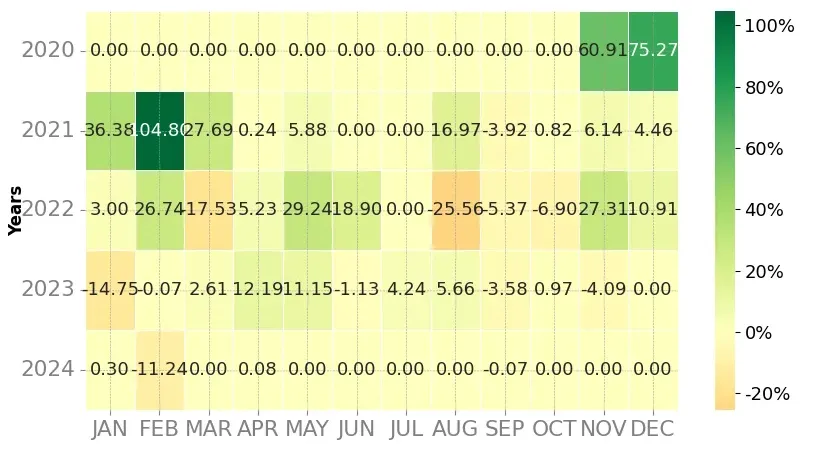

Distribution of the monthly returns of the top strategy

Presentation of DCR

Decred (DCR) is a unique and innovative cryptocurrency that aims to address some of the key challenges faced by traditional cryptocurrencies like Bitcoin. Launched in 2016, Decred positions itself as a decentralized community-driven project that places emphasis on governance, security, sustainability, and scalability.

One of the core features of Decred is its hybrid consensus algorithm, combining both Proof-of-Work (PoW) and Proof-of-Stake (PoS) mechanisms. This approach ensures a fair and secure network, reducing the risk of a single entity gaining too much control over the decision-making process. The PoW aspect allows miners to contribute their computational power to secure the network, while the PoS component allows coin holders to participate in the decision-making process and earn rewards.

Decred’s governance model is another notable aspect of the project. It embraces the concept of decentralization by enabling stakeholders to vote on proposals and changes to the network. This democratic approach ensures that decisions are made collectively, reducing the influence of a small group of individuals. Furthermore, Decred has implemented a Treasury system, allocating a portion of block rewards to fund future development, marketing, and community initiatives. This sustainable funding mechanism empowers the project to evolve over time and adapt to emerging challenges.

In terms of security, Decred utilizes a unique feature known as the “Politeia.” This proposal system enables the community to submit, discuss, and vote on proposals related to the project. This approach increases transparency and accountability while encouraging broad participation. Additionally, Decred has implemented the Lightning Network, a layer 2 solution that enhances the scalability and transaction speed of the network, addressing some of the limitations faced by other cryptocurrencies.

Decred’s focus on governance, security, sustainability, and scalability sets it apart from many other cryptocurrencies. By adopting a hybrid consensus mechanism and enabling stakeholders to actively participate in decision-making, Decred aims to create a more inclusive and equitable system. Its sustainable funding model ensures long-term development and growth, while its emphasis on security and scalability makes it a viable alternative for financial transactions.

In summary, Decred (DCR) is an innovative cryptocurrency that strives to address the challenges faced by traditional cryptocurrencies. Its hybrid consensus algorithm, governance model, security features, and scalability solutions all contribute to its unique value proposition. With its strong emphasis on decentralization, community involvement, and sustainable development, Decred aims to establish itself as a reliable and future-proof digital currency.

Strategy details

«Top trading strategy DCR Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘mineable’, ‘hybrid-pow-pos’, ‘blake256’, ‘medium-of-exchange’, ‘store-of-value’, ‘privacy’, ‘dao’, ‘placeholder-ventures-portfolio’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)