Last update: 02-09-2024

Top trading strategy Compound (COMP) Weekly – Live position:

- No position

Trade history

Over 6 months

Complete

«Top trading strategy Compound (COMP) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy COMP Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

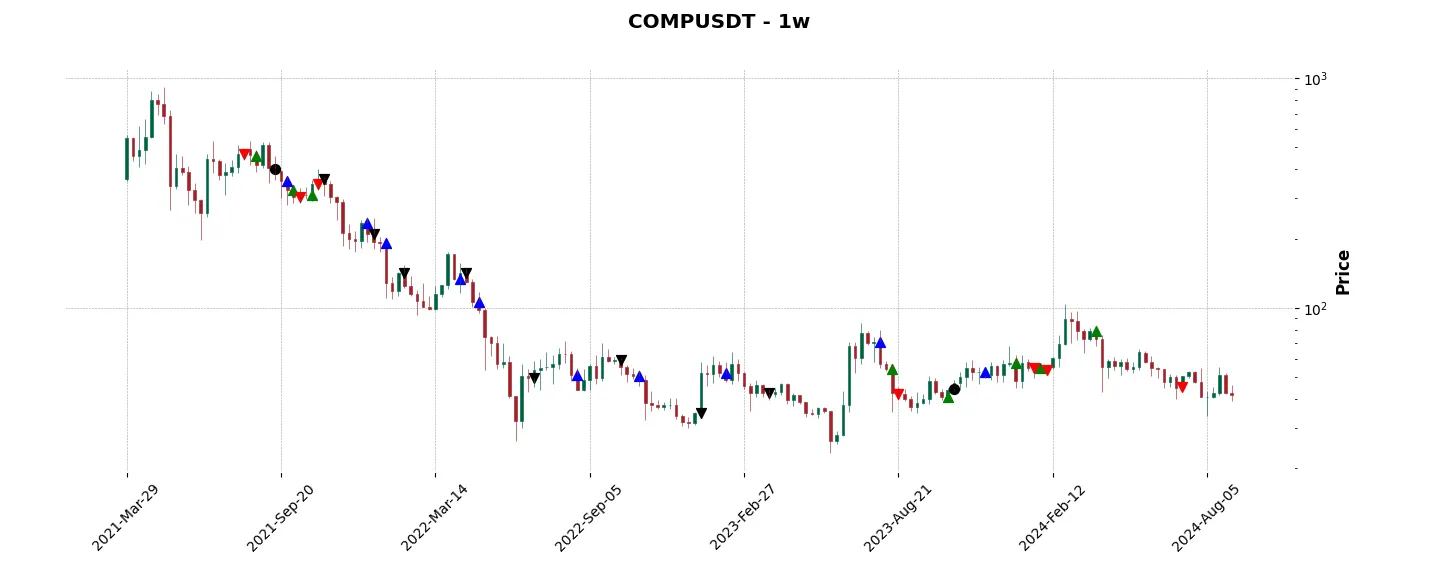

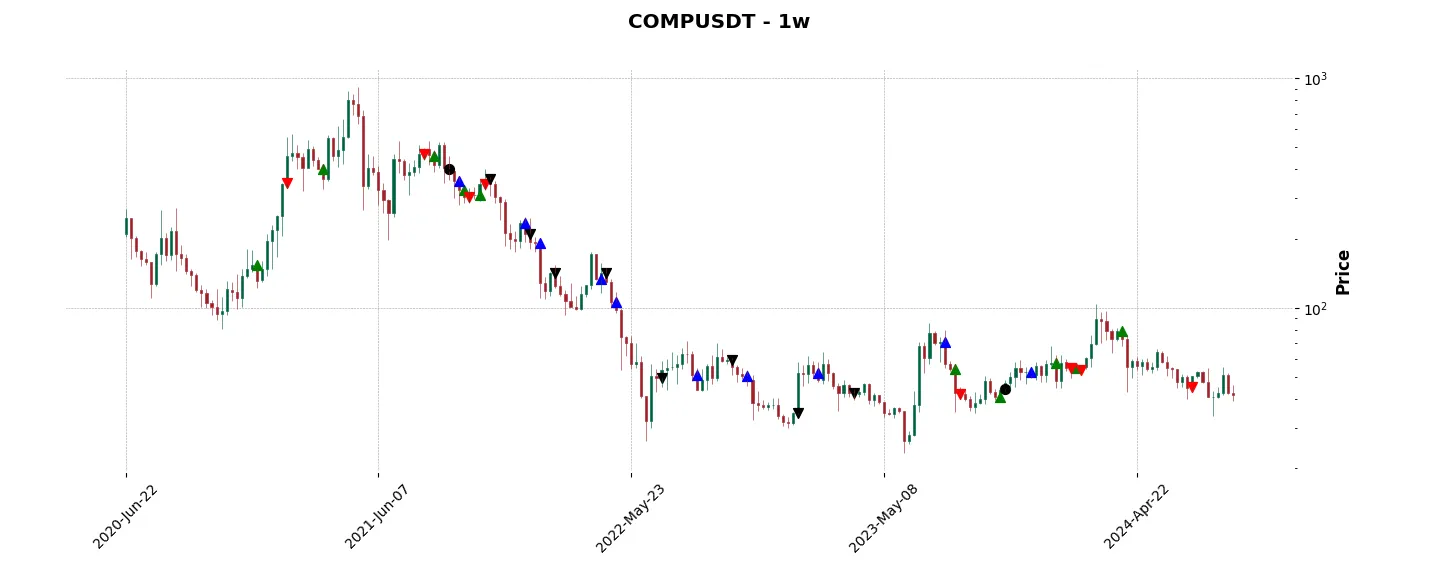

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

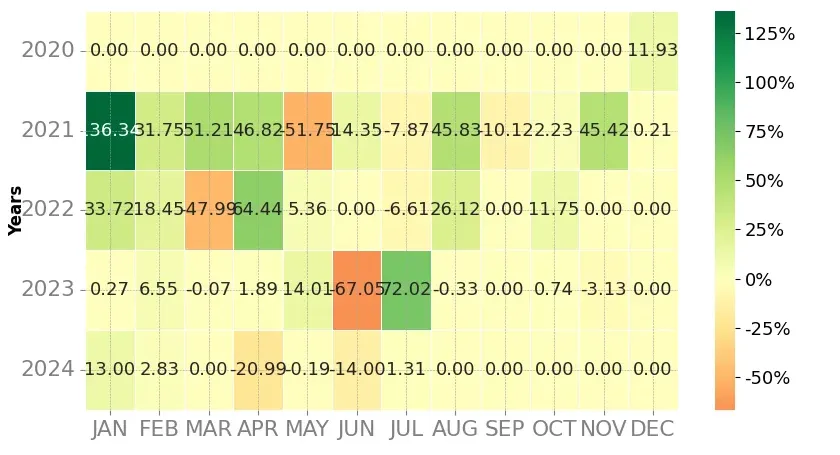

Heatmap of monthly returns

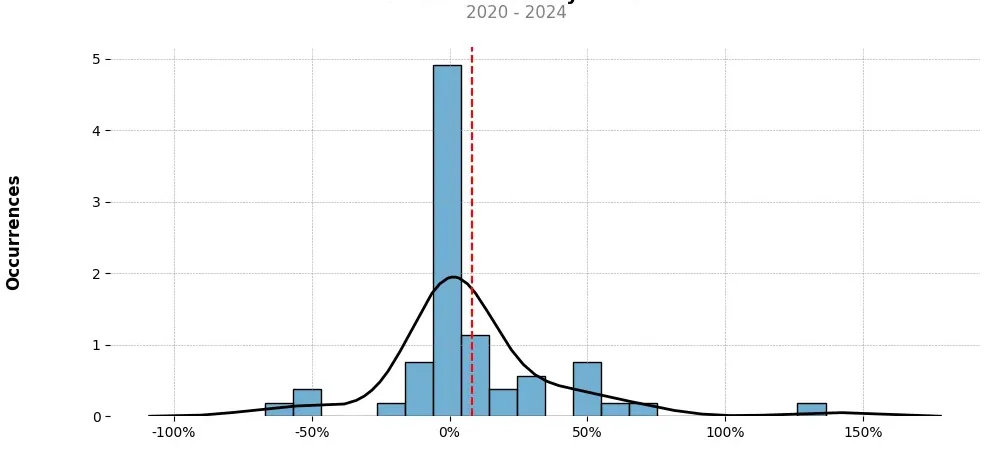

Distribution of the monthly returns of the top strategy

Presentation of COMP

Compound (COMP) is a decentralized lending protocol built on the Ethereum blockchain that allows users to lend and borrow various cryptocurrencies. It enables users to earn interest on their crypto assets and borrow tokens using their existing crypto holdings as collateral. By creating an open and decentralized platform, Compound aims to provide efficient and transparent financial services to users around the world.

One of the key features of Compound is its algorithmic interest rate determination. Unlike traditional lending platforms where interest rates are set by an individual or institution, Compound utilizes an algorithm that adjusts interest rates based on the supply and demand dynamics of each asset. This dynamic interest rate mechanism ensures that the platform remains efficient and responsive to changes in market conditions.

Another notable aspect of Compound is its governance token, COMP. COMP holders have the power to influence the protocol’s decision-making process through voting on proposals. This democratic approach allows users to actively participate in shaping the future of the platform. Additionally, COMP holders can earn additional COMP tokens by lending or borrowing assets on the Compound platform. This incentive structure encourages active participation, increases liquidity, and promotes the growth and stability of the ecosystem.

Compound’s decentralized nature offers several advantages over traditional financial systems. Firstly, it eliminates the need for intermediaries such as banks, enabling direct peer-to-peer lending. This not only reduces costs but also ensures greater accessibility to financial services, especially for individuals who are unbanked or underbanked.

Furthermore, Compound’s open-source architecture allows for auditing and transparency. The entire codebase is publicly available, enabling users to verify the security and integrity of the protocol. This transparency builds trust among users and mitigates the risk of potential fraud or manipulation.

In terms of security, Compound utilizes various mechanisms to protect user funds. Smart contracts on the Ethereum blockchain secure the lending and borrowing process, minimizing the risk of hacks or unauthorized access. Additionally, Compound maintains a robust liquidation mechanism to safeguard against collateral defaults and ensure the overall stability of the platform.

The Compound protocol has gained significant traction since its launch in 2018. It has attracted a wide range of users, including individual investors, crypto enthusiasts, and institutional players, who recognize the potential benefits of decentralized finance (DeFi). As the DeFi ecosystem continues to evolve, Compound remains at the forefront, providing users with innovative lending and borrowing solutions.

In conclusion, Compound (COMP) is a decentralized lending protocol that revolutionizes the way individuals lend and borrow cryptocurrencies. With its algorithmic interest rate determination, governance token, and decentralized architecture, Compound offers users a transparent, efficient, and inclusive financial system. As the adoption of decentralized finance grows, Compound is poised to play a crucial role in shaping the future of the global financial landscape.

Strategy details

«Top trading strategy COMP Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘defi’, ‘dao’, ‘yield-farming’, ‘polkadot-ecosystem’, ‘coinbase-ventures-portfolio’, ‘three-arrows-capital-portfolio’, ‘polychain-capital-portfolio’, ‘lending-borowing’, ‘dragonfly-capital-portfolio’, ‘alameda-research-portfolio’, ‘a16z-portfolio’, ‘pantera-capital-portfolio’, ‘paradigm-portfolio’, ‘arbitrum-ecosytem’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)