Last update: 06-11-2023

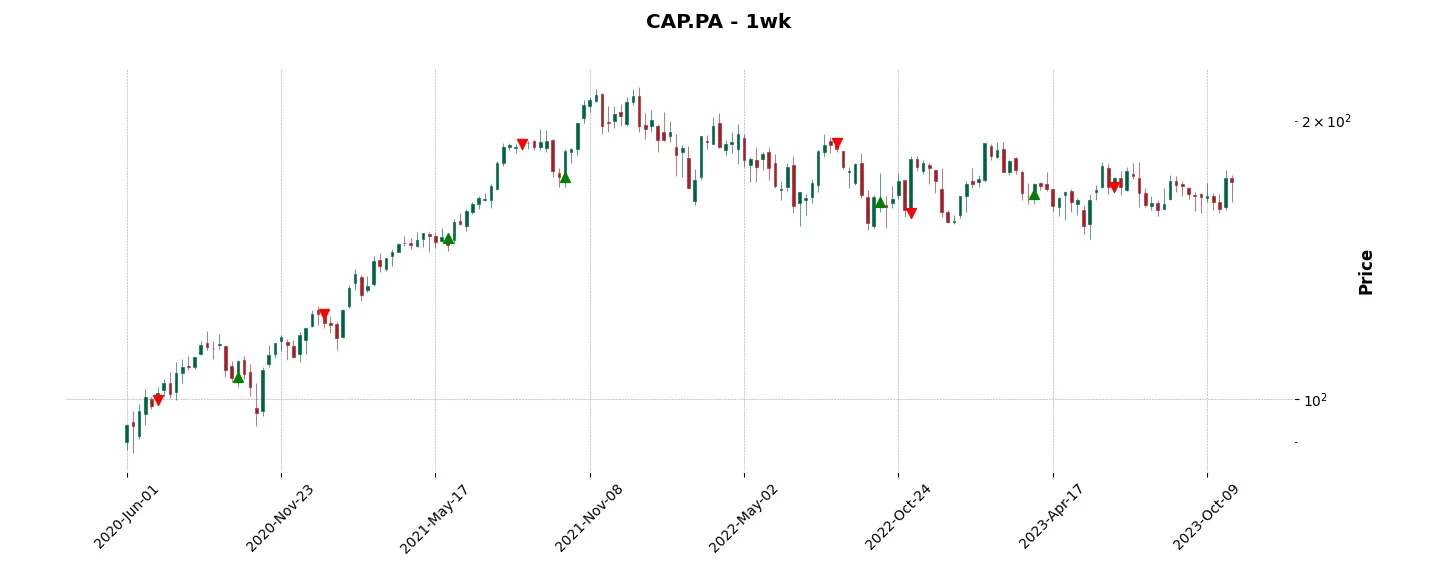

Top trading strategy CapGemini Weekly – Live position:

- No position

Trade history

Over 6 months

Complete

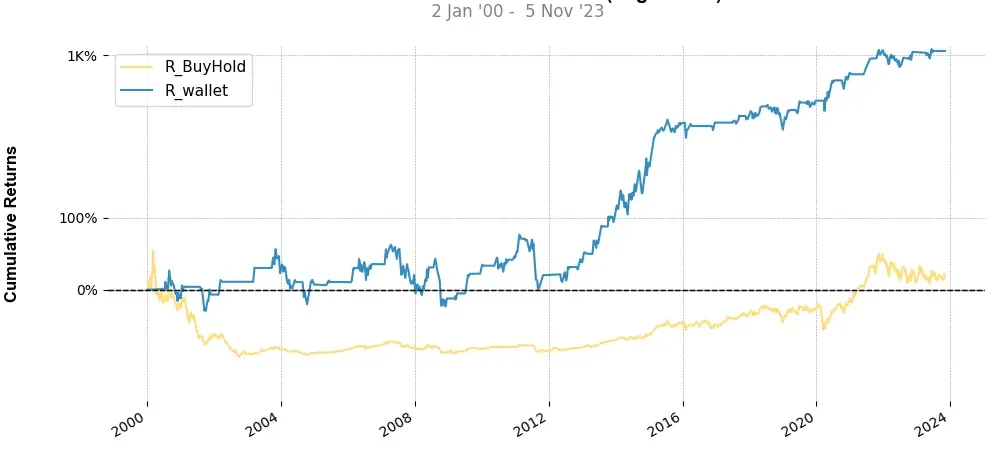

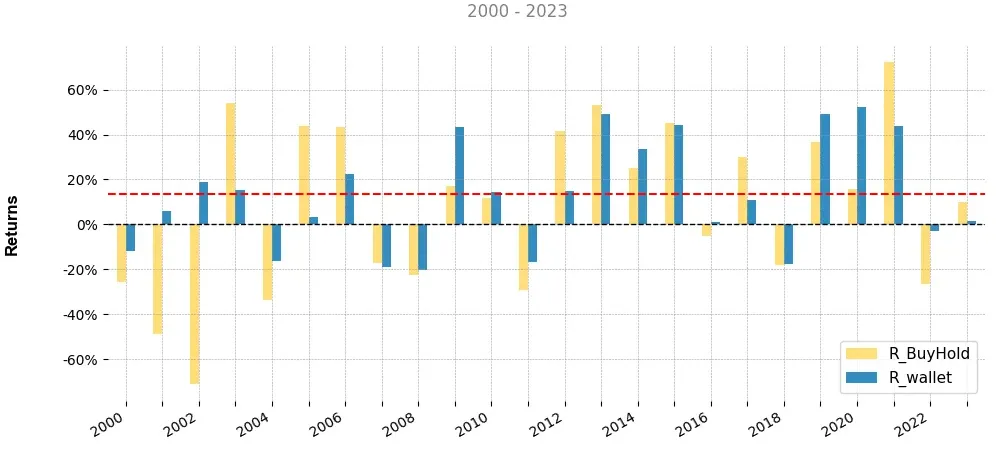

«Top trading strategy CapGemini Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy CapGemini Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

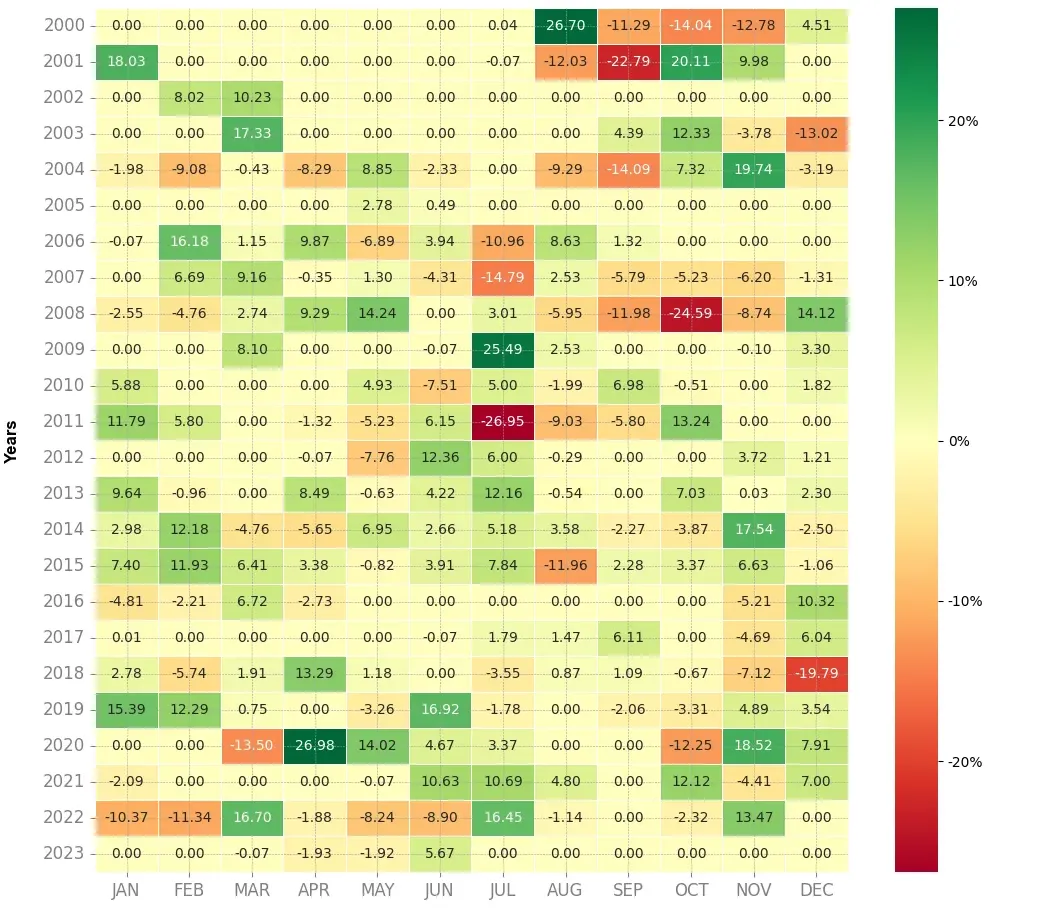

Heatmap of monthly returns

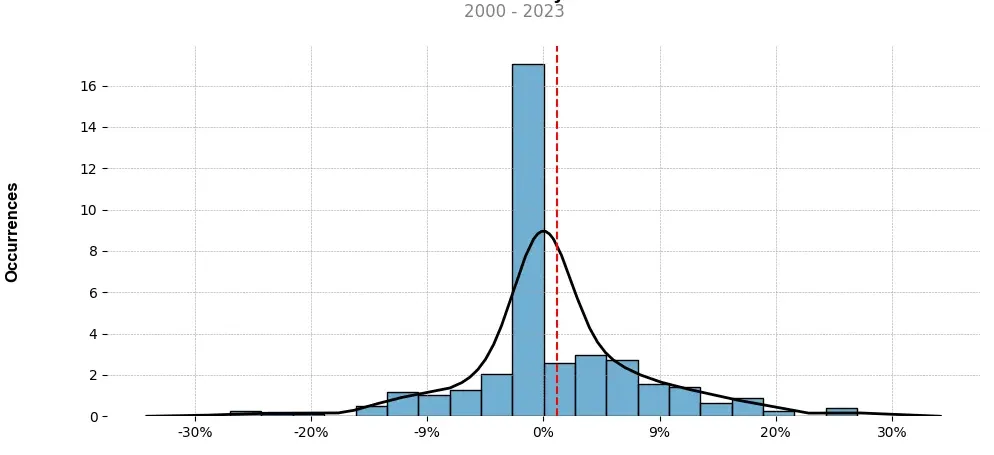

Distribution of the monthly returns of the top strategy

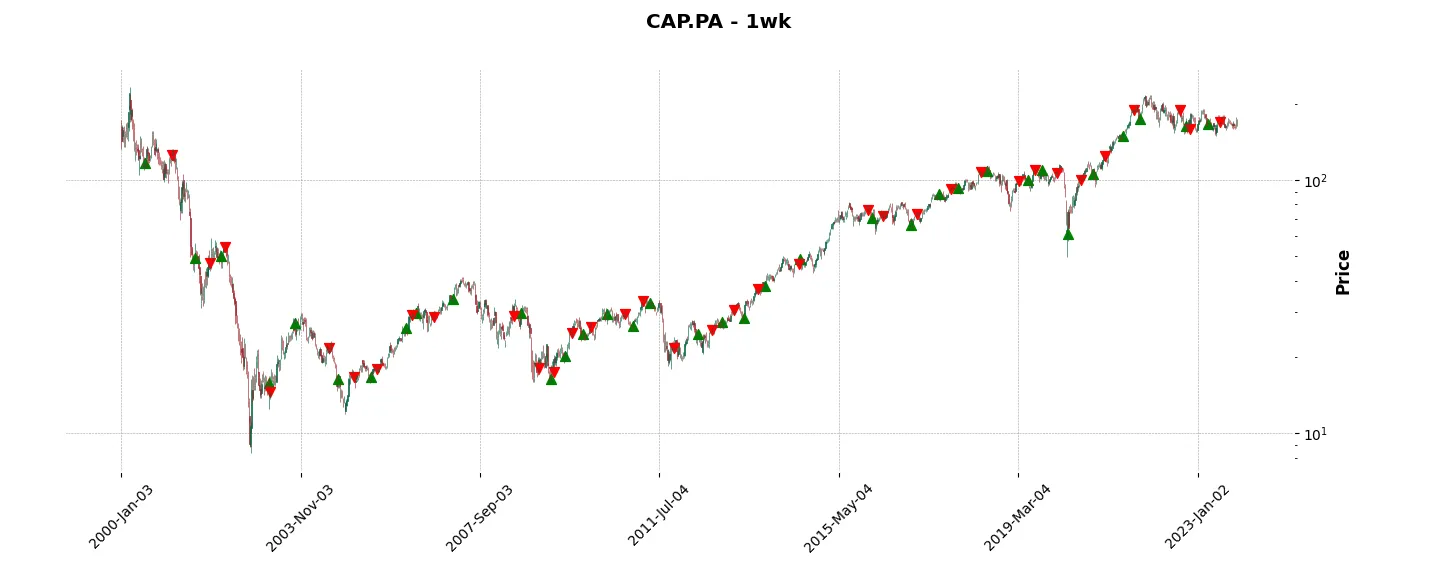

Strategy details

«Top trading strategy CapGemini Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)