Last update: 02-09-2024

Top trading strategy Bitcoin (BTC) Weekly – Live position:

- Open short

- Entry price : 57301.86 $

- Pnl : %

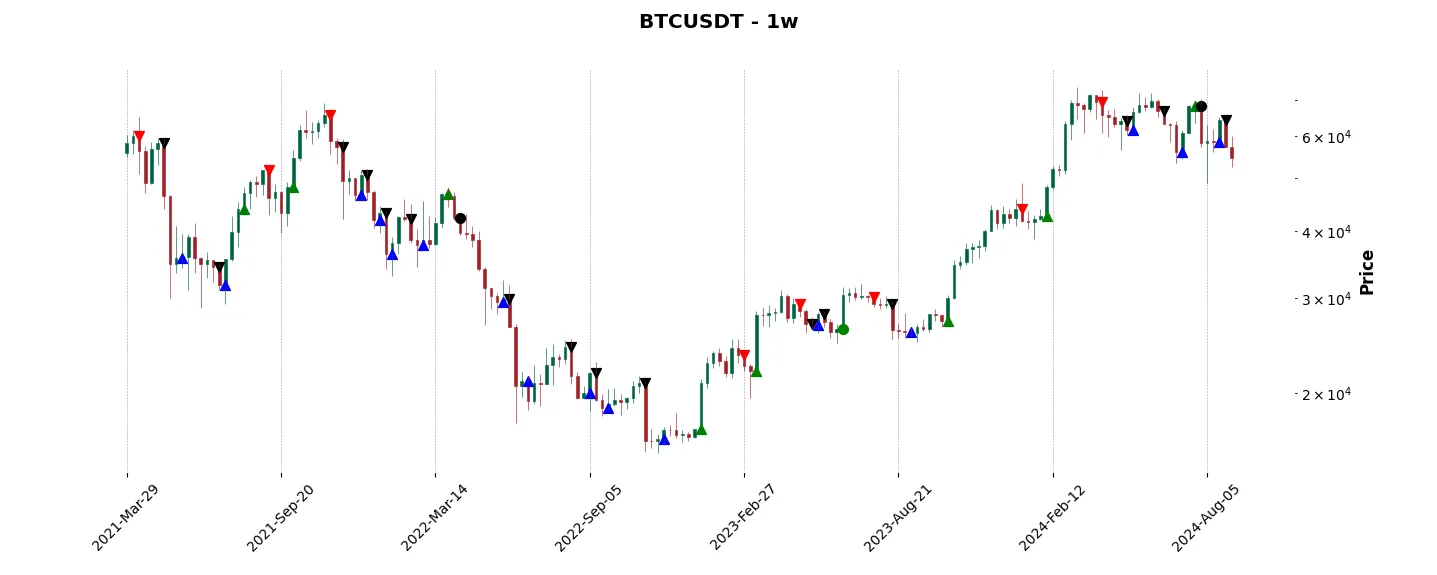

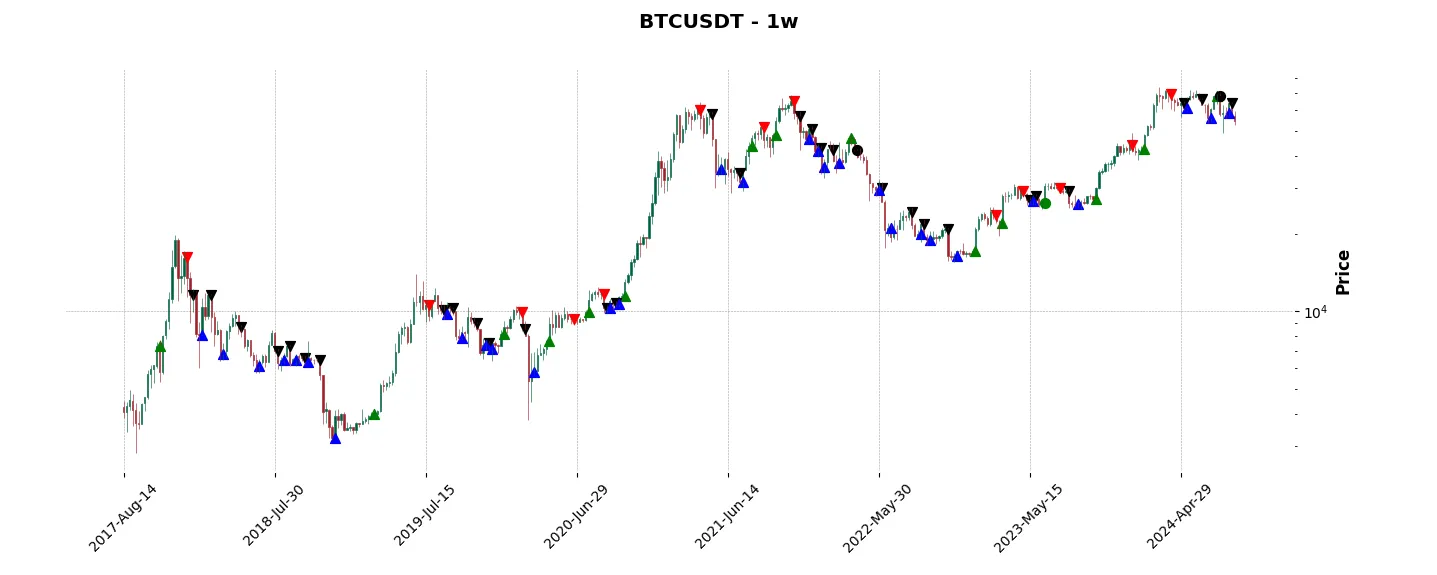

Trade history

Over 6 months

Complete

«Top trading strategy Bitcoin (BTC) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy BTC Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

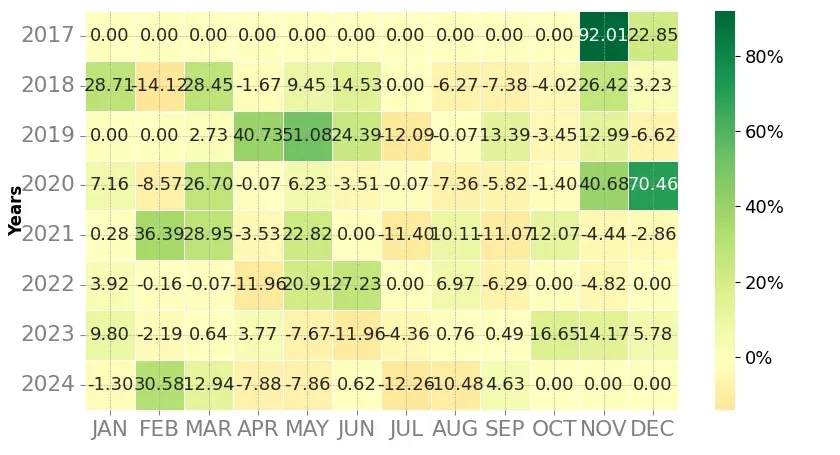

Heatmap of monthly returns

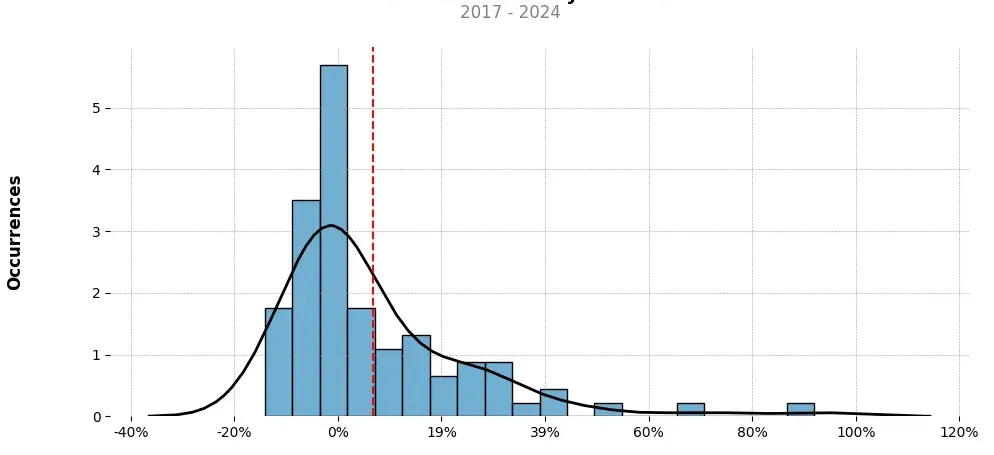

Distribution of the monthly returns of the top strategy

Presentation of BTC

Bitcoin (BTC) is a digital currency and decentralized payment system launched in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Since its inception, Bitcoin has gained significant attention and popularity as the pioneer of cryptocurrencies.

One of the key features of Bitcoin is its decentralization. Unlike traditional currencies that are centralized and controlled by governments or financial institutions, Bitcoin operates on a peer-to-peer network known as the blockchain. This means that transactions are verified and recorded by a distributed network of computers, reducing the need for intermediaries such as banks.

Bitcoin also offers a level of transparency and security that traditional financial systems often lack. Each transaction made with Bitcoin is recorded on the blockchain, a public ledger that is accessible to anyone. This transparency ensures that transactions are genuine and cannot be tampered with. Additionally, Bitcoin uses cryptographic techniques to secure transactions, making it difficult to hack or counterfeit.

One of the major benefits of Bitcoin is its potential to provide financial inclusion and empowerment to individuals who lack access to traditional banking services. With Bitcoin, anyone with internet access can send and receive money without the need for a bank account. This has particularly significant implications for people in underbanked or unbanked regions, where traditional banking infrastructure is limited.

Bitcoin has also attracted attention as a store of value and investment asset class. Due to its limited supply and increasing demand, Bitcoin has experienced significant price appreciation over the years, making early adopters and investors wealthy. This has led to the emergence of a vibrant cryptocurrency market, where individuals can buy and sell Bitcoin and other cryptocurrencies on various exchanges.

However, Bitcoin has not been without its challenges and criticisms. Its decentralized nature and the lack of regulatory oversight have made it attractive to criminals seeking to engage in illicit activities. Additionally, its high volatility and unpredictability have led to concerns about its use as a stable medium of exchange.

Furthermore, Bitcoin’s underlying technology, blockchain, has inspired numerous innovations beyond digital currencies. Many industries and sectors have recognized the potential of blockchain to improve transparency, security, and efficiency in various processes, leading to the development of numerous blockchain-based applications and projects.

In conclusion, Bitcoin has revolutionized the concept of money and payment systems. Its decentralized nature, transparency, and security have attracted a global user base and generated significant interest from both individuals and institutions. While facing challenges, Bitcoin continues to play a significant role in shaping the future of finance and technology.

Strategy details

«Top trading strategy BTC Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘mineable’, ‘pow’, ‘sha-256’, ‘store-of-value’, ‘state-channel’, ‘coinbase-ventures-portfolio’, ‘three-arrows-capital-portfolio’, ‘polychain-capital-portfolio’, ‘binance-labs-portfolio’, ‘blockchain-capital-portfolio’, ‘boostvc-portfolio’, ‘cms-holdings-portfolio’, ‘dcg-portfolio’, ‘dragonfly-capital-portfolio’, ‘electric-capital-portfolio’, ‘fabric-ventures-portfolio’, ‘framework-ventures-portfolio’, ‘galaxy-digital-portfolio’, ‘huobi-capital-portfolio’, ‘alameda-research-portfolio’, ‘a16z-portfolio’, ‘1confirmation-portfolio’, ‘winklevoss-capital-portfolio’, ‘usv-portfolio’, ‘placeholder-ventures-portfolio’, ‘pantera-capital-portfolio’, ‘multicoin-capital-portfolio’, ‘paradigm-portfolio’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our 3 best ETH daily trading strategies/a>

- Trade on the best platform: Binance (100USDT offered)