Last update: 09-07-2024 00:00 UTC

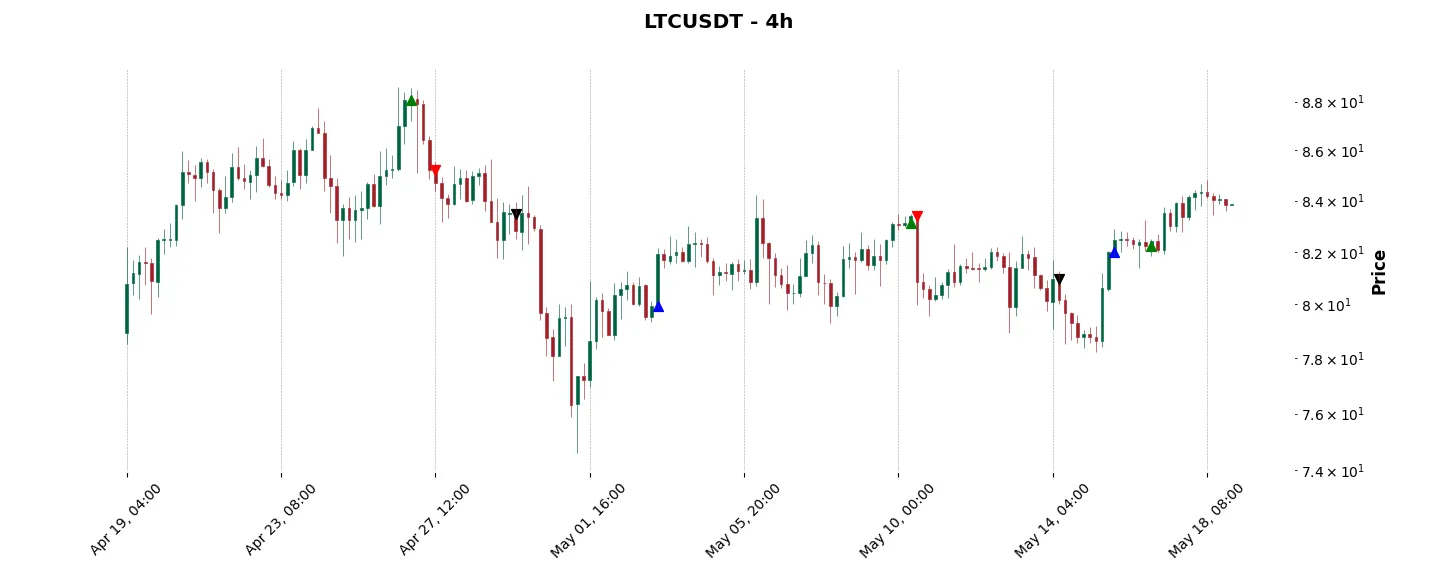

Top trading strategy Litecoin (LTC) 4H – Live position:

- Short in progress

- Entry price : 70.53 $

- Pnl : 8.0 %

Trade history

Over 6 months

Complete

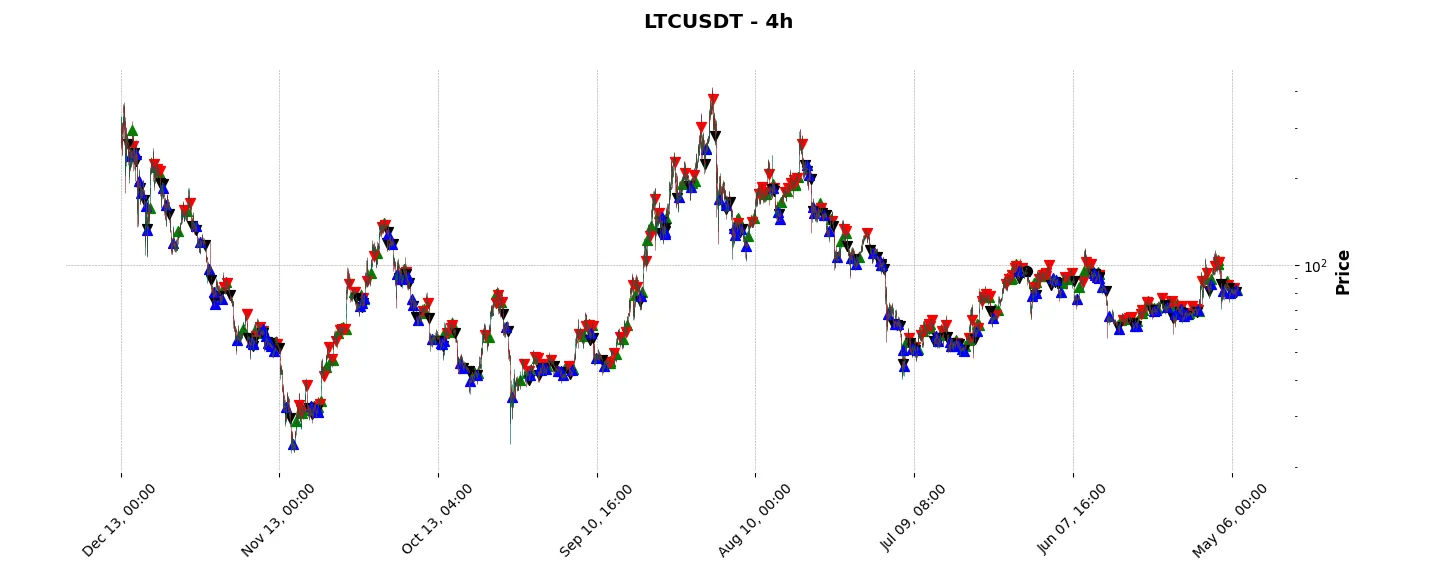

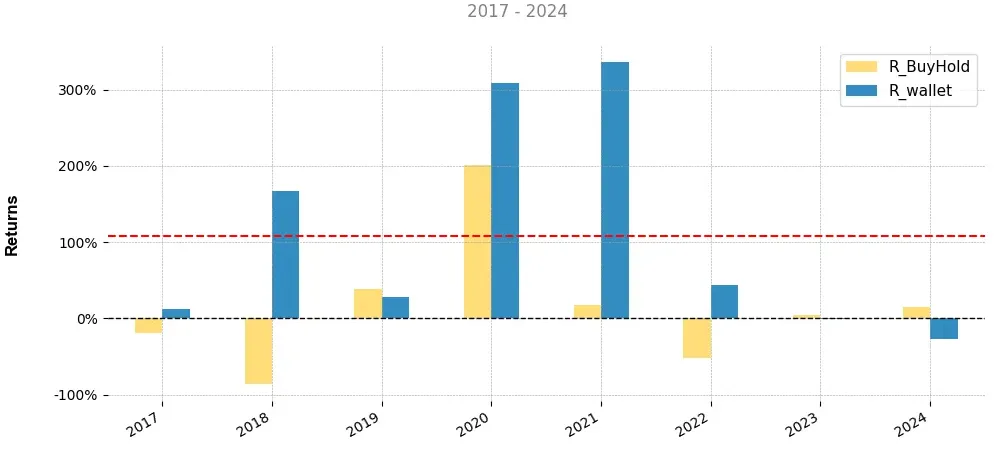

«Top trading strategy Litecoin (LTC) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy LTC 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

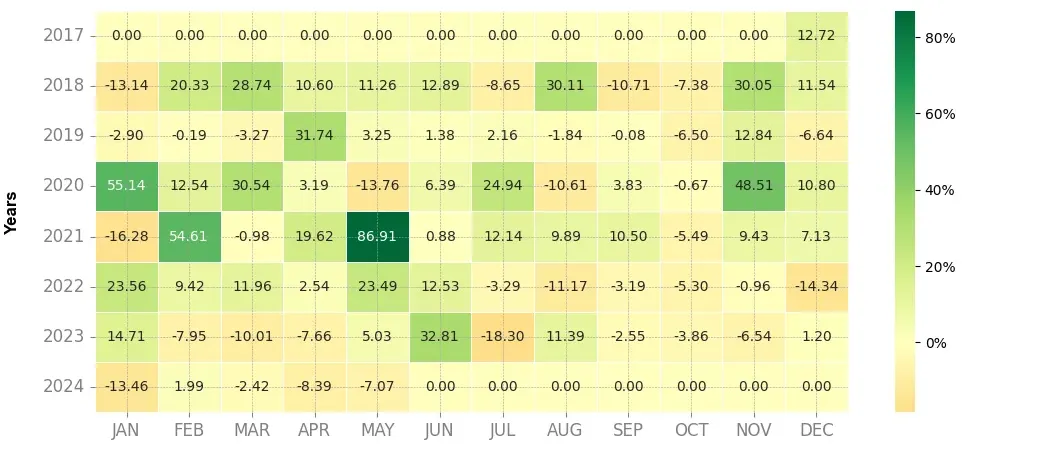

Heatmap of monthly returns

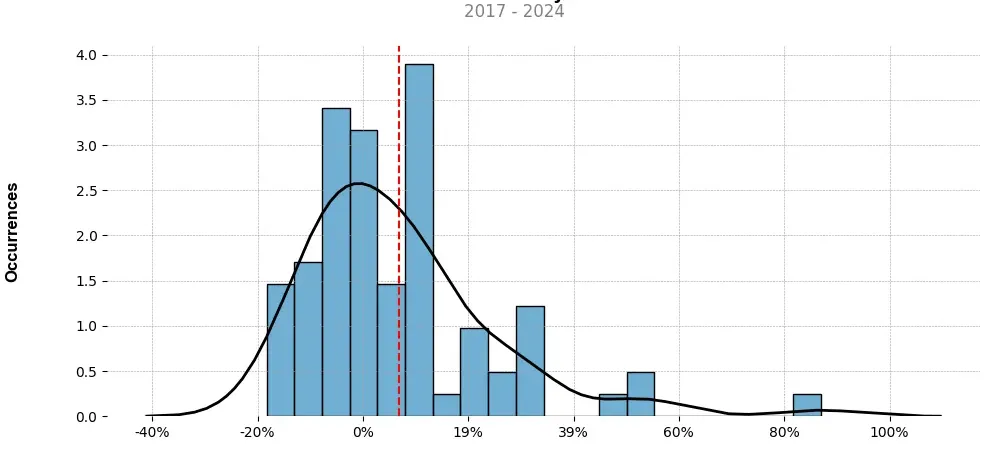

Distribution of the monthly returns of the top strategy

Presentation of LTC

Litecoin (LTC) is one of the pioneering cryptocurrencies, invented by Charlie Lee in October 2011. It shares many similarities with Bitcoin, its predecessor, but there are some key differences that set it apart. In this synthesis, we will explore the origins, features, advantages, and future prospects of Litecoin.

The creation of Litecoin was inspired by Bitcoin’s success, with the aim of addressing its limitations. Litecoin, therefore, serves as a decentralized digital currency that facilitates peer-to-peer transactions without the need for intermediaries such as banks.

One notable feature of Litecoin is its faster transaction confirmation time compared to Bitcoin. While Bitcoin takes an average of 10 minutes to confirm a transaction, Litecoin requires just 2.5 minutes, making it four times faster. This advantage enables Litecoin to handle a higher number of transactions and enhances its scalability.

To achieve this speed, Litecoin uses a different hashing algorithm called “Scrypt” rather than Bitcoin’s “SHA-256.” Scrypt is memory intensive and computationally complex, making it more resistant to hardware-based mining (ASICs). This approach aims to promote a more decentralized mining ecosystem compared to Bitcoin, where mining is dominated by large-scale ASIC mining farms.

Another key feature of Litecoin is its higher maximum coin supply. While Bitcoin has a cap of 21 million coins, Litecoin has a limit of 84 million coins. This larger supply, combined with its faster block generation time, means that Litecoin will have more total coins in circulation. However, this does not necessarily devalue Litecoin, as its divisibility allows for smaller transaction amounts and broader adoption.

Litecoin has gained significant popularity and acceptance within the cryptocurrency community. It is widely available on various cryptocurrency exchanges, making it easily accessible to traders and investors. Additionally, Litecoin has gained merchant acceptance, with various businesses now accepting it as a means of payment. This increasing adoption contributes to the growing value and relevance of Litecoin in the crypto space.

Looking ahead, Litecoin aims to continue enhancing its technology and offerings. The development team continually works on improving the network’s security, privacy, and efficiency. They are exploring innovative features such as MimbleWimble to enhance privacy and scalability further. Moreover, the Lightning Network, a layer-two scaling solution, has been successfully implemented in Litecoin, facilitating near-instant and low-cost transactions.

In conclusion, Litecoin (LTC) has emerged as a reputable cryptocurrency since its inception. Its faster transaction confirmation time, larger coin supply, and ongoing technological advancements set it apart from Bitcoin and other cryptocurrencies. As the crypto industry evolves, Litecoin’s growing adoption and continuous development efforts indicate a promising future for this pioneering digital currency.

Strategy details

«Top trading strategy LTC 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘mineable’, ‘pow’, ‘scrypt’, ‘medium-of-exchange’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)