Last update: 08-07-2024 20:00 UTC

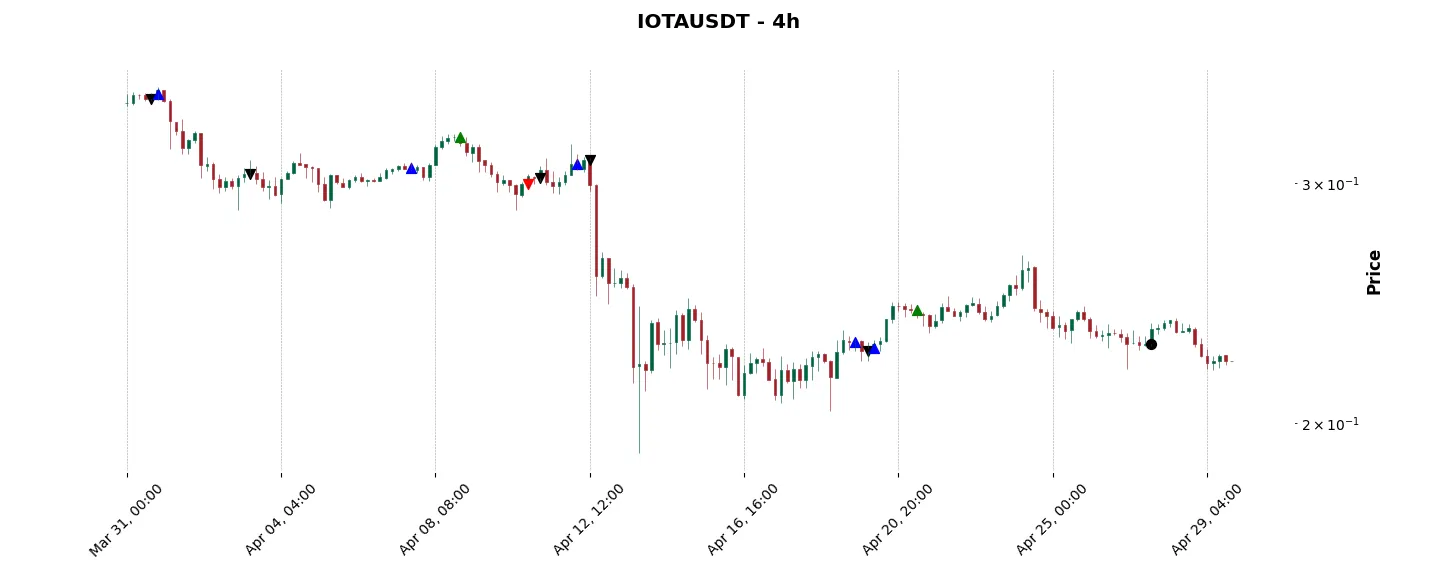

Top trading strategy IOTA (IOTA) 4H – Live position:

- Short in progress

- Entry price : 0.1705 $

- Pnl : 11.38 %

Trade history

Over 6 months

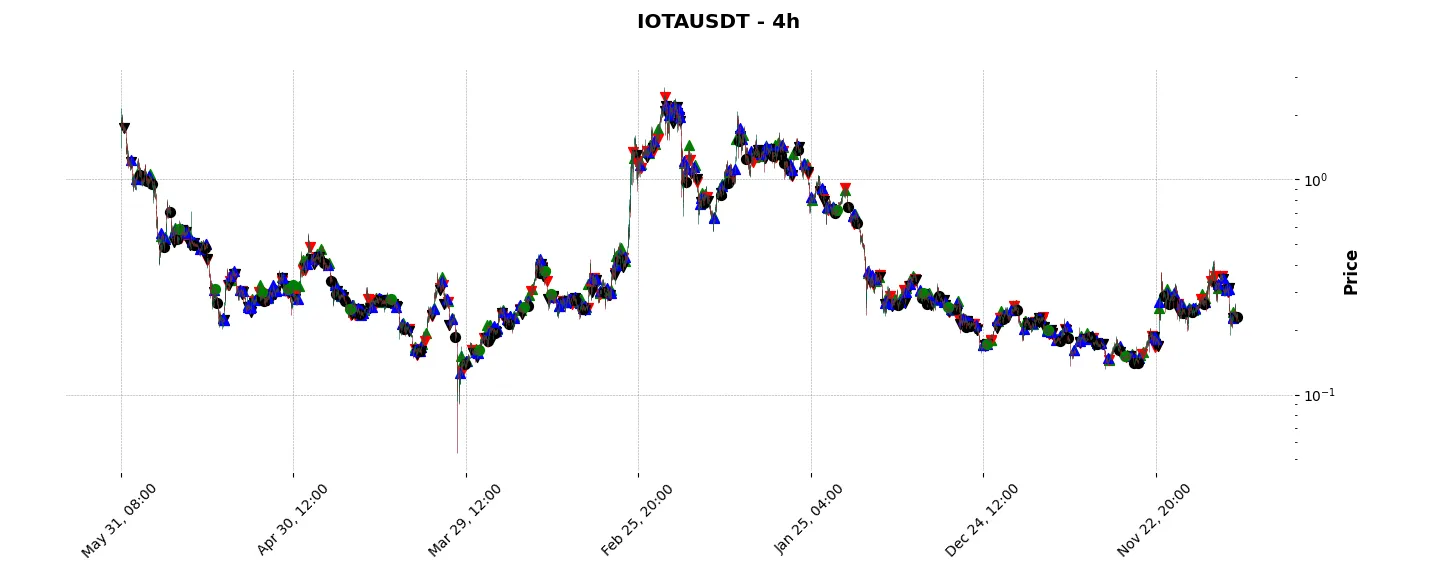

Complete

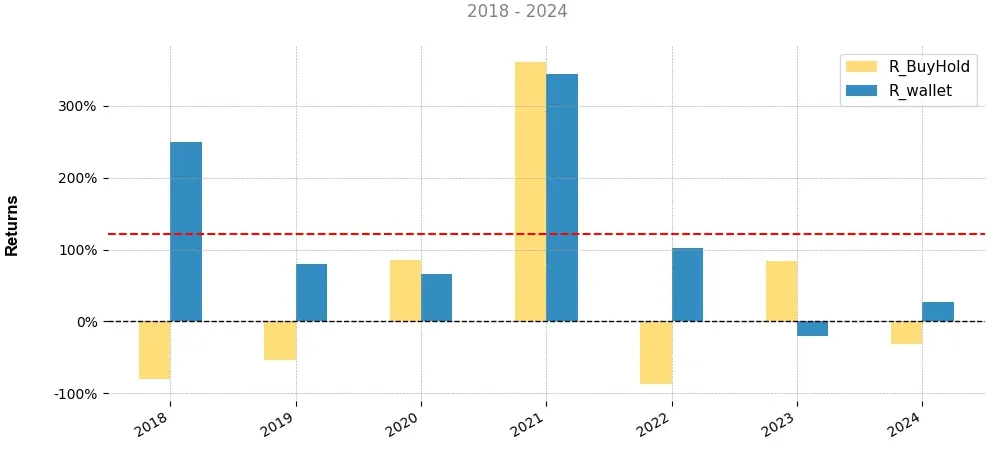

«Top trading strategy IOTA (IOTA) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy MIOTA 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

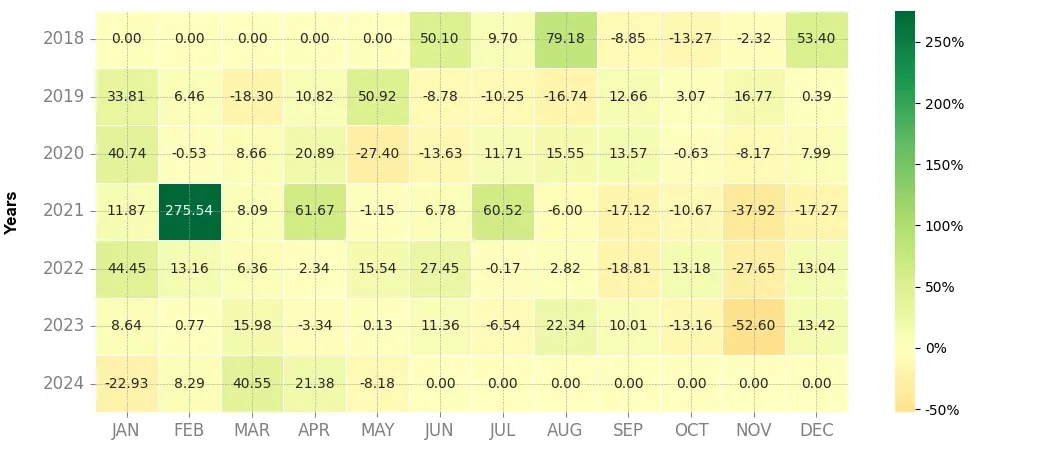

Heatmap of monthly returns

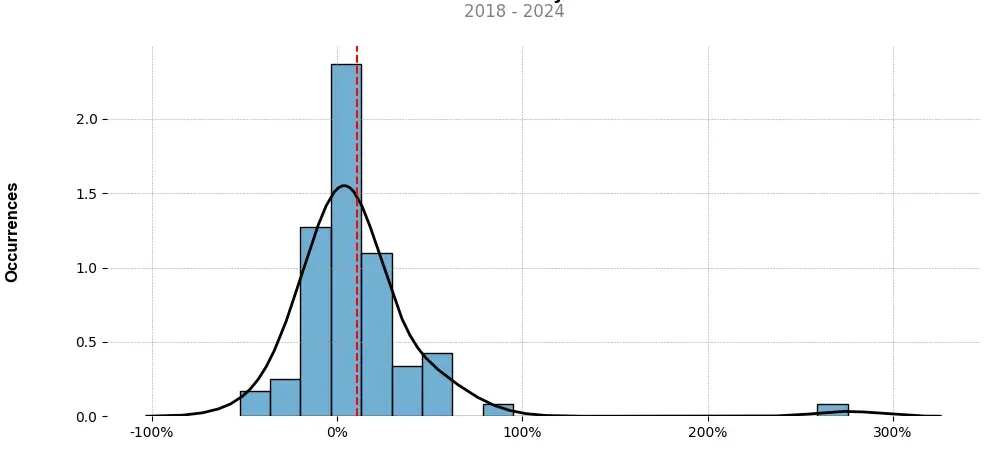

Distribution of the monthly returns of the top strategy

Presentation of MIOTA

IOTA, designated by the symbol MIOTA, is a cryptocurrency that aims to revolutionize the Internet of Things (IoT) industry through its unique technology and features. It was created to provide a scalable, feeless, and secure platform for machine-to-machine communication and data transfer.

One of the key distinguishing factors of IOTA is its underlying technology called the Tangle. Unlike traditional blockchain architectures, which consist of linear chains of blocks, the Tangle forms a Directed Acyclic Graph (DAG). This means that every transaction in the IOTA network is connected to multiple other transactions, making it highly scalable and enabling parallel processing.

Another significant advantage of IOTA is its feeless nature. In contrast to most cryptocurrencies that require transaction fees, IOTA allows for feeless microtransactions. This makes it well-suited for facilitating the transfer of small amounts of value within IoT networks, where countless connected devices may require frequent and seamless transactions.

Moreover, IOTA emphasizes security through its unique consensus mechanism called “Coordicide.” While many cryptocurrencies rely on proof-of-work (PoW) or proof-of-stake (PoS) algorithms, IOTA aims to eliminate any centralized entity (such as a coordinator) that may pose a potential vulnerability. The Coordicide initiative is an ongoing effort to replace the Coordinator with a decentralized consensus mechanism, further enhancing security and decentralization.

As an IoT-focused cryptocurrency, IOTA has the potential to reshape various industries and sectors. With its feeless nature, scalability, and focus on secure machine-to-machine communication, IOTA can enable new business models and applications. For example, it can facilitate micropayments between autonomous vehicles, incentivize data sharing within smart cities, or optimize supply chain management by securely tracking goods and validating transactions.

However, IOTA also faces some challenges. The relatively young technology is still being developed, and issues such as scalability and security vulnerabilities need to be thoroughly addressed to gain wider adoption. Additionally, the absence of transaction fees also raises concerns about potential spam attacks, although IOTA has implemented measures to prevent them.

In conclusion, IOTA (MIOTA) is a cryptocurrency designed to revolutionize the Internet of Things industry. With its feeless nature, scalable Tangle architecture, and focus on secure machine-to-machine communication, it has the potential to reshape various sectors. While challenges and improvements are still underway, IOTA represents an innovative approach to creating a decentralized, scalable, and secure infrastructure for the future of IoT.

Strategy details

«Top trading strategy MIOTA 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘dag’, ‘medium-of-exchange’, ‘iot’, ‘sharing-economy’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)