Last update: 25-10-2024 12:00 UTC

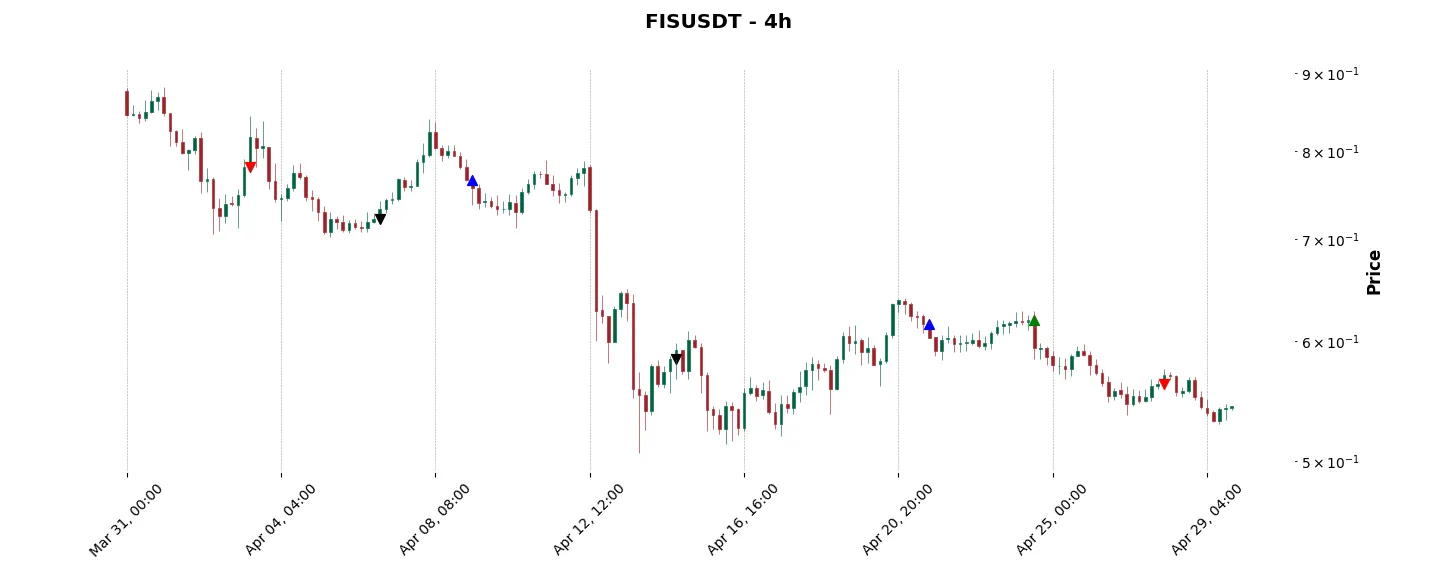

Top trading strategy StaFi (FIS) 4H – Live position:

- No position

Trade history

Over 6 months

Complete

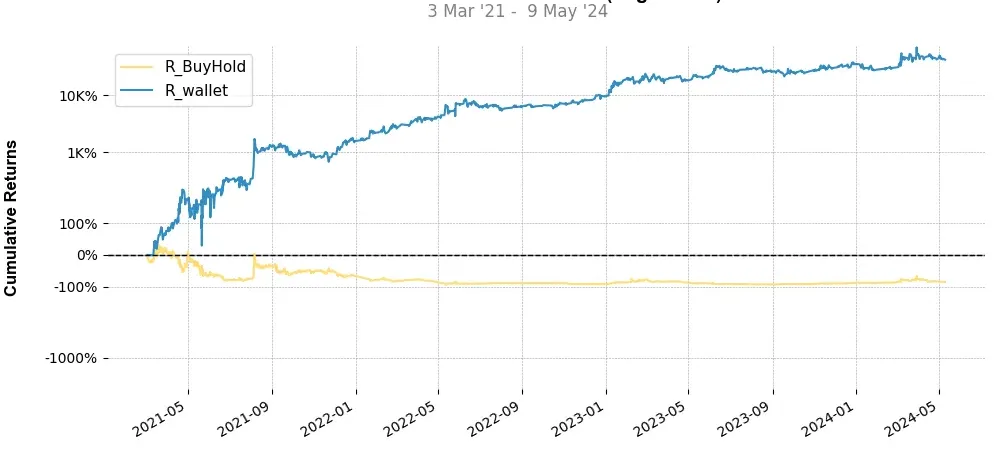

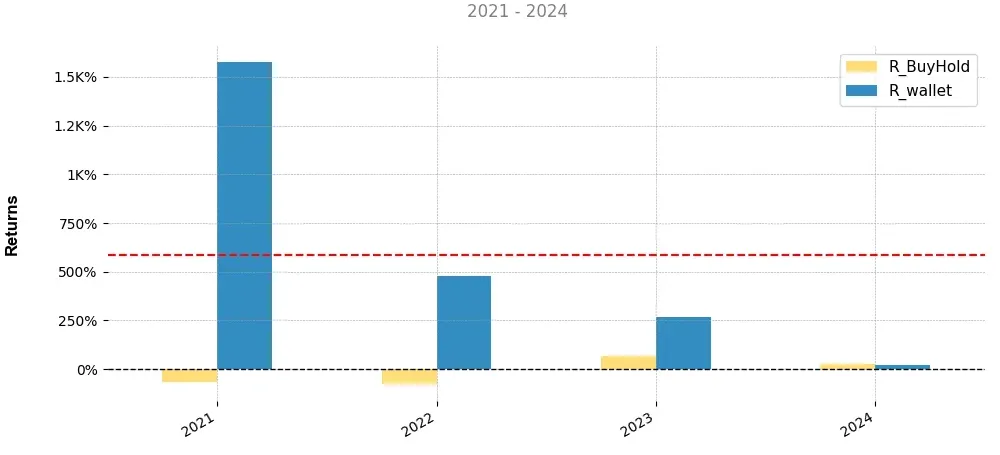

«Top trading strategy StaFi (FIS) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy FIS 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

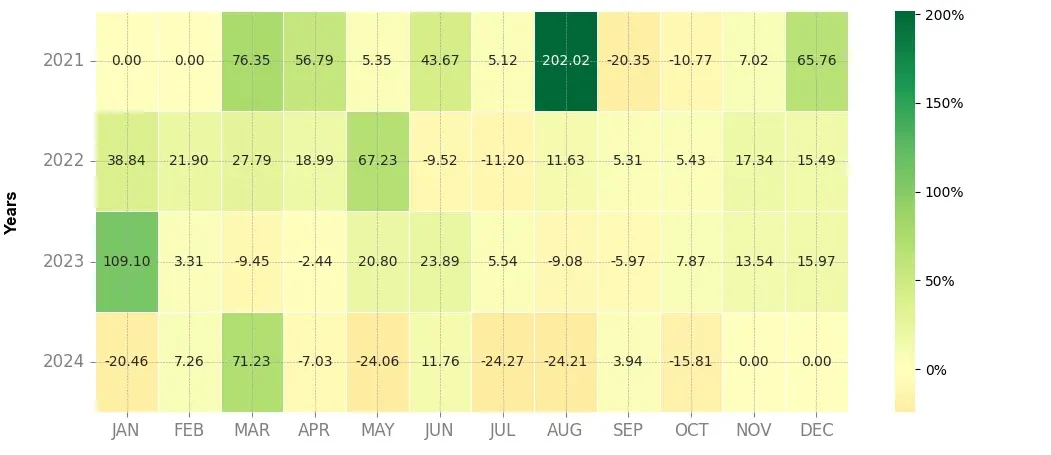

Heatmap of monthly returns

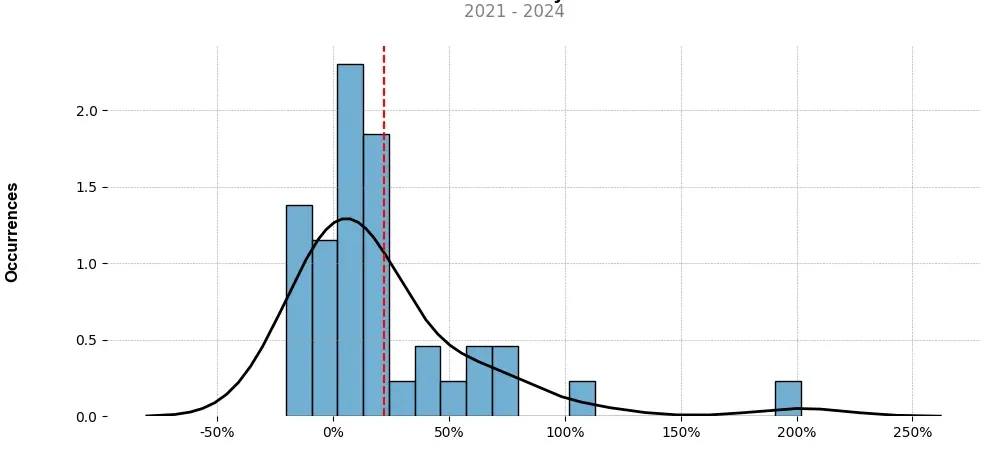

Distribution of the monthly returns of the top strategy

Presentation of FIS

StaFi, also known as FIS, is a cryptocurrency that offers users the ability to stake their assets and gain liquidity in return. It aims to bridge the gap between decentralized finance (DeFi) and traditional finance by allowing users to stake their tokens and receive rTokens, which represent their staked assets, in return. These rTokens can then be traded or used as collateral for borrowing in the DeFi ecosystem.

One of the key features of StaFi is its ability to provide liquidity to staked assets. Unlike traditional staking, where tokens are locked up for a certain period of time, StaFi allows users to trade their rTokens on decentralized exchanges (DEXs) while still earning staking rewards. This means that users can enjoy the benefits of staking, such as earning passive income, while also having the flexibility to trade their assets whenever they want.

Another important aspect of StaFi is its focus on interoperability. The platform aims to support a wide range of assets, including both native coins and tokens from other blockchains. This allows users to stake various cryptocurrencies and gain liquidity in return, creating a diverse and flexible staking ecosystem.

StaFi’s approach to staking also brings added security for users. By tokenizing staked assets into rTokens, individuals no longer need to worry about issues such as slashing or losing their staked tokens. Instead, they can hold rTokens, which represent their staked assets, and control their own funds securely.

Furthermore, StaFi incorporates governance features to ensure that the community has a say in the platform’s development and decision-making. FIS token holders can participate in voting and propose changes to the platform, making it a truly decentralized and community-driven ecosystem.

In conclusion, StaFi (FIS) is a cryptocurrency that offers users the ability to stake their assets, gain liquidity, and bridge the gap between DeFi and traditional finance. With its focus on interoperability, trading flexibility, security, and community governance, StaFi aims to provide a holistic solution for individuals looking to engage in staking and participate in the growing DeFi ecosystem.

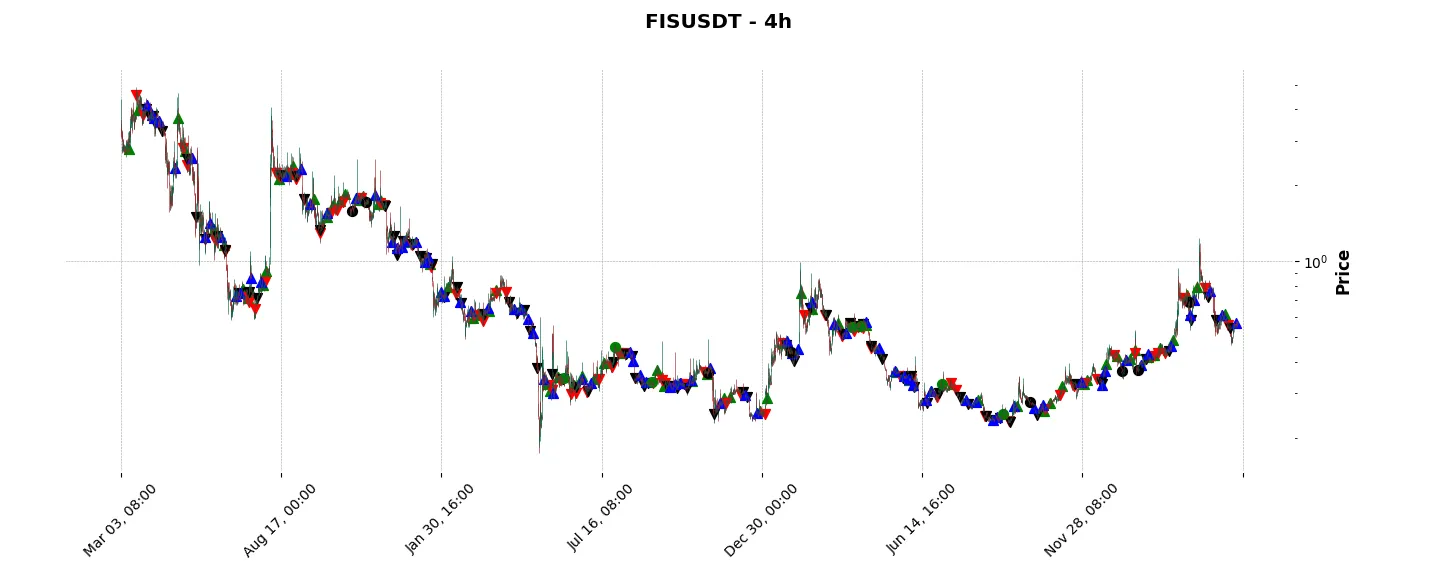

Strategy details

«Top trading strategy FIS 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘defi’, ‘substrate’, ‘polkadot’, ‘polkadot-ecosystem’, ‘exnetwork-capital-portfolio’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)