Last update: 08-07-2024 20:00 UTC

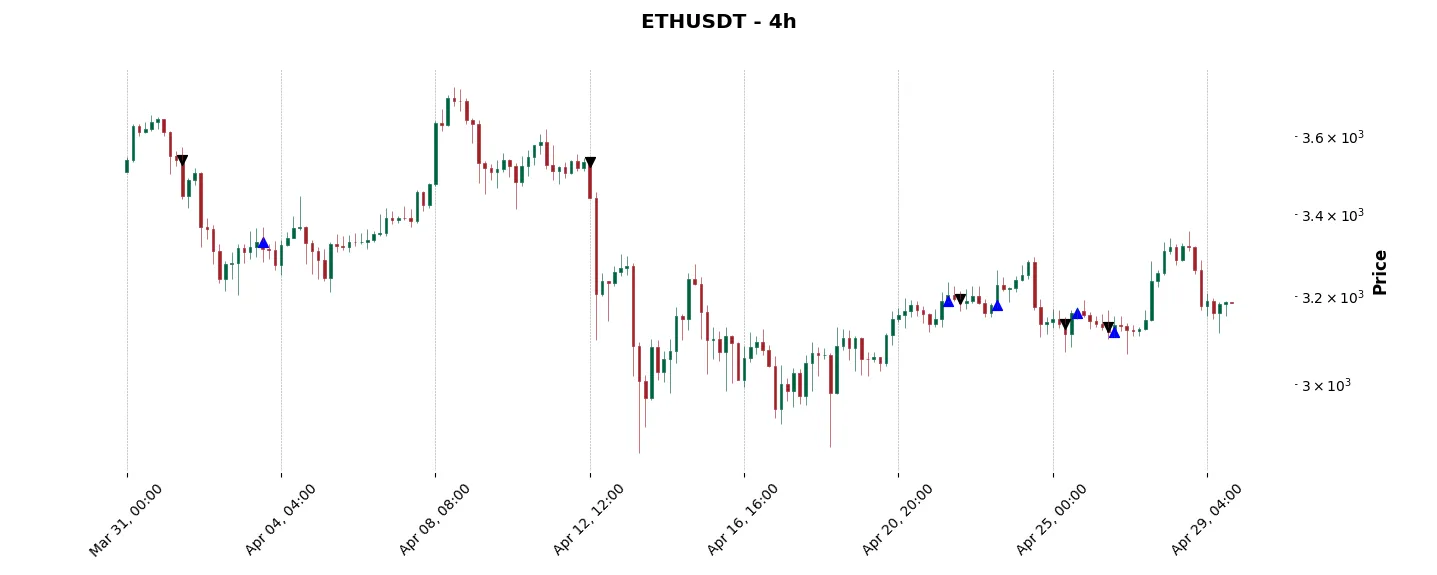

Top trading strategy Ethereum (ETH) 4H – Live position:

- Short in progress

- Entry price : 3442.2 $

- Pnl : 12.7 %

Trade history

Over 6 months

Complete

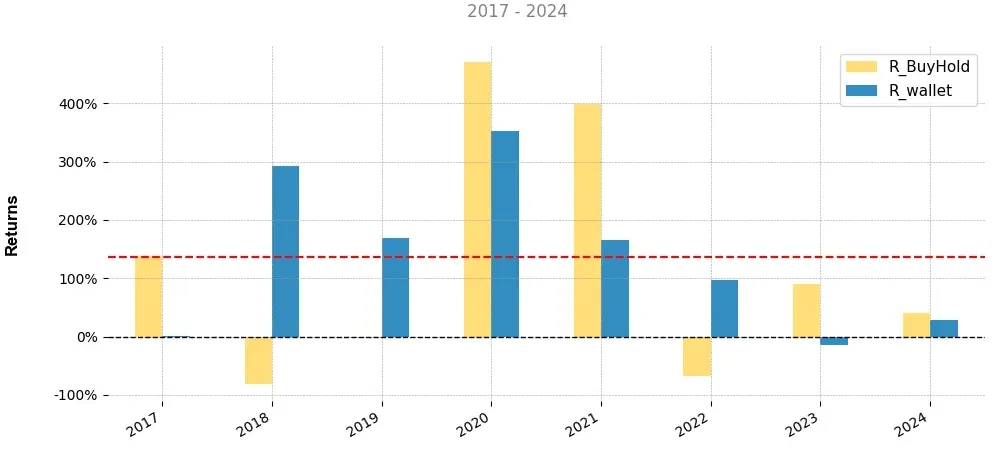

«Top trading strategy Ethereum (ETH) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy ETH 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

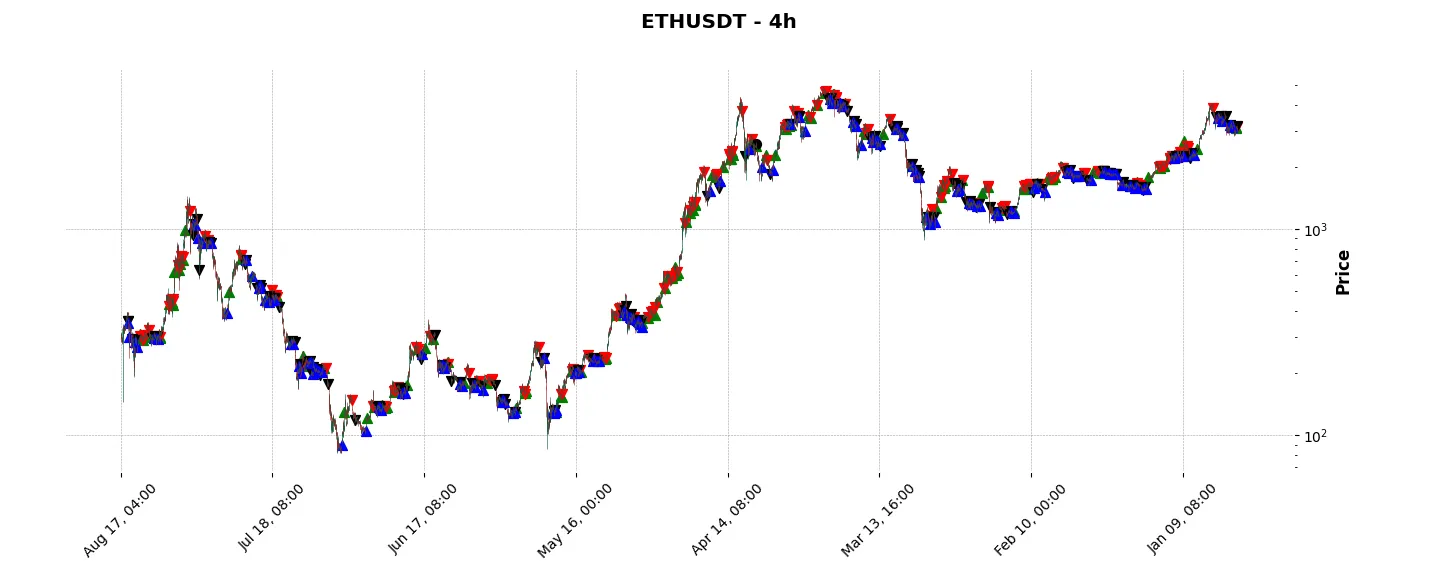

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

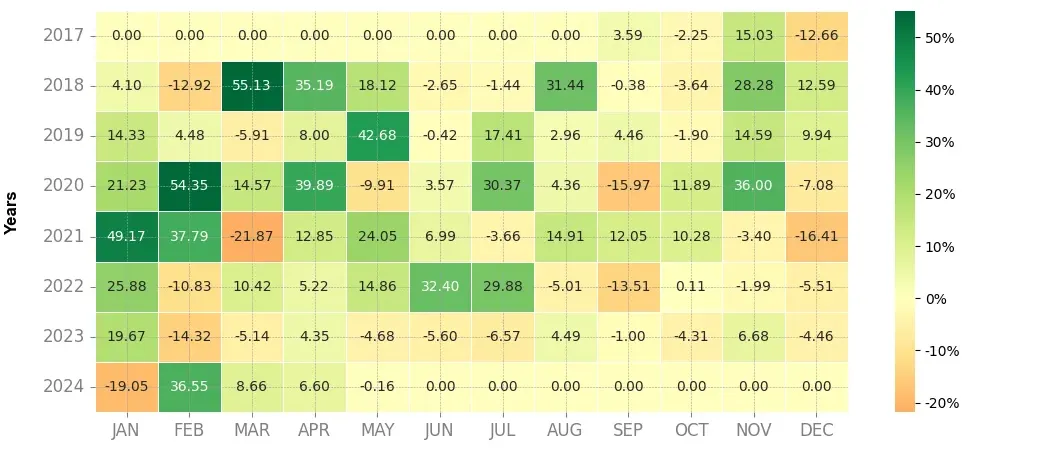

Heatmap of monthly returns

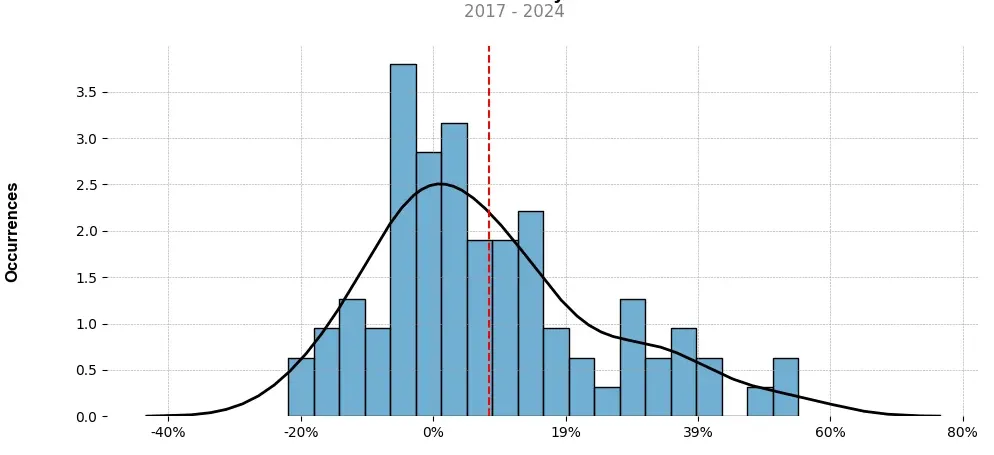

Distribution of the monthly returns of the top strategy

Presentation of ETH

Ethereum (ETH) is a decentralized blockchain platform that has emerged as one of the most prominent cryptocurrencies. Introduced in 2015 by Vitalik Buterin, Ethereum offers unique features and capabilities, setting it apart from other cryptocurrencies like Bitcoin.

One of the key differentiators of Ethereum is its ability to support programmable smart contracts. Smart contracts are self-executing agreements that automatically execute specified actions once certain conditions are met. This feature enhances the functionality of Ethereum and makes it a preferred platform for developing decentralized applications (dApps). These dApps can be built on top of Ethereum’s blockchain, utilizing its robust infrastructure and secure network.

Furthermore, Ethereum introduced its native cryptocurrency called Ether (ETH), which plays a crucial role within the Ethereum ecosystem. Ether serves as a digital currency facilitating transactions and powering the execution of smart contracts on the Ethereum network. It is also commonly used as a means of crowdfunding through Initial Coin Offerings (ICOs) for various projects and startups.

ETH’s popularity and market value have grown significantly, making it the second-largest cryptocurrency by market capitalization after Bitcoin. Its wide adoption, along with its active developer community, has led to the creation of numerous decentralized applications, fostering innovation and promoting the integration of blockchain technology into various industries.

In addition to its role as a cryptocurrency, Ethereum has been at the forefront of addressing scalability issues that plague blockchain networks. Ethereum 2.0, a major upgrade currently under development, aims to transition Ethereum from a Proof-of-Work (PoW) consensus mechanism to a more energy-efficient Proof-of-Stake (PoS) mechanism, enabling faster transaction processing and increased scalability.

The future prospects of Ethereum are promising, as it continues to attract investments and partnerships from major companies and institutions. With its focus on enabling decentralized applications through smart contracts, Ethereum has the potential to disrupt traditional systems and revolutionize industries such as finance, supply chain management, and healthcare.

Despite its success, Ethereum faces challenges such as scalability, security concerns, and competition from other blockchain platforms. However, its active development community and continuous improvements aim to overcome these obstacles and further enhance the capabilities of the Ethereum network.

In conclusion, Ethereum (ETH) has established itself as a prominent cryptocurrency and blockchain platform through its smart contract functionality, innovative applications, and growing market capitalization. Its ongoing developments and upgrades indicate a commitment to addressing key challenges, paving the way for a decentralized and programmable future.

Strategy details

«Top trading strategy ETH 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘pos’, ‘smart-contracts’, ‘ethereum-ecosystem’, ‘coinbase-ventures-portfolio’, ‘three-arrows-capital-portfolio’, ‘polychain-capital-portfolio’, ‘binance-labs-portfolio’, ‘blockchain-capital-portfolio’, ‘boostvc-portfolio’, ‘cms-holdings-portfolio’, ‘dcg-portfolio’, ‘dragonfly-capital-portfolio’, ‘electric-capital-portfolio’, ‘fabric-ventures-portfolio’, ‘framework-ventures-portfolio’, ‘hashkey-capital-portfolio’, ‘kenetic-capital-portfolio’, ‘huobi-capital-portfolio’, ‘alameda-research-portfolio’, ‘a16z-portfolio’, ‘1confirmation-portfolio’, ‘winklevoss-capital-portfolio’, ‘usv-portfolio’, ‘placeholder-ventures-portfolio’, ‘pantera-capital-portfolio’, ‘multicoin-capital-portfolio’, ‘paradigm-portfolio’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Trade on the best platform: Binance (100USDT offered)