Last update: 25-10-2024 12:00 UTC

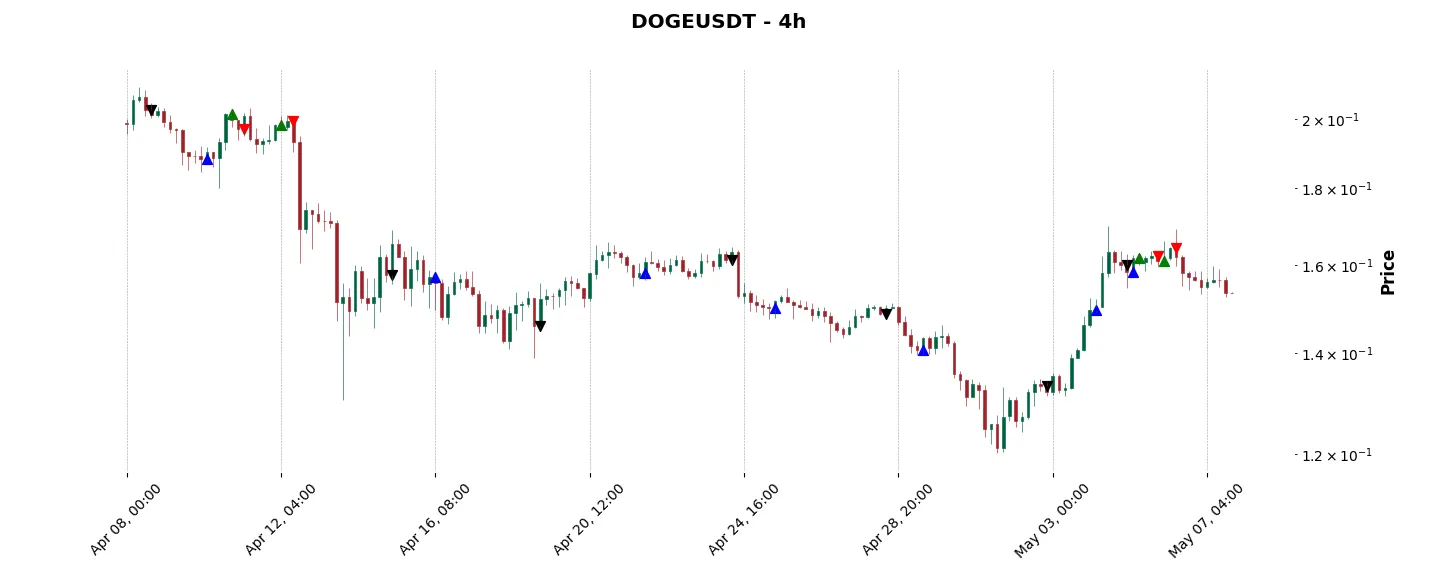

Top trading strategy Dogecoin (DOGE) 4H – Live position:

- No position

Trade history

Over 6 months

Complete

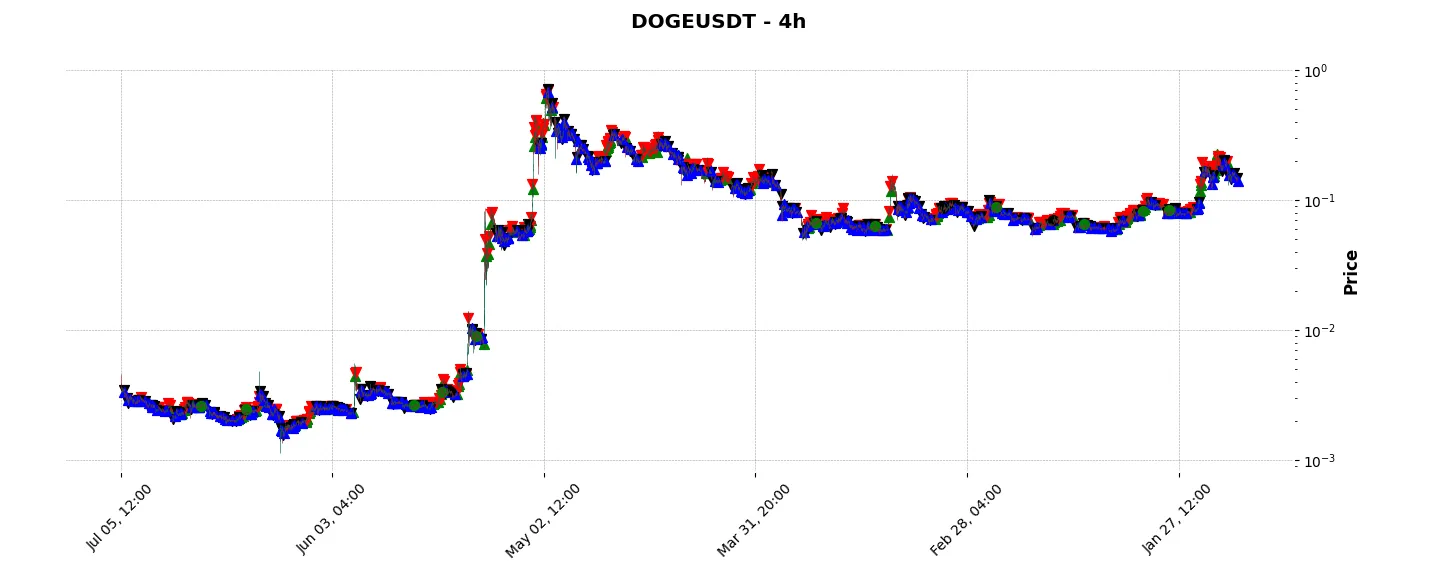

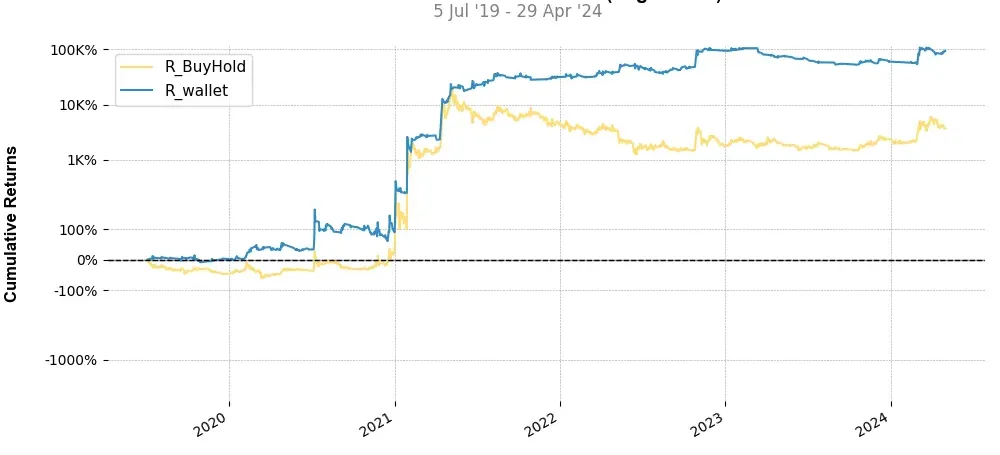

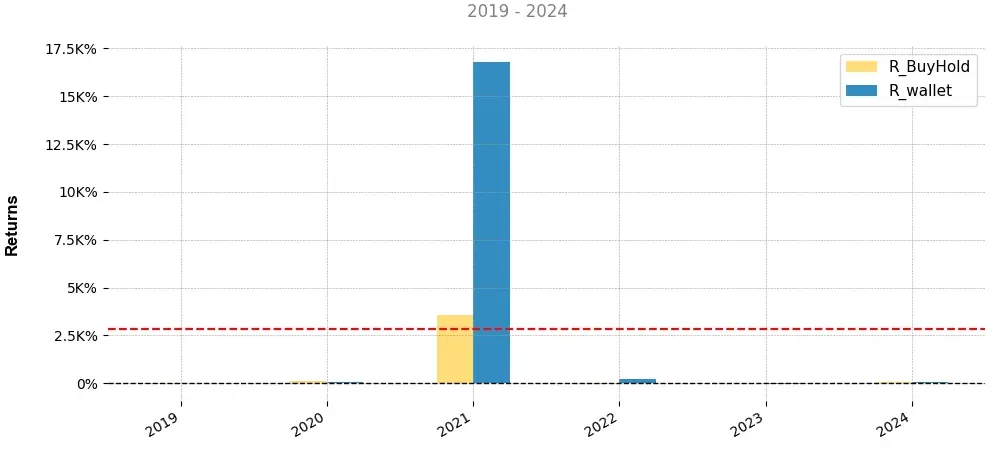

«Top trading strategy Dogecoin (DOGE) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy DOGE 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

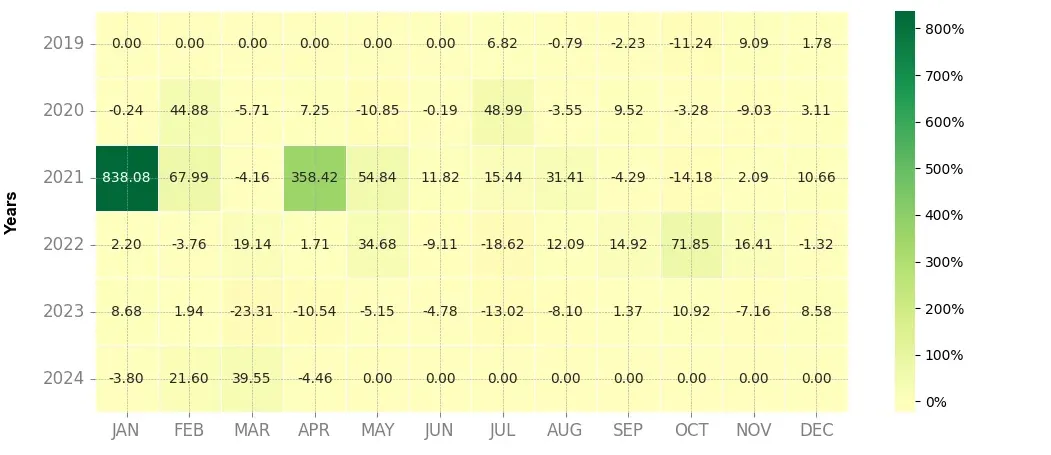

Heatmap of monthly returns

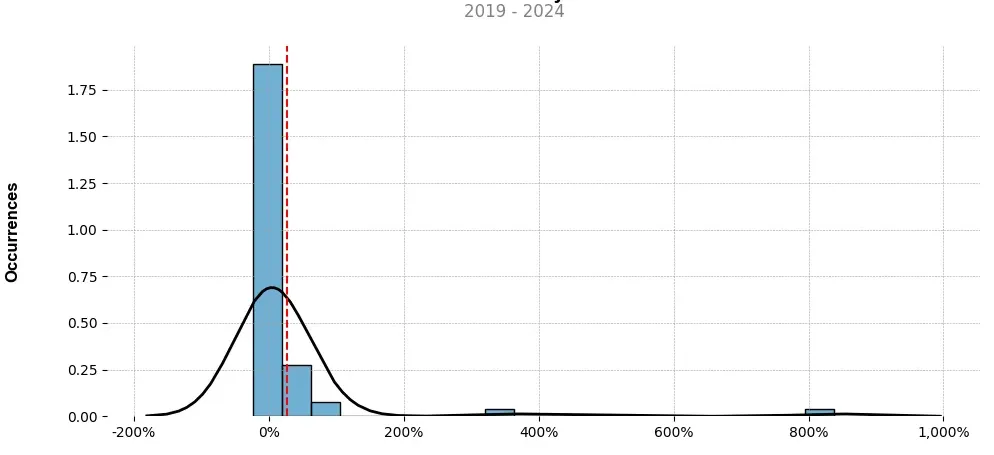

Distribution of the monthly returns of the top strategy

Presentation of DOGE

Dogecoin (DOGE) is a cryptocurrency that was launched in December 2013 as a light-hearted and playful alternative to Bitcoin. It is based on the popular internet meme featuring a Shiba Inu dog. Despite its initial creation as a joke, Dogecoin quickly gained a significant following and has become one of the most well-known cryptocurrencies in the world.

One of the unique aspects of Dogecoin is its strong emphasis on community and generosity. The cryptocurrency has been associated with various charitable causes, with the Dogecoin community often coming together to raise funds for various initiatives. This philanthropic aspect has contributed to the popularity and positive reputation of Dogecoin.

Technically, Dogecoin is similar to other cryptocurrencies like Bitcoin and Litecoin, as it uses a blockchain to record transactions. However, Dogecoin differentiates itself by having a faster block time, allowing for quicker transaction confirmations compared to other cryptocurrencies. This feature has made it more suitable for smaller, day-to-day transactions.

Another notable feature of Dogecoin is its inflationary supply. Unlike Bitcoin, which has a limited supply of 21 million coins, Dogecoin has no maximum supply limit. Instead, it has an annual inflation rate of approximately 5%. This has led to a constantly growing supply of Dogecoins, which is intended to encourage spending and broader circulation rather than hoarding.

In recent years, Dogecoin has gained significant attention from high-profile individuals and celebrities, further boosting its popularity. Elon Musk, the CEO of Tesla and SpaceX, has been a vocal advocate for Dogecoin on social media, creating a considerable buzz around the cryptocurrency. Additionally, prominent sports teams and organizations have started accepting Dogecoin as a form of payment, further solidifying its mainstream adoption.

It’s important to note that, despite its popularity and positive community, Dogecoin has also faced criticism. Skeptics argue that its lack of a maximum supply and high inflation rate could lead to potential devaluation over time. Additionally, being a meme-based cryptocurrency, some view its rise as a speculative mania that may not have a strong foundation for long-term sustainability.

In conclusion, Dogecoin has emerged as a unique and influential cryptocurrency that blends community, philanthropy, and playful humor. While it started as a joke, Dogecoin’s popularity and adoption have grown exponentially, drawing attention from high-profile individuals and businesses. While there are differing opinions on its long-term viability, it remains an interesting and significant player in the ever-evolving world of cryptocurrencies.

Strategy details

«Top trading strategy DOGE 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘mineable’, ‘pow’, ‘scrypt’, ‘medium-of-exchange’, ‘memes’, ‘payments’, ‘doggone-doggerel’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)