Last update: 08-07-2024 04:00 UTC

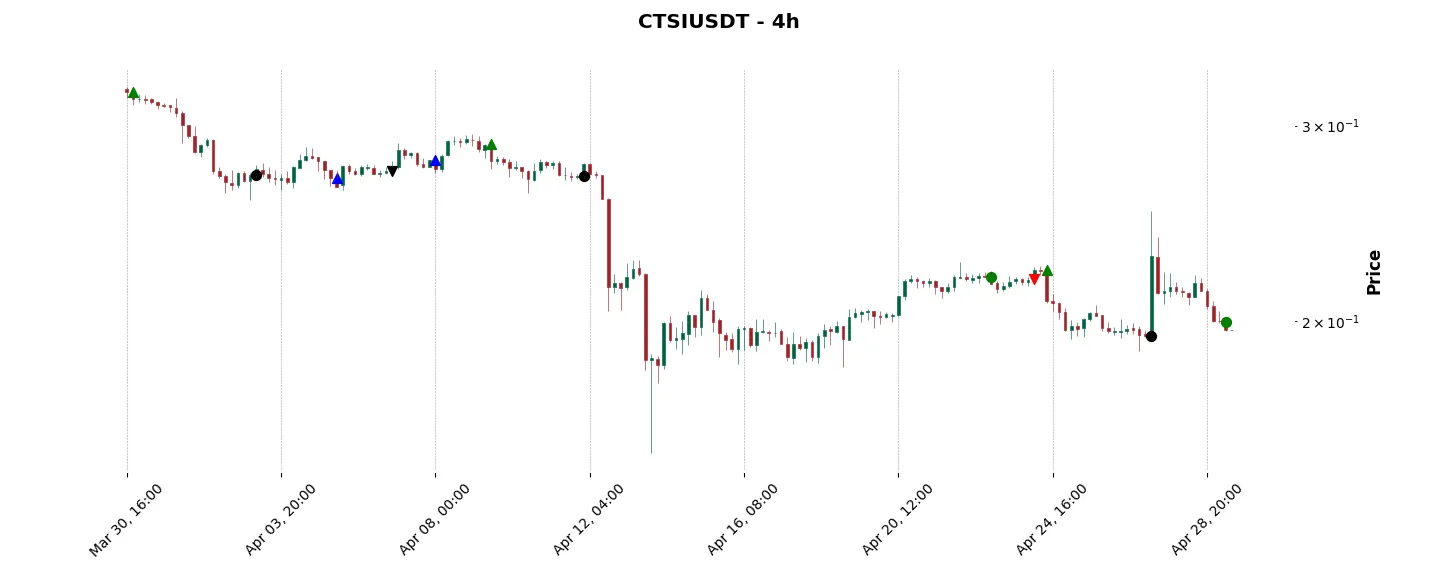

Top trading strategy Cartesi (CTSI) 4H – Live position:

- Close short

- Entry price : 0.1367 $

- Pnl : 0.51 %

Trade history

Over 6 months

Complete

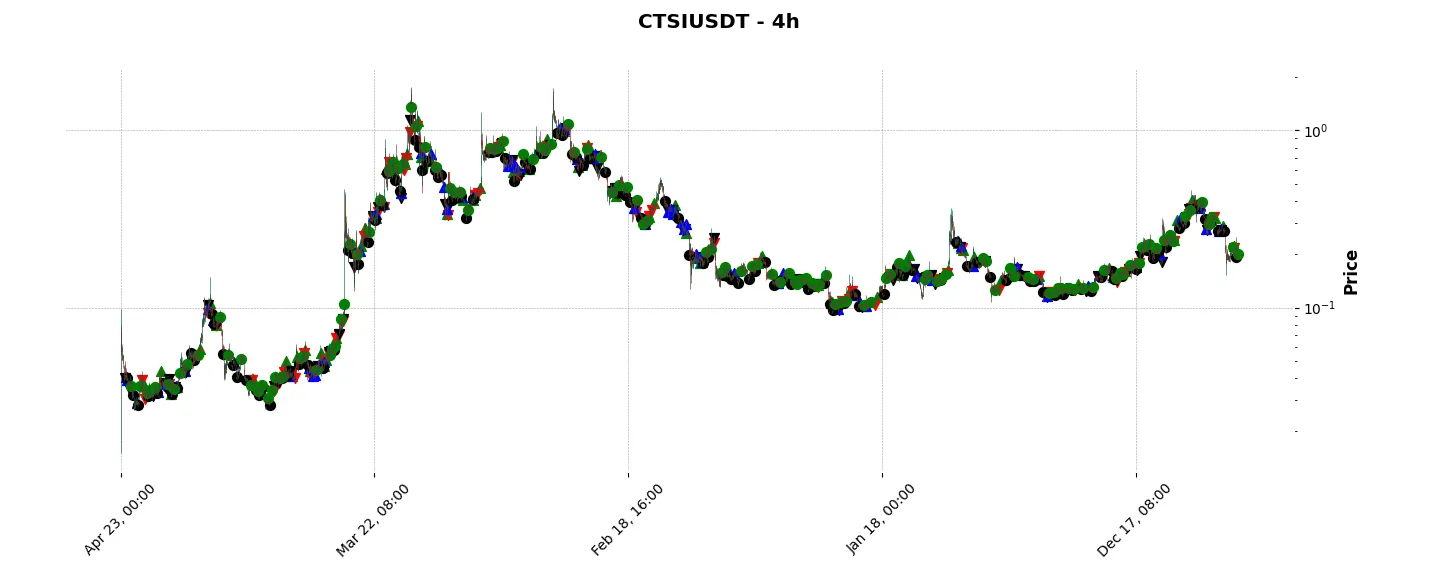

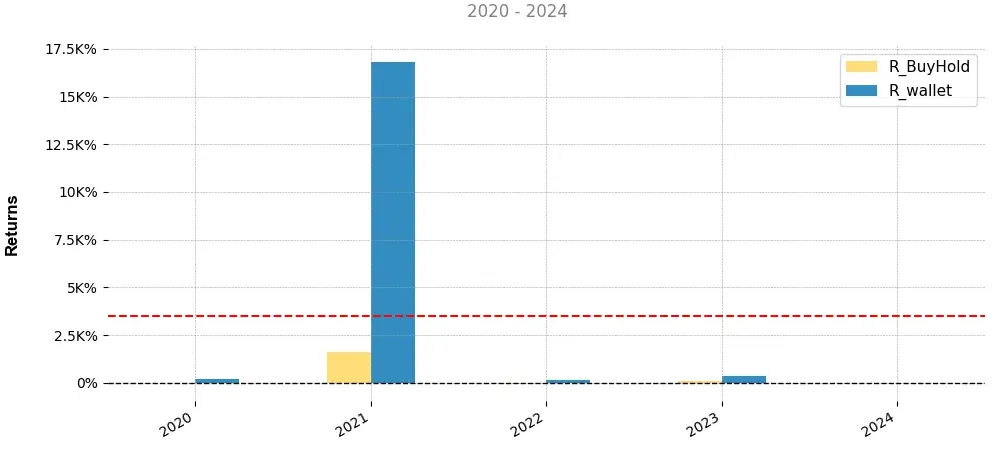

«Top trading strategy Cartesi (CTSI) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy CTSI 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

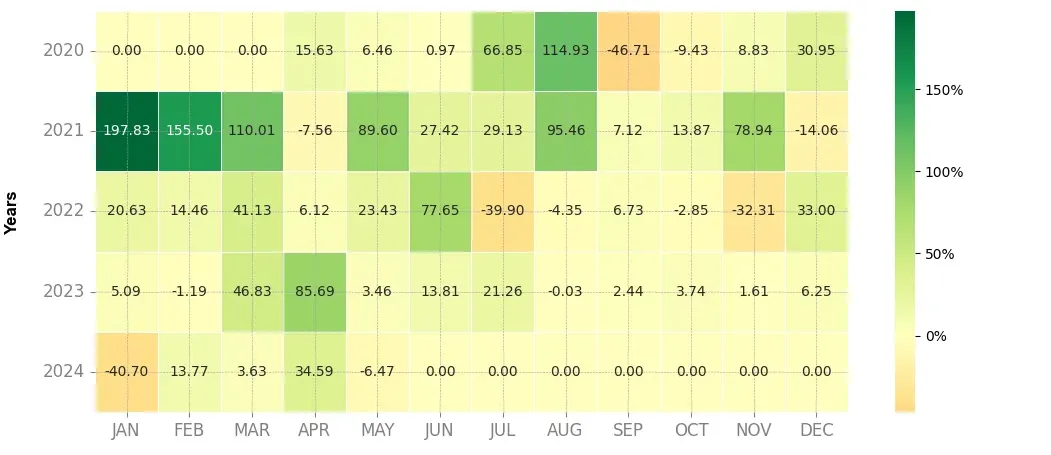

Heatmap of monthly returns

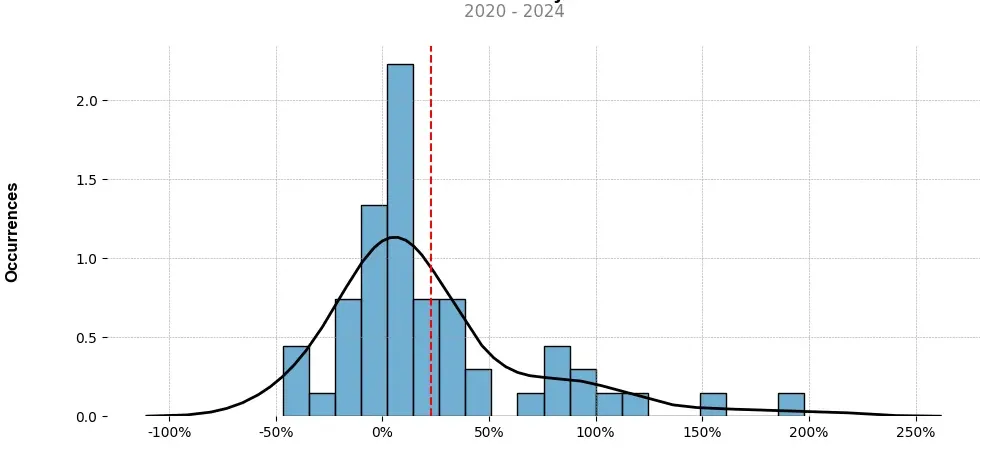

Distribution of the monthly returns of the top strategy

Presentation of CTSI

Cartesi (CTSI) is a decentralized blockchain platform that aims to bridge the gap between the world of blockchain and traditional computing. It allows developers to build and deploy complex applications on top of blockchain networks, leveraging off-chain computation.

Cartesi introduces a technology called Descartes that enables developers to write and execute smart contracts using mainstream software stacks. This means that instead of learning new programming languages specific to blockchain environments, developers can utilize familiar tools, libraries, and frameworks such as Linux, Docker, and MySQL.

By doing so, Cartesi expands the possibilities of what can be achieved on blockchain networks. It allows developers to tackle computationally intensive tasks that are typically challenging to execute on-chain due to limitations of processing power and storage capacity. With Cartesi, developers can offload these tasks to off-chain nodes, improving scalability, efficiency, and cost-effectiveness while maintaining the security and trustlessness of the blockchain.

Another significant aspect of Cartesi is its commitment to ensuring the integrity of off-chain computation. It accomplishes this through verifiability and determinism. Developers can verify the correctness of off-chain computations by checking the results on-chain. They can also have deterministic execution by generating cryptographic proofs.

Furthermore, Cartesi supports Ethereum as its first blockchain integration, allowing developers to seamlessly deploy Cartesi-enabled applications on the Ethereum network. However, Cartesi’s vision extends beyond Ethereum, aiming to be blockchain-agnostic, thereby enabling developers to leverage its capabilities across different blockchain networks.

The native cryptocurrency of the Cartesi platform is CTSI. It serves as the fuel for the Cartesi ecosystem, used for various purposes such as staking, paying for services, and participating in governance decisions. CTSI has a capped supply, ensuring scarcity and potentially driving its value as the platform gains adoption.

In conclusion, Cartesi (CTSI) offers a groundbreaking solution for developers seeking to harness the power of blockchain while utilizing familiar programming tools. With its Descartes technology, Cartesi enables off-chain computation, improving scalability and efficiency while maintaining the security and trustlessness of blockchain networks. With Ethereum as its first integration and the potential for expansion to other blockchains, Cartesi aims to revolutionize the way developers build and deploy decentralized applications.

Strategy details

«Top trading strategy CTSI 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘pos’, ‘platform’, ‘cosmos-ecosystem’, ‘scaling’, ‘smart-contracts’, ‘staking’, ‘dapp’, ‘ethereum-ecosystem’, ‘binance-smart-chain’, ‘layer-2’, ‘rollups’, ‘sidechain’, ‘binance-launchpad’, ‘binance-labs-portfolio’, ‘arbitrum-ecosytem’, ‘injective-ecosystem’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)