Last update: 28-11-2022 00:00 UTC

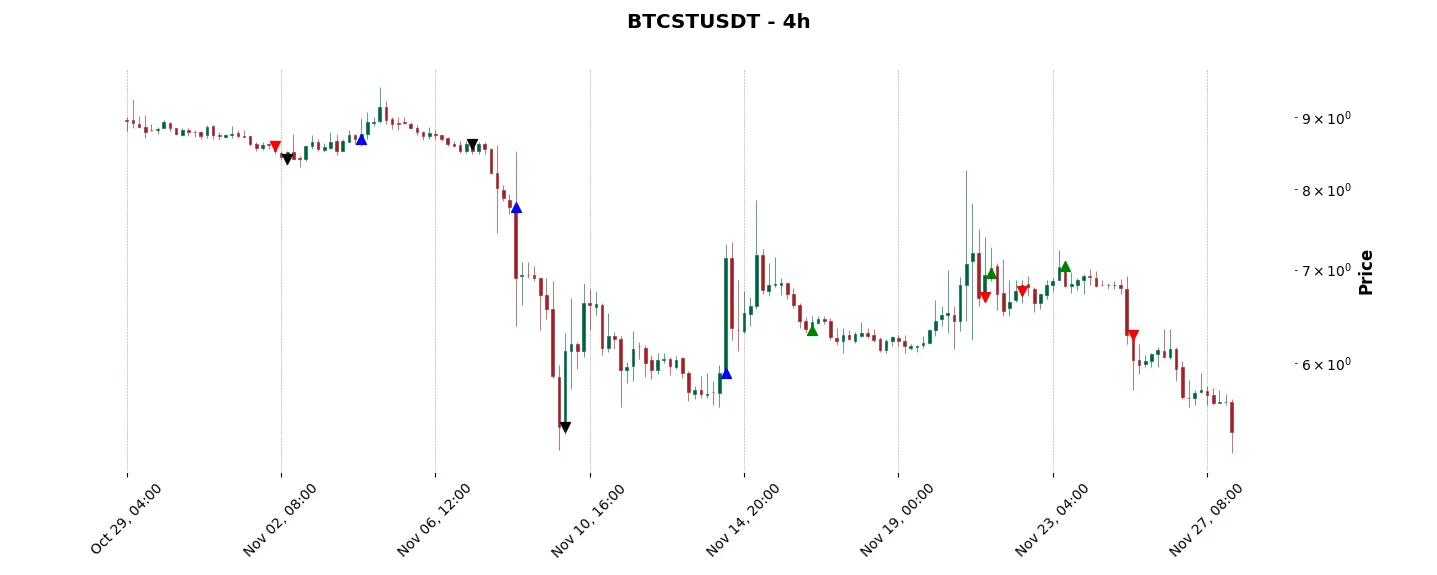

Top trading strategy Bitcoin Standard Hashrate Token (BTCST) 4H – Live position:

- No position

Trade history

Over 6 months

Complete

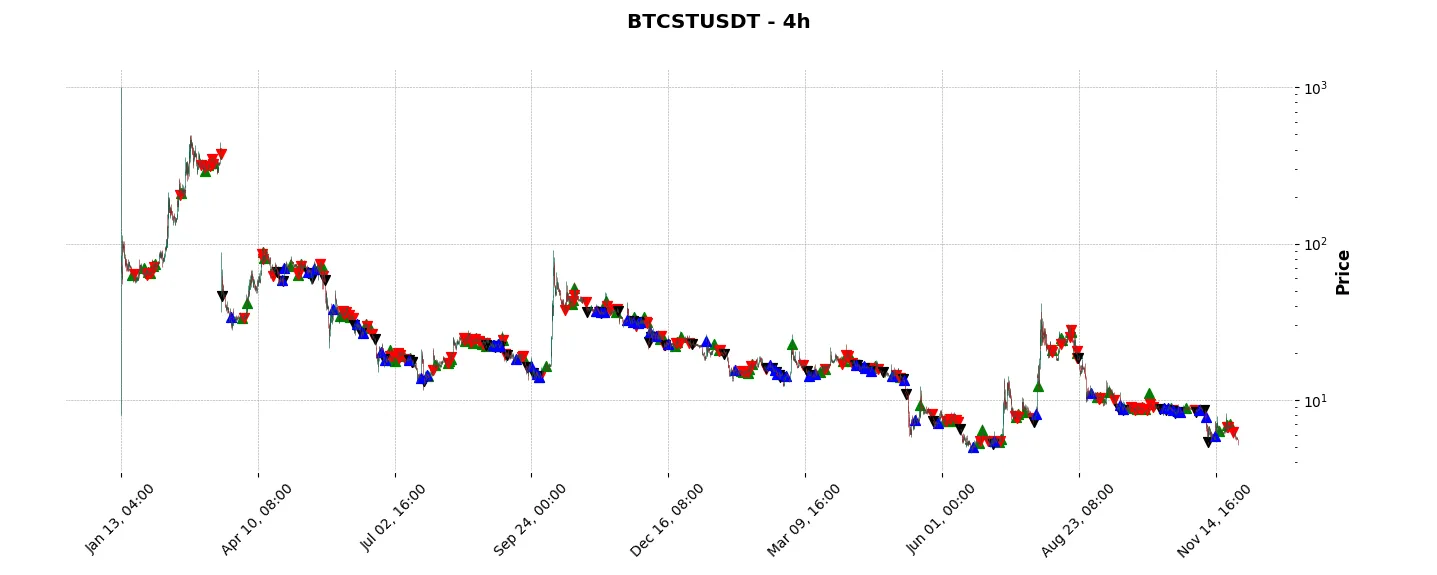

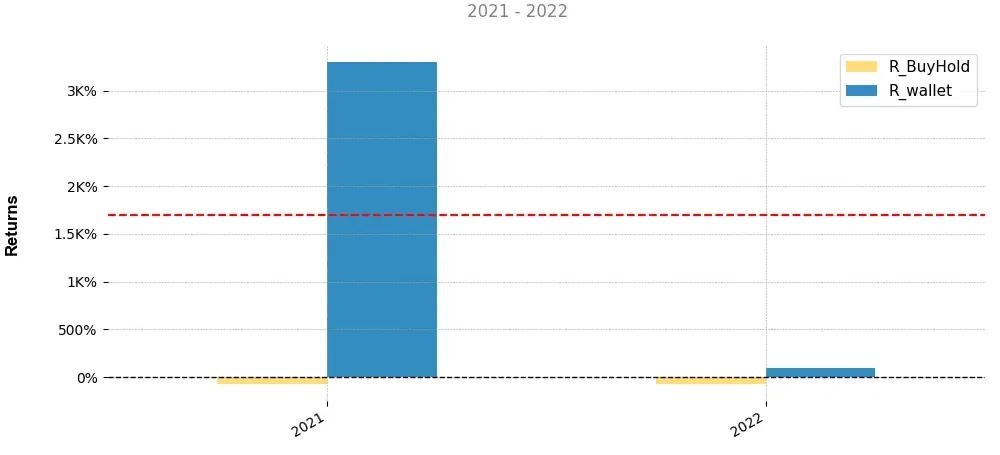

«Top trading strategy Bitcoin Standard Hashrate Token (BTCST) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy BTCST 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

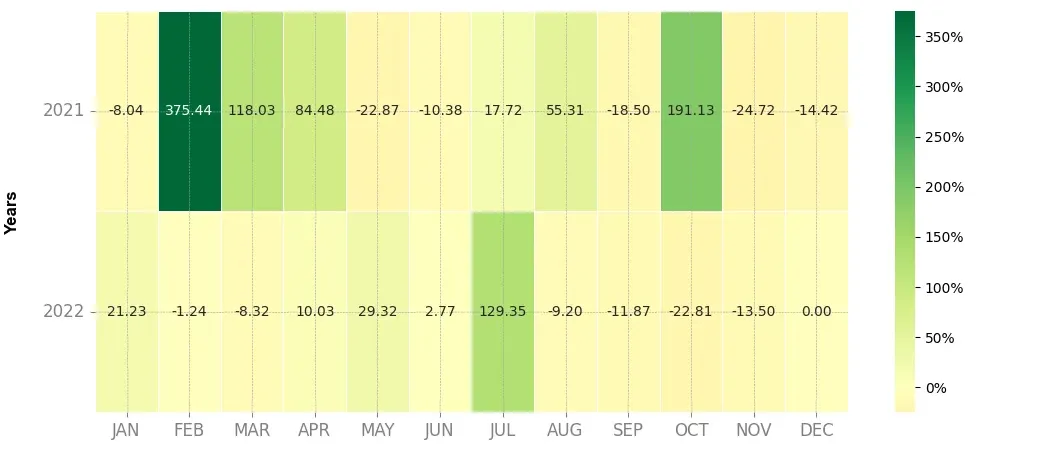

Heatmap of monthly returns

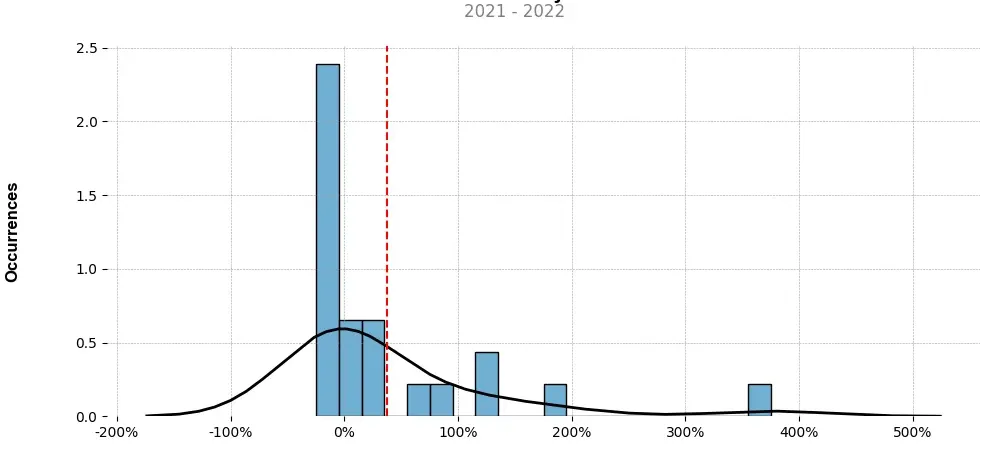

Distribution of the monthly returns of the top strategy

Presentation of BTCST

Bitcoin Standard Hashrate Token (BTCST) is a unique crypto asset that offers users an innovative way to access and participate in Bitcoin mining. In this synthesis, we will discuss the fundamentals of BTCST, its underlying technology, its benefits and risks, and its potential impact on the cryptocurrency ecosystem.

BTCST is a tokenized representation of Bitcoin hashrate, which refers to the computational power required to mine new bitcoins. This tokenization process allows users to trade and invest in Bitcoin mining without the need to directly own and operate mining hardware. It provides an alternative investment opportunity for individuals who are interested in the potential profitability of Bitcoin mining but lack the necessary resources or technical expertise to engage in it directly.

The technology behind BTCST is based on the Binance Smart Chain (BSC), a blockchain platform known for its low transaction fees and fast confirmation times. Using BSC, BTCST ensures efficient and secure transactions, minimizing the potential risks associated with traditional mining operations. This blockchain infrastructure also facilitates the seamless integration and compatibility of BTCST with other decentralized finance (DeFi) protocols, enabling users to leverage their BTCST holdings for additional financial opportunities.

One of the key benefits of BTCST is its potential for generating passive income. By staking BTCST tokens, users can earn daily Bitcoin rewards proportional to the hashrate represented by their staked tokens. As Bitcoin mining becomes more challenging and resource-intensive, BTCST offers a simplified and cost-effective approach to earning Bitcoin rewards. Moreover, unlike traditional mining operations that require continuous attention and maintenance, BTCST holders can earn rewards automatically, allowing for a passive income stream.

However, it is essential to acknowledge the potential risks and considerations associated with BTCST. Like any investment, BTCST’s value can be subject to market volatility, which can result in potential capital loss. Additionally, the profitability of Bitcoin mining is influenced by various factors, including the price of Bitcoin, mining difficulty, and energy costs. Any adverse changes in these variables can impact the rewards earned from staking BTCST.

Furthermore, as BTCST operates on Binance Smart Chain, it is essential to consider the potential risks associated with this blockchain infrastructure. BSC has faced criticism regarding its centralized governance structure and the potential vulnerabilities it may introduce. Users should stay vigilant and conduct appropriate due diligence before engaging with BTCST or any other cryptocurrency on BSC.

In conclusion, Bitcoin Standard Hashrate Token (BTCST) presents an innovative approach to accessing and participating in Bitcoin mining. By tokenizing Bitcoin hashrate and leveraging the benefits of Binance Smart Chain, BTCST offers individuals a simpler and more accessible way to earn Bitcoin rewards and potentially generate passive income. However, users must be aware of the risks associated with market volatility, as well as the potential challenges and vulnerabilities of the underlying technology. As with any investment, thorough research and risk assessment are crucial before engaging with BTCST.

Strategy details

«Top trading strategy BTCST 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘binance-launchpool’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)