Last update: 18-05-2024 16:00 UTC

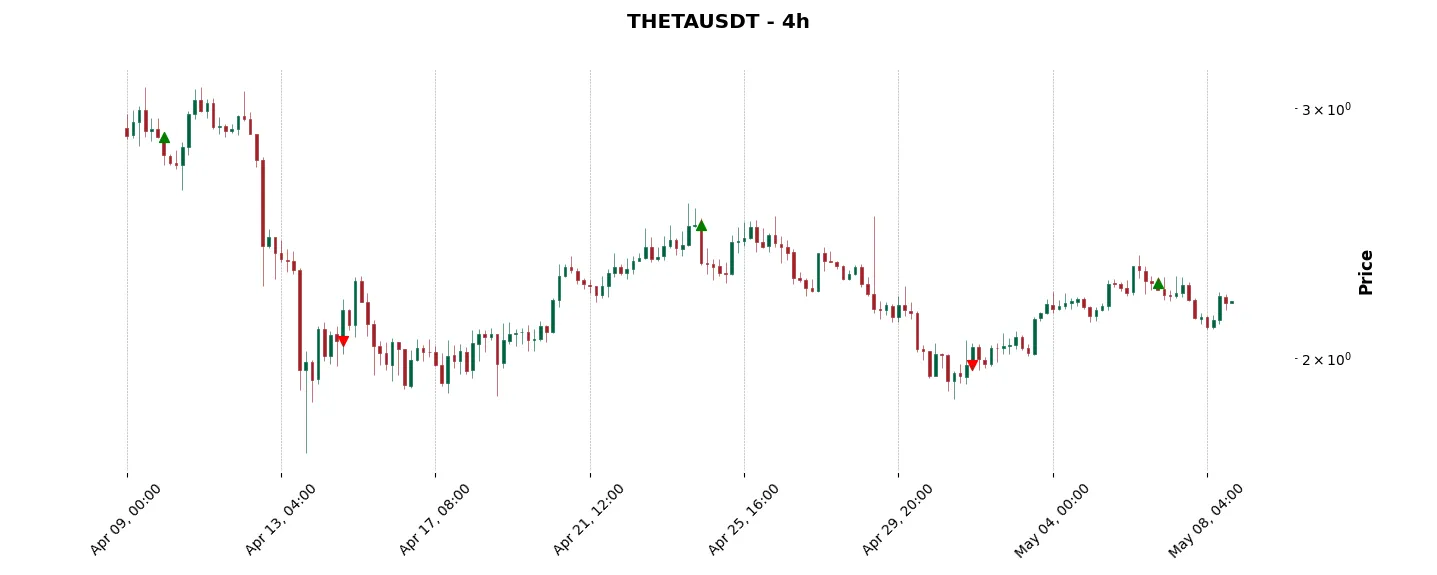

Top trading strategy Theta Network (THETA) 4H – Live position:

- Long in progress

- Entry price : 2.22 $

- Pnl : -0.99 %

Trade history

Over 6 months

Complete

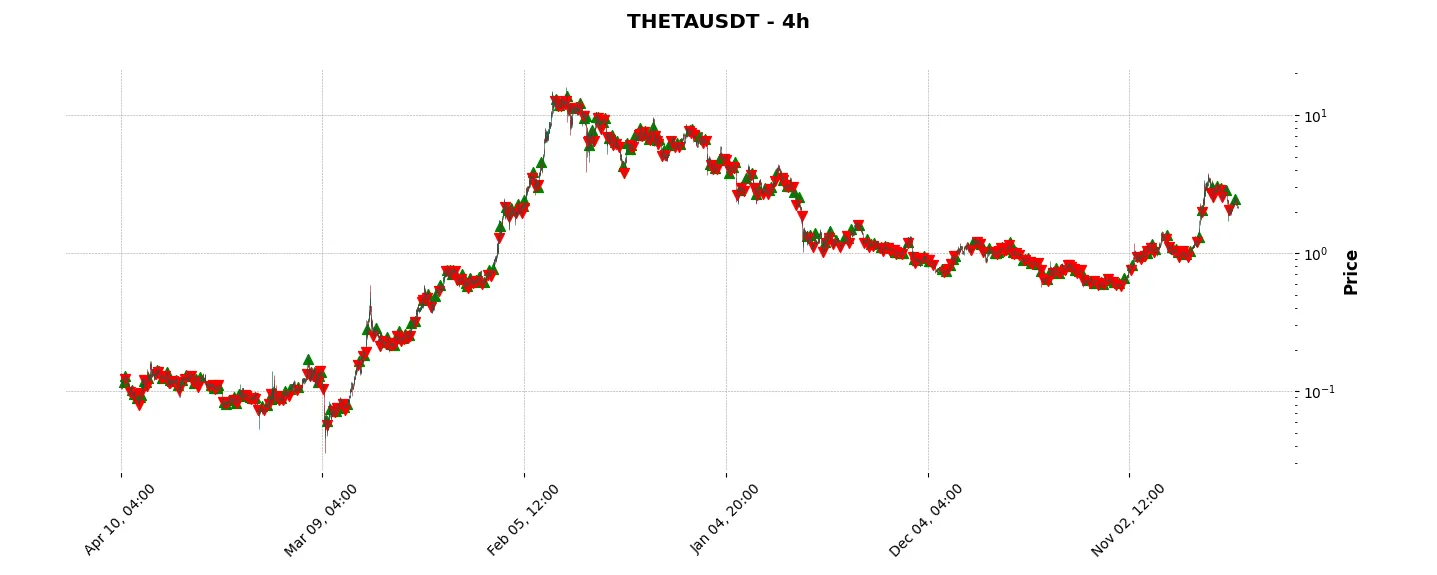

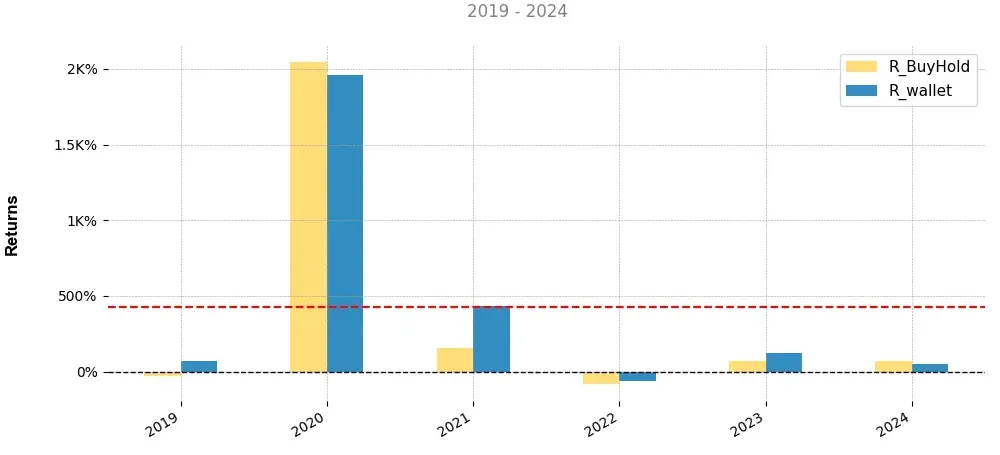

«Top trading strategy Theta Network (THETA) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy THETA 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

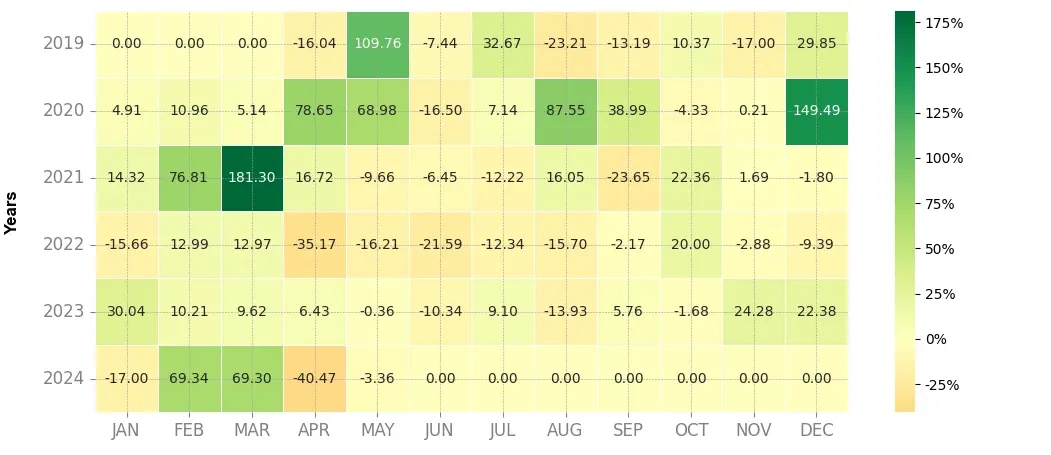

Heatmap of monthly returns

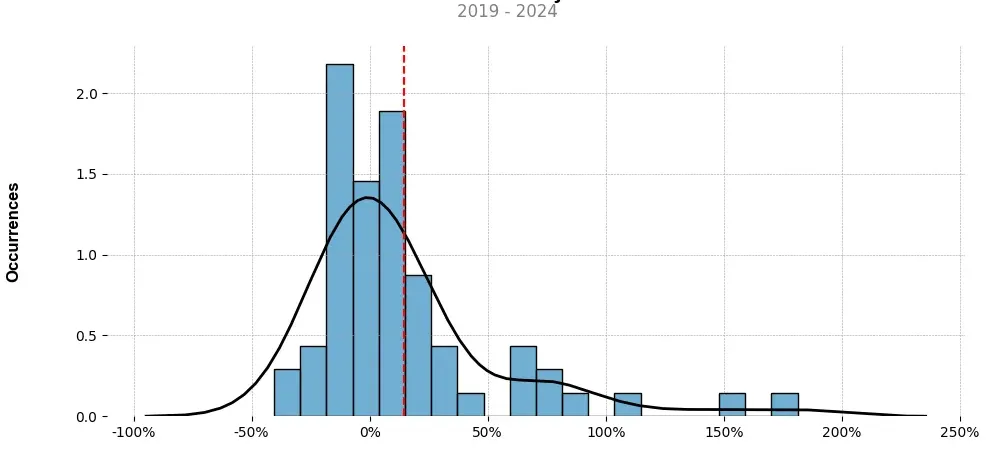

Distribution of the monthly returns of the top strategy

Presentation of THETA

Theta Network (THETA) is a revolutionary blockchain-based protocol that aims to decentralize the video streaming industry. It represents a synthesis of cutting-edge technologies such as blockchain and peer-to-peer (P2P) streaming to offer a seamless and decentralized way of delivering video content.

At its core, Theta Network seeks to address the limitations of traditional video streaming platforms by leveraging blockchain technology. It enables users to share their excess bandwidth and computational resources with others on the network, creating a more efficient and cost-effective video delivery system. This concept of resource sharing through a decentralized network is known as content delivery optimization, and Theta Network aims to become the leading platform for it.

One of the key components of Theta Network is its native cryptocurrency, THETA. THETA is used as a medium of exchange within the ecosystem to incentivize participants for sharing their resources and contribute to the network’s stability and growth. Users can earn THETA tokens by sharing their bandwidth and computational power, aka “Theta fuel” (TFUEL), or by supporting the network as validators.

Theta Network effectively utilizes blockchain technology to create an incentivized ecosystem that benefits all participants. Content creators can earn THETA tokens by streaming their content through the network, while viewers can be rewarded for watching and engaging with the videos. This innovative model encourages content creators to switch to Theta Network for better revenue opportunities and provides viewers with an engaging and rewarding video streaming experience.

Furthermore, Theta Network implements a blockchain-based governance model that allows token holders to have a say in the decision-making process. This ensures a decentralized and democratic approach to platform development and allows for community-driven improvements.

Another notable aspect of Theta Network is its partnerships with prominent players in the video streaming industry. Notable collaborations include Theta Labs partnering with Samsung VR, allowing millions of Samsung phone users to access Theta Network easily. Such partnerships help Theta Network gain traction and increase its user base, ultimately leading to widespread adoption.

In conclusion, Theta Network synthesizes various cutting-edge technologies such as blockchain, P2P streaming, and cryptocurrencies to revolutionize the video streaming industry. Through incentivized content delivery optimization and an engaging ecosystem, Theta Network aims to disrupt traditional centralized streaming platforms. With its unique features and growing list of partnerships, Theta Network exhibits promising potential for both content creators and viewers alike.

Strategy details

«Top trading strategy THETA 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘media’, ‘collectibles-nfts’, ‘content-creation’, ‘defi’, ‘video’, ‘metaverse’, ‘huobi-capital-portfolio’, ‘web3’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)