Last update: 03-04-2024 00:00 UTC

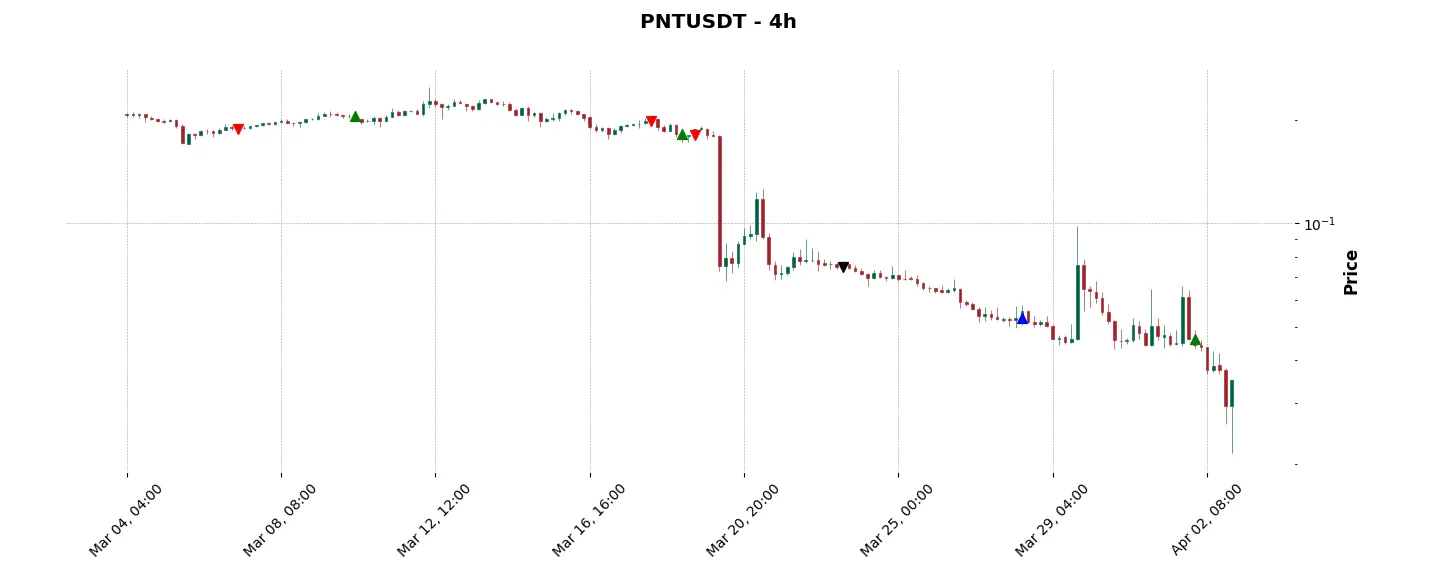

Top trading strategy pNetwork (PNT) 4H – Live position:

- Long in progress

- Entry price : 0.0443 $

- Pnl : -20.99 %

Trade history

Over 6 months

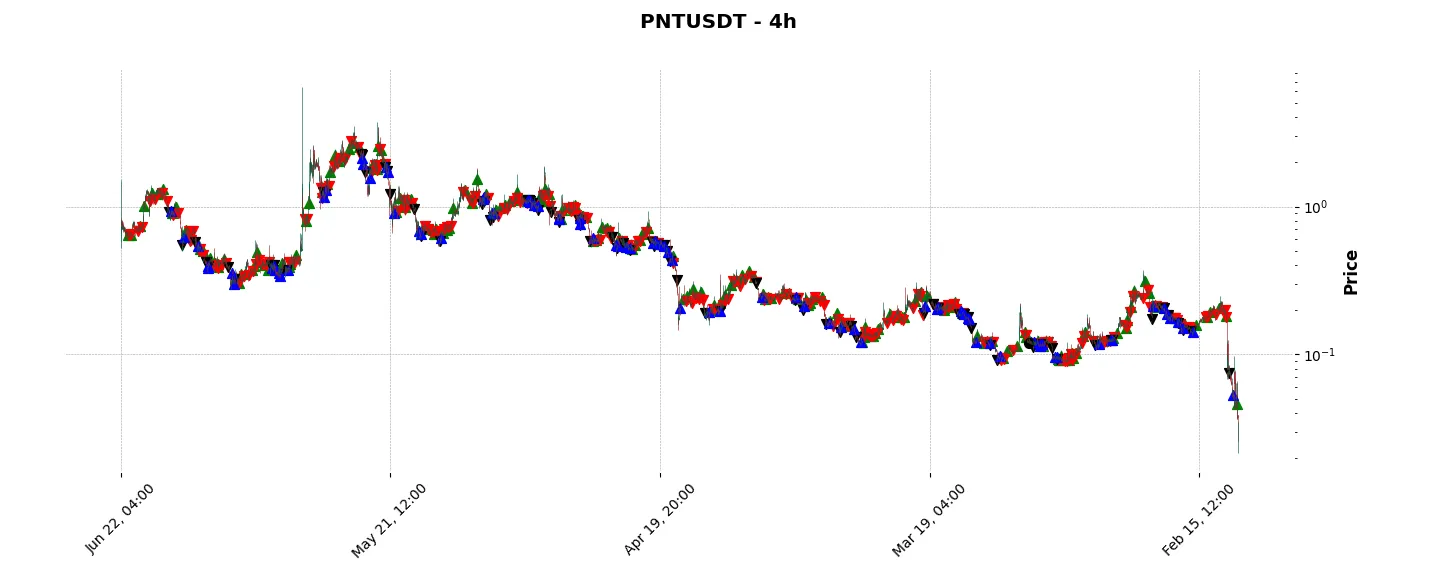

Complete

«Top trading strategy pNetwork (PNT) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy PNT 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

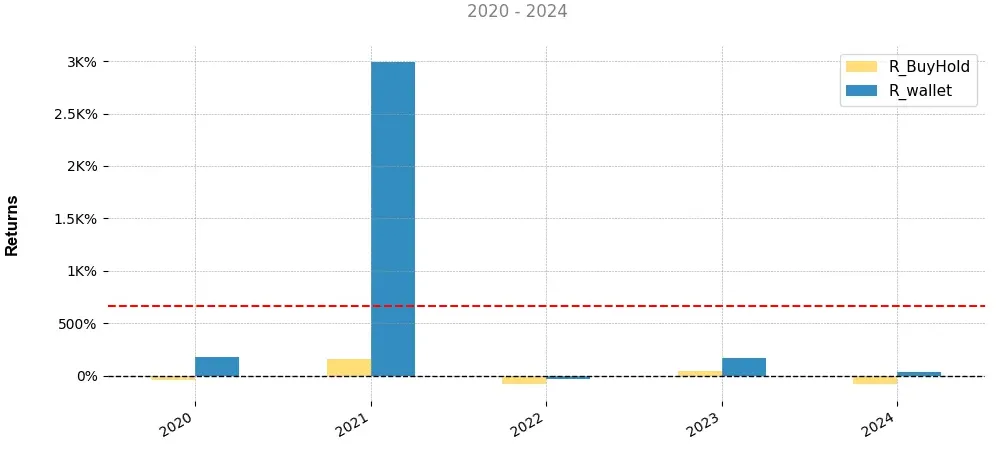

Annual comparison of cumulative returns with Buy & Holds

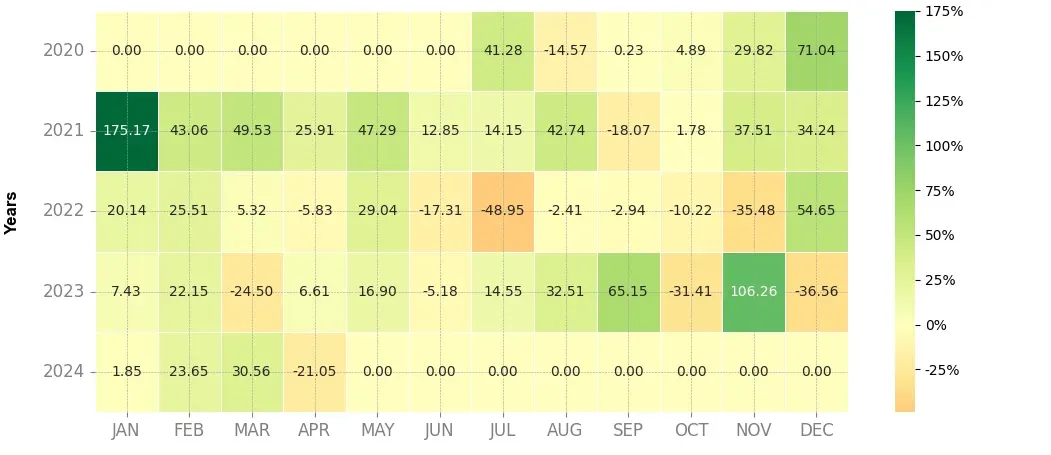

Heatmap of monthly returns

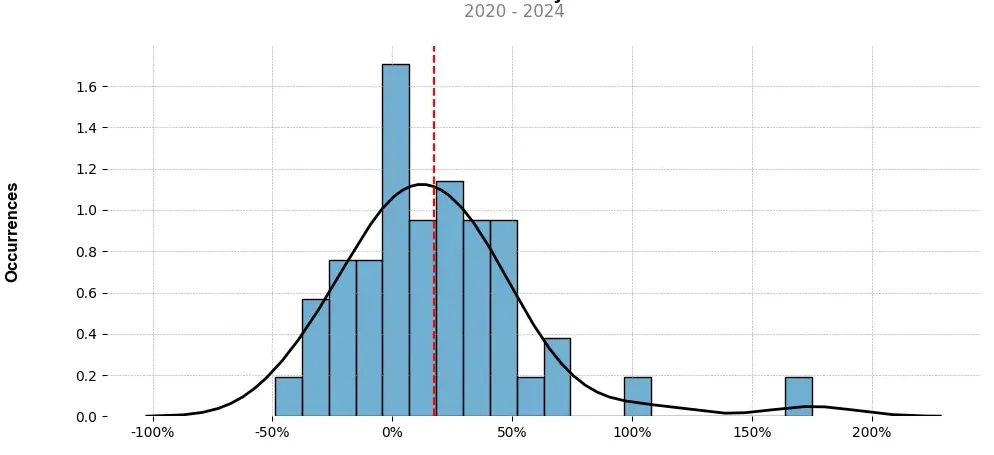

Distribution of the monthly returns of the top strategy

Presentation of PNT

PNetwork (PNT) is a cryptocurrency that aims to bridge the gap between different blockchain networks and enhance interoperability within the decentralized finance (DeFi) ecosystem. It serves as the native token of the pNetwork, a blockchain project that empowers cross-chain interactions and enables users to seamlessly transfer assets between different blockchain platforms.

At its core, pNetwork operates as a decentralized network of validators, known as P-Nodes, which facilitate the creation and management of wrapped tokens. These wrapped tokens represent a pegged value of the original asset, enabling it to be securely transferred across different blockchain networks. For example, an Ethereum-based asset like Ether (ETH) can be wrapped to become a pToken that can be utilized on other networks like Binance Smart Chain or Polkadot.

One of the key features of pNetwork is its decentralized custodian model, which ensures the security and integrity of wrapped tokens. This is achieved through the use of multi-signature wallets and a network of validators that collectively manage the custody of the original assets backing the wrapped tokens.

Furthermore, pNetwork aims to eliminate the need for centralized intermediaries or costly bridges when transferring assets between different networks. By utilizing the PNT token, users can participate in the governance and decision-making processes of the pNetwork ecosystem. This provides them with voting rights and the ability to influence the network’s development and direction.

In addition to its interoperability solutions, pNetwork also offers users the opportunity to earn passive income through staking their PNT tokens. Participants can stake their tokens in the pNetwork DAO, and in return, receive a portion of the transaction fees generated by the network. This incentivizes users to actively contribute to the growth and adoption of the ecosystem.

Overall, pNetwork and its native cryptocurrency, PNT, aim to solve the fragmentation and lack of interoperability that currently plagues the DeFi space. By providing a decentralized and secure solution for transferring assets across multiple blockchain networks, pNetwork enhances the accessibility and efficiency of decentralized finance. The ability to wrap and transfer assets seamlessly, while allowing users to participate in network governance and earn passive income, makes PNT an intriguing cryptocurrency for both investors and active participants in the DeFi ecosystem.

Strategy details

«Top trading strategy PNT 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘collectibles-nfts’, ‘defi’, ‘dao’, ‘governance’, ‘polygon-ecosystem’, ‘arbitrum-ecosytem’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)