Last update: 19-05-2024 00:00 UTC

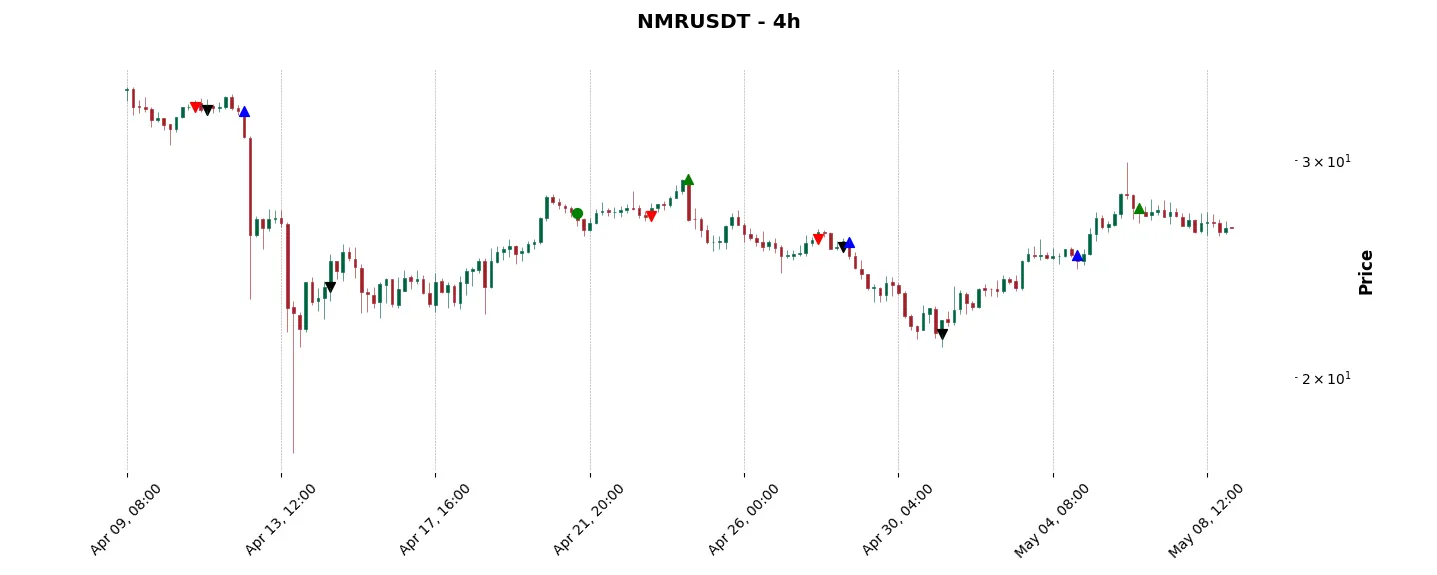

Top trading strategy Numeraire (NMR) 4H – Live position:

- No position

Trade history

Over 6 months

Complete

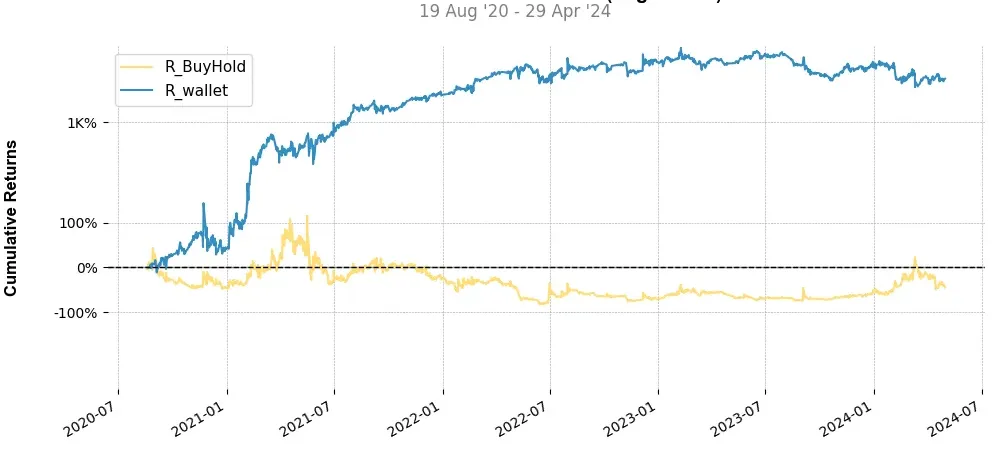

«Top trading strategy Numeraire (NMR) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy NMR 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

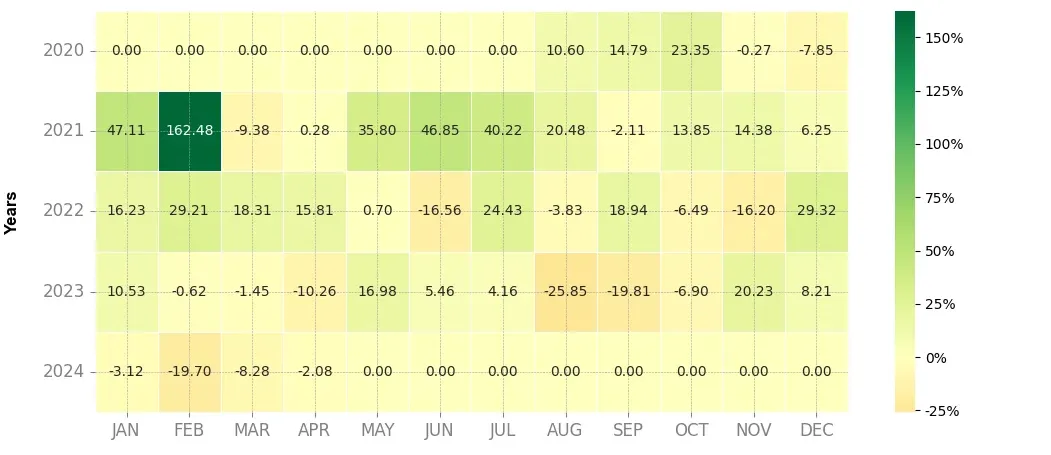

Annual comparison of cumulative returns with Buy & Holds

Heatmap of monthly returns

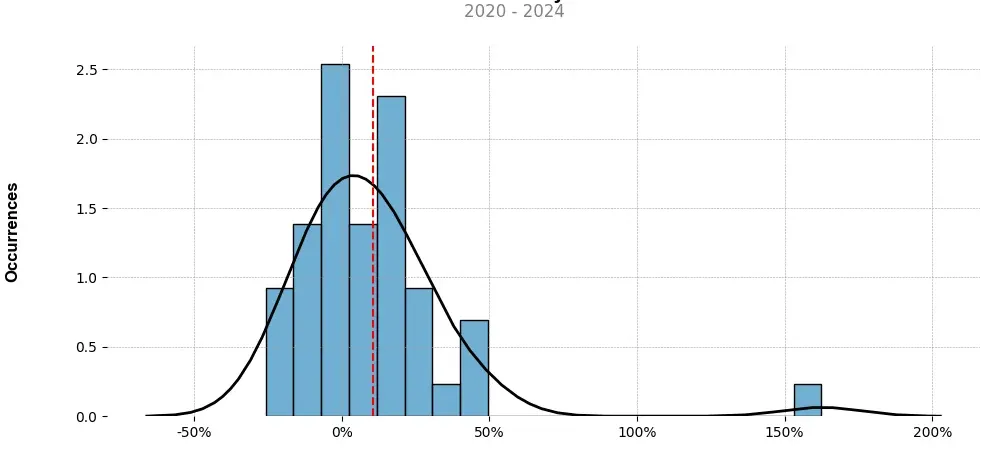

Distribution of the monthly returns of the top strategy

Presentation of NMR

Numeraire (NMR) is a unique cryptocurrency that was created to revolutionize the field of artificial intelligence (AI) and data science. It aims to incentivize and reward talented data scientists for contributing their expertise to predictive modeling competitions.

One of the key features of Numeraire is its use of a decentralized network. This means that there is no central authority in control of the currency, and all transactions are verified and recorded on a public blockchain. This ensures transparency and security in all financial transactions related to Numeraire.

The primary use case of Numeraire is the Numerai platform, which is a decentralized marketplace for data scientists to participate in weekly AI prediction tournaments. Participants are provided with encrypted data sets and are tasked with building predictive models based on this data. The models are then evaluated based on their performance, and the data scientists are ranked accordingly. The top-performing models are integrated into Numerai’s investment algorithms, and the data scientists are rewarded in Numeraire tokens for their contributions.

The use of Numeraire tokens as a reward mechanism brings several advantages. Firstly, it aligns the incentives of data scientists with the goals of Numerai, as they are directly rewarded for producing accurate and valuable models. This leads to a competitive and meritocratic environment, where only the best models are selected and integrated into the investment algorithms.

Secondly, Numeraire tokens have an inherent value due to their scarcity. The total supply of NMR tokens is capped at 11 million, which creates a deflationary effect that can potentially increase the value of the tokens over time. Additionally, Numeraire tokens can be staked by data scientists to participate in governance decisions related to the platform, giving them a say in the future development and direction of Numerai.

Numeraire has gained significant attention and popularity within the AI and data science communities since its launch in 2017. The platform has attracted top talent from around the world, and its unique approach to incentivizing data scientists has resulted in impressive predictive models. This has led to partnerships with prominent hedge funds and investment firms, who see the value in leveraging Numerai’s models for improving their investment strategies.

In conclusion, Numeraire (NMR) is a groundbreaking cryptocurrency that combines the power of AI, blockchain technology, and decentralized networks. It provides a unique platform for data scientists to compete, contribute, and be rewarded for their predictive modeling skills. As the field of AI continues to grow, Numeraire has the potential to significantly disrupt traditional investment models and establish itself as a leading player in the future of finance.

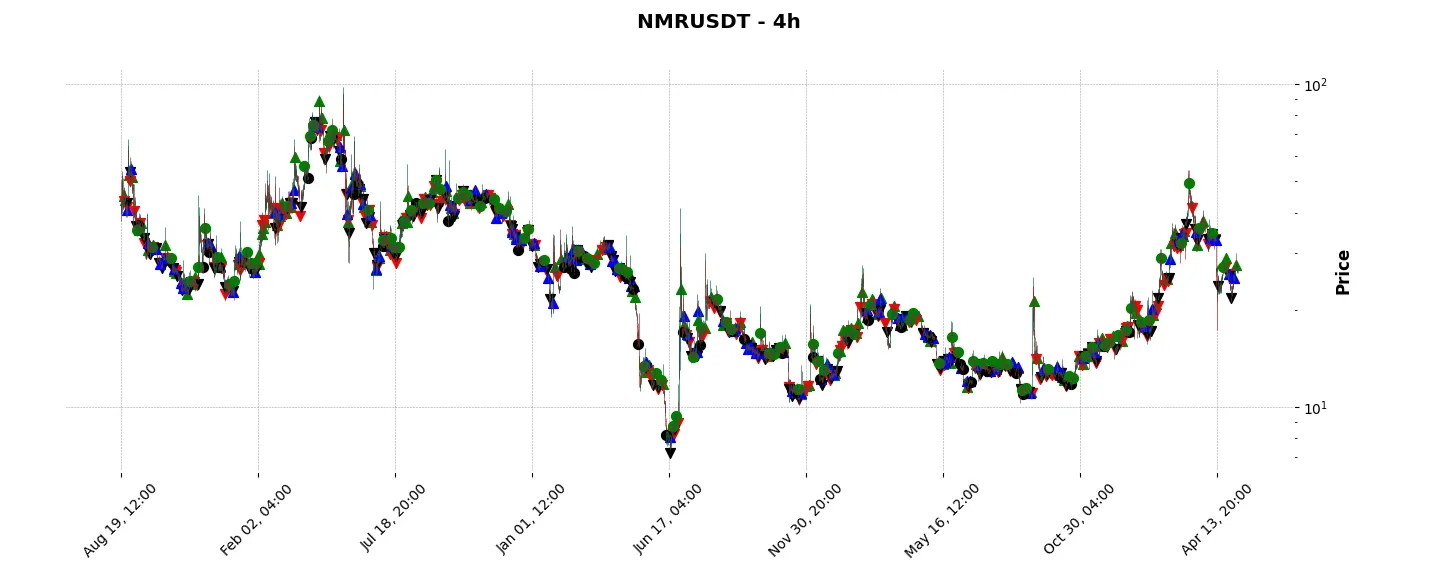

Strategy details

«Top trading strategy NMR 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘asset-management’, ‘ai-big-data’, ‘defi’, ‘payments’, ‘research’, ‘coinfund-portfolio’, ‘usv-portfolio’, ‘placeholder-ventures-portfolio’, ‘paradigm-portfolio’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)