Last update: 27-12-2022 00:00 UTC

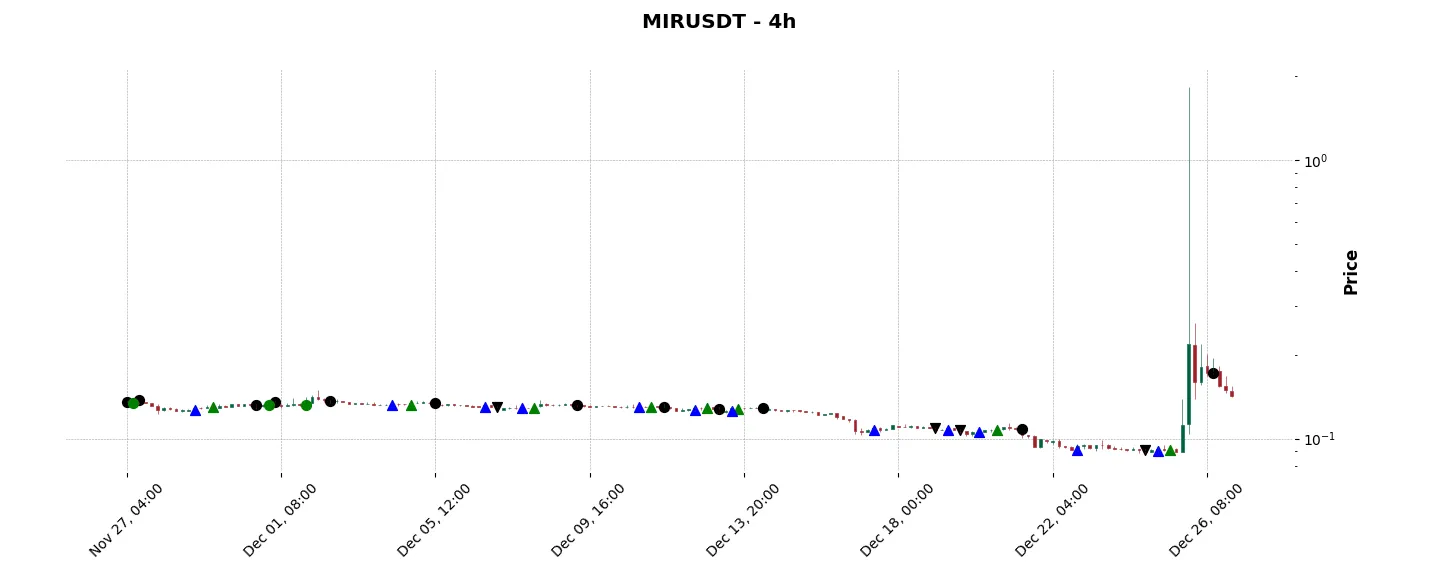

Top trading strategy Mirror Protocol (MIR) 4H – Live position:

- Short in progress

- Entry price : 0.17447 $

- Pnl : 18.79 %

Trade history

Over 6 months

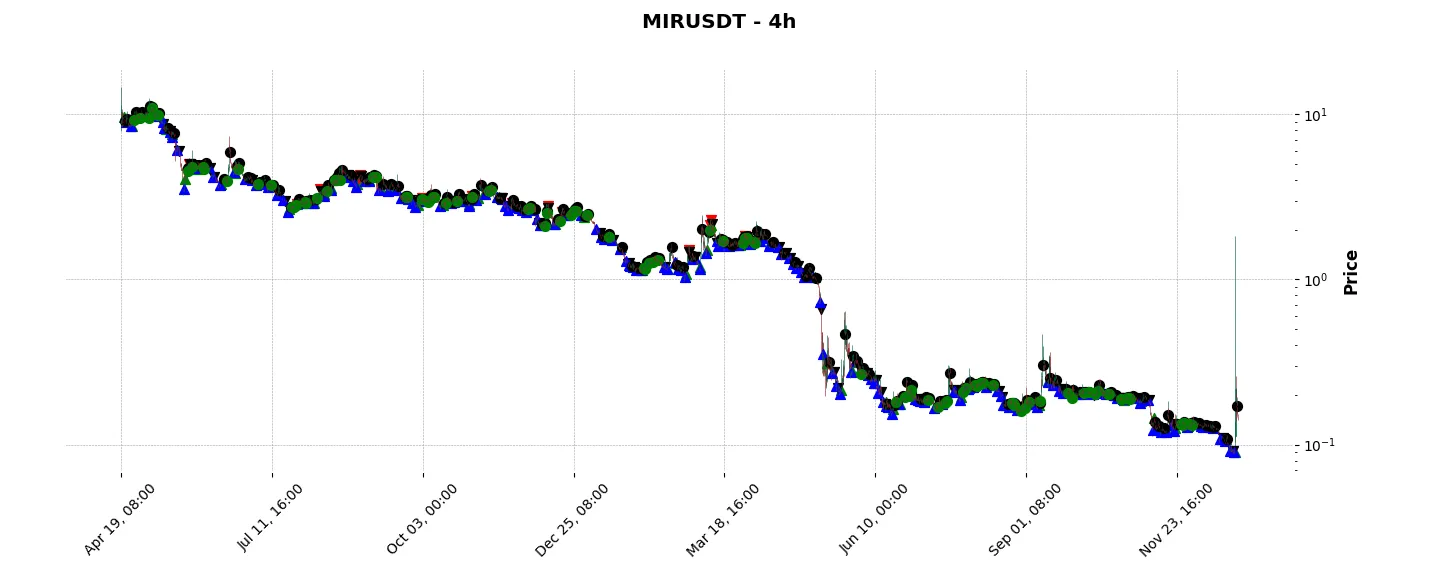

Complete

«Top trading strategy Mirror Protocol (MIR) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy MIR 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

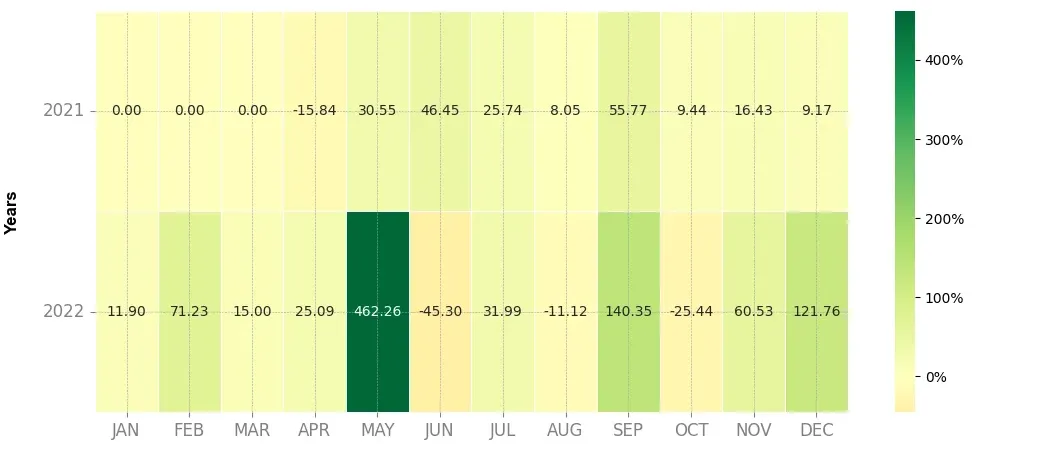

Heatmap of monthly returns

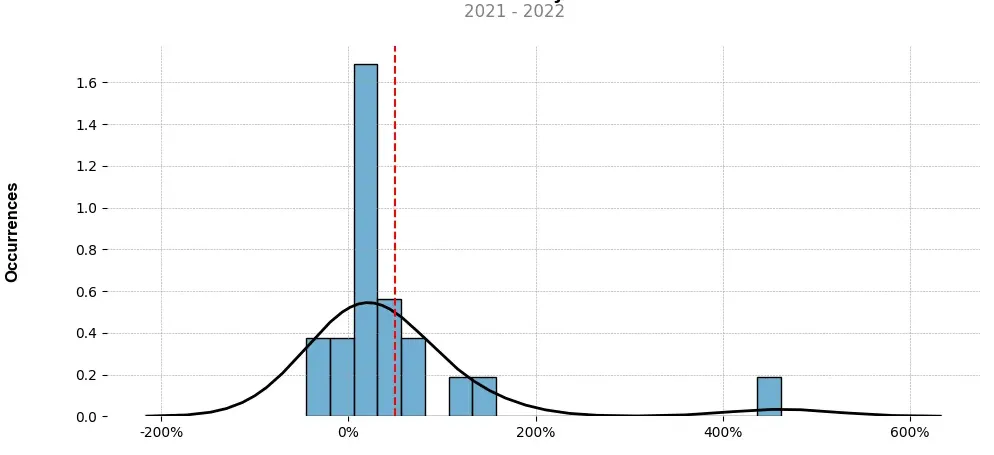

Distribution of the monthly returns of the top strategy

Presentation of MIR

Mirror Protocol (MIR) is a cryptocurrency project that aims to bridge the traditional financial world with the decentralized finance (DeFi) ecosystem through the concept of synthetic assets. Synthetics enable the creation and trading of real-world assets on blockchain platforms, providing access to assets like stocks, commodities, or fiat currencies without holding the underlying asset. MIR is designed to facilitate this process, allowing users to create, trade, and interact with various synthetic assets.

One of the main objectives of Mirror Protocol is to democratize access to traditional financial markets. By tokenizing real-world assets and representing them as ERC-20 tokens on the Ethereum blockchain, Mirror Protocol allows anyone with an internet connection to access these assets, regardless of their geographic location or financial status. This opens up vast opportunities for individuals who were previously excluded from traditional financial markets due to barriers such as high costs, limited access, or regulatory restrictions.

Mirror Protocol operates on the Terra blockchain, utilizing its stablecoin, Terra (UST), as a collateral unit. This stability helps to minimize the risks inherent in synthetic asset trading. Users can lock up their UST in smart contracts to mint synthetic assets in a process known as mirroring. These synthetic assets mirror the value of their underlying assets, which can range from popular stocks like Tesla or Apple to commodities like gold or silver.

MIR, the native cryptocurrency of Mirror Protocol, plays a crucial role within the ecosystem. It serves as a governance token, allowing holders to participate in decision-making processes related to the protocol’s future development. MIR holders can vote on proposals and changes to improve system parameters, upgrade functionalities, or introduce new synthetic assets.

Furthermore, MIR holders can also stake their tokens to earn additional rewards. The protocol allocates a portion of the transaction fees generated through mirror trading to reward MIR stakers. This incentivizes token holders to actively participate in the protocol and support its growth while creating a sustainable ecosystem for all stakeholders.

Mirror Protocol has gained significant attention in the DeFi space due to its innovative approach to synthetic assets and the potential it offers for expanding financial inclusion. By removing the need for intermediaries and providing borderless access to traditional assets, Mirror Protocol empowers individuals to diversify their portfolios and gain exposure to a wide range of assets normally inaccessible to them. Additionally, the transparency and security of blockchain technology ensure trust and reliability throughout the entire process.

In conclusion, Mirror Protocol is revolutionizing the decentralized finance landscape by introducing synthetic assets based on real-world assets. By combining the benefits of blockchain technology, stablecoins, and decentralized governance, Mirror Protocol creates a platform where anyone can participate in the global financial markets. The MIR token plays a pivotal role in governing the protocol and rewarding active participants, fostering a vibrant and inclusive ecosystem for all stakeholders.

Strategy details

«Top trading strategy MIR 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘cosmos-ecosystem’, ‘defi’, ‘derivatives’, ‘synthetics’, ‘arrington-xrp-capital-portfolio’, ‘pantera-capital-portfolio’, ‘terra-ecosystem’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)