Last update: 10-09-2024 00:00 UTC

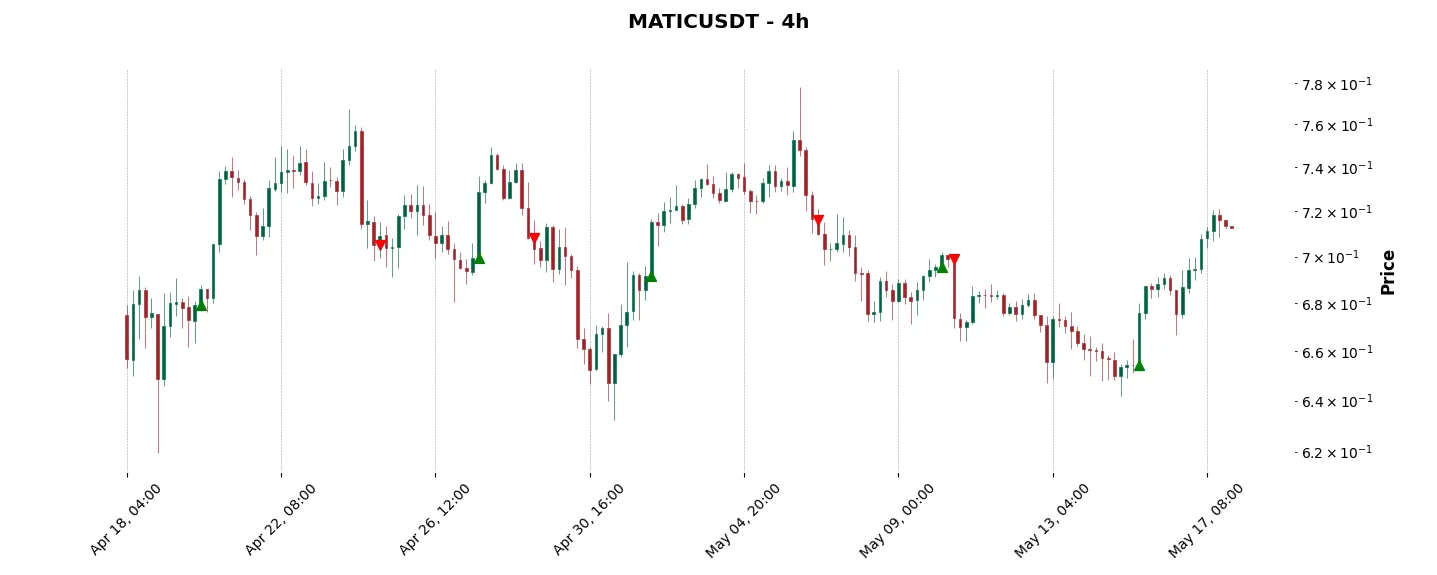

Top trading strategy Polygon (MATIC) 4H – Live position:

- Long in progress

- Entry price : 0.3733 $

- Pnl : 1.63 %

Trade history

Over 6 months

Complete

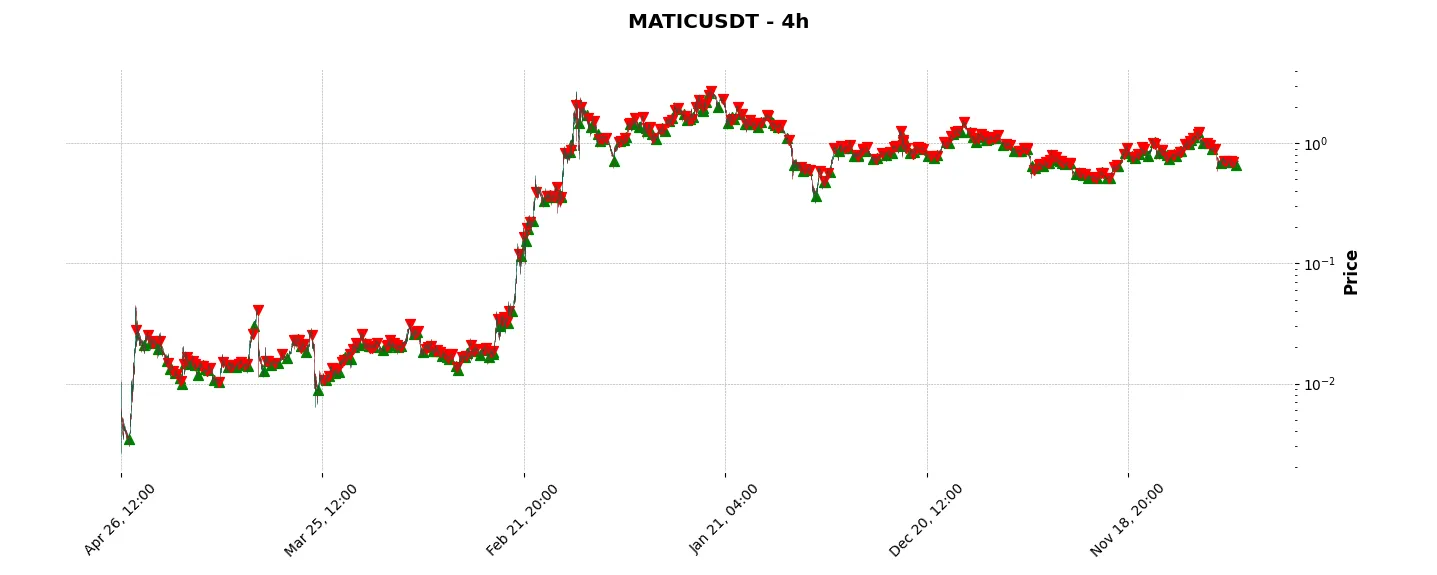

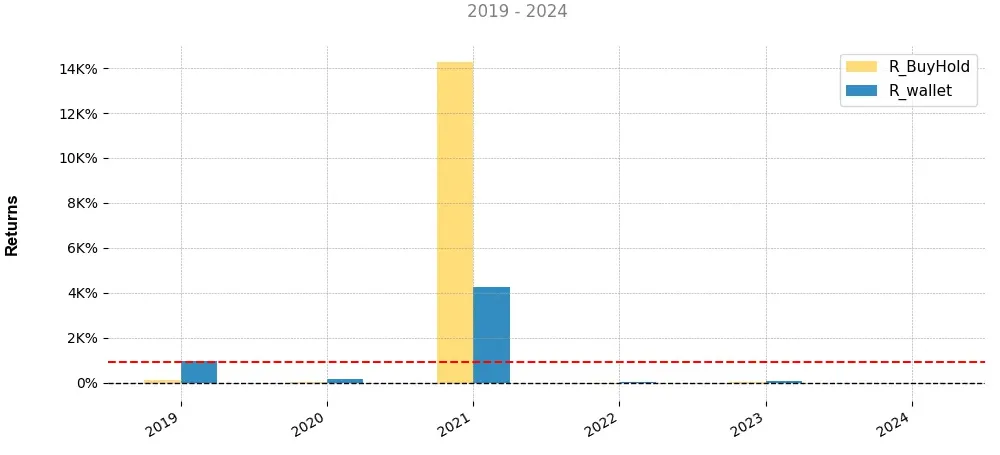

«Top trading strategy Polygon (MATIC) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy MATIC 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

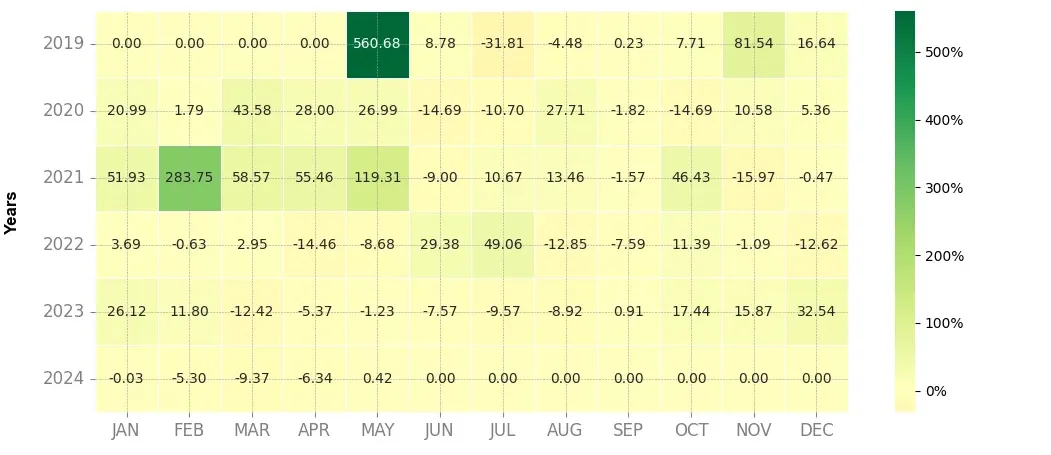

Heatmap of monthly returns

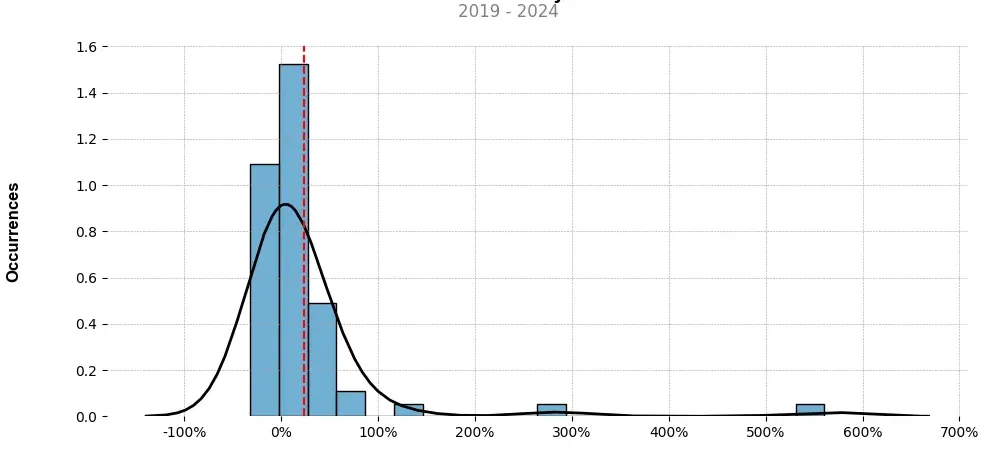

Distribution of the monthly returns of the top strategy

Presentation of MATIC

Polygon (previously known as Matic) is a prominent cryptocurrency that has gained significant attention and recognition within the crypto world. It is an important player in the blockchain space, aiming to address some of the major challenges faced by existing blockchain protocols.

Polygon operates as a layer two scaling solution for Ethereum and offers a framework for developing and connecting multiple blockchain networks. Ethereum, despite its popularity, has faced scalability issues resulting in high gas fees and slow transaction speeds. Polygon has emerged as a solution to tackle these problems by providing a scalable and efficient platform for developers and users.

One of the key features of Polygon is its ability to support various types of blockchains, making it versatile and adaptable to meet different needs. Its architecture enables developers to build their own custom-made blockchain networks while taking advantage of Ethereum’s security and features. This flexibility has attracted numerous projects to adopt Polygon as their preferred blockchain solution.

Furthermore, Polygon incorporates a Proof-of-Stake (PoS) consensus mechanism, ensuring energy efficiency and reducing the environmental impact of mining. This approach has garnered attention from environmentally conscious investors and developers who recognize the importance of sustainable blockchain technologies.

Another significant aspect of Polygon is its focus on interoperability. It aims to create an interconnected ecosystem where different blockchains can seamlessly communicate and transact with each other. This interoperability allows for the easy transfer of assets and data, creating a more connected and efficient blockchain network.

In addition, Polygon has its native token called MATIC, which serves as the fuel for transactions and securing the network. MATIC holders can participate in staking and earn rewards, further incentivizing the community to actively participate in maintaining the network’s security and stability.

The adoption of Polygon has been rapidly growing, with numerous decentralized applications (DApps) and protocols integrating with the platform. This growing network effect signifies the confidence and trust that developers and users place in Polygon’s capabilities.

Overall, Polygon (MATIC) has positioned itself as a crucial solution to the scalability and interoperability challenges faced by blockchain protocols like Ethereum. Its innovative technology, scalability solutions, interoperability features, and sustainable consensus mechanism make it an attractive option for developers and users alike.

Strategy details

«Top trading strategy MATIC 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘enterprise-solutions’, ‘scaling’, ‘state-channel’, ‘coinbase-ventures-portfolio’, ‘binance-launchpad’, ‘binance-labs-portfolio’, ‘polygon-ecosystem’, ‘moonriver-ecosystem’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)