Last update: 18-05-2024 16:00 UTC

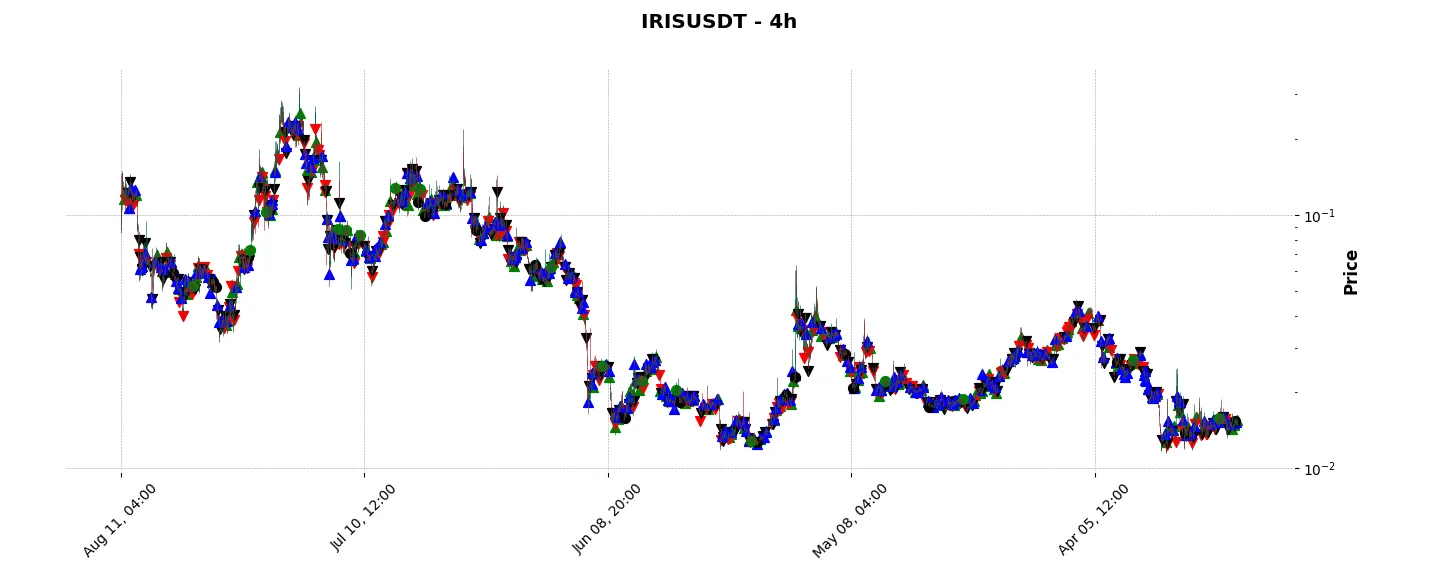

Top trading strategy IRISnet (IRIS) 4H – Live position:

- Short in progress

- Entry price : 0.02368 $

- Pnl : -0.72 %

Trade history

Over 6 months

Complete

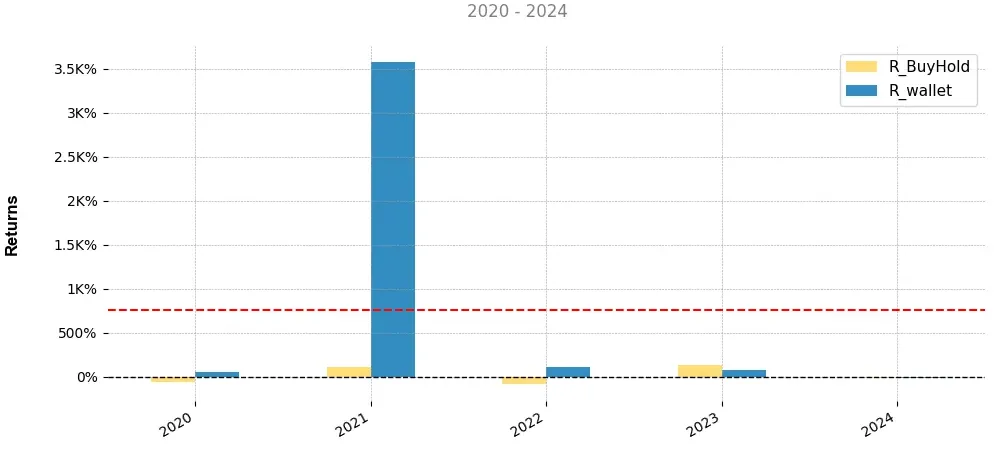

«Top trading strategy IRISnet (IRIS) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy IRIS 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

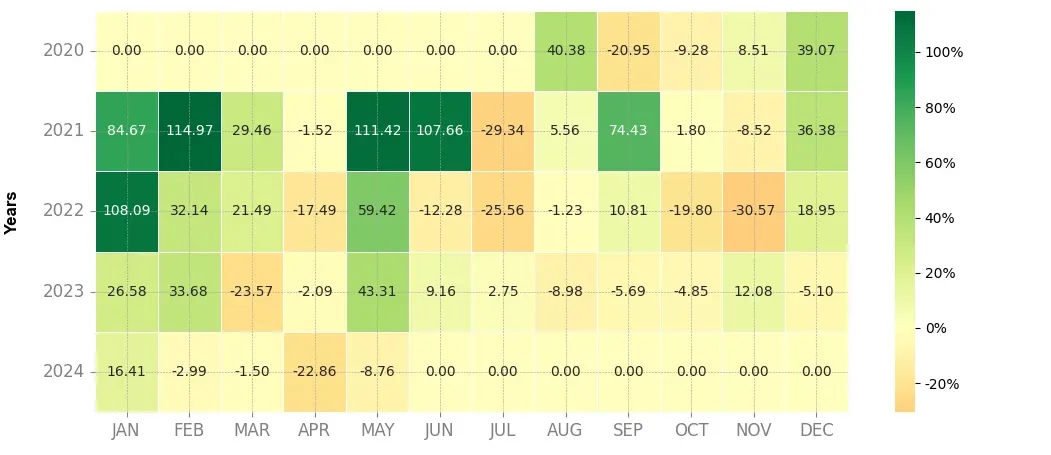

Heatmap of monthly returns

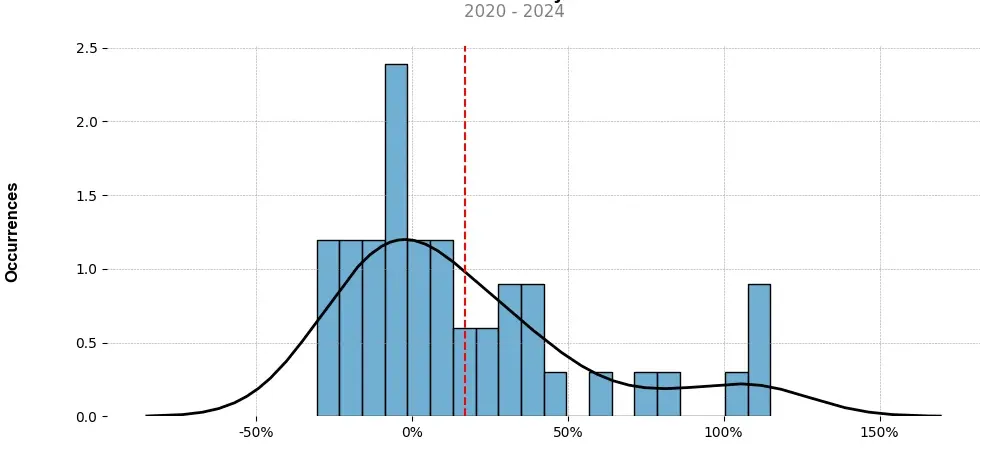

Distribution of the monthly returns of the top strategy

Presentation of IRIS

IRISnet (IRIS) is a cryptocurrency and blockchain interoperability network that aims to facilitate seamless integration and communication between different blockchain networks. As the adoption of blockchain technology expands, the need for interoperability becomes increasingly evident, as different blockchains are often incompatible and cannot efficiently communicate with each other. IRISnet addresses this challenge by providing a unified platform that enables the transfer of value and data across multiple blockchains.

One of the key features of IRISnet is its modular and pluggable design, which allows developers to easily build and customize interoperable applications. The network supports the integration of public and private blockchains, as well as systems based on different consensus algorithms. This flexibility is crucial in enabling various blockchain networks to collaborate and share resources effectively.

IRISnet utilizes the Inter-Blockchain Communication (IBC) protocol, a standardized protocol for secure and reliable communication between heterogeneous blockchains. IBC enables the seamless transfer of tokens and data between different blockchain networks, thereby unlocking new possibilities for cross-chain decentralized applications (dApps). This interoperability also helps to mitigate scalability challenges by allowing the load to be shared across multiple blockchains.

Furthermore, IRISnet features a governance mechanism that encourages community participation and decision-making. Token holders can propose and vote on proposals related to the network’s development and upgrades, ensuring a decentralized and inclusive ecosystem. This democratic approach enhances the network’s resilience, security, and responsiveness to evolving needs.

IRISnet has established partnerships with various industry players, including Binance, Huobi, Chainlink, and Kava, among others. These collaborations help to expand the reach and adoption of IRISnet, as well as enrich its interoperability capabilities through integration with different blockchain networks and external services.

In summary, IRISnet aims to bridge the gap between different blockchain networks, offering a seamless environment for cross-chain communication and collaboration. With its modular design, standardized protocols, and decentralized governance, IRISnet has the potential to unlock new frontiers in the world of decentralized finance and facilitate the widespread adoption of blockchain technology.

Strategy details

«Top trading strategy IRIS 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘cosmos-ecosystem’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)