Last update: 25-10-2024 12:00 UTC

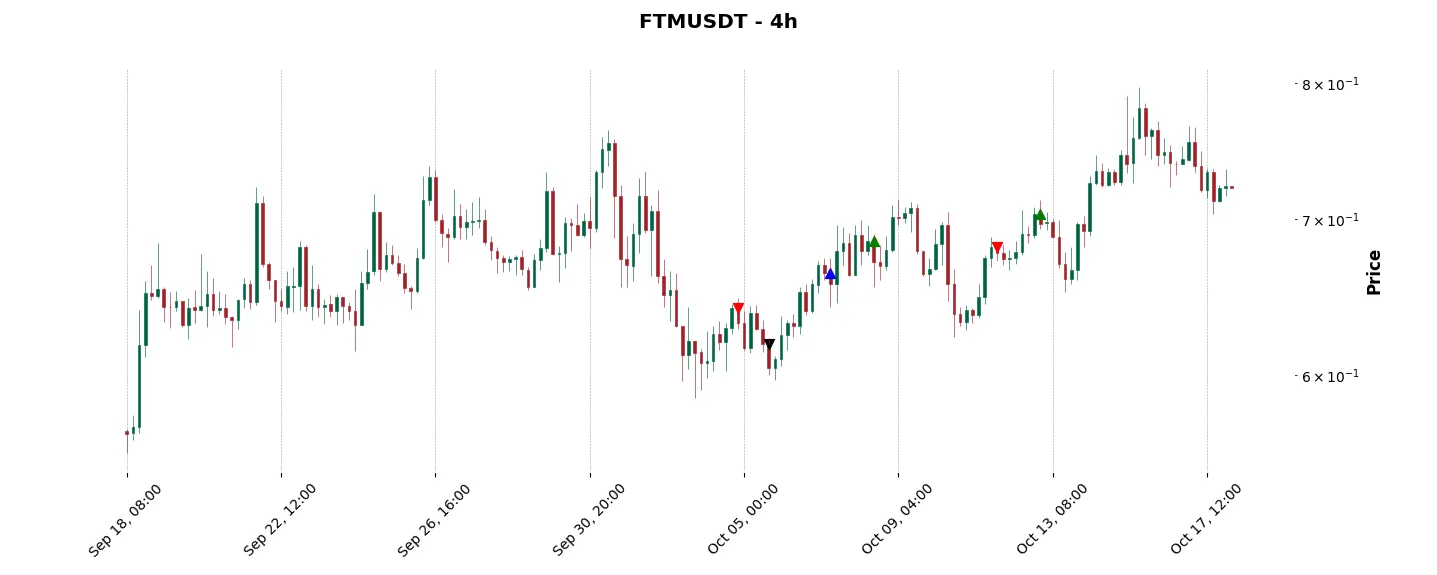

Top trading strategy Fantom (FTM) 4H – Live position:

- Short in progress

- Entry price : 0.6815 $

- Pnl : -0.84 %

Trade history

Over 6 months

Complete

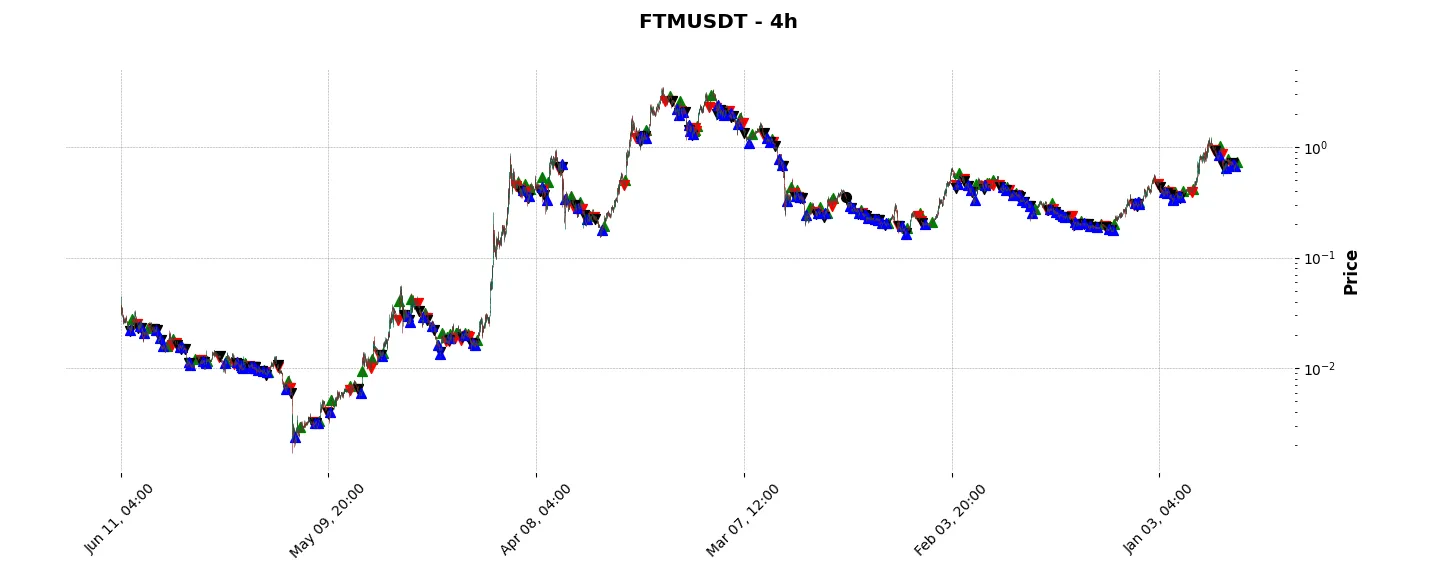

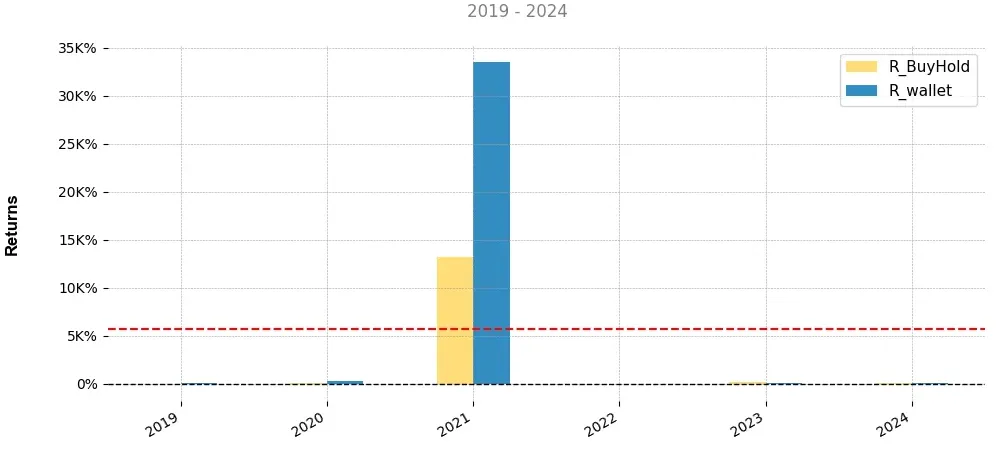

«Top trading strategy Fantom (FTM) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy FTM 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

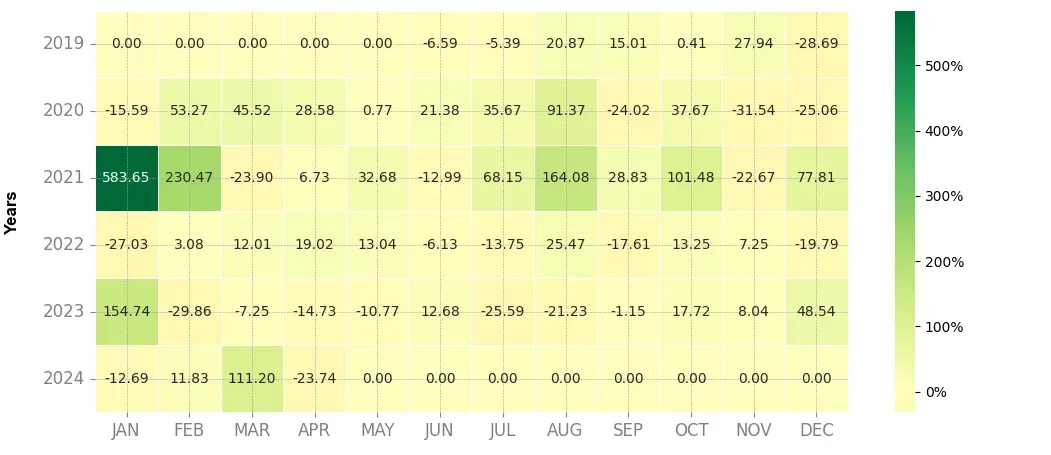

Heatmap of monthly returns

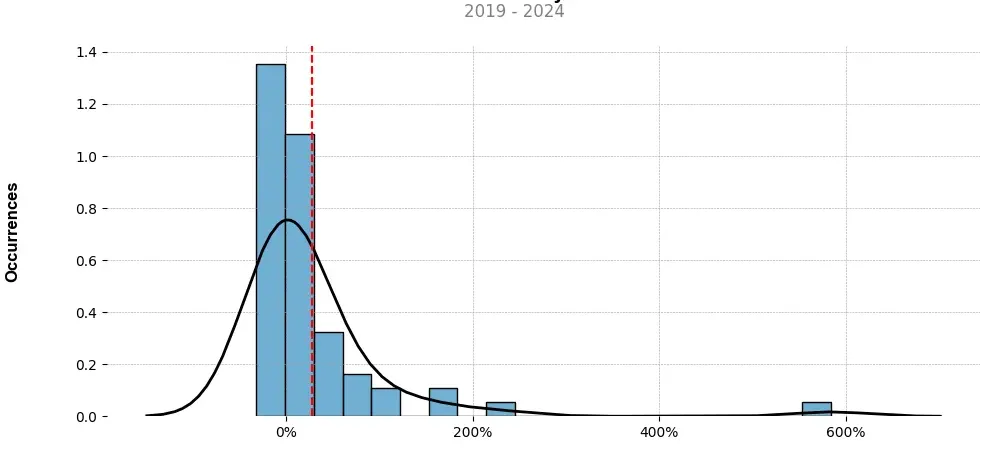

Distribution of the monthly returns of the top strategy

Presentation of FTM

Fantom (FTM) is a blockchain platform designed to offer fast, secure, and scalable solutions for decentralized applications (dApps) and smart contracts. Launched in 2018, Fantom aims to address the limitations faced by existing blockchain networks, such as slow transaction speeds, high fees, and lack of scalability.

One of the key features of Fantom is its innovative consensus mechanism called Lachesis. By utilizing an aBFT (asynchronous Byzantine Fault Tolerant) protocol, Fantom achieves near-instant finality, allowing for fast transaction processing and validation. This rapid consensus mechanism plays a crucial role in enabling high transaction throughput and low latency, making Fantom an efficient and scalable blockchain platform.

Another noteworthy aspect of Fantom is its use of a Directed Acyclic Graph (DAG) structure. In contrast to traditional linear blockchain structures, DAG allows for parallel processing of transactions, enhancing scalability. Fantom’s DAG-based framework, known as the Fantom Opera Chain, facilitates rapid confirmation of transactions, ensuring faster execution and greater capacity for handling dApps and smart contracts.

In addition to speed and scalability, Fantom also addresses the cost concerns associated with blockchain transactions. Its efficient and resource-friendly design minimizes transaction fees, making it more affordable for developers and users alike. This fee economy is advantageous for widespread adoption, particularly in areas where high fees can limit participation.

To foster a developer-friendly ecosystem, Fantom supports compatibility with the Ethereum Virtual Machine (EVM) and Solidity, allowing dApps built on Ethereum to migrate seamlessly to the Fantom platform. This makes it easier for developers to leverage existing code and tools while benefiting from Fantom’s enhanced performance and scalability.

Furthermore, Fantom emphasizes decentralization and community governance. Its decentralized decision-making process involves stakeholders who hold FTM tokens, ensuring that the network is governed by token holders’ consensus. This approach is aimed at promoting inclusivity, transparency, and community participation in shaping the platform’s future development.

Overall, Fantom (FTM) aims to provide a scalable and efficient blockchain solution for dApps and smart contracts. Its Lachesis consensus mechanism, DAG structure, low fees, and compatibility with existing Ethereum code create an ecosystem that prioritizes speed, scalability, and affordability. As Fantom continues to evolve, it has the potential to be a prominent player in the blockchain industry, offering practical solutions for a wide range of applications.

Strategy details

«Top trading strategy FTM 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘enterprise-solutions’, ‘defi’, ‘research’, ‘scaling’, ‘smart-contracts’, ‘fantom-ecosystem’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)