Last update: 18-05-2024 00:00 UTC

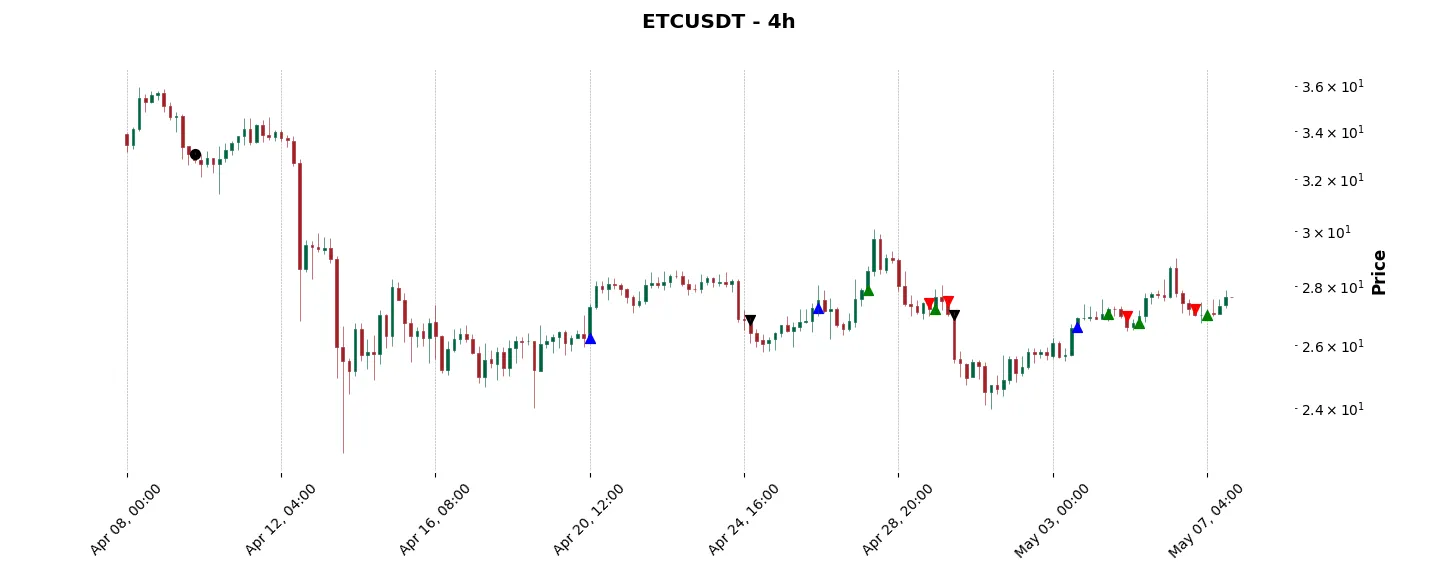

Top trading strategy Ethereum Classic (ETC) 4H – Live position:

- Long in progress

- Entry price : 27.26 $

- Pnl : 3.85 %

Trade history

Over 6 months

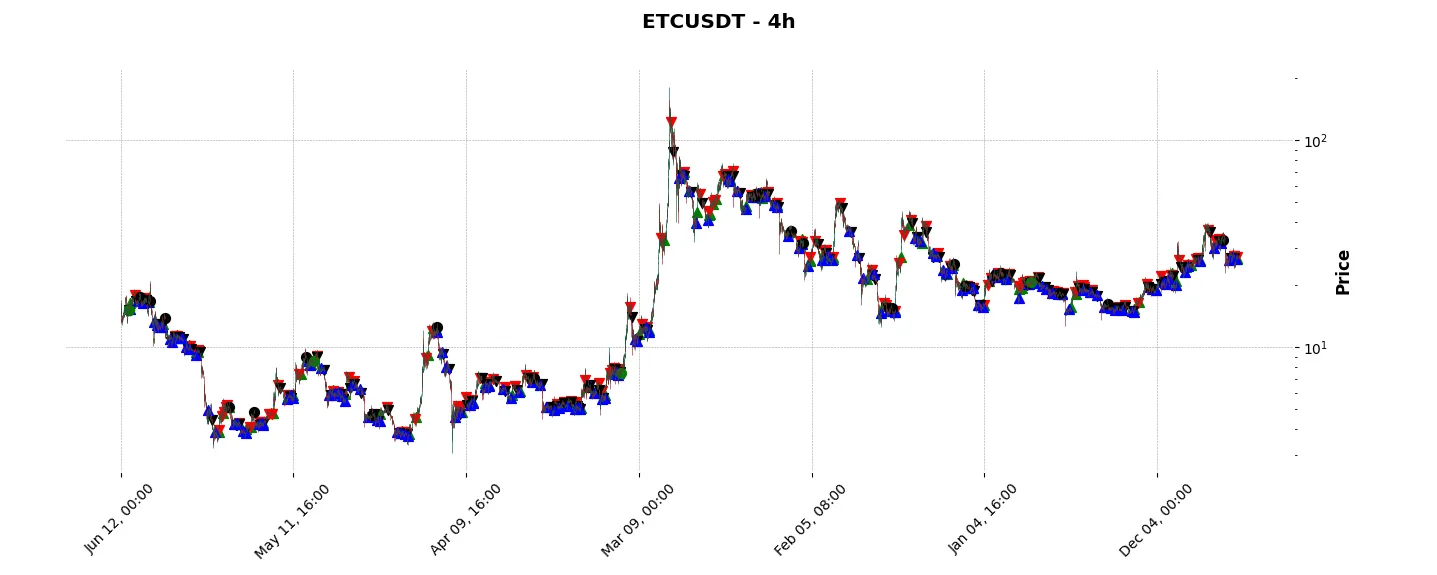

Complete

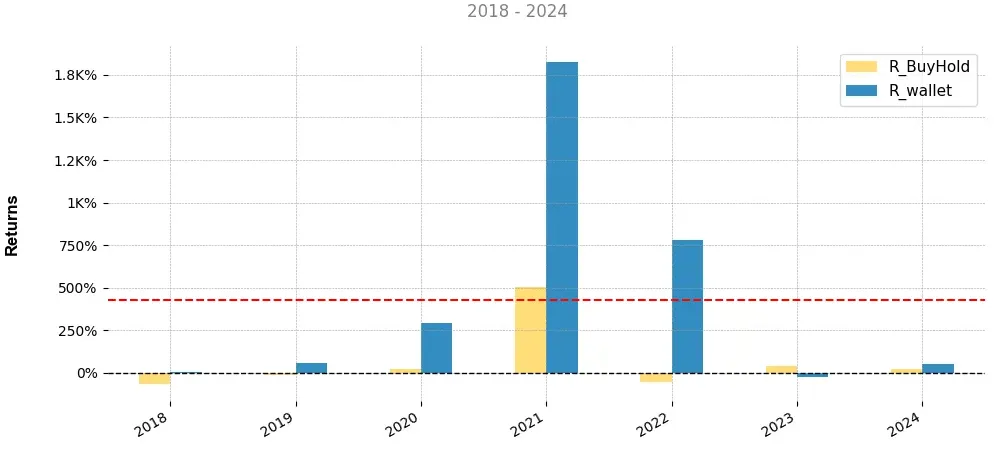

«Top trading strategy Ethereum Classic (ETC) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy ETC 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

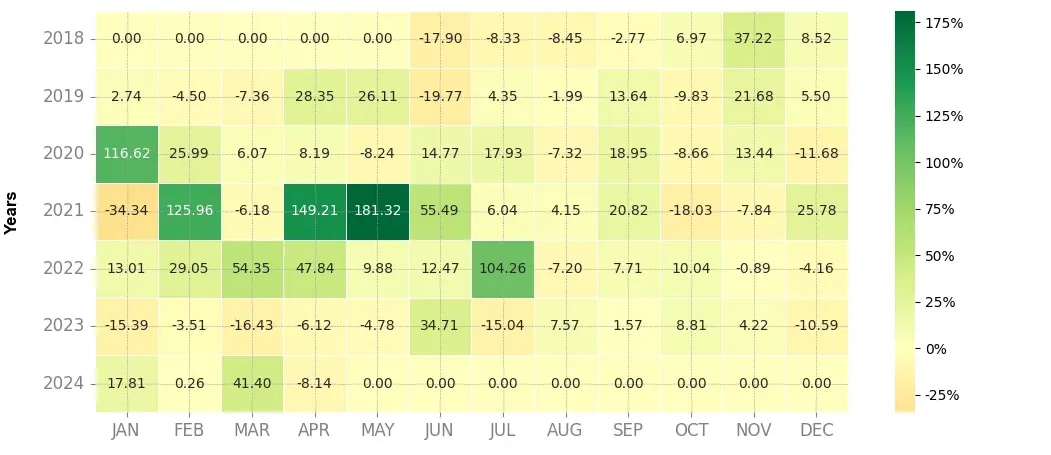

Heatmap of monthly returns

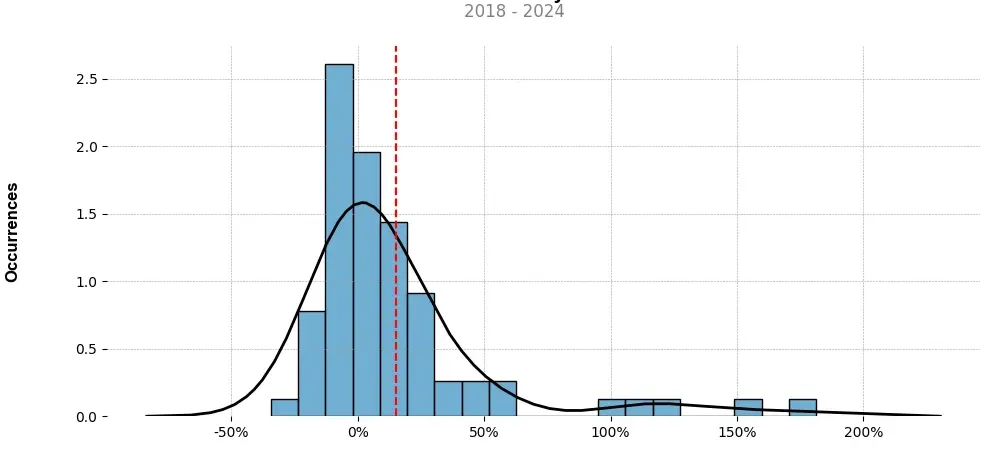

Distribution of the monthly returns of the top strategy

Presentation of ETC

Ethereum Classic (ETC) is a decentralized, open-source blockchain platform that emerged as a result of a contentious hard fork in the Ethereum network in July 2016. This fork occurred after a significant hack on The DAO, a decentralized autonomous organization built on top of the Ethereum blockchain. The hack led to the loss of millions of dollars worth of Ether.

The Ethereum community was divided on whether to implement a hard fork to reverse the hack and recover the stolen funds or stick to the principle of immutability, maintaining the integrity of the blockchain. The majority of the community supported the hard fork, resulting in the creation of a new blockchain known as Ethereum (ETH). However, a small faction of the community, adhering to the principle of immutability, continued on the original Ethereum blockchain, which later became Ethereum Classic.

Ethereum Classic upholds a similar architecture and functionality to Ethereum, allowing developers to build smart contracts and decentralized applications (DApps). It also operates as a global, decentralized supercomputer, facilitating the execution of applications through the use of its native cryptocurrency, ETC.

One of the key principles that differentiates Ethereum Classic from Ethereum is its commitment to immutability. Ethereum Classic believes that the blockchain should remain immutable and not be altered retroactively in order to maintain trust and credibility. This principle aligns with the original vision of Ethereum, emphasizing the importance of decentralization and censorship resistance.

ETC has gained traction and established a community of its own, appealing to those who value blockchain principles, immutability, and censorship resistance. It provides an alternative for users who do not support the governing decisions made by the Ethereum Foundation and prefer a blockchain platform that adheres strictly to its original philosophy.

Despite sharing similarities with Ethereum, Ethereum Classic has faced its share of challenges. It has struggled to gain the same level of mainstream adoption and developer support as Ethereum, primarily due to its smaller community and less frequent updates. Additionally, the contentious history surrounding Ethereum Classic might have created hesitancy among potential adopters.

However, Ethereum Classic remains an active blockchain network with ongoing development, improvements, and partnerships. It continues to provide a platform for developers and businesses to build and deploy decentralized applications, benefiting from the security and immutability features it offers. As the blockchain industry evolves, Ethereum Classic has the potential to carve out its niche and find its place as a steadfast supporter of the principles of decentralization and immutability.

Strategy details

«Top trading strategy ETC 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘mineable’, ‘pow’, ‘ethash’, ‘platform’, ‘smart-contracts’, ‘dcg-portfolio’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)