Last update: 19-05-2024 00:00 UTC

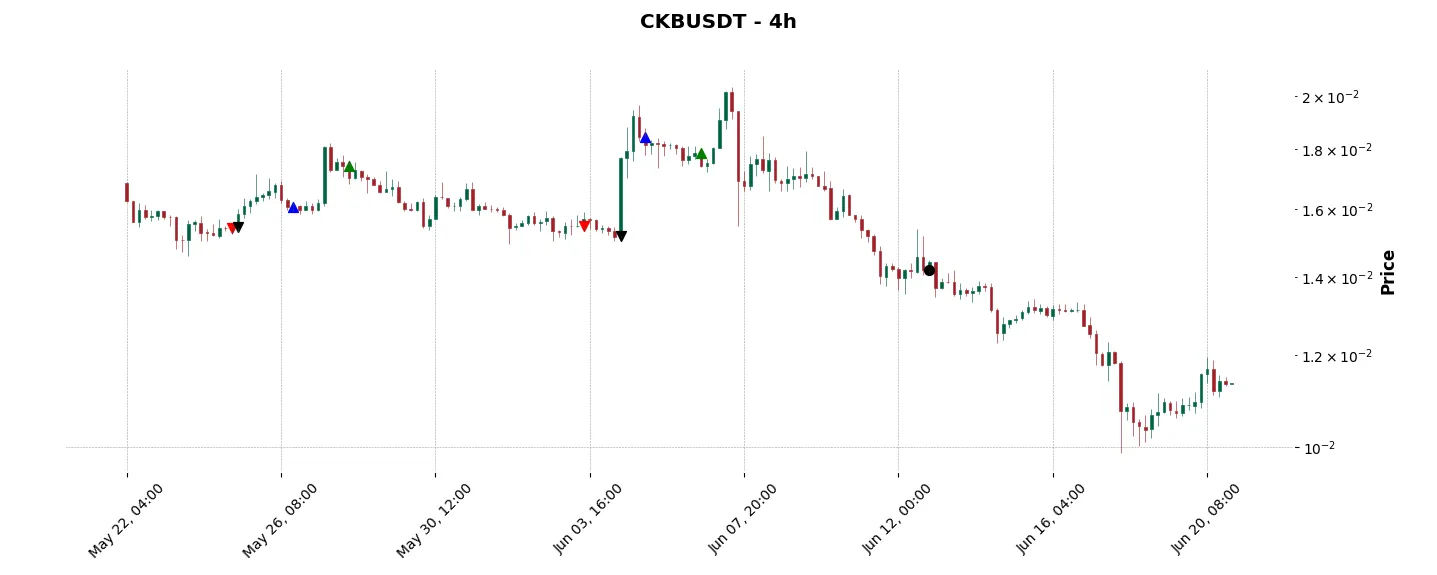

Top trading strategy Nervos Network (CKB) 4H – Live position:

- No position

Trade history

Over 6 months

Complete

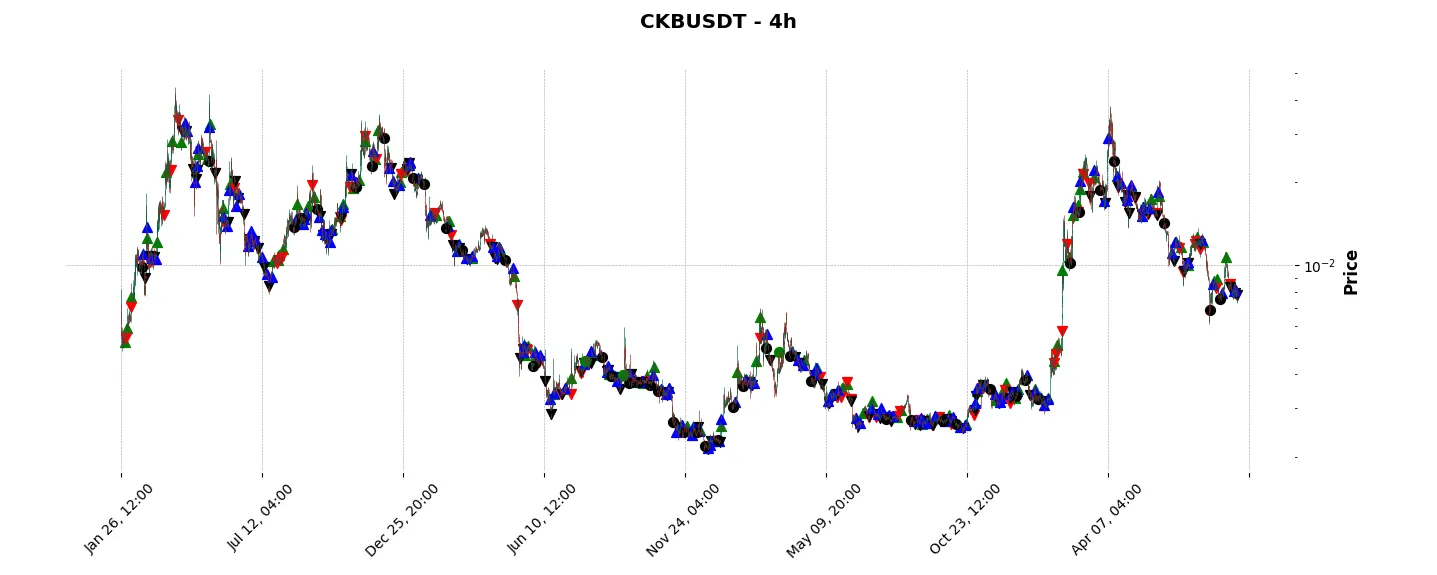

«Top trading strategy Nervos Network (CKB) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy CKB 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

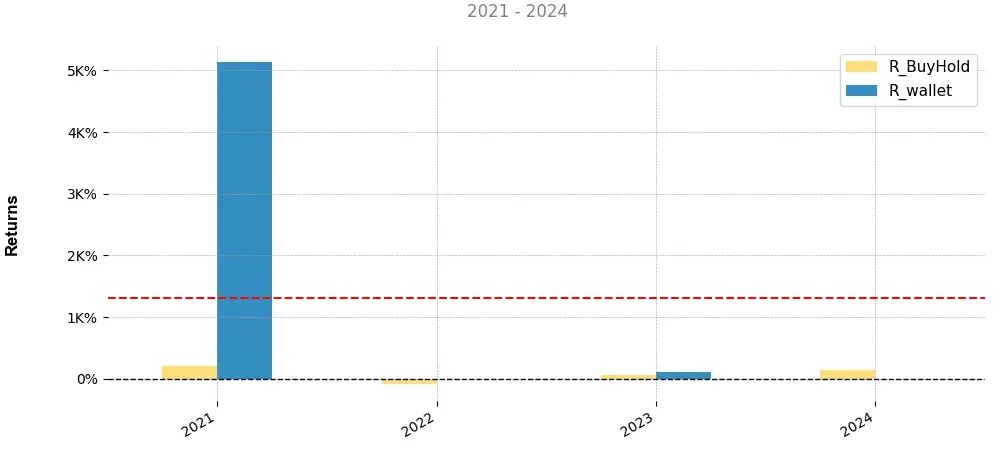

Annual comparison of cumulative returns with Buy & Holds

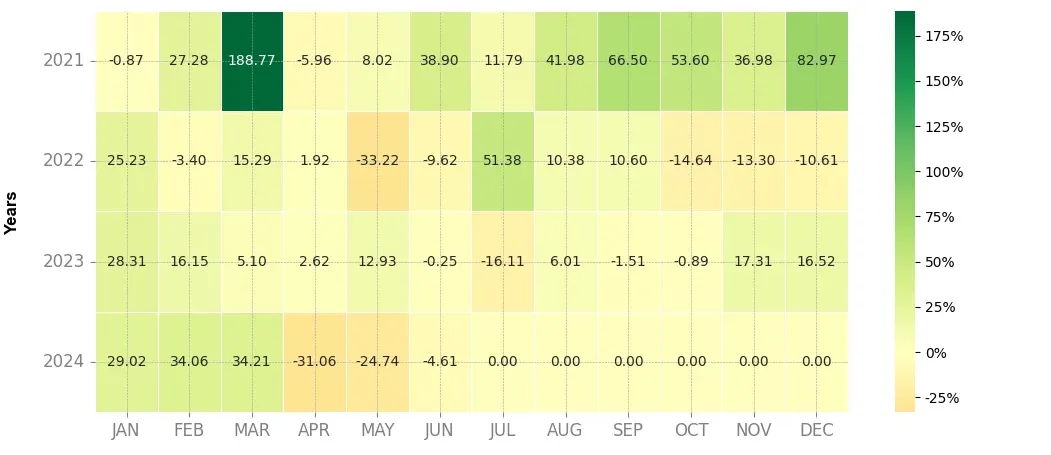

Heatmap of monthly returns

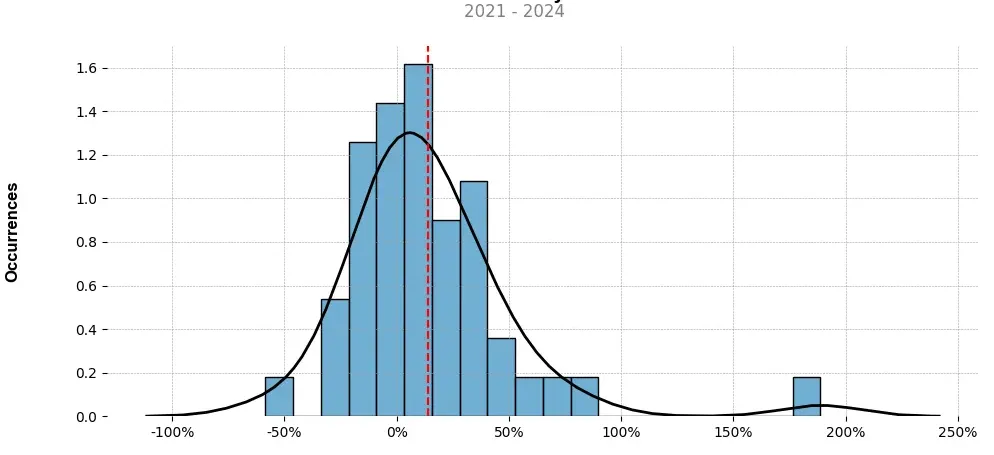

Distribution of the monthly returns of the top strategy

Presentation of CKB

Nervos Network (CKB) is an innovative cryptocurrency that aims to address the scalability and interoperability challenges faced by many existing blockchain networks. It is designed to support decentralized applications (dApps) and provide a scalable and sustainable infrastructure for the future of blockchain technology.

One of the key features of Nervos Network is its layered architecture, which consists of two distinct layers – the “store of value” layer and the “computing” layer. The store of value layer, powered by the Nervos Common Knowledge Base (CKB) blockchain, ensures the secure and decentralized storage of assets and tokens. This layer follows the UTXO (Unspent Transaction Output) model, which is proven and widely adopted in the blockchain industry.

On top of the store of value layer, the computing layer provides a platform for building and running dApps. It supports smart contracts, allowing developers to create decentralized applications with customizable business logic. This layer is intended to be more flexible and programmable, providing a wide range of possibilities for developers to build innovative applications.

Nervos Network also introduces a unique consensus mechanism known as Proof-of-Work (PoW) and Proof-of-Stake (PoS) hybrid. This hybrid approach combines the security and decentralization of PoW with the energy efficiency and low transaction costs of PoS. This makes the network more secure, sustainable, and cost-effective for users.

Moreover, Nervos Network emphasizes interoperability, allowing seamless integration with existing blockchain networks. It supports assets from other blockchains, enabling cross-chain transactions and increasing overall liquidity. This interoperability feature aims to break down barriers between different blockchain ecosystems and foster collaboration.

In terms of scalability, Nervos Network utilizes a technology called “layer 2 scaling,” which allows for high throughput and efficient transaction processing. This technology enables the network to handle a large number of transactions per second, making it suitable for wide-scale adoption.

In conclusion, Nervos Network (CKB) is a groundbreaking cryptocurrency that addresses major challenges in the blockchain industry. Its layered architecture, hybrid consensus mechanism, and interoperability features make it a highly scalable, secure, and sustainable solution for the future of decentralized applications. With its innovative approach and focus on usability, Nervos Network has the potential to revolutionize the blockchain landscape and drive mainstream adoption of blockchain technology.

Strategy details

«Top trading strategy CKB 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘mineable’, ‘pow’, ‘platform’, ‘collectibles-nfts’, ‘defi’, ‘interoperability’, ‘research’, ‘scaling’, ‘smart-contracts’, ‘dao’, ‘polychain-capital-portfolio’, ‘rollups’, ‘blockchain-capital-portfolio’, ‘cms-holdings-portfolio’, ‘dragonfly-capital-portfolio’, ‘electric-capital-portfolio’, ‘hashkey-capital-portfolio’, ‘huobi-capital-portfolio’, ‘1confirmation-portfolio’, ‘multicoin-capital-portfolio’, ‘web3’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)