Last update: 19-05-2024 00:00 UTC

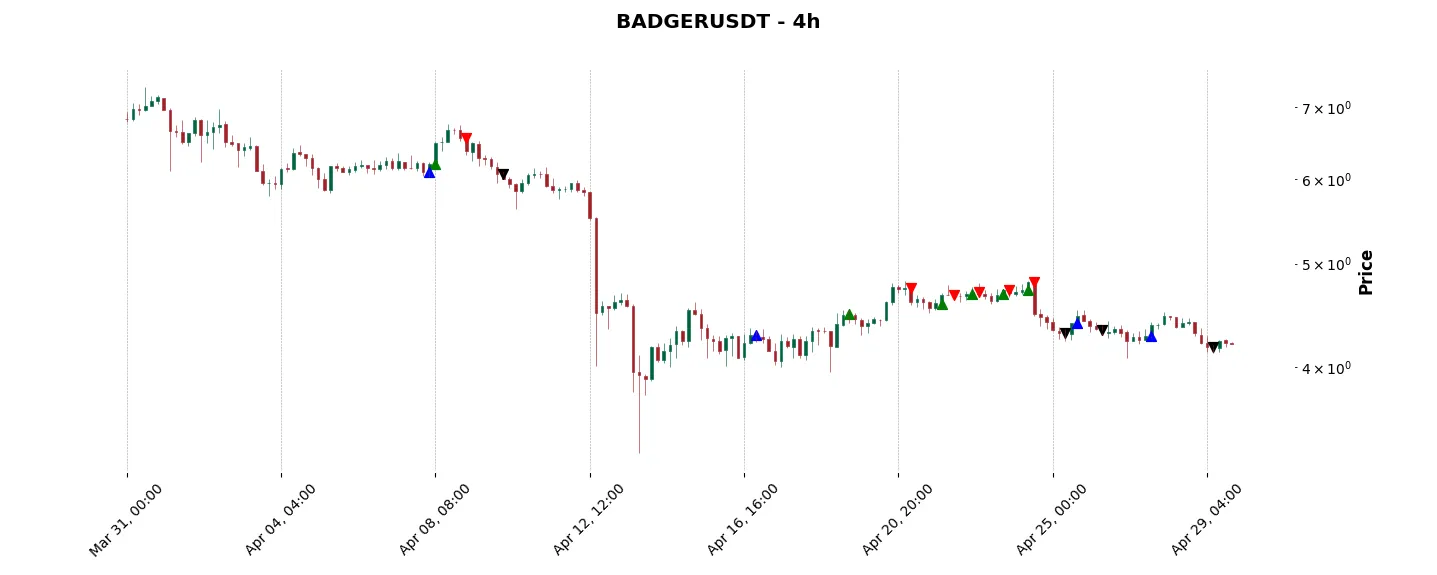

Top trading strategy Badger DAO (BADGER) 4H – Live position:

- No position

Trade history

Over 6 months

Complete

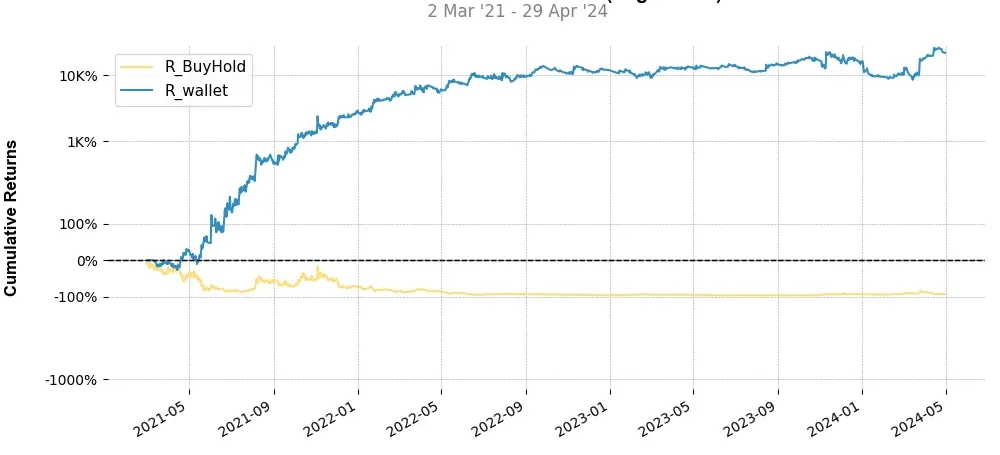

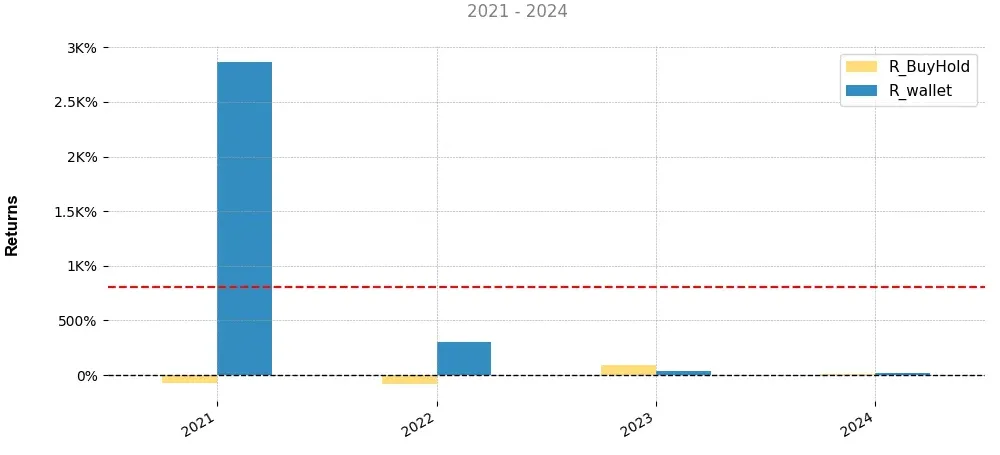

«Top trading strategy Badger DAO (BADGER) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy BADGER 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

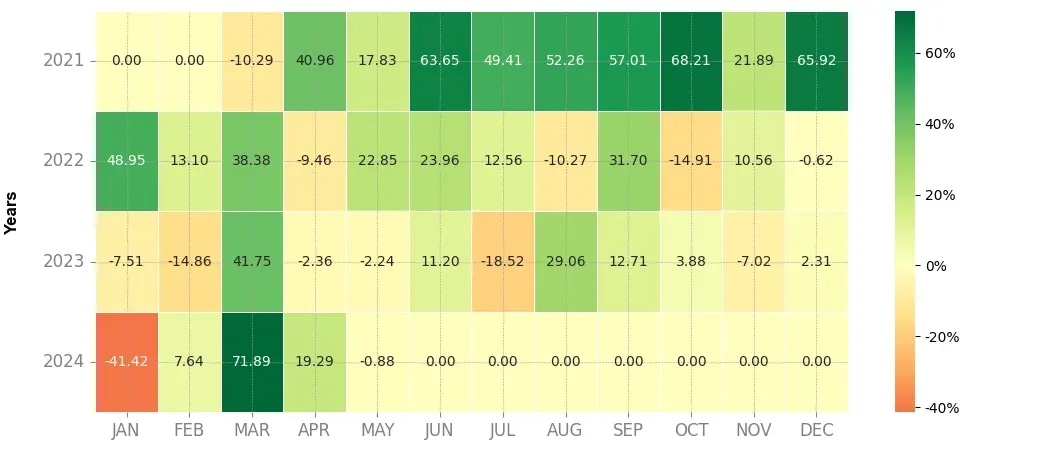

Heatmap of monthly returns

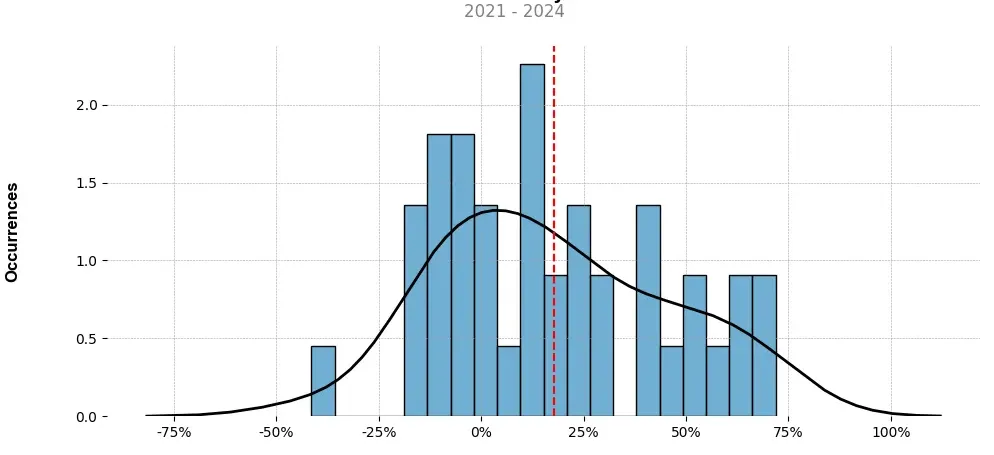

Distribution of the monthly returns of the top strategy

Presentation of BADGER

Badger DAO (BADGER) is a crypto project focused on bridging the gap between decentralized finance (DeFi) protocols and Bitcoin. As Bitcoin has gained immense popularity as a store of value, it has faced limitations in terms of its utility within DeFi ecosystems. Badger DAO aims to address this issue by enabling Bitcoin holders to participate in yield farming and other lucrative DeFi activities.

One of the key features of Badger DAO is the Badger Sett Vaults, which allow users to deposit their Bitcoin and earn yield in the form of BADGER tokens. These Sett Vaults leverage innovative strategies to optimize yield farming opportunities across various DeFi protocols. By providing a seamless way to put Bitcoin to work in DeFi, Badger DAO enhances the overall efficiency and productivity of the crypto ecosystem.

Moreover, Badger DAO has also introduced the concept of “Badger Badger Badger” (BIP-41). This protocol upgrade aims to introduce a decentralized governance system, enabling the community to influence the direction of the project. Through on-chain voting, BADGER token holders are empowered to propose and vote on various protocol upgrades, ensuring decentralized decision-making and fostering community involvement.

In addition to its focus on DeFi and governance, Badger DAO places a strong emphasis on user experience. The project aims to simplify the interface between Bitcoin and DeFi, making it more accessible and user-friendly for both novice and experienced crypto users. By providing intuitive tools and a smooth user interface, Badger DAO intends to encourage broader adoption of DeFi and attract more Bitcoin holders to participate in this emerging financial ecosystem.

Furthermore, Badger DAO has established strategic partnerships with prominent players in the DeFi space, such as Yearn Finance and SushiSwap. These collaborations enhance the interoperability and synergies between different DeFi protocols, creating a more interconnected and robust ecosystem for users. By leveraging the expertise and resources of these partners, Badger DAO is well-positioned to expand its offerings and provide even more value to its users.

Overall, Badger DAO serves as a bridge between Bitcoin and DeFi, enabling Bitcoin holders to tap into the potential of decentralized finance. Through its Sett Vaults, decentralized governance, user-friendly interface, and strategic partnerships, Badger DAO aims to unlock new opportunities for Bitcoin holders and contribute to the growth and adoption of DeFi as a whole.

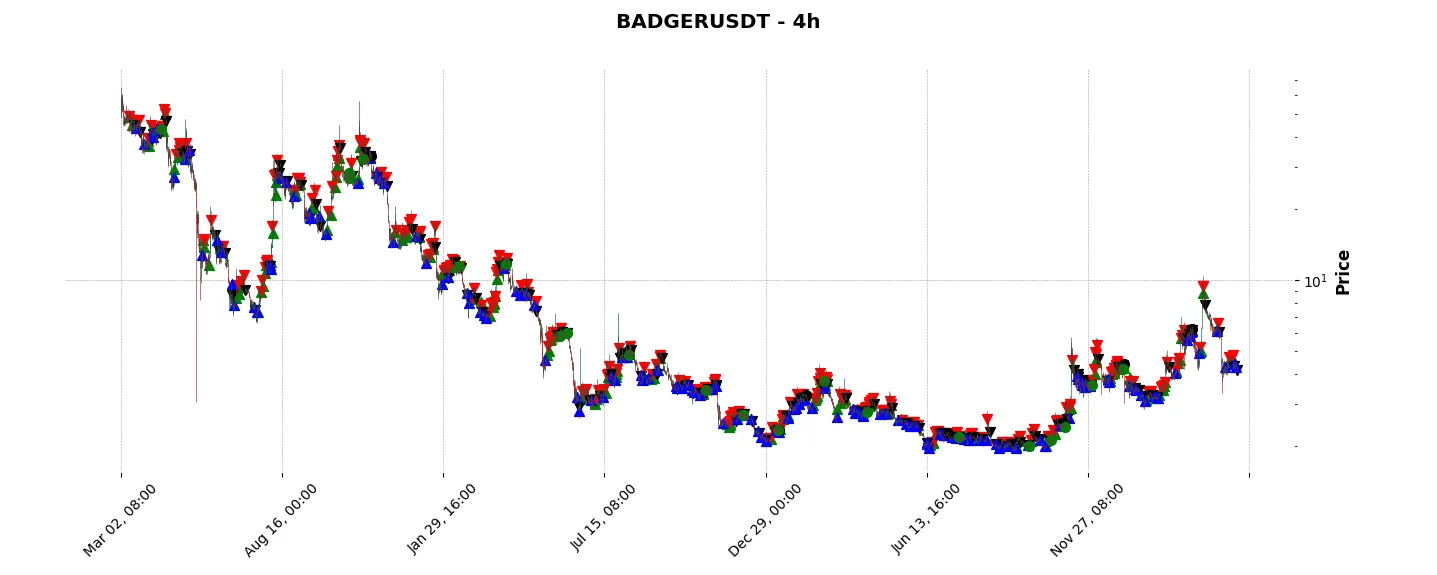

Strategy details

«Top trading strategy BADGER 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘defi’, ‘dao’, ‘yield-farming’, ‘yield-aggregator’, ‘governance’, ‘blockchain-capital-portfolio’, ‘arbitrum-ecosytem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)