Last update: 17-06-2024 00:00 UTC

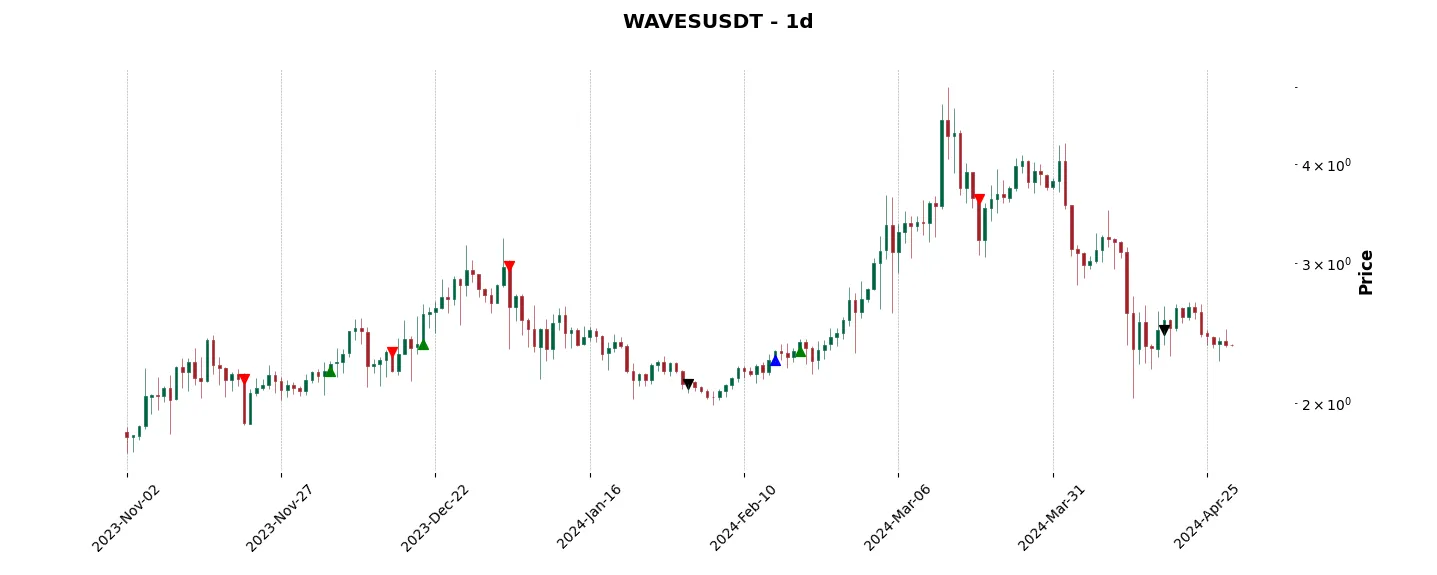

Top trading strategy Waves (WAVES) daily – Live position:

- Short in progress

- Entry price : 2.406 $

- Pnl : 55.28 %

Trade history

Over 6 months

Complete

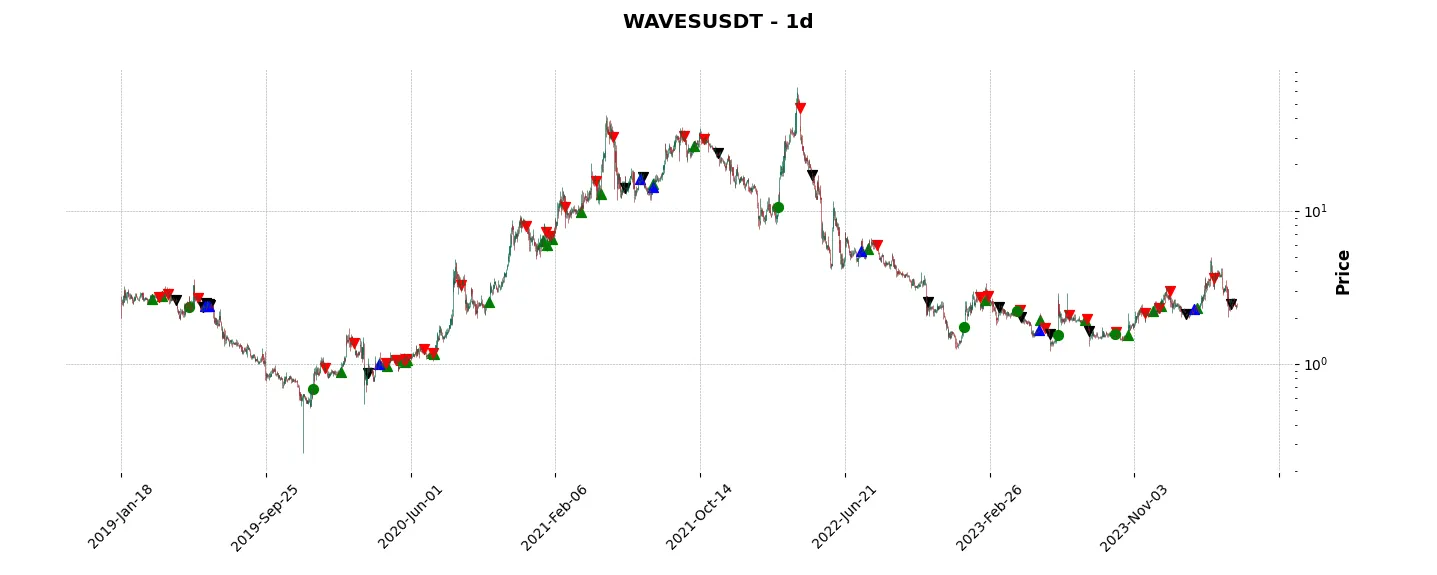

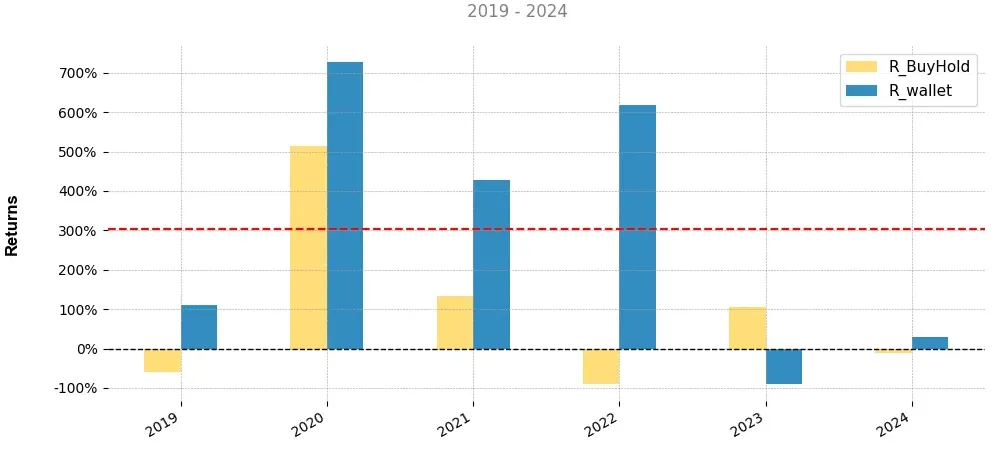

«Top trading strategy Waves (WAVES) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy WAVES daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

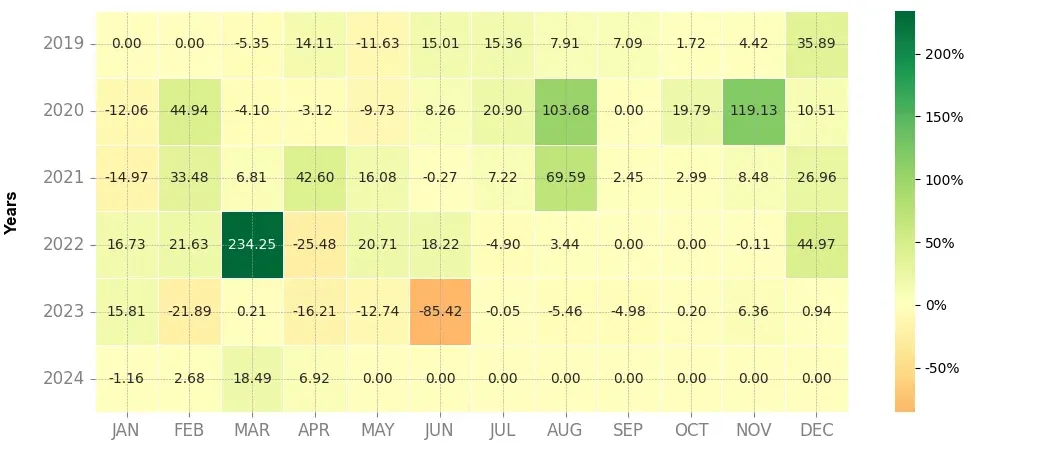

Heatmap of monthly returns

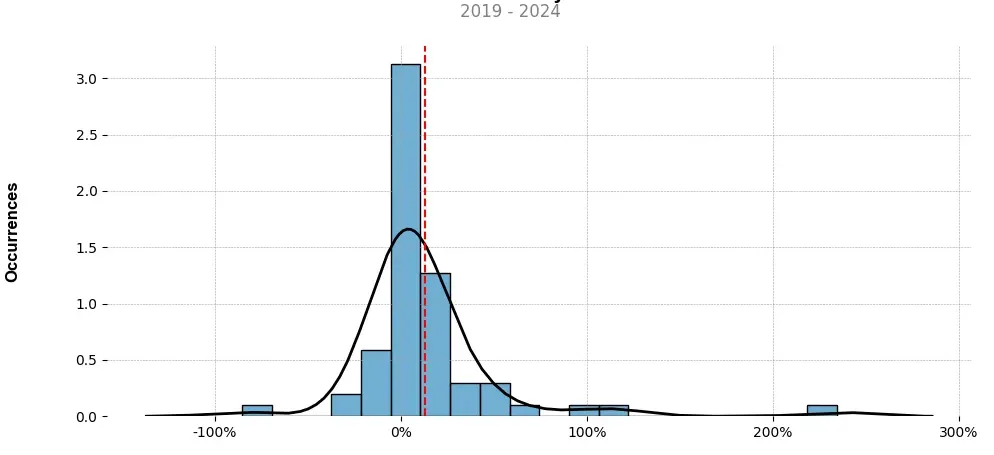

Distribution of the monthly returns of the top strategy

Presentation of WAVES

Waves (WAVES) is a popular cryptocurrency that has gained significant attention within the crypto community. Launched in 2016, Waves was developed by Sasha Ivanov, a well-known entrepreneur in the blockchain space. This digital currency aims to facilitate the creation and trading of various types of assets on its platform.

One key feature of Waves is its blockchain technology, which enables fast and decentralized transactions. The Waves blockchain operates on a proof-of-stake consensus algorithm, allowing users to validate and secure transactions in a more energy-efficient manner compared to traditional proof-of-work systems like Bitcoin.

The primary use case of Waves is its decentralized exchange (DEX) known as Waves.Exchange. This DEX enables users to trade Waves tokens and other digital assets without the need for centralized intermediaries. By providing a secure and transparent platform for asset exchange, Waves.Exchange has become a popular alternative for traders looking for greater control and privacy over their transactions.

Furthermore, Waves offers users the ability to create and issue their own custom tokens on the Waves blockchain. This feature has attracted numerous projects and businesses seeking to tokenize assets such as real estate, intellectual property, and even fiat currencies. Through the Waves platform, these tokens can be easily issued, managed, and traded, providing greater liquidity and accessibility to a wide range of assets.

Moreover, Waves has implemented smart contract functionality, allowing developers to create and deploy decentralized applications (dApps) on the platform. This functionality opens up opportunities for building various blockchain-based solutions, including crowdfunding campaigns, supply chain management systems, and decentralized finance (DeFi) applications.

In terms of scalability, Waves has been able to handle a significant volume of transactions due to its optimized blockchain architecture. With high throughput capabilities, the platform can process countless transactions per second, ensuring swift and efficient operations.

It is worth noting that Waves has also established partnerships and collaborations with various industry players. By fostering relationships with established organizations, Waves aims to enhance its adoption and utility in the cryptosphere. This includes partnerships with financial institutions, governments, and blockchain projects, showcasing the versatility and potential of Waves as a groundbreaking cryptocurrency.

In conclusion, Waves (WAVES) is a decentralized blockchain platform that offers a variety of features, including a fast and secure blockchain, a decentralized exchange, token issuance capabilities, smart contract functionality, and scalability. The project has garnered significant attention and adoption due to its user-friendly design and ability to cater to different asset types. With ongoing developments and partnerships, Waves continues to position itself as a prominent cryptocurrency in the market.

Strategy details

«Top trading strategy WAVES daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘lpos’, ‘platform’, ‘smart-contracts’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)