Last update: 04-03-2025 00:00 UTC

Top trading strategy TROY (TROY) daily – Live position:

- Short in progress

- Entry price : 0.001815 $

- Pnl : 27.71 %

Trade history

Over 6 months

Complete

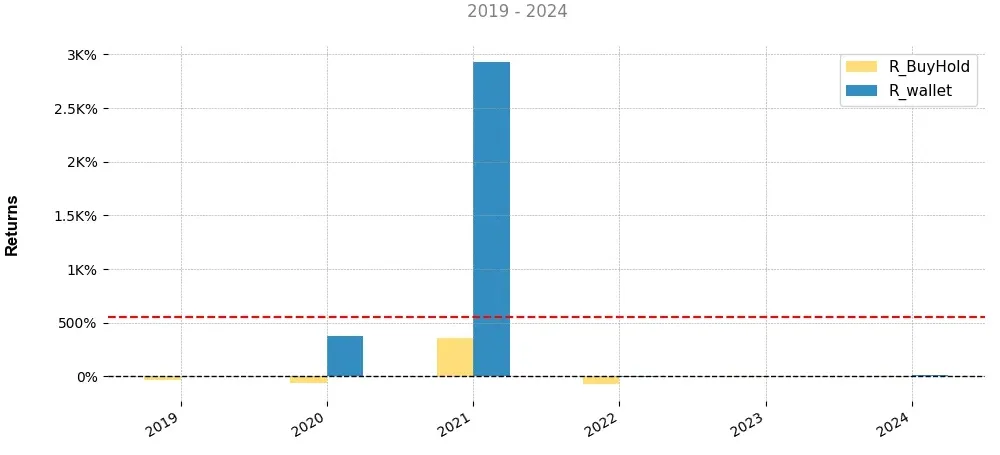

«Top trading strategy TROY (TROY) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy TROY daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

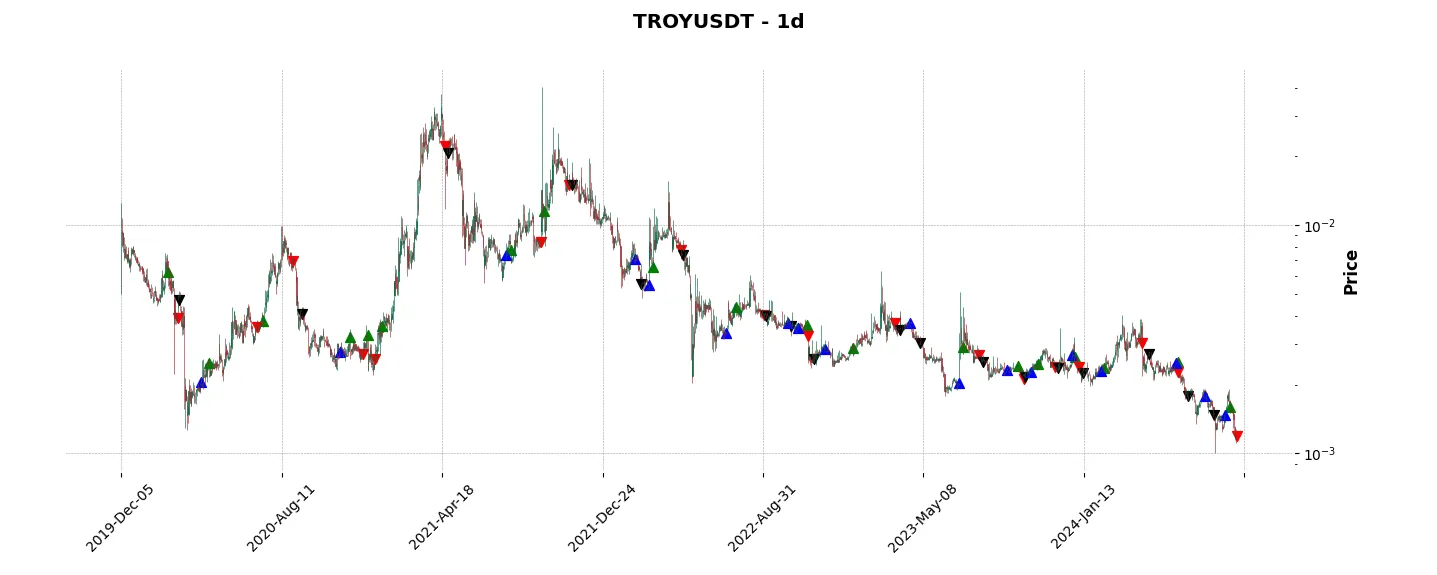

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

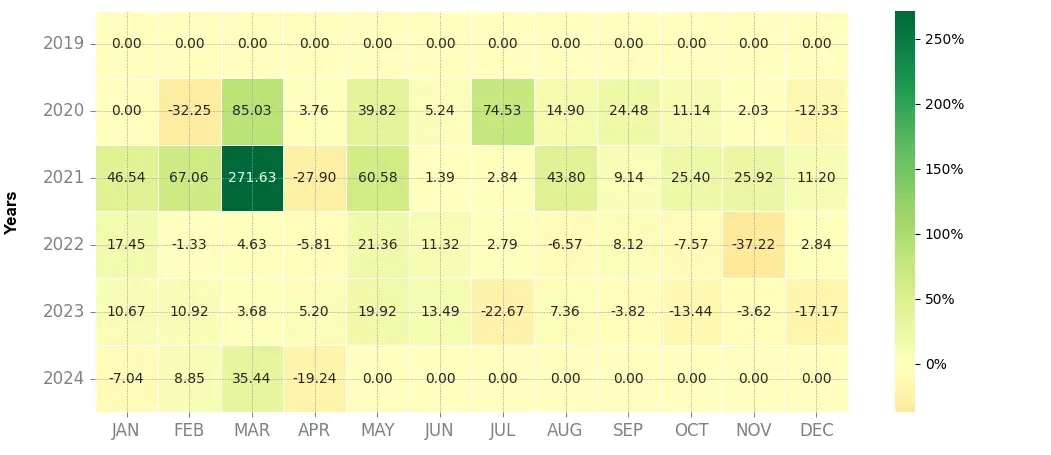

Heatmap of monthly returns

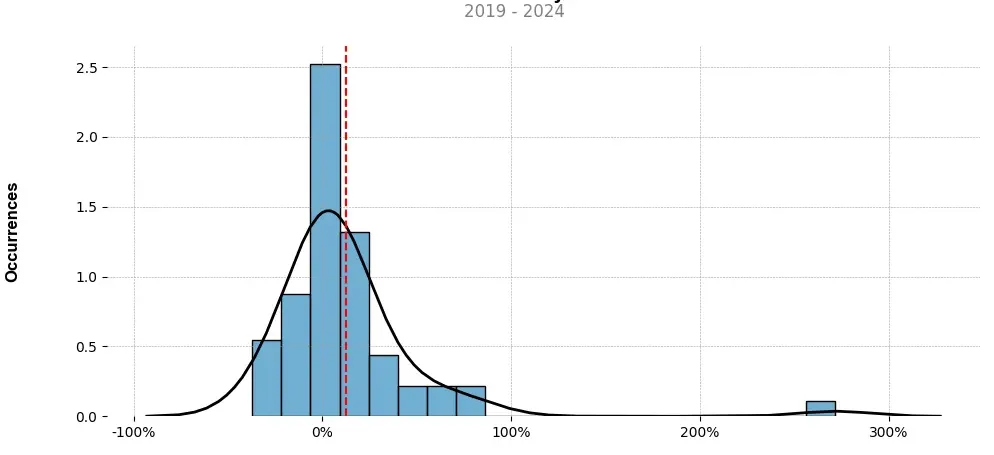

Distribution of the monthly returns of the top strategy

Presentation of TROY

TROY (TROY) is a cryptocurrency that aims to revolutionize the digital asset trading industry by providing a platform for seamless trading and investment solutions. This synthesis will explore the key features of TROY and its potential impact on the cryptocurrency market.

One of the main goals of TROY is to promote inclusivity in the cryptocurrency market. The platform offers a user-friendly interface that allows both experienced traders and newcomers to engage in digital asset trading. By reducing the complexity associated with cryptocurrency trading, TROY aims to attract a wider audience and foster mass adoption of digital assets.

TROY also addresses the issue of fragmented liquidity in the cryptocurrency market. It provides a liquidity aggregator that connects various trading platforms, allowing users to access multiple liquidity sources through a single point of entry. This feature enhances trading efficiency and ensures better prices for users, ultimately improving overall market liquidity.

Moreover, TROY emphasizes the importance of security in digital asset trading. The platform employs advanced security measures such as two-factor authentication, encryption, and cold storage, ensuring the safety of users’ assets. By prioritizing security, TROY aims to mitigate the risks associated with cryptocurrency trading and build trust among users.

In addition to its trading features, TROY offers innovative investment solutions. The platform enables users to participate in various investment opportunities such as token sales, initial exchange offerings (IEOs), and decentralized finance (DeFi) projects. By providing access to these investment options, TROY aims to empower users and diversify their investment portfolios.

One significant aspect of TROY is its focus on community building and collaboration. The platform facilitates interaction among users, fostering a sense of community and shared knowledge. TROY also encourages collaboration between different stakeholders, including traders, developers, and entrepreneurs, to stimulate innovation and drive the growth of the cryptocurrency ecosystem.

Overall, TROY (TROY) aims to disrupt the digital asset trading industry by offering a comprehensive platform that addresses the key challenges associated with cryptocurrency trading. Through its user-friendly interface, liquidity aggregator, robust security measures, and diverse investment opportunities, TROY strives to democratize access to digital assets and foster mass adoption. As the cryptocurrency market continues to evolve, TROY has the potential to play a significant role in shaping its future.

Strategy details

«Top trading strategy TROY daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘binance-launchpad’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)