Last update: 08-07-2024 00:00 UTC

Top trading strategy Stacks (STX) daily – Live position:

- No position

Trade history

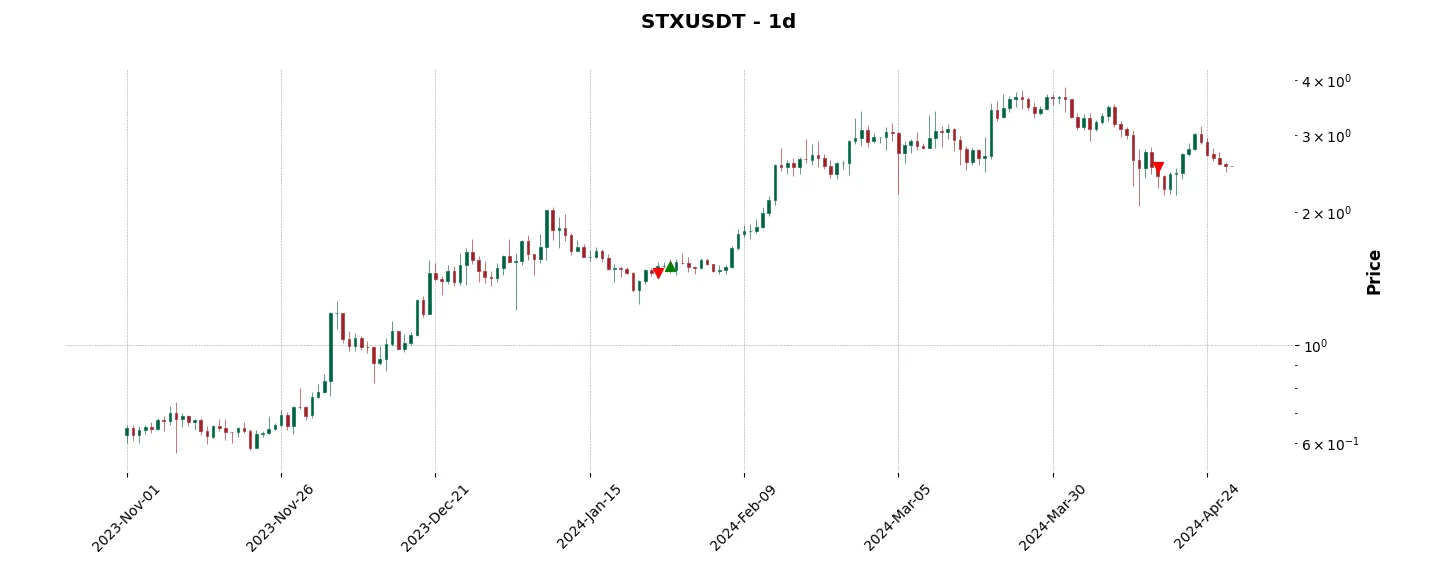

Over 6 months

Complete

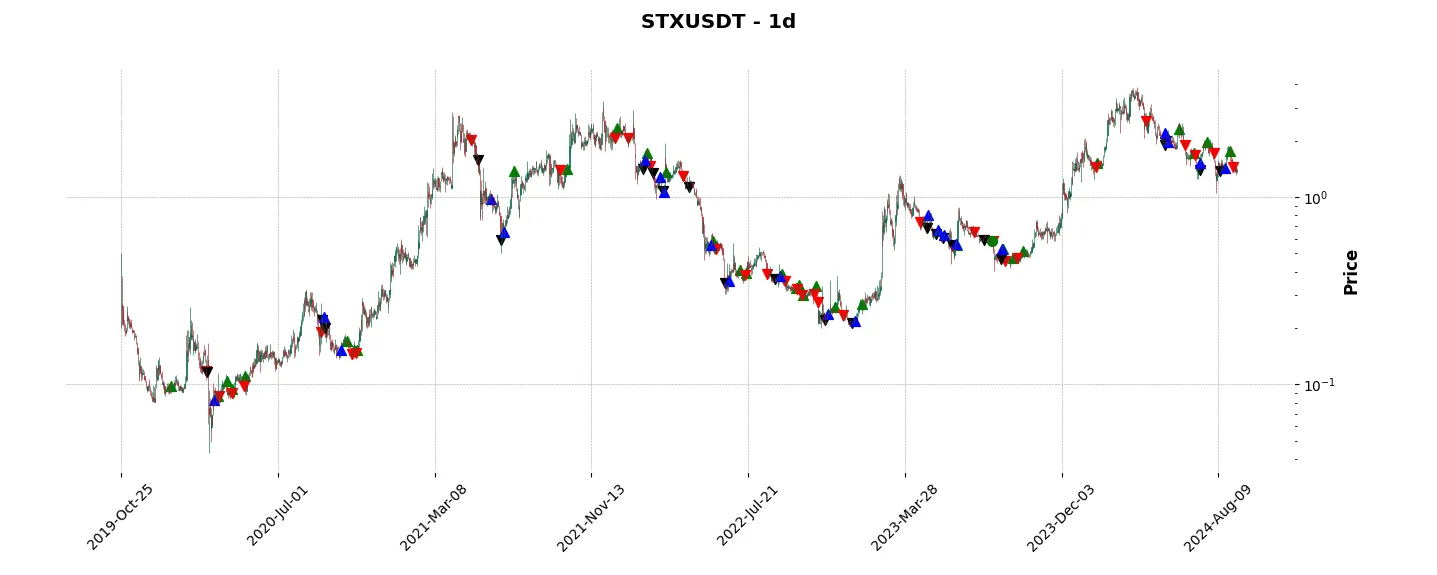

«Top trading strategy Stacks (STX) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy STX daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

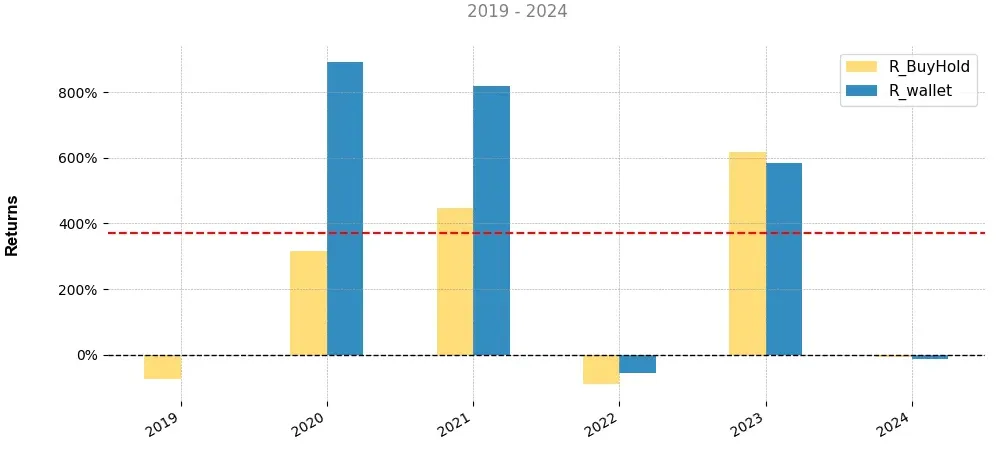

Annual comparison of cumulative returns with Buy & Holds

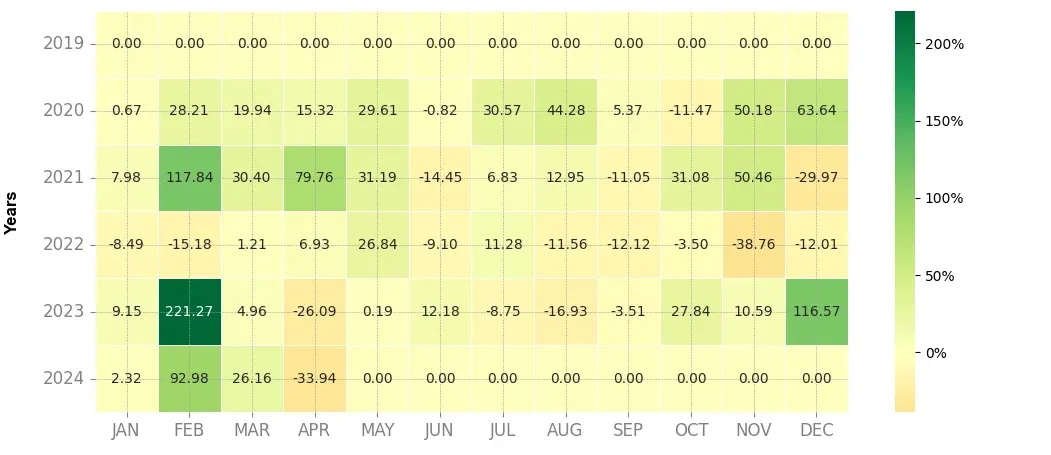

Heatmap of monthly returns

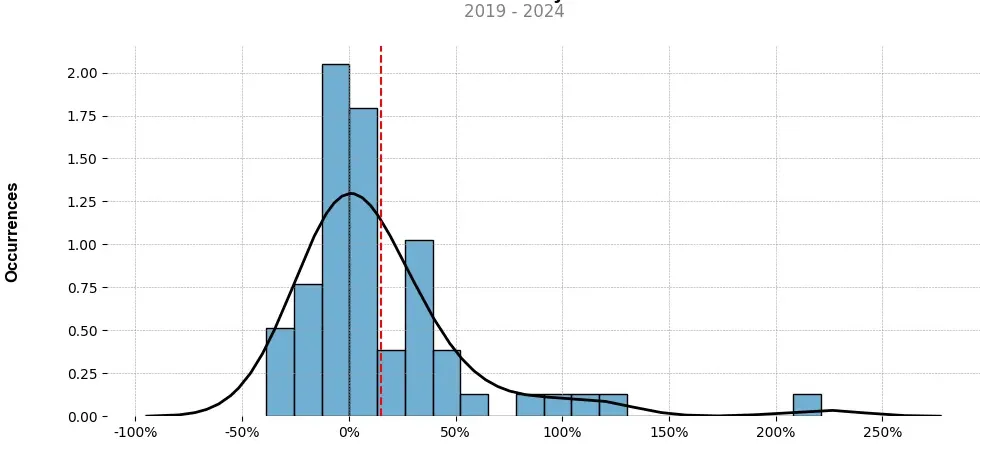

Distribution of the monthly returns of the top strategy

Presentation of STX

Stacks (STX) is a groundbreaking cryptocurrency that promises to revolutionize the way decentralized applications (dApps) are built and accessed. It serves as the native cryptocurrency for the Stacks blockchain, which is designed to work with the Bitcoin blockchain using a unique consensus mechanism called Proof of Transfer (PoX).

One of the key features that set Stacks apart is its focus on enabling smart contracts on the Bitcoin network. Traditional blockchain networks, such as Ethereum, have their own native smart contract functionality. However, Stacks takes a different approach by leveraging the security and proven track record of the Bitcoin blockchain, while incorporating smart contracts through the Stacks blockchain.

By utilizing a two-way peg, the Stacks blockchain enables seamless interoperability with Bitcoin, allowing STX holders to lock their Bitcoin on the Bitcoin network and earn STX in return. This PoX mechanism not only incentivizes Bitcoin holders to participate in the Stacks ecosystem, but also enhances the security of the Stacks blockchain by relying on the immense hash power of Bitcoin.

With Stacks, developers have the ability to create decentralized applications that run on the Stacks blockchain and interact with the Bitcoin blockchain. This innovative approach opens up numerous possibilities for building dApps that leverage the security and liquidity of Bitcoin, while benefiting from the flexibility and programmability of smart contracts.

Furthermore, Stacks aims to solve the scalability issues typically associated with decentralized networks. By processing most of the computation off-chain and ensuring that only a small amount of data is recorded on the blockchain, Stacks achieves higher transaction throughput and faster confirmations. This makes it practical for developers and users to utilize dApps built on the Stacks blockchain without experiencing the scalability limitations that other networks might face.

Moreover, Stacks takes privacy seriously. With the advent of technology like Clarity, a language specifically designed for dApp development on Stacks, developers have the tools to build privacy-focused applications. This capability is highly desirable in an era where data is often exploited, giving users more control over their personal information.

In conclusion, Stacks (STX) is poised to disrupt the decentralized application landscape by coupling the security and stability of the Bitcoin network with the programmability and agility of smart contracts. Its unique PoX consensus mechanism, interoperability with Bitcoin, scalability solutions, and privacy features make it an enticing option for developers and users alike. With Stacks, the future of decentralized applications looks promising, as it bridges the gap between the Bitcoin and decentralized application ecosystems.

Strategy details

«Top trading strategy STX daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘mineable’, ‘platform’, ‘collectibles-nfts’, ‘defi’, ‘smart-contracts’, ‘metaverse’, ‘arrington-xrp-capital-portfolio’, ‘blockchain-capital-portfolio’, ‘dcg-portfolio’, ‘fabric-ventures-portfolio’, ‘hashkey-capital-portfolio’, ‘huobi-capital-portfolio’, ‘usv-portfolio’, ‘web3’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)