Last update: 04-03-2025 00:00 UTC

Top trading strategy Cosmos (ATOM) daily – Live position:

- Open short

- Entry price : 4.226 $

- Pnl : %

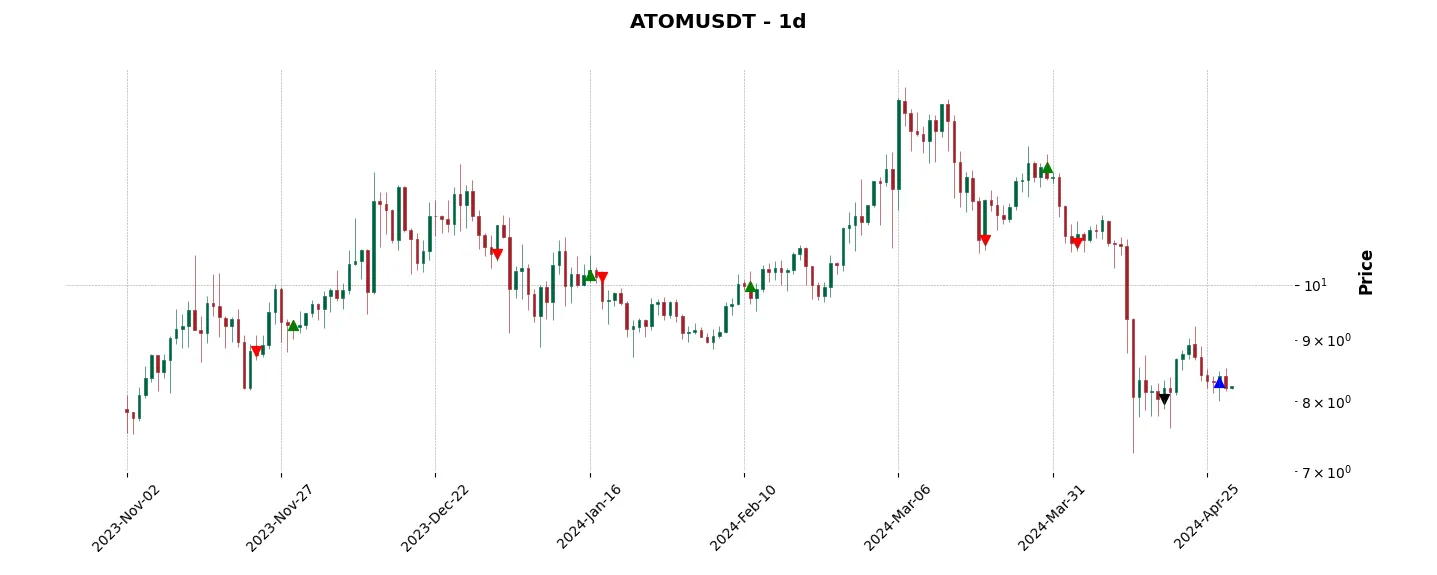

Trade history

Over 6 months

Complete

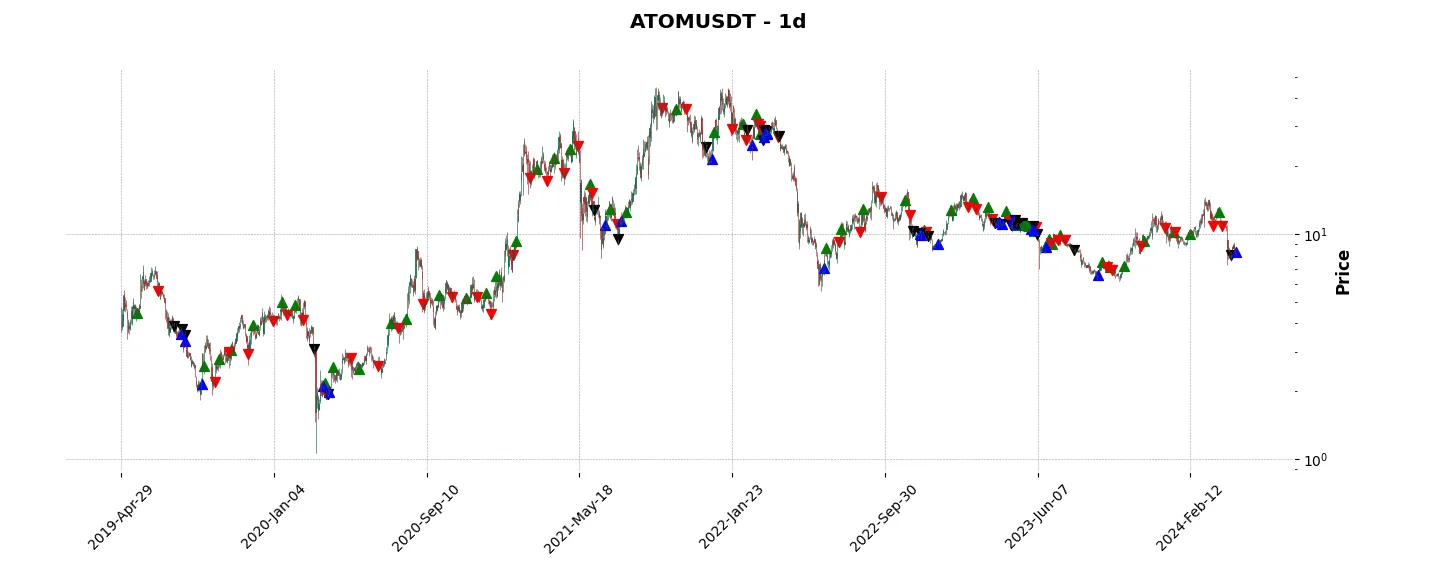

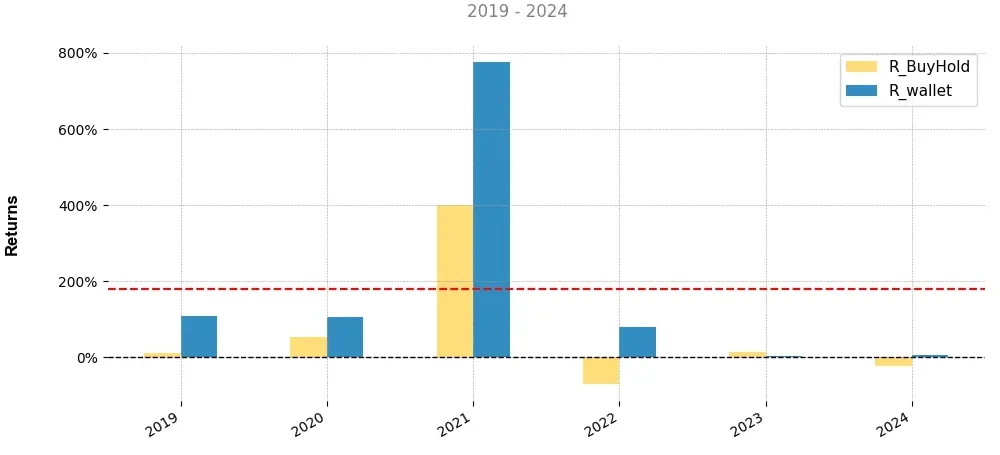

«Top trading strategy Cosmos (ATOM) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy ATOM daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

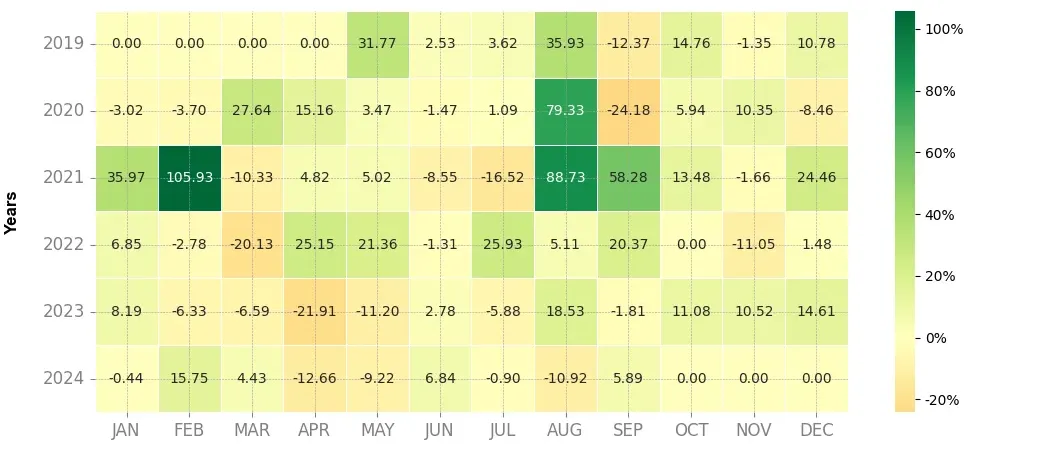

Heatmap of monthly returns

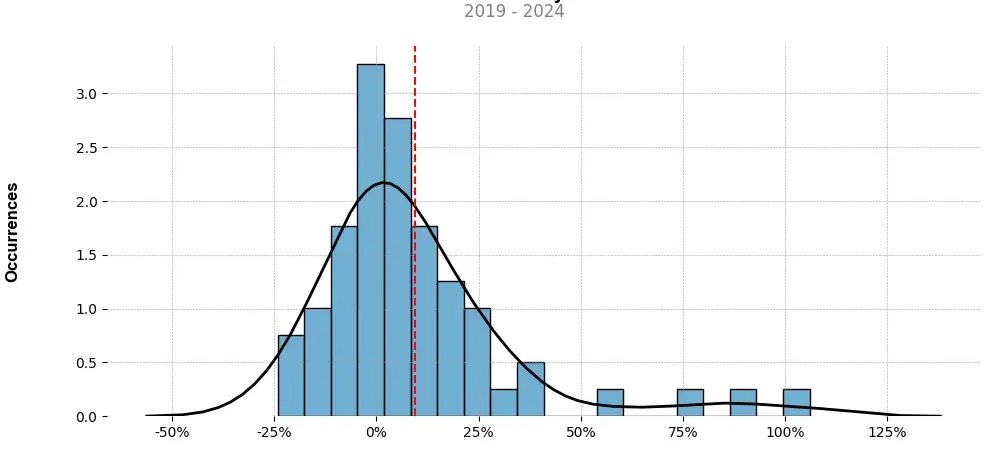

Distribution of the monthly returns of the top strategy

Presentation of ATOM

Cosmos (ATOM) is a cryptocurrency and blockchain platform that aims to create an interconnected network of independent blockchains, known as the “Internet of Blockchains.” This innovative project seeks to solve some of the scalability, interoperability, and usability issues faced by the blockchain industry.

At its core, Cosmos enables different blockchains to communicate and transact with each other through the use of its Inter-Blockchain Communication (IBC) protocol. This protocol establishes a secure and trustless way for different chains to exchange information and value, fostering seamless interaction between disparate blockchain ecosystems.

One of the key features of Cosmos is its ability to scale. By creating a network of interconnected blockchains, it is possible to offload transactions and computational load from the main chain to connected sidechains. This allows for increased throughput and processing capacity, enabling Cosmos to handle a higher volume of transactions compared to traditional standalone blockchains.

Interoperability is another crucial aspect of Cosmos. With its IBC protocol, Cosmos empowers chains to interoperate and share data, assets, and functionalities. This cross-chain compatibility opens up new opportunities for developers and users, as it eliminates the need for centralized intermediaries and enables the creation of decentralized applications (DApps) that can leverage multiple blockchain ecosystems simultaneously.

In terms of user experience, Cosmos focuses on usability and accessibility. Its interface, known as the Cosmos Software Development Kit (SDK), provides developers with the necessary tools and resources to build their own blockchain applications, reducing the barriers to entry and fostering innovation within the Cosmos ecosystem. At the same time, end-users can access various applications and services built on Cosmos, benefiting from a user-friendly and robust environment.

From a governance perspective, Cosmos utilizes a decentralized governance model. The project emphasizes community participation, allowing token holders to propose and vote on changes or upgrades to the network. This inclusive governance mechanism empowers the community to collectively make decisions and shape the future of Cosmos.

Overall, Cosmos (ATOM) crypto addresses several critical issues faced by the blockchain industry, including scalability, interoperability, and usability. Through its interconnected network of blockchains, it enables seamless communication and interaction between different blockchain ecosystems, empowering developers and users to create and access decentralized applications. With its focus on scalability, user experience, and decentralized governance, Cosmos stands as a prominent project in the crypto space, with the potential to shape the future of blockchain technology.

Strategy details

«Top trading strategy ATOM daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘cosmos-ecosystem’, ‘content-creation’, ‘interoperability’, ‘polychain-capital-portfolio’, ‘dragonfly-capital-portfolio’, ‘hashkey-capital-portfolio’, ‘1confirmation-portfolio’, ‘paradigm-portfolio’, ‘exnetwork-capital-portfolio’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)