Last update: 25-10-2024 12:00 UTC

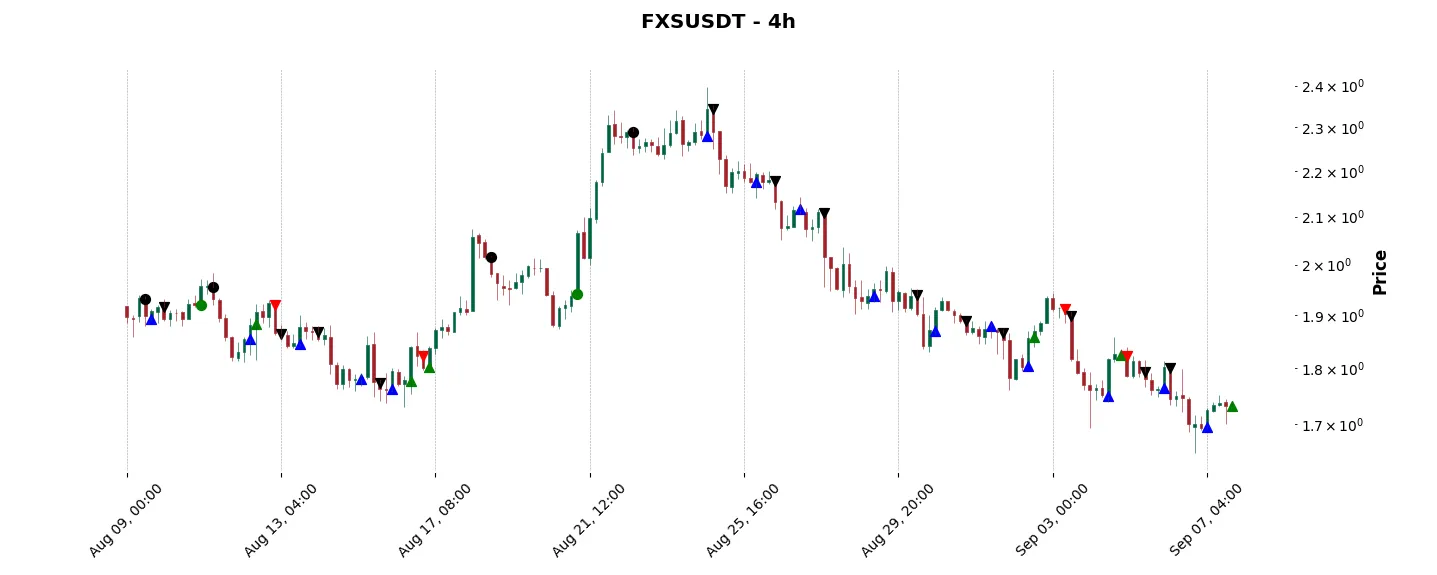

Top trading strategy Frax Share (FXS) 4H – Live position:

- Short in progress

- Entry price : 1.965 $

- Pnl : -0.92 %

Trade history

Over 6 months

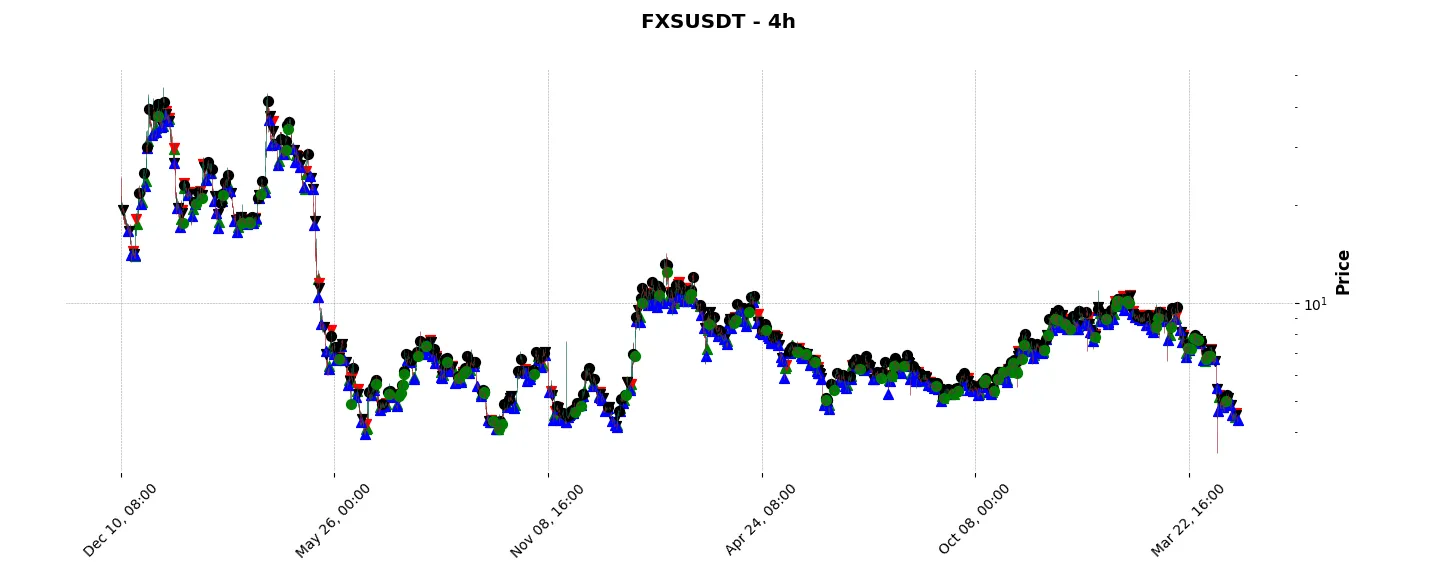

Complete

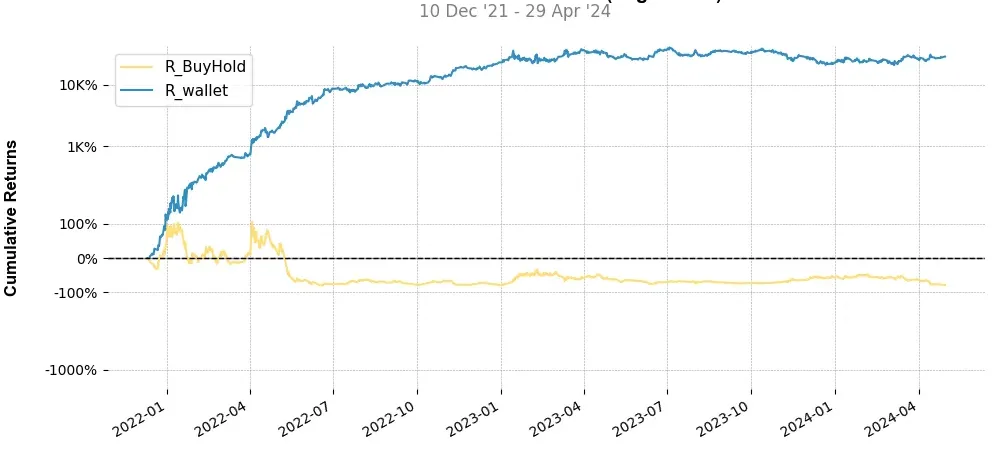

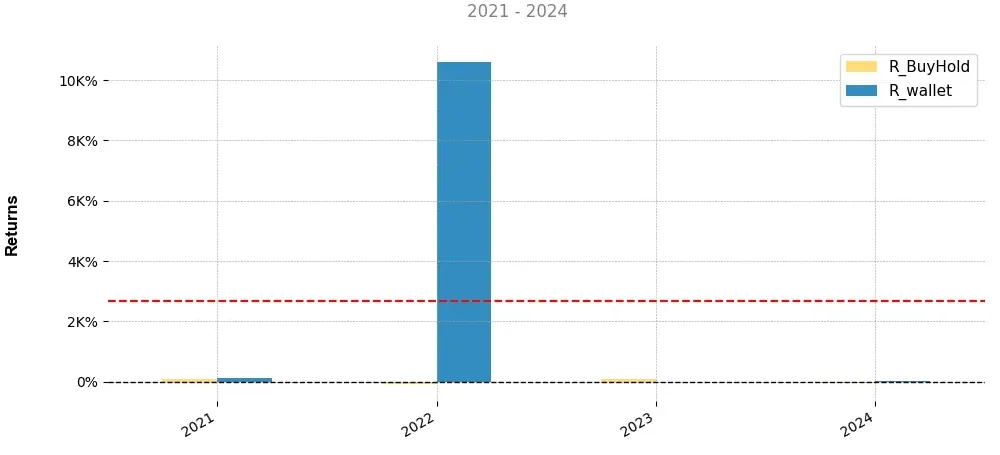

«Top trading strategy Frax Share (FXS) 4H» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy FXS 4H». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

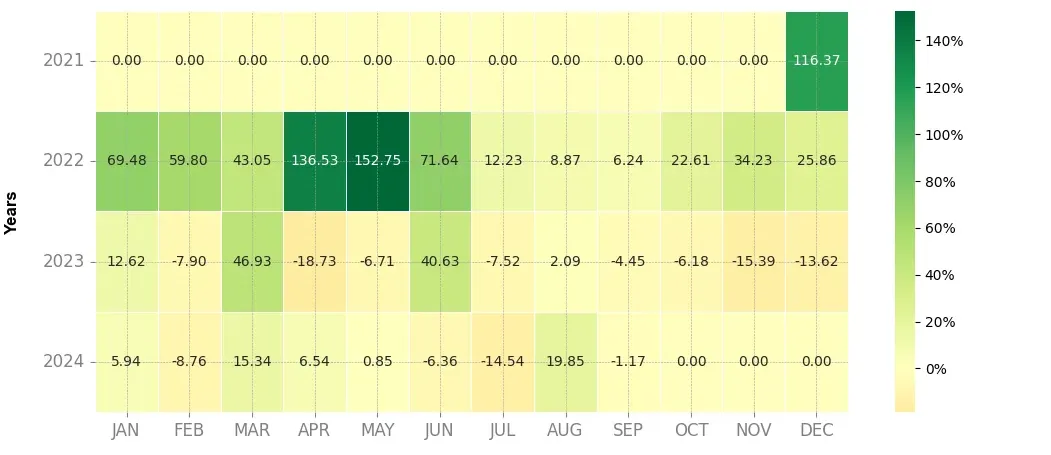

Heatmap of monthly returns

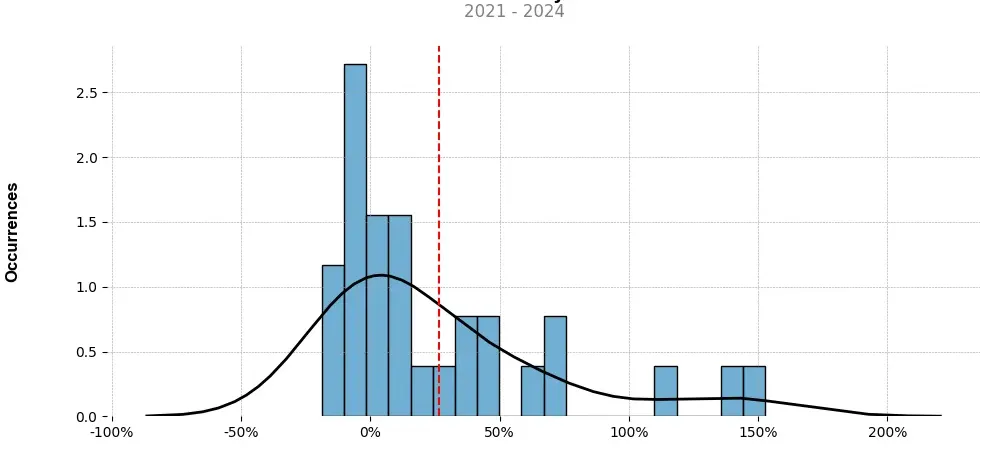

Distribution of the monthly returns of the top strategy

Presentation of FXS

Frax Share (FXS) is a cryptocurrency token that operates within the Frax Protocol ecosystem. The Frax Protocol is a decentralized stablecoin protocol that aims to create a stable, scalable, and decentralized digital currency. FXS plays a vital role within this ecosystem, and its value proposition lies in its ability to stabilize the Frax stablecoin, known as FRAX.

FRAX, the stablecoin created by the Frax Protocol, is designed to maintain a 1:1 ratio with the US dollar. However, to achieve this stability, the protocol utilizes a two-token model, consisting of Frax and Frax Share. This approach differentiates Frax from many other stablecoins in the market.

Frax Share (FXS) serves as the governance and seigniorage token within the Frax ecosystem. Seigniorage refers to the profit generated by the ability to mint a currency at a lower cost than its face value. In the case of Frax, when the demand for FRAX exceeds its 1:1 peg with the US dollar, new FRAX tokens are minted and sold on secondary markets to ensure stability. The generated revenue, or seigniorage, is used to buy back FXS tokens from the market, effectively reducing their supply and potentially increasing their value.

FXS holders have governance rights within the Frax Protocol, allowing them to propose and vote on changes to the protocol’s parameters. This community-driven governance model ensures decentralization and allows FXS holders to shape the direction of the Frax ecosystem. This democratic approach distinguishes Frax Share from stablecoins that lack such governance capabilities.

Furthermore, FXS provides incentives for token holders through features like staking and rewards. Users can stake FXS to earn additional tokens and actively participate in the protocol’s decision-making processes. By offering these incentives, Frax Share encourages token holders to actively engage with and contribute to the stability and governance of the Frax ecosystem.

In conclusion, Frax Share (FXS) plays a critical role within the Frax Protocol ecosystem as the governance and seigniorage token. Its unique design enables the stabilization of FRAX, the stablecoin within the ecosystem, while providing holders with governance rights, stake-based rewards, and community-driven decision-making capabilities. As the Frax Protocol continues to evolve, FXS remains an essential element in maintaining stability, decentralization, and long-term sustainability for the Frax ecosystem.

Strategy details

«Top trading strategy FXS 4H» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘defi’, ‘seigniorage’, ‘avalanche-ecosystem’, ‘exnetwork-capital-portfolio’, ‘olympus-pro-ecosystem’, ‘arbitrum-ecosytem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)