Last update: 02-09-2024

Top trading strategy Chainlink (LINK) Weekly – Live position:

- Long in progress

- Entry price : 14.941 $

- Pnl : -31.0 %

Trade history

Over 6 months

Complete

«Top trading strategy Chainlink (LINK) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy LINK Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

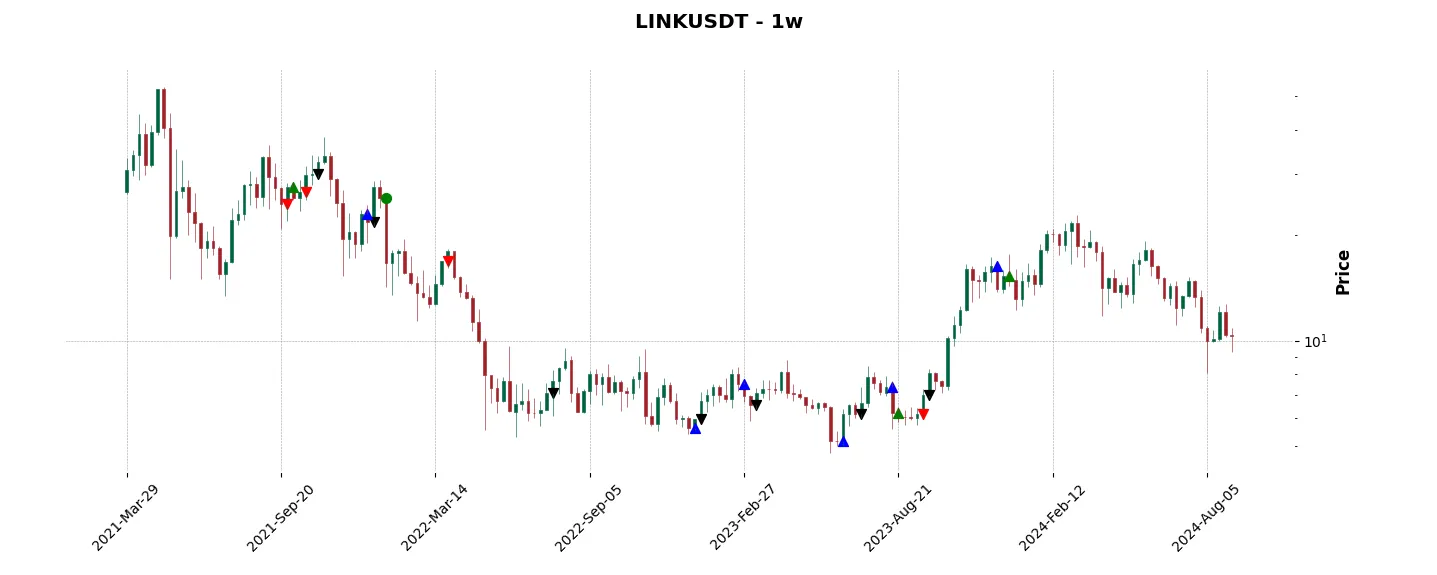

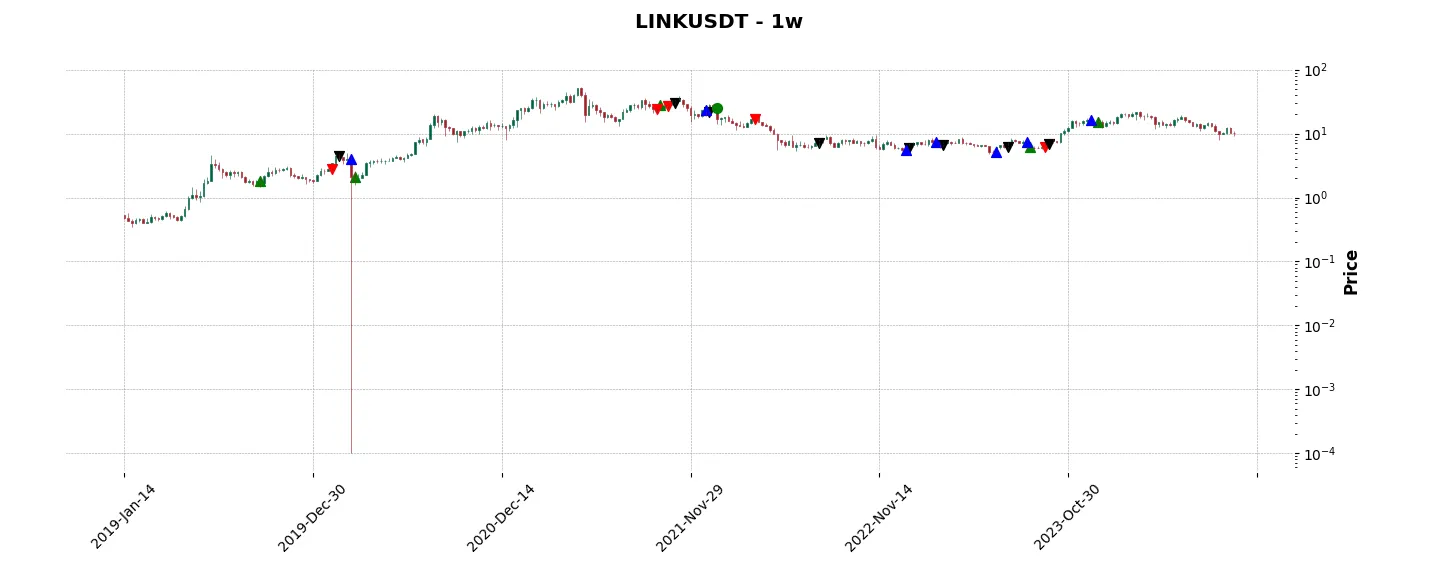

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

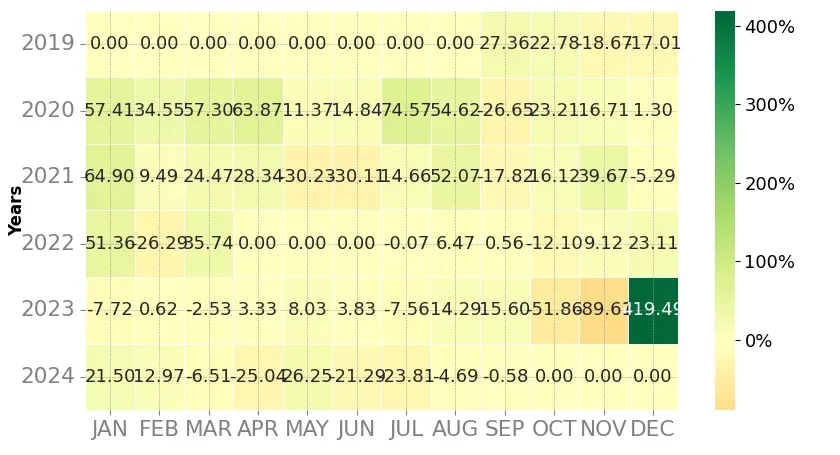

Heatmap of monthly returns

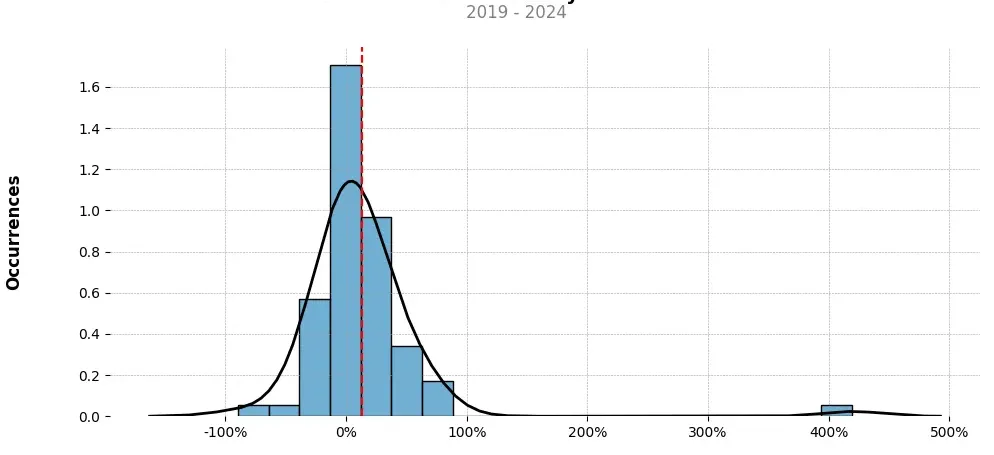

Distribution of the monthly returns of the top strategy

Presentation of LINK

Chainlink (LINK) is a decentralized oracle network that aims to bridge the gap between blockchain-based smart contracts and real-world data. Synthesizing various concepts, Chainlink brings reliability, security, and decentralization to the process of connecting smart contracts with off-chain data sources, APIs, and traditional financial systems.

One fundamental challenge in designing smart contracts is their inability to access real-time data from external sources without an intermediary. Traditional oracles, acting as intermediaries, often introduce a centralized point of failure, compromising the trustless nature of blockchain-based systems. Here is where Chainlink comes in, redefining the oracle landscape.

Chainlink operates on a decentralized network of oracles, ensuring that data input to smart contracts can be verified and trusted by multiple independent nodes. This approach enhances the reliability and security of smart contracts, as it prevents single points of failure and malicious data manipulation. Each oracle within the Chainlink network is incentivized to provide accurate data through a reputation system, promoting reliability and trust among all participants.

The protocol’s versatility allows developers to create custom-built oracle solutions for their specific use cases. Chainlink is designed to enable interactions with widely used APIs, payment systems, backend systems, and databases. This allows smart contracts to seamlessly access and use real-world data, extending their functionality beyond the blockchain while maintaining transparency and immutability.

The native cryptocurrency of the Chainlink ecosystem is LINK, which plays a vital role within the network. LINK tokens are used as a medium of exchange between users who request data and the oracle providers who supply it. Additionally, LINK tokens can be staked as collateral, ensuring the correct execution of smart contracts and incentivizing oracles to perform their tasks honestly.

By connecting blockchain-based applications with the outside world in a secure, reliable, and decentralized manner, Chainlink opens up new possibilities for the development of smart contracts across various industries. Applications range from Decentralized Finance (DeFi), decentralized gaming, supply chain management, insurance, prediction markets, and more. The versatility and robustness of the Chainlink network make it an essential component for the continued growth and adoption of blockchain technology.

In summary, Chainlink (LINK) is a decentralized oracle network that revolutionizes the integration of blockchain-based smart contracts with real-world data. By providing reliable, secure, and decentralized connections between these two realms, Chainlink enhances the trustworthiness, transparency, and functionality of smart contracts. With its native cryptocurrency, LINK, and its ability to support various use cases, Chainlink plays a crucial role in unlocking the full potential of blockchain technology across multiple industries.

Strategy details

«Top trading strategy LINK Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘defi’, ‘oracles’, ‘smart-contracts’, ‘substrate’, ‘polkadot’, ‘polkadot-ecosystem’, ‘avalanche-ecosystem’, ‘solana-ecosystem’, ‘framework-ventures-portfolio’, ‘polygon-ecosystem’, ‘fantom-ecosystem’, ‘cardano-ecosystem’, ‘web3’, ‘near-protocol-ecosystem’, ‘arbitrum-ecosytem’, ‘cardano’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)