Last update: 02-09-2024

Top trading strategy Solana (SOL) Weekly – Live position:

- No position

Trade history

Over 6 months

Complete

«Top trading strategy Solana (SOL) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy SOL Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

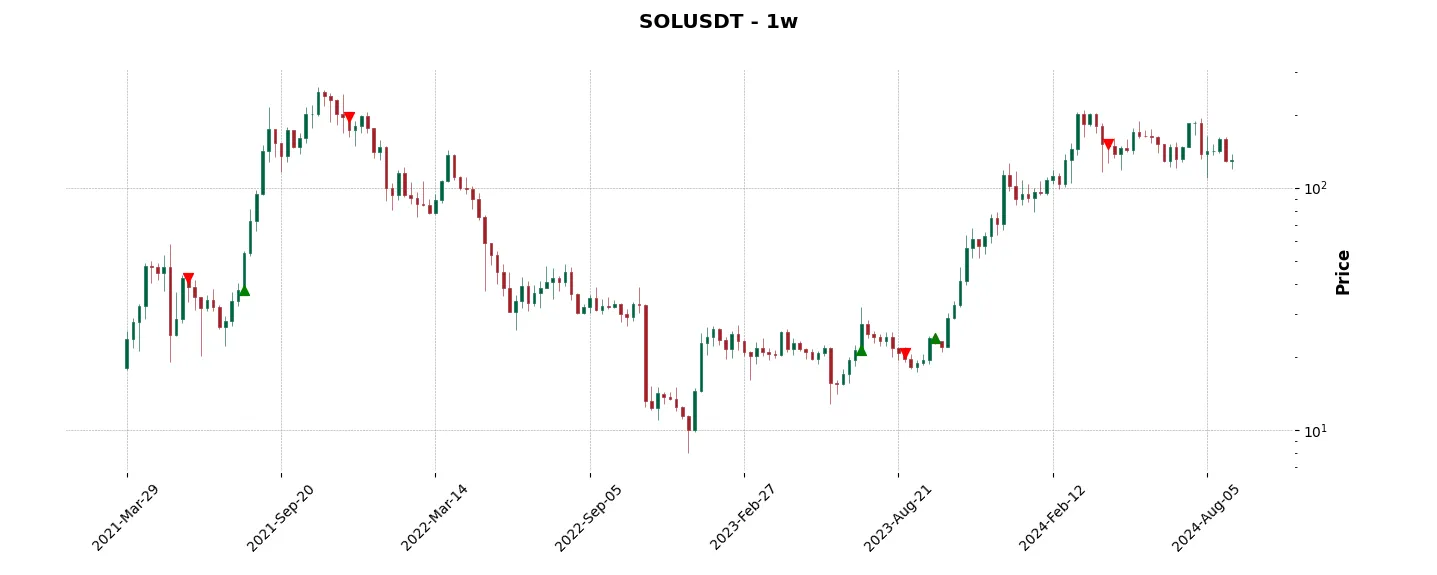

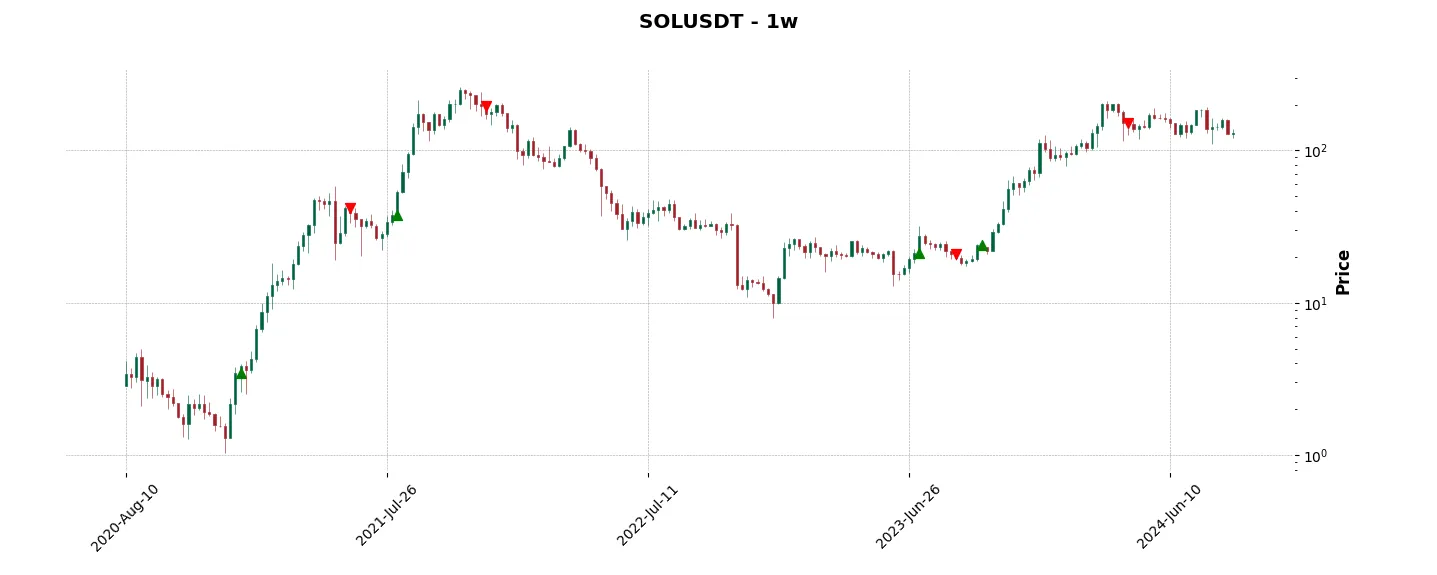

Historical comparison of cumulative returns with Buy & Hold

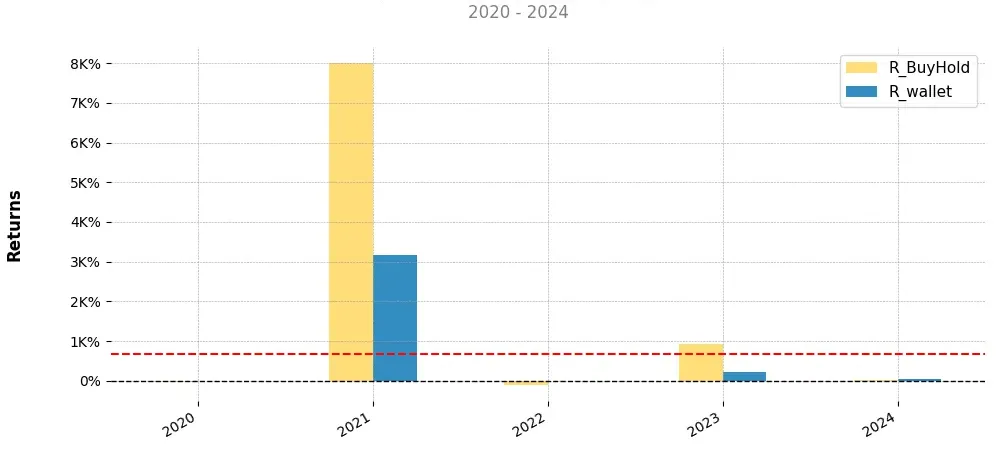

Annual comparison of cumulative returns with Buy & Holds

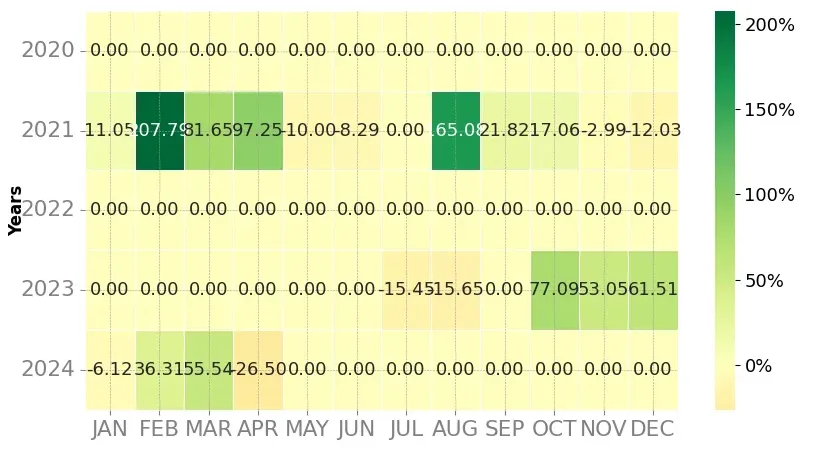

Heatmap of monthly returns

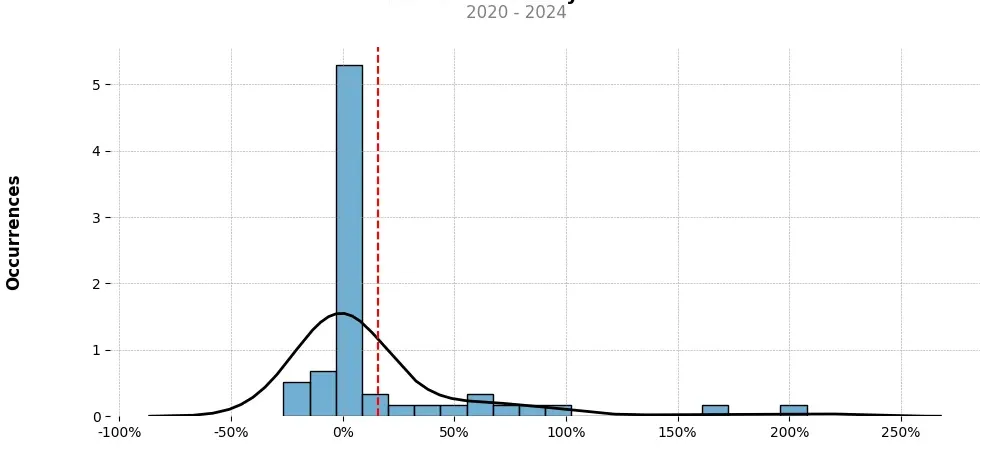

Distribution of the monthly returns of the top strategy

Presentation of SOL

Solana (SOL) is a revolutionary cryptocurrency that aims to overcome the scalability challenges faced by other blockchain networks. Launched in March 2020, Solana is designed to process thousands of transactions per second, making it one of the fastest blockchain networks in the world.

One of the key features of Solana is its unique consensus mechanism called Proof of History (PoH). PoH timestamps every transaction, creating a historical record that facilitates faster transaction verifications and improves network scalability. By combining PoH with the traditional Proof of Stake (PoS) consensus mechanism, Solana ensures high throughput, low transaction fees, and quick settlement times.

Another notable feature of Solana is its smart contract platform. It is based on the Ethereum Virtual Machine (EVM), allowing developers to easily deploy and execute smart contracts on the network. This compatibility with EVM opens up a wide range of possibilities for decentralized applications (DApps) and developers looking to migrate from Ethereum.

Solana’s ecosystem is backed by notable investors and industry leaders, including prominent venture capital firms and cryptocurrency exchanges. This support has helped drive adoption and awareness of Solana, attracting developers and projects to build on its blockchain.

Furthermore, Solana has gained popularity for its vibrant and growing community. Active participation from community members, developers, and validators contribute to the network’s security and ongoing development. The community organizes events, hackathons, and initiatives that further enhance the ecosystem and foster collaboration.

The SOL token serves multiple purposes within the Solana network. It functions as the native cryptocurrency, used for staking, participating in governance decisions, and paying for transaction fees. SOL holders can also benefit from the network’s inflationary rewards by staking their tokens.

In conclusion, Solana (SOL) is a promising cryptocurrency that addresses the scalability issues faced by other blockchain networks. Its innovative consensus mechanism, fast transaction processing, and compatibility with the Ethereum ecosystem have positioned it as a formidable contender in the cryptocurrency space. With a strong community, growing adoption, and support from industry leaders, Solana has the potential to revolutionize decentralized applications and potentially become a major player in the overall blockchain industry.

Strategy details

«Top trading strategy SOL Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘pos’, ‘platform’, ‘solana-ecosystem’, ‘cms-holdings-portfolio’, ‘kenetic-capital-portfolio’, ‘alameda-research-portfolio’, ‘multicoin-capital-portfolio’, ‘okex-blockdream-ventures-portfolio’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)