Last update: 02-09-2024

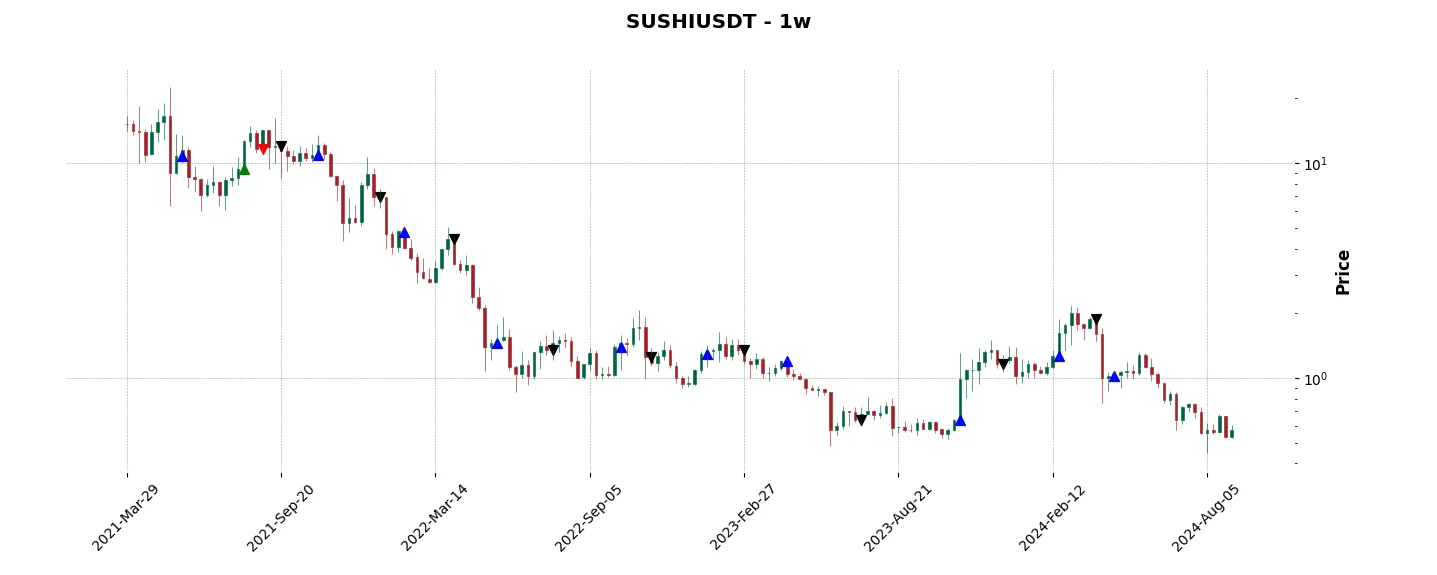

Top trading strategy SushiSwap (SUSHI) Weekly – Live position:

- No position

Trade history

Over 6 months

Complete

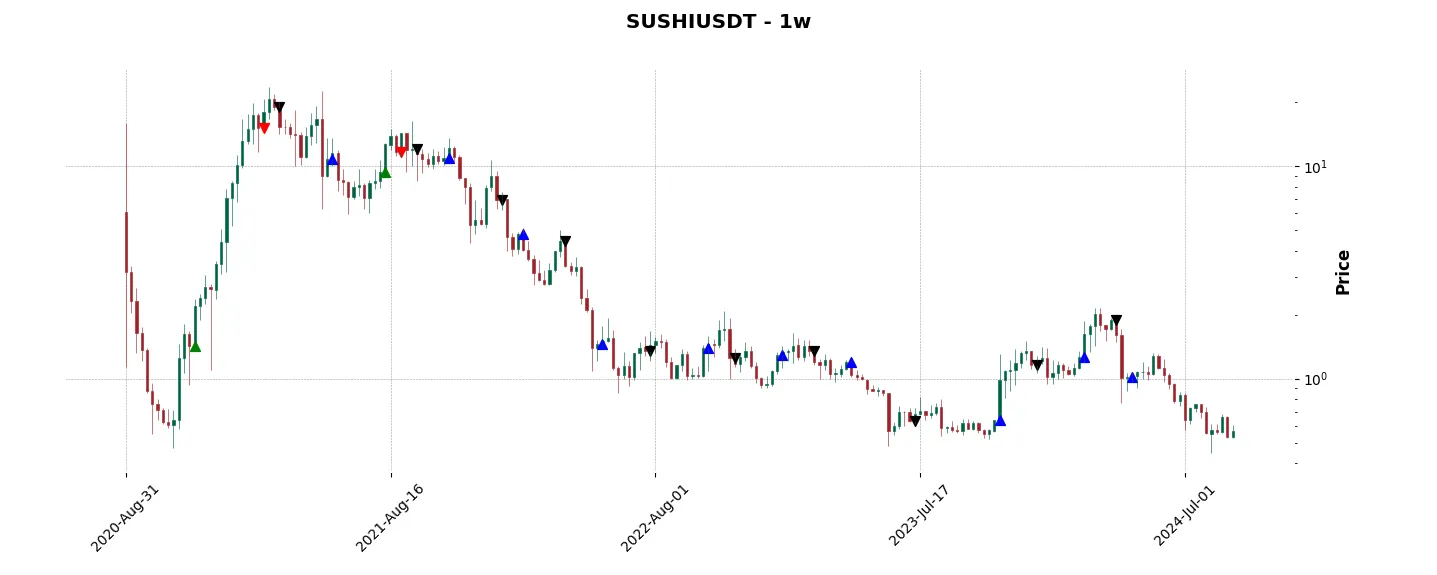

«Top trading strategy SushiSwap (SUSHI) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy SUSHI Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

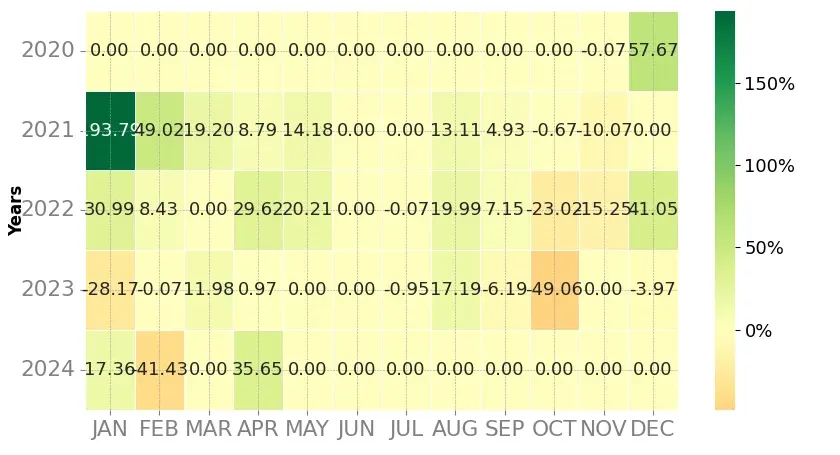

Heatmap of monthly returns

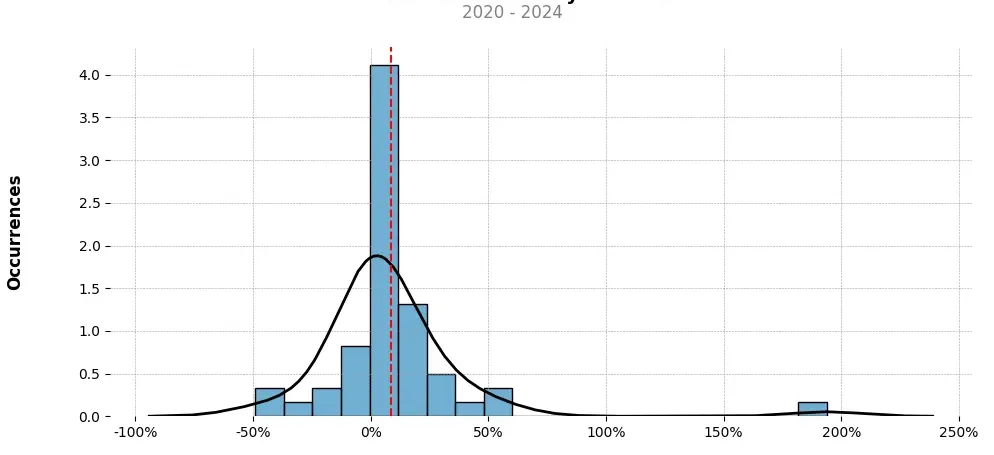

Distribution of the monthly returns of the top strategy

Presentation of SUSHI

SushiSwap is a decentralized cryptocurrency exchange protocol that operates on the Ethereum blockchain. It was created as a fork of Uniswap, another popular decentralized exchange protocol, by an anonymous developer known as “Chef Nomi” in August 2020. The aim of SushiSwap was to provide users with an enhanced version of Uniswap, offering additional features and incentives to attract liquidity providers.

The SushiSwap protocol functions on a concept of automated market making (AMM), where liquidity is provided by users through their cryptocurrency holdings. These funds are locked in smart contracts, allowing users to trade without relying on traditional intermediaries. In return for providing liquidity, users receive SUSHI tokens, which play a crucial role in the SushiSwap ecosystem.

One of the key features of SushiSwap is yield farming, also known as liquidity mining. Users can stake their SUSHI tokens or other supported cryptocurrencies into liquidity pools, earning rewards in the form of additional SUSHI tokens. These incentives encourage users to contribute liquidity to the platform, leading to increased trading volume and overall development of the SushiSwap ecosystem.

Another notable feature of SushiSwap is the concept of “Onsen,” which provides boosted rewards for liquidity providers in particular pools. Onsen allows liquidity providers to earn additional tokens for a specified period, helping to attract liquidity to specific pairs and increase overall trading activity.

Furthermore, SushiSwap introduced a governance system, giving SUSHI token holders the ability to propose and vote on changes to the protocol. This allows the community to influence the direction and development of SushiSwap, making it a more decentralized and community-driven platform.

While SushiSwap gained popularity for its incentivized liquidity provision and yield farming opportunities, it also encountered controversy shortly after its launch. Chef Nomi, the anonymous creator, initially sold a significant portion of their SUSHI tokens for ETH, causing concerns over their commitment to the project. However, this issue was later resolved when Chef Nomi returned the funds to the SushiSwap development treasury and handed over the project’s control to Sam Bankman-Fried, the founder of FTX exchange.

Overall, SushiSwap has established itself as a prominent player in the decentralized finance (DeFi) space, offering users a unique and incentivized way to trade and provide liquidity. With its emphasis on community governance and various rewarding mechanisms, SushiSwap continues to evolve and attract users looking for decentralized and innovative financial solutions.

Strategy details

«Top trading strategy SUSHI Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘collectibles-nfts’, ‘decentralized-exchange-dex-token’, ‘defi’, ‘dao’, ‘yield-farming’, ‘amm’, ‘yearn-partnerships’, ‘governance’, ‘avalanche-ecosystem’, ‘metaverse’, ‘blockchain-capital-portfolio’, ‘defiance-capital-portfolio’, ‘alameda-research-portfolio’, ‘pantera-capital-portfolio’, ‘polygon-ecosystem’, ‘fantom-ecosystem’, ‘arbitrum-ecosytem’, ‘harmony-ecosystem’, ‘injective-ecosystem’, ‘bnb-chain’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)