Last update: 02-09-2024

Top trading strategy Avalanche (AVAX) Weekly – Live position:

- Close long

- Entry price : 22.91 $

- Pnl : 0.0 %

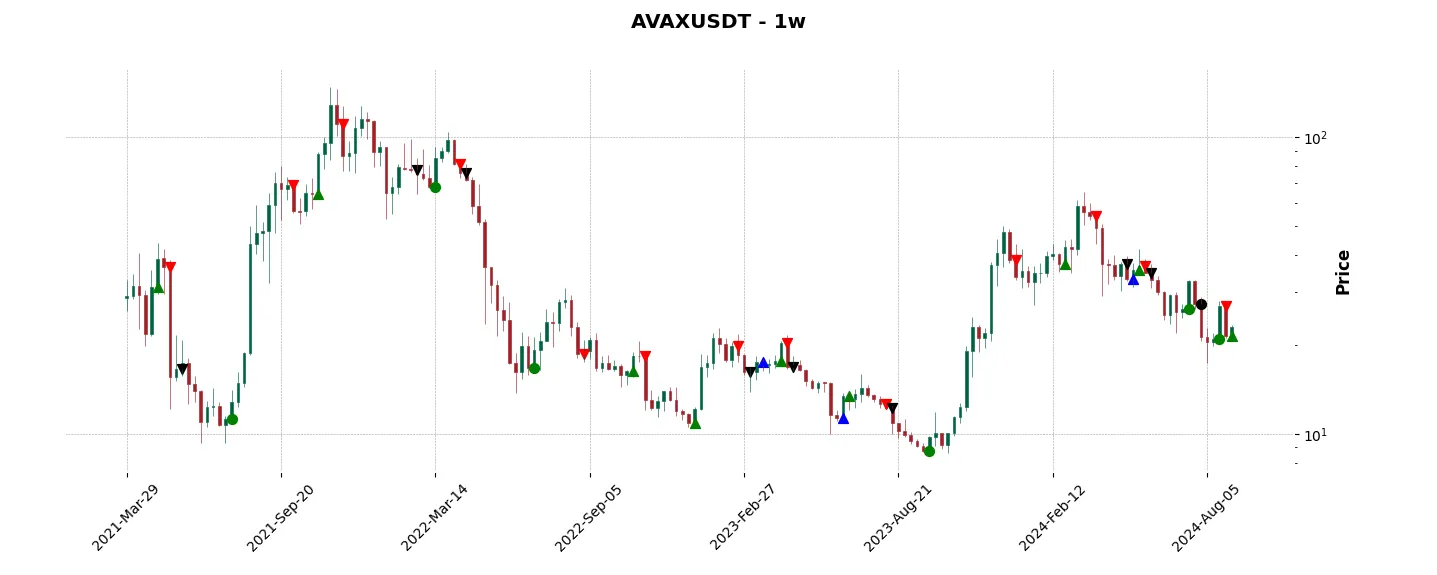

Trade history

Over 6 months

Complete

«Top trading strategy Avalanche (AVAX) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy AVAX Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

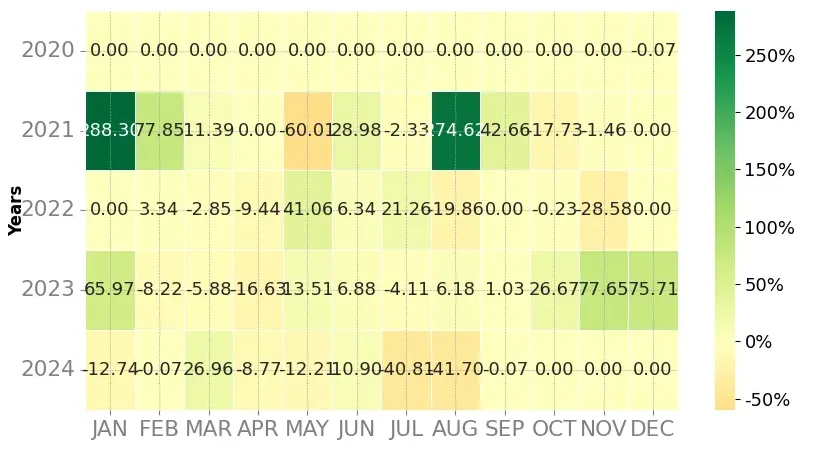

Heatmap of monthly returns

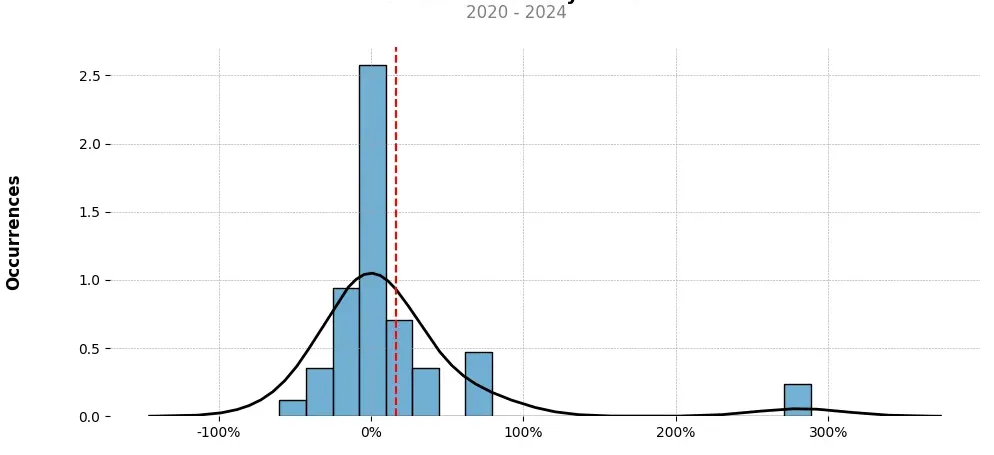

Distribution of the monthly returns of the top strategy

Presentation of AVAX

Avalanche (AVAX) is a decentralized cryptocurrency that operates on a cutting-edge blockchain platform designed to provide scalable, fast, and secure transactions. It was created by Ava Labs, a team that sought to address some of the limitations faced by other blockchain networks, such as slow transaction speeds, high fees, and scalability issues.

AVAX aims to provide a scalable infrastructure for the decentralized finance (DeFi) ecosystem and enable the creation of highly customizable blockchain networks for various applications. The platform utilizes a unique consensus protocol called Avalanche, which is a leaderless, Byzantine fault tolerant (BFT) consensus mechanism.

The Avalanche consensus protocol allows the network to achieve high throughput and low latency, making it suitable for handling a large number of transactions. This efficiency is achieved through the utilization of a system in which network participants reach consensus quickly and independently, without relying on a centralized authority. This innovative approach enables Avalanche to process thousands of transactions per second, rivaling traditional payment systems like Visa and Mastercard.

One of the significant advantages of the Avalanche platform is its ability to support smart contracts, enabling the creation of decentralized applications (dApps). These smart contracts execute automatically when certain predefined conditions are met, eliminating the need for intermediaries and improving efficiency. Developers can leverage the flexibility of Avalanche to build their own dApps for various purposes, including decentralized finance, identity solutions, supply chain management, and more.

The AVAX token serves as the native currency of the Avalanche ecosystem, allowing users to pay for transaction fees, staking, and participating in governance decisions. Staking AVAX provides users the opportunity to validate transactions, secure the network, and earn rewards in the form of additional AVAX tokens. This incentivizes participation and contributes to the overall stability and security of the network.

Moreover, Avalanche places a strong emphasis on security. The platform implements several measures to protect user funds and assets, including high levels of encryption, regular audits, and anonymous transactions. These security measures aim to mitigate the risks associated with centralized intermediaries and enhance user trust in the network.

In conclusion, Avalanche (AVAX) is a decentralized cryptocurrency built on an innovative blockchain platform that seeks to address the scalability, speed, and security concerns of existing networks. With its Avalanche consensus protocol, AVAX provides a highly efficient and scalable infrastructure, enabling the creation of decentralized applications across various sectors. By combining technological advancements with security features, Avalanche aims to revolutionize the blockchain industry and empower the decentralized finance ecosystem.

Strategy details

«Top trading strategy AVAX Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘defi’, ‘smart-contracts’, ‘three-arrows-capital-portfolio’, ‘polychain-capital-portfolio’, ‘avalanche-ecosystem’, ‘cms-holdings-portfolio’, ‘dragonfly-capital-portfolio’, ‘moonriver-ecosystem’, ‘injective-ecosystem’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)