Last update: 02-09-2024

Top trading strategy Streamr (DATA) Weekly – Live position:

- Open short

- Entry price : 0.03351 $

- Pnl : %

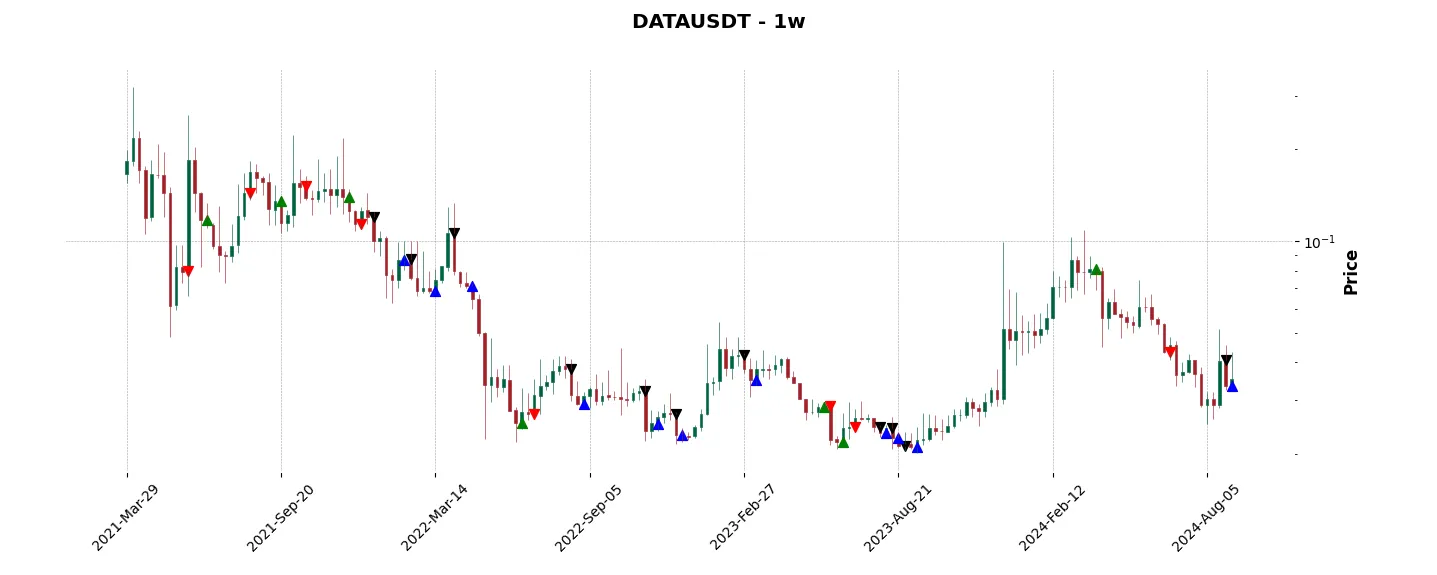

Trade history

Over 6 months

Complete

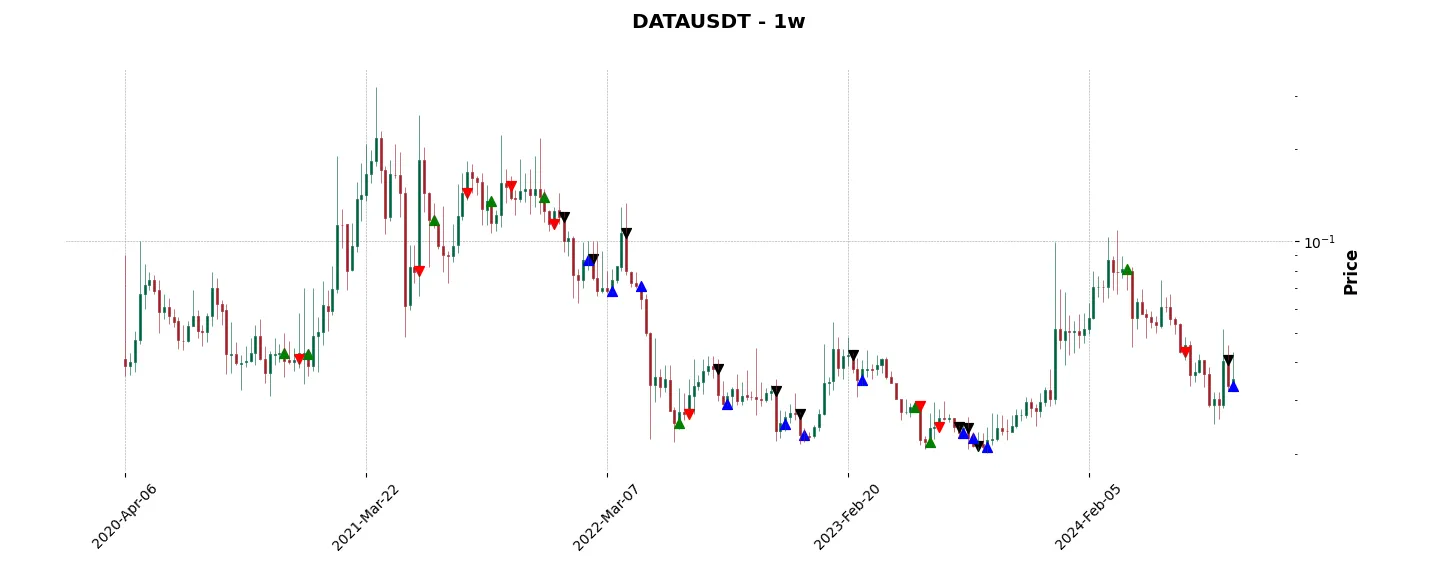

«Top trading strategy Streamr (DATA) Weekly» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy DATA Weekly». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

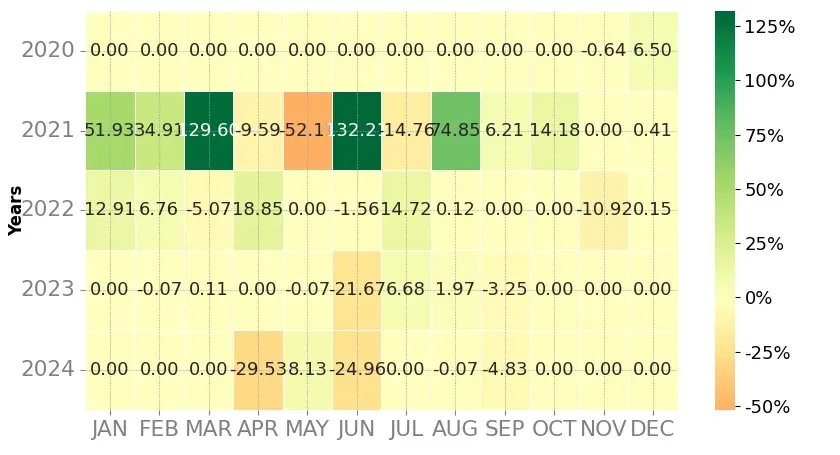

Heatmap of monthly returns

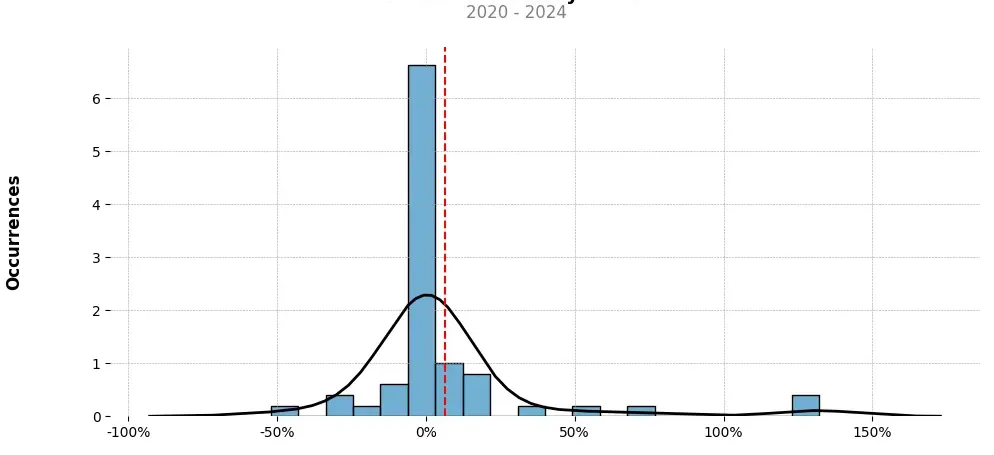

Distribution of the monthly returns of the top strategy

Presentation of DATA

Streamr (DATA) is a cryptocurrency that was created to address the challenges of data ownership, transparency, and monetization in today’s digital world. It aims to provide individuals and organizations with the ability to control and profit from the data they generate.

The concept behind Streamr revolves around the idea that data is a valuable asset, and those who generate it should have control over how it is used. With the proliferation of smart devices and the internet of things (IoT), there has been a massive increase in the amount of data being generated. However, the current infrastructure lacks a proper mechanism to handle this data and ensure its secure and fair utilization.

Streamr acts as a decentralized marketplace for real-time data, where users can buy and sell data streams. By leveraging blockchain technology, Streamr enables a transparent and tamper-proof ecosystem where data providers can directly connect with data consumers, without the need for intermediaries. This eliminates issues related to data privacy and trust, as all transactions and data streams are stored on the blockchain, ensuring transparency and immutability.

Furthermore, Streamr provides users with the ability to create and customize data streams, allowing them to aggregate data from various sources and manipulate it to extract meaningful insights. This empowers individuals and organizations to transform raw data into valuable and actionable information, which can be utilized for various purposes, such as market research, predictive analytics, and AI training.

In terms of monetization, Streamr introduces the concept of “data unions,” which allows individuals to form collective entities and sell their data collectively, rather than individually. This enables individuals with small amounts of data to pool their resources and negotiate better deals with data buyers, thus increasing their earning potential.

Another important aspect of Streamr is its emphasis on data ownership and control. With traditional data platforms, individuals often lose control over their data once it is uploaded or shared. However, with Streamr, data ownership and control remain in the hands of the data creators. They can choose who can access their data and under what conditions, ensuring that their data is used ethically and in a manner that aligns with their interests.

Overall, Streamr (DATA) offers a promising solution to the challenges associated with data ownership, transparency, and monetization. By leveraging blockchain technology and decentralization, Streamr aims to revolutionize the way data is handled, providing individuals and organizations with greater control over their data and the ability to profit from it in a fair and transparent manner.

Strategy details

«Top trading strategy DATA Weekly» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘ai-big-data’, ‘distributed-computing’, ‘filesharing’, ‘iot’, ‘fabric-ventures-portfolio’, ‘web3’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)