Last update: 04-03-2025 00:00 UTC

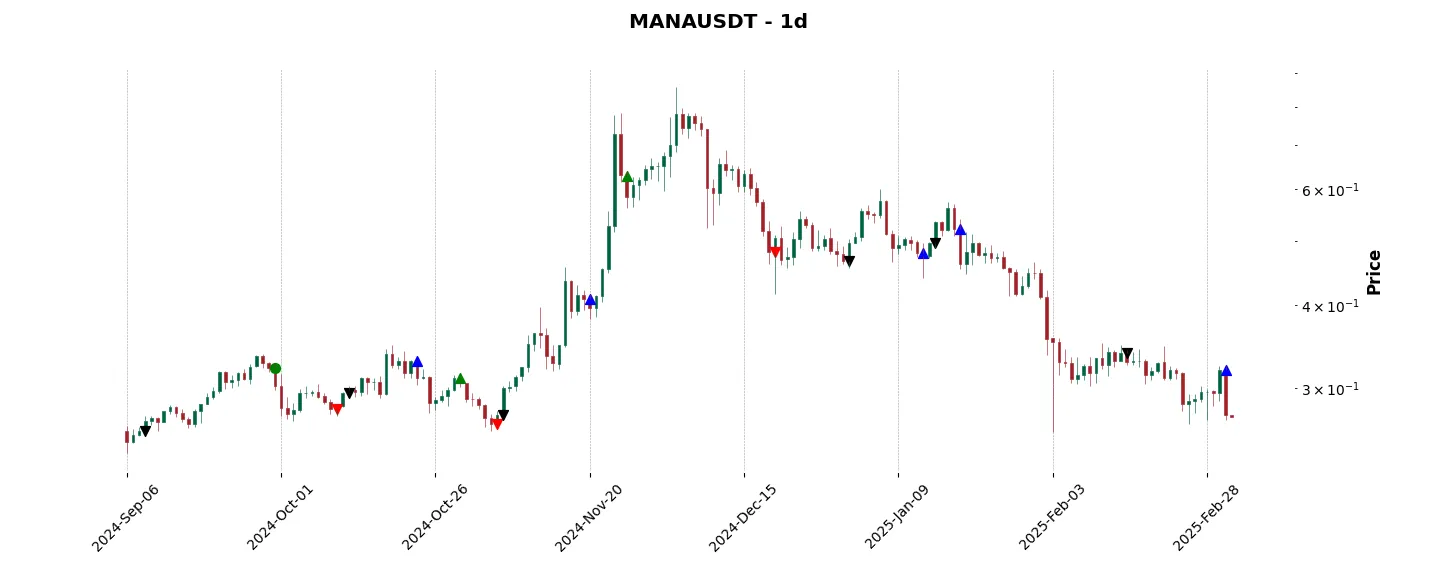

Top trading strategy Decentraland (MANA) daily – Live position:

- Close short

- Entry price : 0.3287 $

- Pnl : 17.07 %

Trade history

Over 6 months

Complete

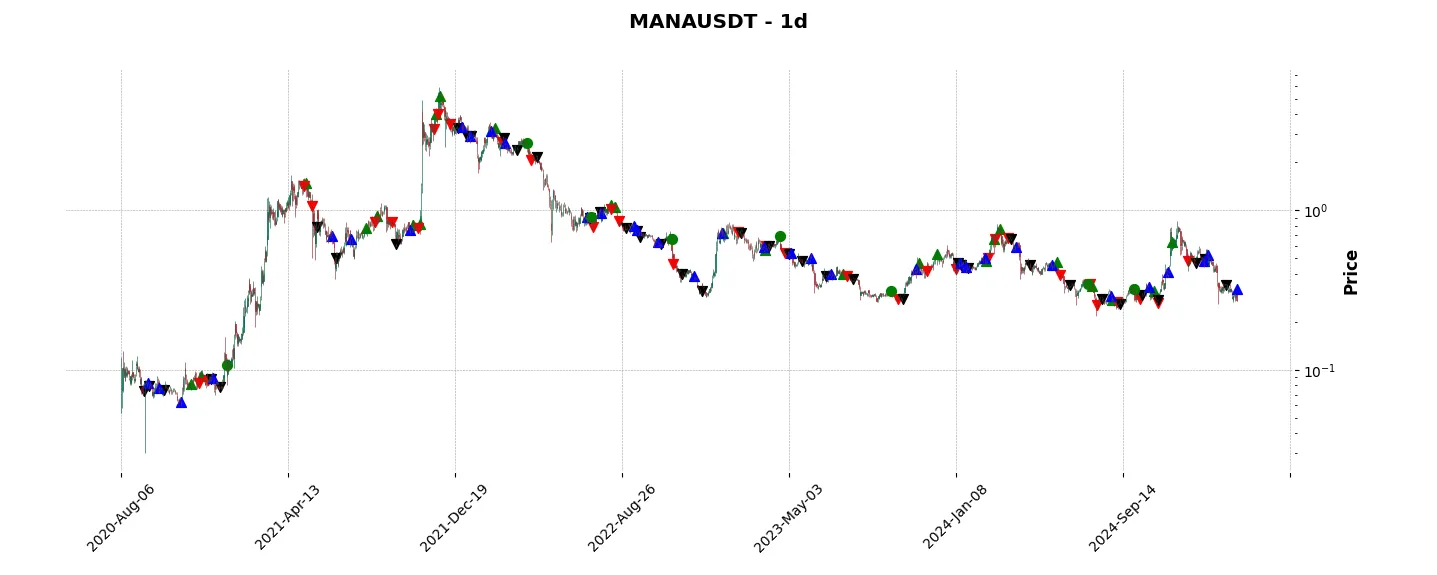

«Top trading strategy Decentraland (MANA) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy MANA daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

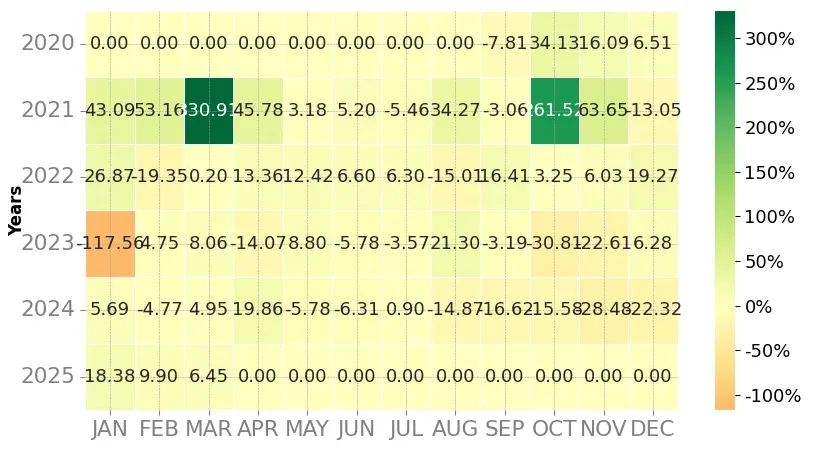

Heatmap of monthly returns

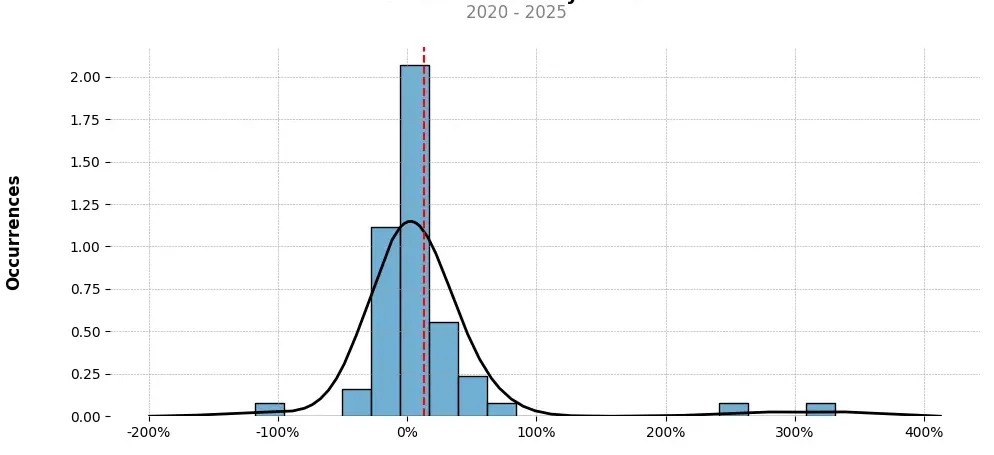

Distribution of the monthly returns of the top strategy

Presentation of MANA

Decentraland (MANA) is a cryptocurrency that aims to create a decentralized virtual world where users can explore, interact, and transact using blockchain technology. The platform combines virtual reality (VR) and blockchain technology to enable a fully immersive and user-driven experience.

One of the main features of Decentraland is its ownership of digital assets represented by non-fungible tokens (NFTs), which are unique and indivisible digital assets. Users can purchase and own virtual land parcels, known as LANDs, within the virtual world. These LANDs can be bought, sold, and developed by users, allowing for the creation of virtual real estate and infrastructure.

The ownership and control over these virtual assets are facilitated by the Ethereum blockchain, ensuring transparency, security, and immutability. Smart contracts are utilized to enforce ownership rights and enable economic transactions within Decentraland. This decentralized nature of the platform provides users with autonomy and control over their digital assets.

Additionally, Decentraland supports the development of interactive and engaging experiences, applications, and games within the virtual world. Users can create and monetize their virtual experiences, attracting visitors and earning revenue through their creations. This encourages a dynamic ecosystem where users can both contribute and benefit from the platform.

The MANA token serves as the native currency of Decentraland, enabling users to purchase virtual assets, participate in auctions, and transact within the platform. MANA can also be staked to support the governance and operational decisions within the Decentraland ecosystem. This mechanism allows token holders to have a say in shaping the platform’s development.

Decentraland has gained significant attention, attracting investors, developers, and users interested in its potential for creating a new digital economy and immersive virtual experiences. Its combination of virtual reality, blockchain technology, and user-driven content creation distinguishes it from traditional centralized virtual worlds. Furthermore, the platform taps into the growing interest in NFTs and their potential as unique digital assets.

As with any emerging technology, there are both opportunities and challenges for Decentraland. While it offers the potential for user-driven creativity, decentralized ownership, and immersive experiences, there are also concerns about scalability, user adoption, and the sustainability of the virtual economy. However, Decentraland’s active community and ongoing development efforts indicate its commitment to address these challenges and evolve the platform.

In summary, Decentraland (MANA) represents a compelling and innovative project aiming to create a decentralized virtual world where users can explore, create, and transact. By combining virtual reality, blockchain technology, and user-driven content creation, Decentraland opens up new possibilities for digital ownership, creativity, and economic opportunities. As the platform continues to evolve, its potential impact on the virtual world and its associated economies remains to be seen.

Strategy details

«Top trading strategy MANA daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘platform’, ‘collectibles-nfts’, ‘gaming’, ‘payments’, ‘metaverse’, ‘boostvc-portfolio’, ‘dcg-portfolio’, ‘fabric-ventures-portfolio’, ‘kenetic-capital-portfolio’, ‘polygon-ecosystem’, ‘play-to-earn’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)