Last update: 04-03-2025 00:00 UTC

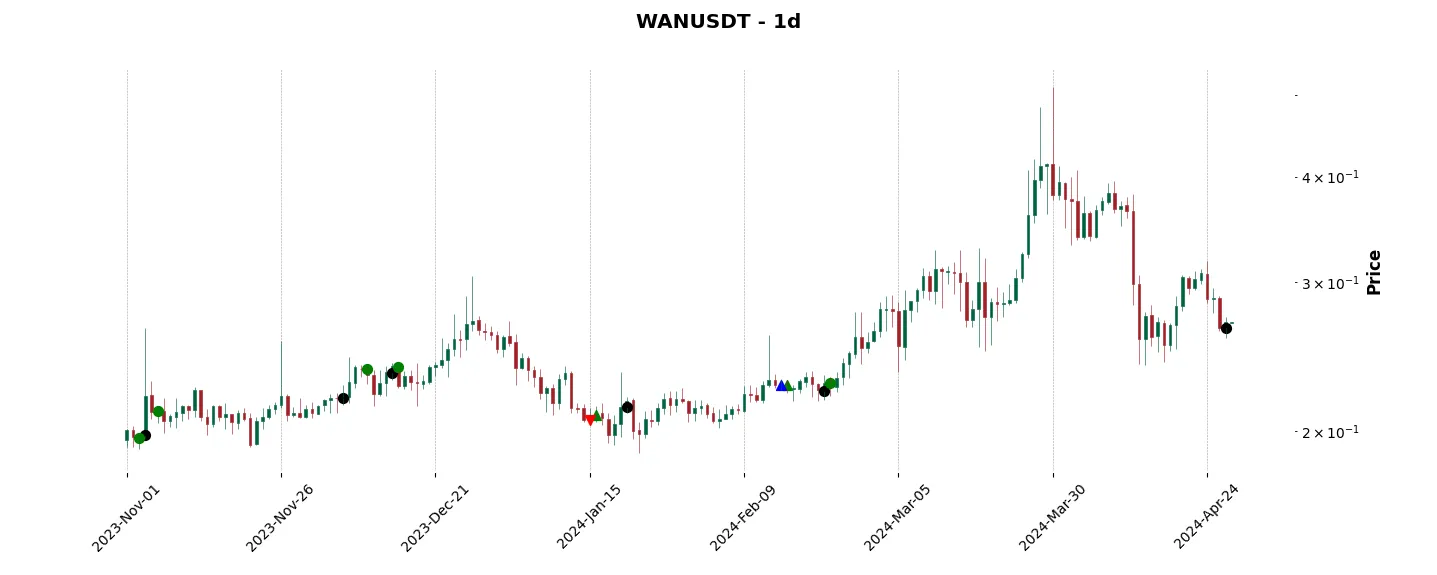

Top trading strategy Wanchain (WAN) daily – Live position:

- Short in progress

- Entry price : 0.2397 $

- Pnl : 49.4 %

Trade history

Over 6 months

Complete

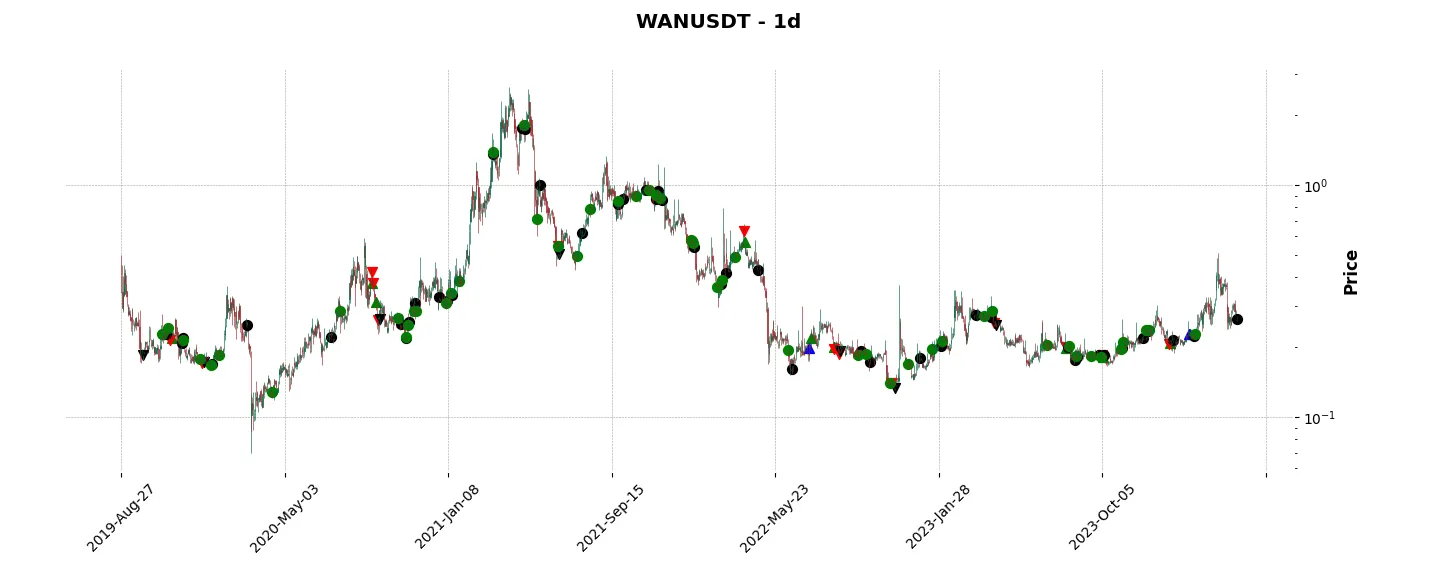

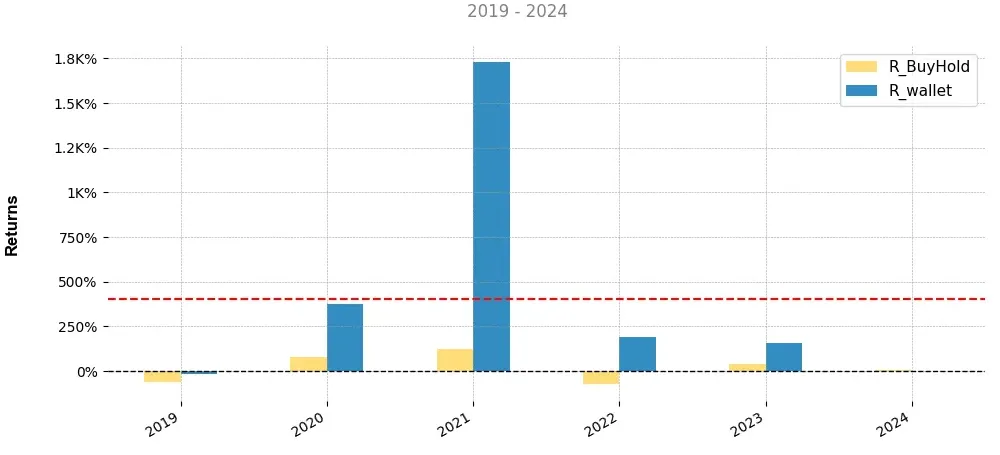

«Top trading strategy Wanchain (WAN) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy WAN daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

Annual comparison of cumulative returns with Buy & Holds

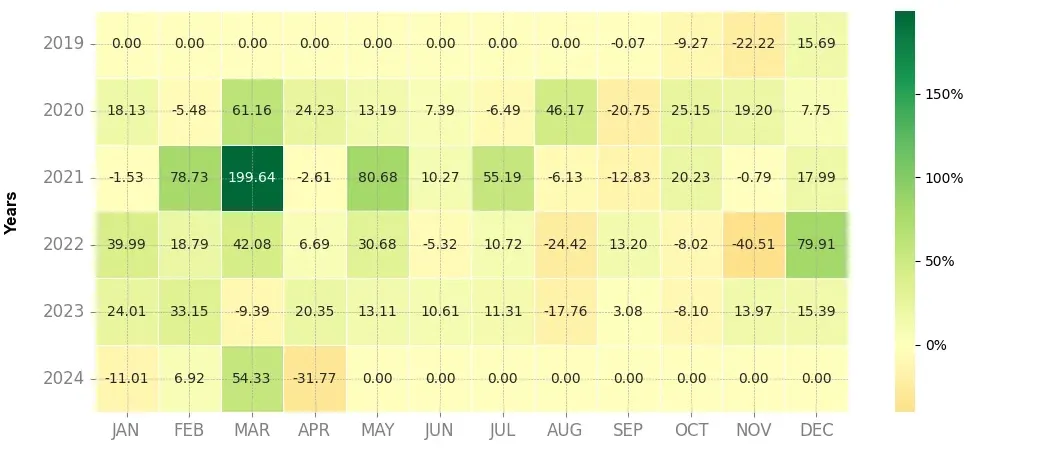

Heatmap of monthly returns

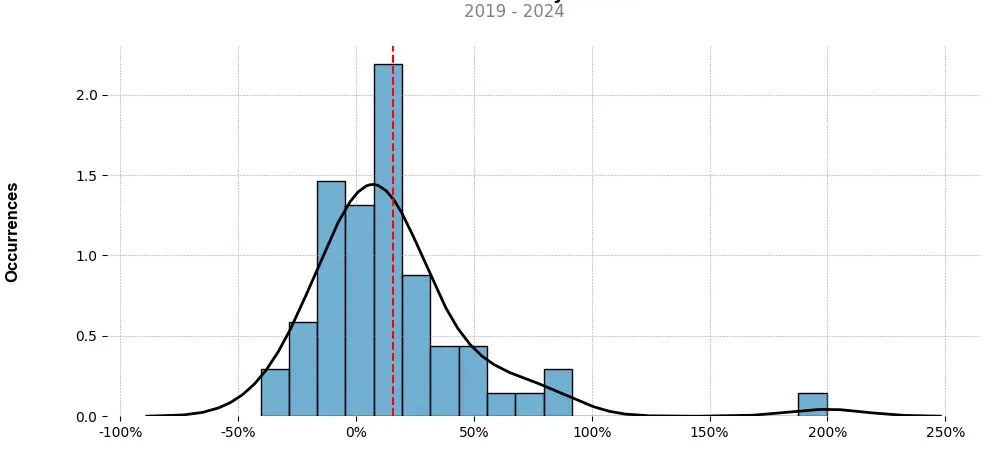

Distribution of the monthly returns of the top strategy

Presentation of WAN

Wanchain (WAN) is a cryptocurrency that aims to bridge the gap between various blockchain networks and enable seamless interoperability between them. Released in 2017, Wanchain has gained traction as a leading solution for connecting different blockchain platforms.

One of the significant challenges facing the blockchain industry is the lack of interoperability. Most cryptocurrencies and blockchain networks operate independently, making it difficult for them to communicate and share data. This isolation restricts the growth of decentralized applications (dApps) and limits the potential of the blockchain ecosystem as a whole.

Wanchain aims to solve this problem by creating a decentralized infrastructure that connects different blockchains. This interoperability is achieved through the use of the Wanchain smart contract platform, which allows for the creation of cross-chain transactions and communication between various networks. By bridging these blockchain platforms, Wanchain enables the seamless transfer of assets and information across different chains.

One of the notable features of Wanchain is its privacy protection capabilities. The platform implements secure multi-party computation (sMPC) and ring signatures to ensure anonymous transactions. This privacy-focused approach offers users the ability to protect their financial information, making it attractive for individuals and organizations concerned about data security.

Additionally, Wanchain provides tools for developers to build decentralized applications on its platform. With Wanchain’s development framework, developers can leverage the interoperability features to create innovative applications that integrate with multiple blockchains simultaneously. This opens up a world of possibilities for dApps, as they can access a broader user base and tap into the unique features of different blockchain platforms.

Wanchain’s native cryptocurrency, WAN, serves as the utility token within the ecosystem. It is used for transaction fees, executing smart contracts, and participating in network governance decisions. With a total supply of 210 million WAN, the cryptocurrency holds value as demand for cross-chain capabilities and privacy protection increases.

In conclusion, Wanchain (WAN) is a prominent cryptocurrency that provides an interoperable infrastructure for blockchain networks. Through its smart contract platform, privacy protection features, and developer tools, Wanchain aims to bridge the gap between different blockchains, unlocking new possibilities for decentralized applications. As the need for connectivity and data security in the blockchain industry continues to grow, Wanchain offers a promising solution for the future of blockchain interoperability.

Strategy details

«Top trading strategy WAN daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘marketplace’, ‘enterprise-solutions’, ‘defi’, ‘interoperability’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)