Last update: 25-12-2024 00:00 UTC

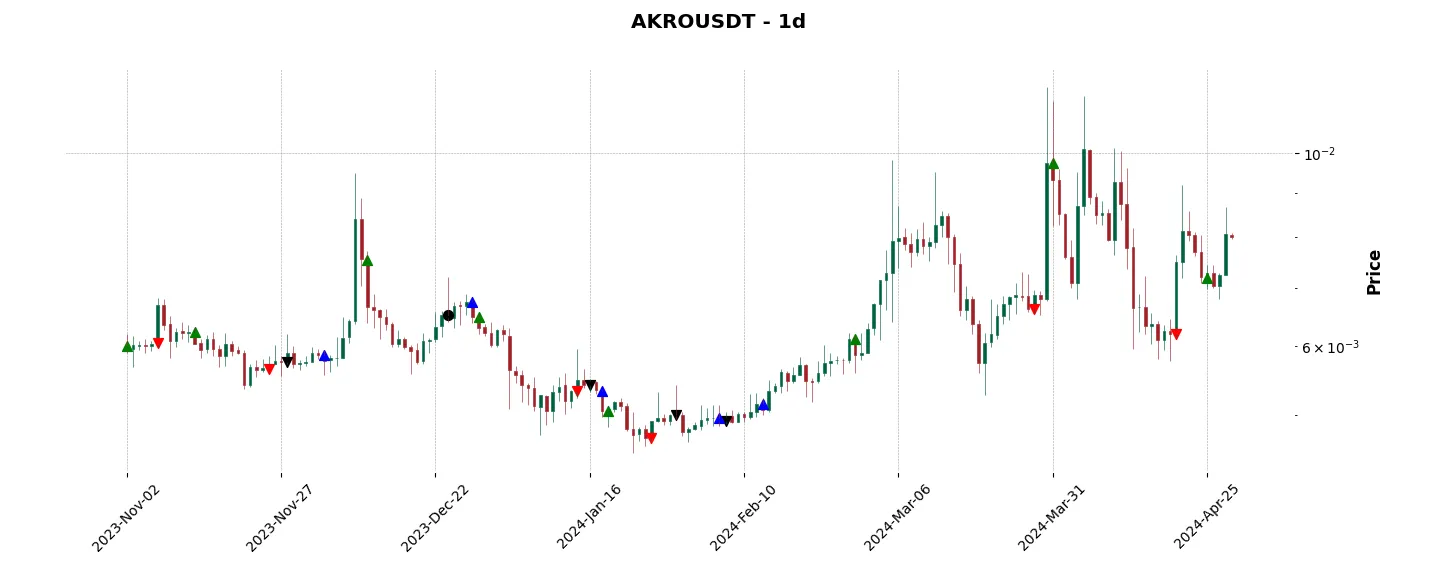

Top trading strategy Akropolis (AKRO) daily – Live position:

- Long in progress

- Entry price : 0.005748 $

- Pnl : -82.93 %

Trade history

Over 6 months

Complete

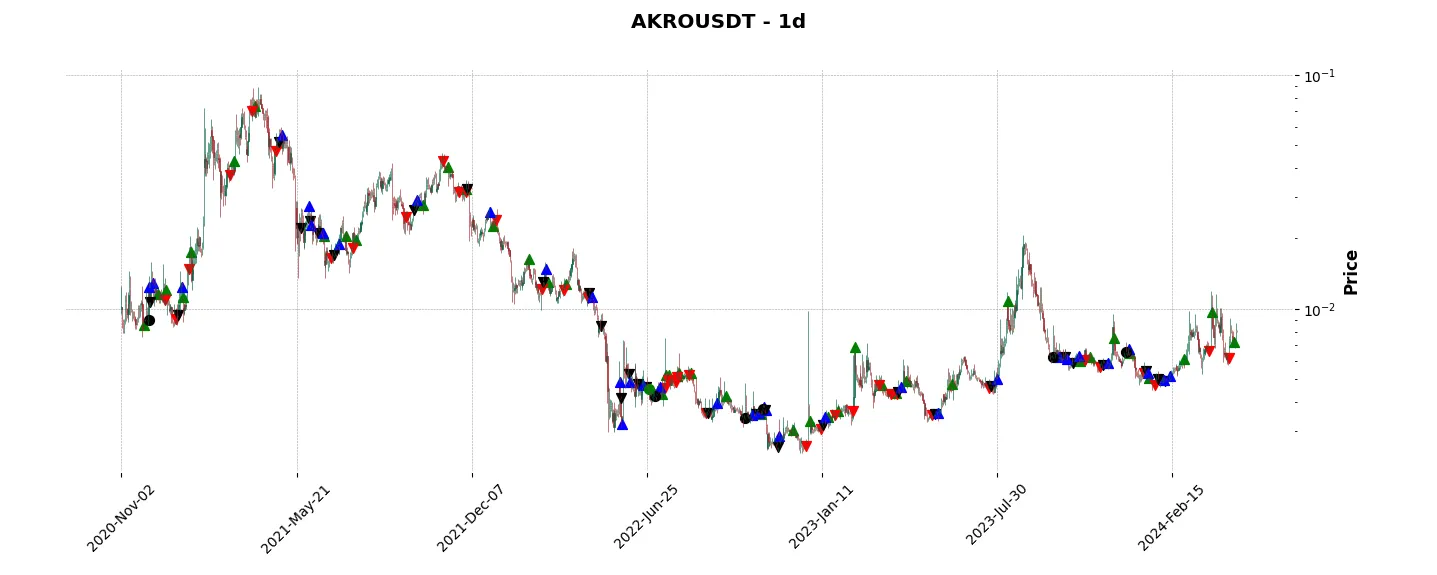

«Top trading strategy Akropolis (AKRO) daily» vs Buy & Hold ?

For this comparison we started from an initial portfolio of $1000 allocated to the «Top trading strategy AKRO daily». was split evenly between the ten cryptocurrencies. It is compared to a Buy & Hold strategy consisting simply of buying and holding its asset.

Historical comparison of cumulative returns with Buy & Hold

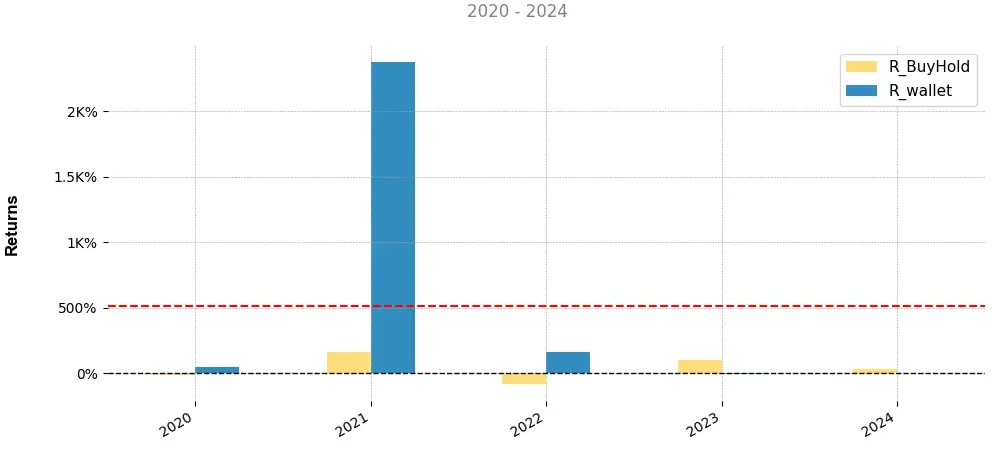

Annual comparison of cumulative returns with Buy & Holds

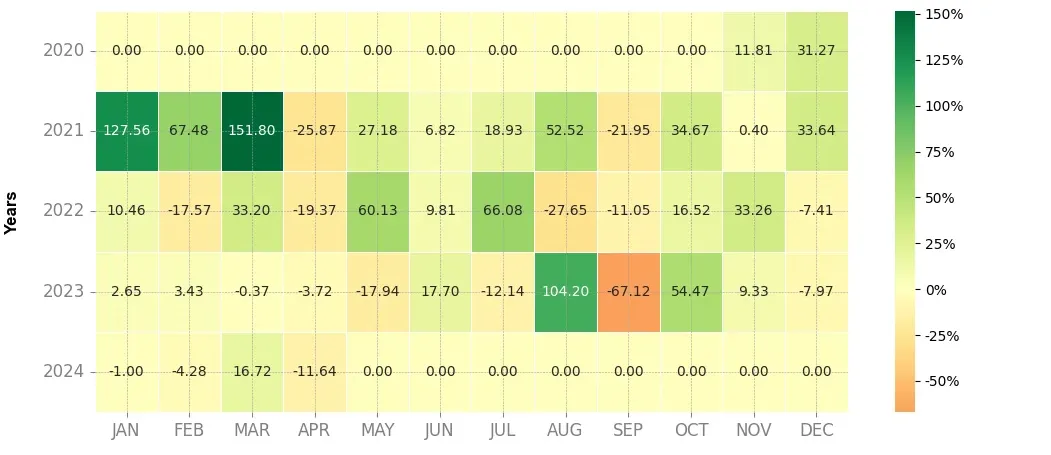

Heatmap of monthly returns

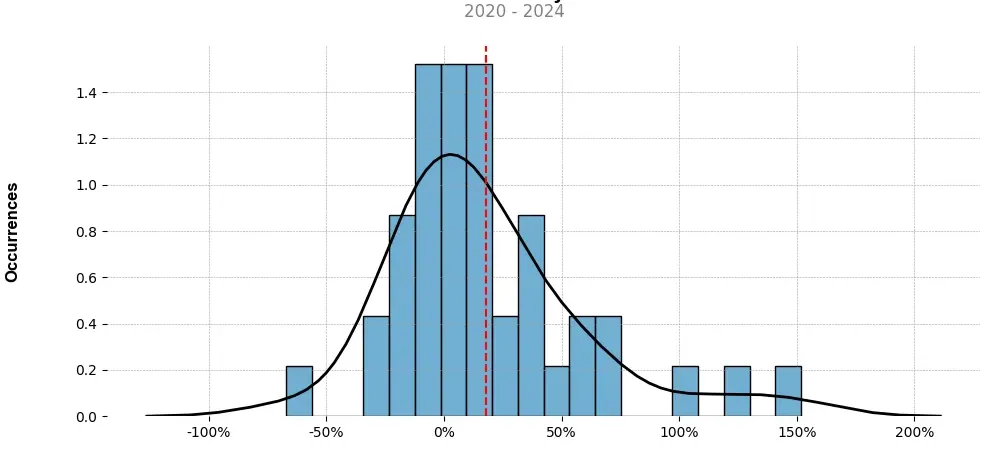

Distribution of the monthly returns of the top strategy

Presentation of AKRO

Akropolis (AKRO) is a cryptocurrency that aims to revolutionize the financial industry by leveraging blockchain technology to provide decentralized and transparent solutions for savings and investment. Founded in 2017, the project aims to cater to the needs of both individuals and institutions, making it a versatile platform for financial services.

One of the primary objectives of Akropolis is to tackle the challenges of the traditional banking system, such as lack of transparency, high fees, and limited accessibility. By utilizing blockchain, Akropolis aims to eliminate intermediaries, reduce costs, and provide users with direct control over their funds.

Akropolis offers various financial products and services, including self-certifying accounts, peer-to-peer lending services, and staking mechanisms. These features enable individuals to save, invest, and grow their wealth within a decentralized and secure ecosystem.

Moreover, Akropolis understands the importance of security, especially in the world of cryptocurrencies. To ensure the safety of users’ funds, Akropolis utilizes smart contract technology, which guarantees the execution of transactions without the need for intermediaries. These smart contracts are programmed to follow predefined rules and cannot be altered, ensuring that funds are secure and transactions are executed as intended.

Additionally, Akropolis emphasizes the importance of financial inclusion. The project is designed to be accessible to individuals from all walks of life, regardless of their financial background. By leveraging blockchain technology, Akropolis removes barriers to entry, allowing anyone with an internet connection to participate in the financial ecosystem.

Furthermore, Akropolis acknowledges the value of partnerships and collaborations. The project has established strategic alliances with other blockchain companies, financial institutions, and industry experts. These collaborations not only strengthen Akropolis’ position in the market but also enable the project to benefit from diverse expertise, further improving their product offerings.

In conclusion, Akropolis (AKRO) is a cryptocurrency that strives to revolutionize the financial industry by leveraging blockchain technology to provide decentralized and transparent solutions for savings and investment. With its focus on transparency, accessibility, security, and partnerships, Akropolis has the potential to become a disruptive force in the financial sector, empowering individuals and institutions alike.

Strategy details

«Top trading strategy AKRO daily» is the result of meticulous selection work. Above all, we backtested long and short around 20 strategies. Then, we selected for you the best of them on the basis of their success rate and their risk gain ratio. In order to refine the money management of the trading strategy, we take into account the relative cumulative return between the three strategies for each position taken. We are currently working on incorporating Kelly’s formula into position sizing.

Tags : [‘defi’, ‘dao’, ‘substrate’, ‘polkadot-ecosystem’, ‘yield-aggregator’, ‘yearn-partnerships’, ‘kenetic-capital-portfolio’, ‘ledgerprime-portfolio’, ‘alameda-research-portfolio’, ‘spartan-group’]

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors are advised to conduct their own research and consult financial professionals before making investment decisions.

You can also follow :

- Our top 3 BTC daily trading strategies

- Our 3 best ETH daily trading strategies

- Trade on the best platform: Binance (100USDT offered)